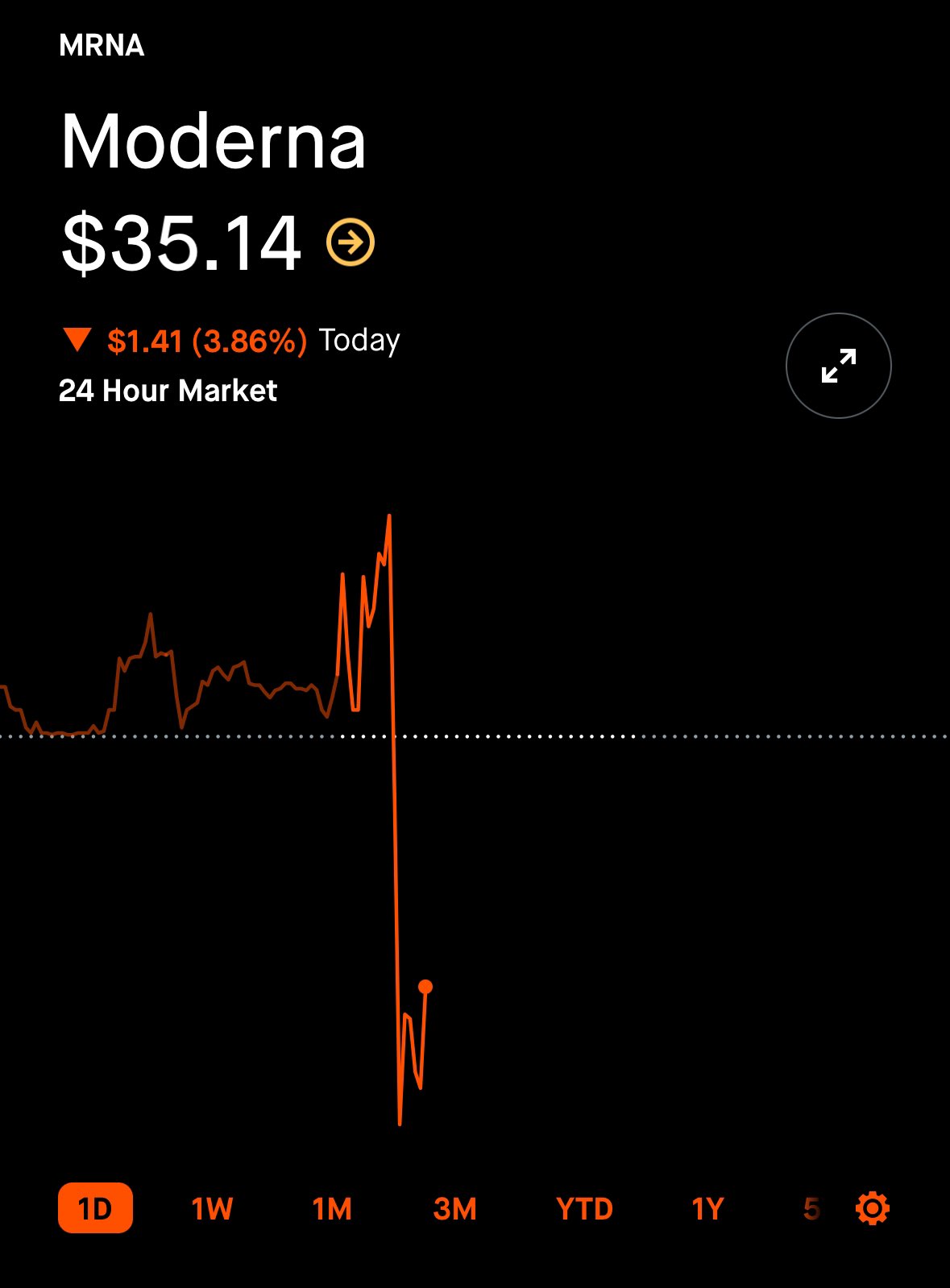

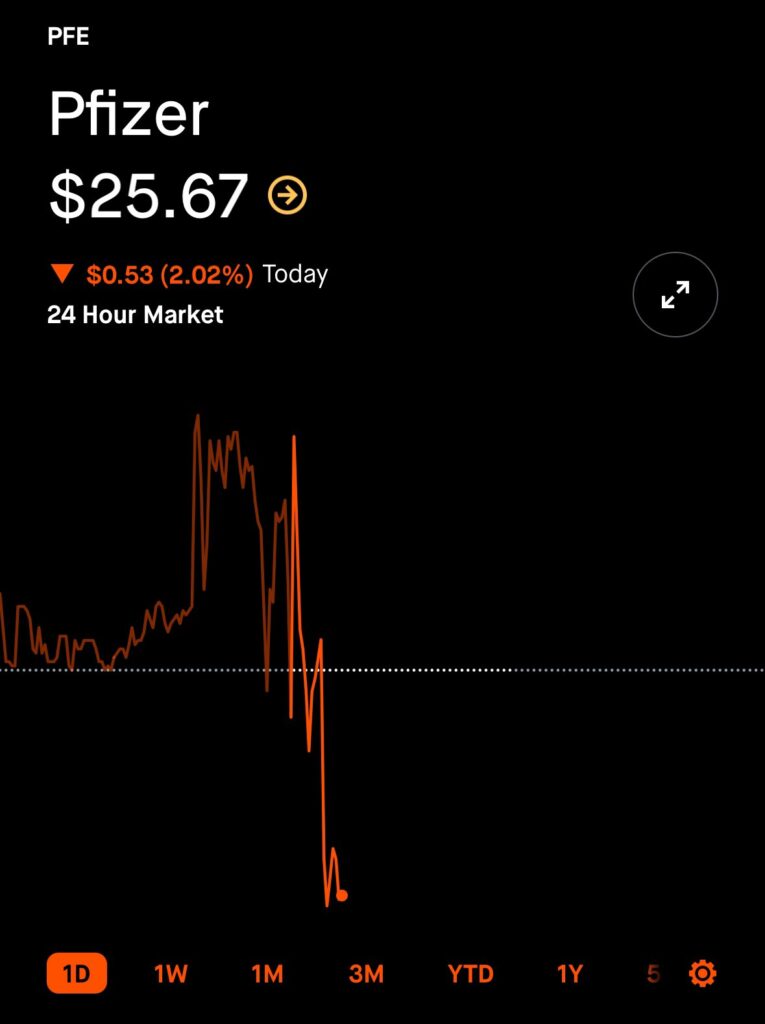

The stocks of both vaccine manufacturers, Pfizer and Moderna, immediately crashed after RFK Jr.’s nomination advanced toward the Senate. Robert F. Kennedy has vowed to crack down the covid 19 pandemic...

Read moreGeo Politics

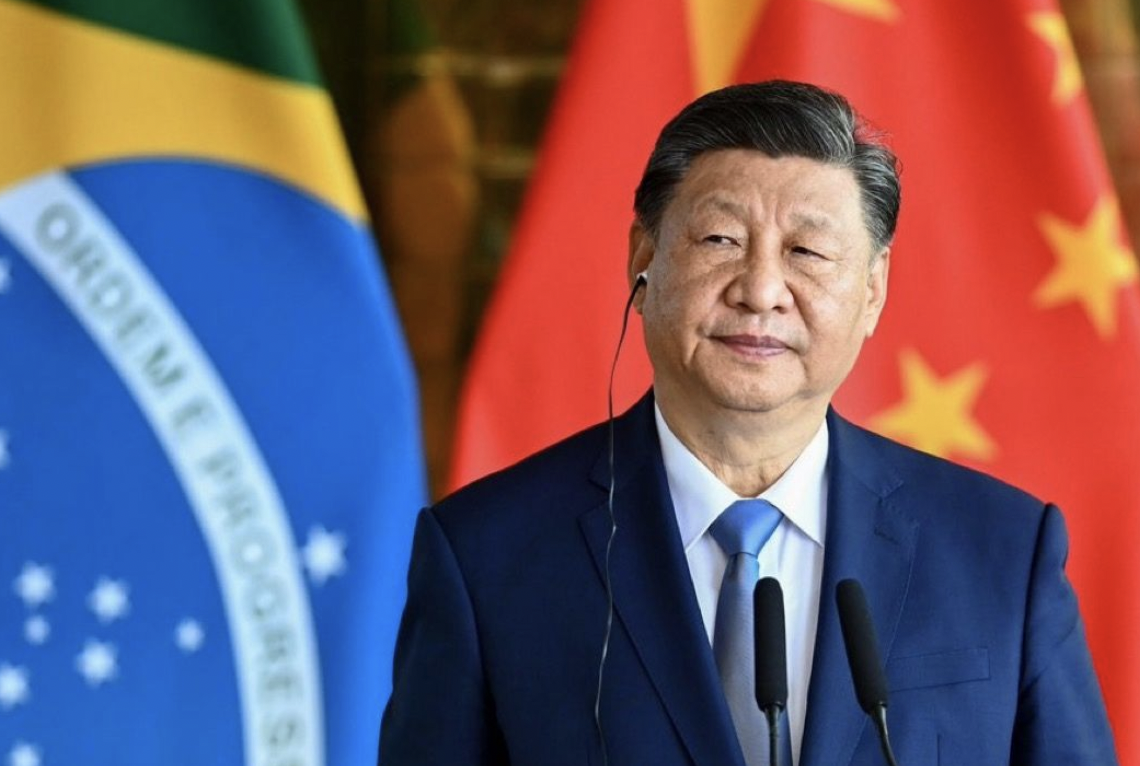

China has announced a series of new trade measures targeting key U.S. industries, escalating economic tensions between the two nations. As part of these measures, China will impose a 15% tariff...

Read moreChina has announced a series of new trade measures targeting key U.S. industries, escalating economic tensions between the two nations. As part of these measures, China will impose a 15% tariff on U.S. coal and liquefied natural gas (LNG), sectors that are vital to American energy exports. Additionally, a 10% tariff will be applied to U.S. oil and agricultural machinery, further impacting major industries that contribute significantly to the U.S. economy.

They also announced an antitrust investigation into Google, signaling a broader crackdown on foreign technology firms amid rising tensions with the United States. The probe, launched by China’s State Administration for Market Regulation (SAMR), will examine whether Google has engaged in monopolistic practices that unfairly restrict competition in the Chinese market.

While Google’s core search engine is already blocked in China due to the country’s strict internet regulations, the company still has business ties within the region, particularly through Android, its mobile operating system, and advertising services. Chinese regulators are expected to scrutinize Google’s dominance in these areas, including potential restrictions placed on local smartphone manufacturers that use Android, Google Play Store policies, and the company’s control over digital advertising revenues.

This investigation aligns with China’s broader efforts to regulate Big Tech and assert greater control over digital markets. It also comes at a time of heightened U.S.-China trade disputes, raising concerns that this move could be politically motivated, serving as retaliation for U.S. restrictions on Chinese tech firms such as Huawei and TikTok.

If China finds Google in violation of antitrust laws, the company could face hefty fines, operational restrictions, or even a forced restructuring of its business within China. Such a decision could have global implications, influencing how other nations approach regulation of dominant U.S. tech firms and further fragmenting the international technology landscape.

- [posts_like_dislike id=287]

Tags:Covid19United States

New Findings Strengthen the Lab-Leak Hypothesis A recent investigation by the White Coat Waste Project (WCW) has uncovered new evidence linking U.S. government funding to Ben Hu, the Wuhan Institute of...

Read moreNew Findings Strengthen the Lab-Leak Hypothesis

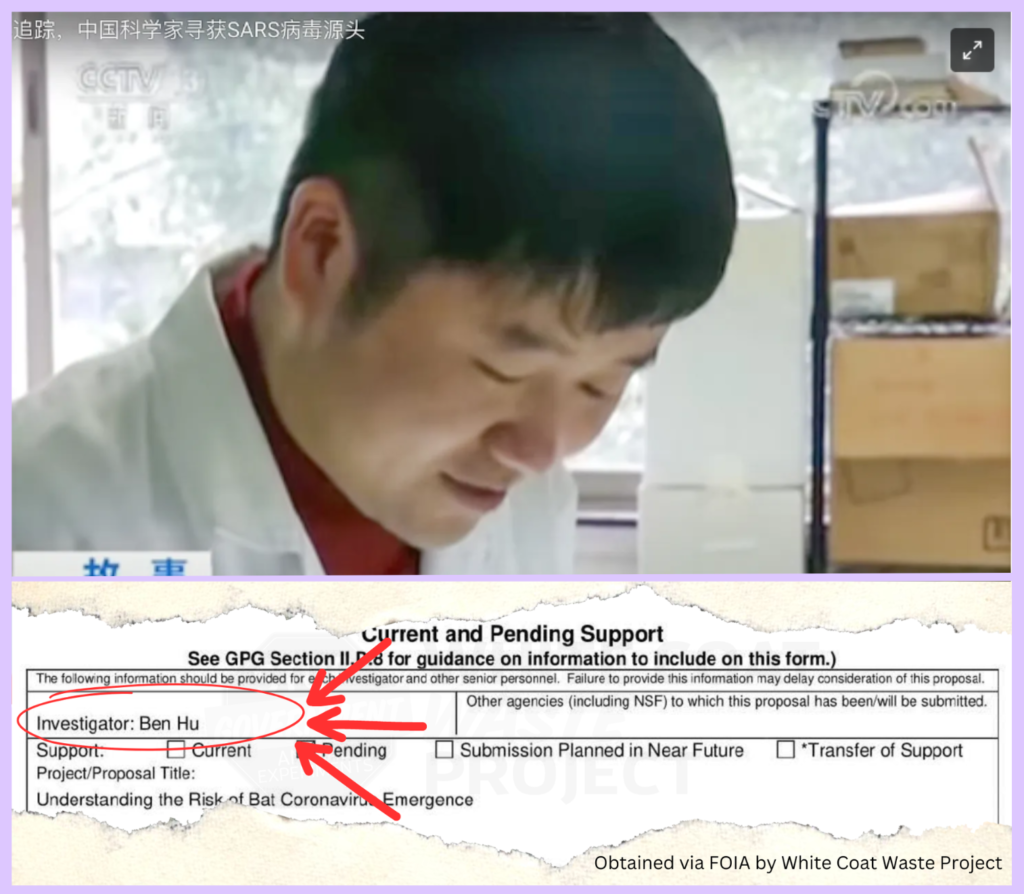

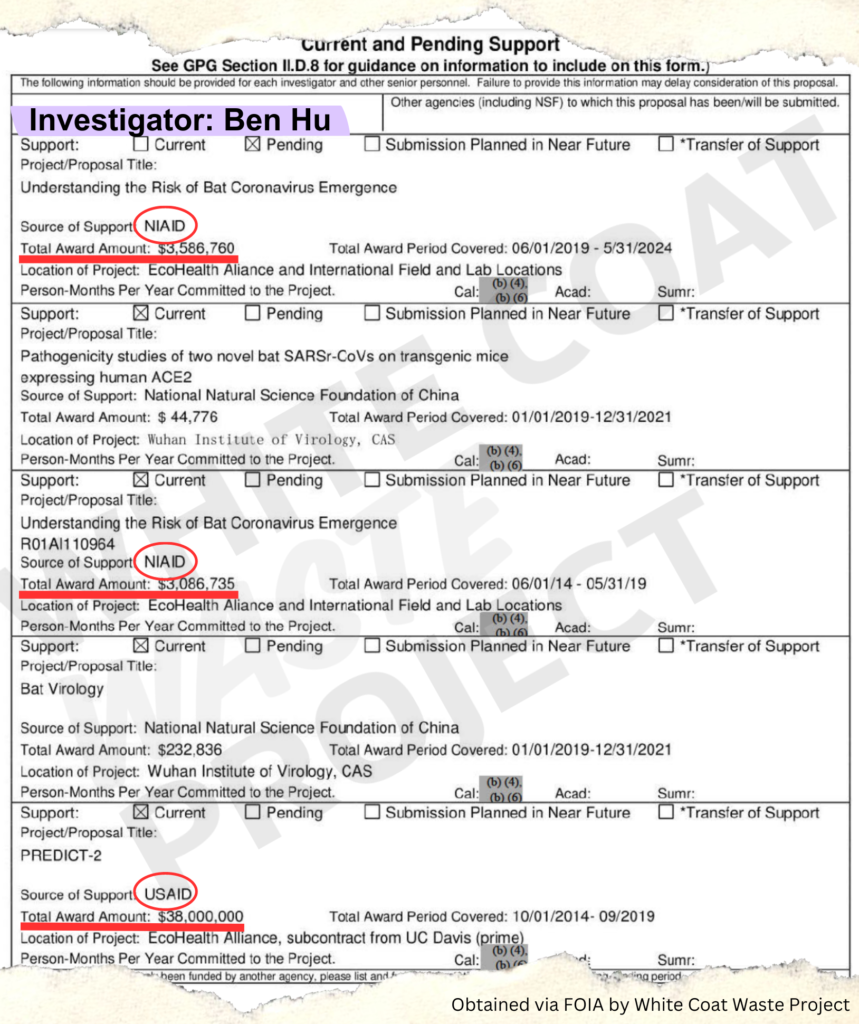

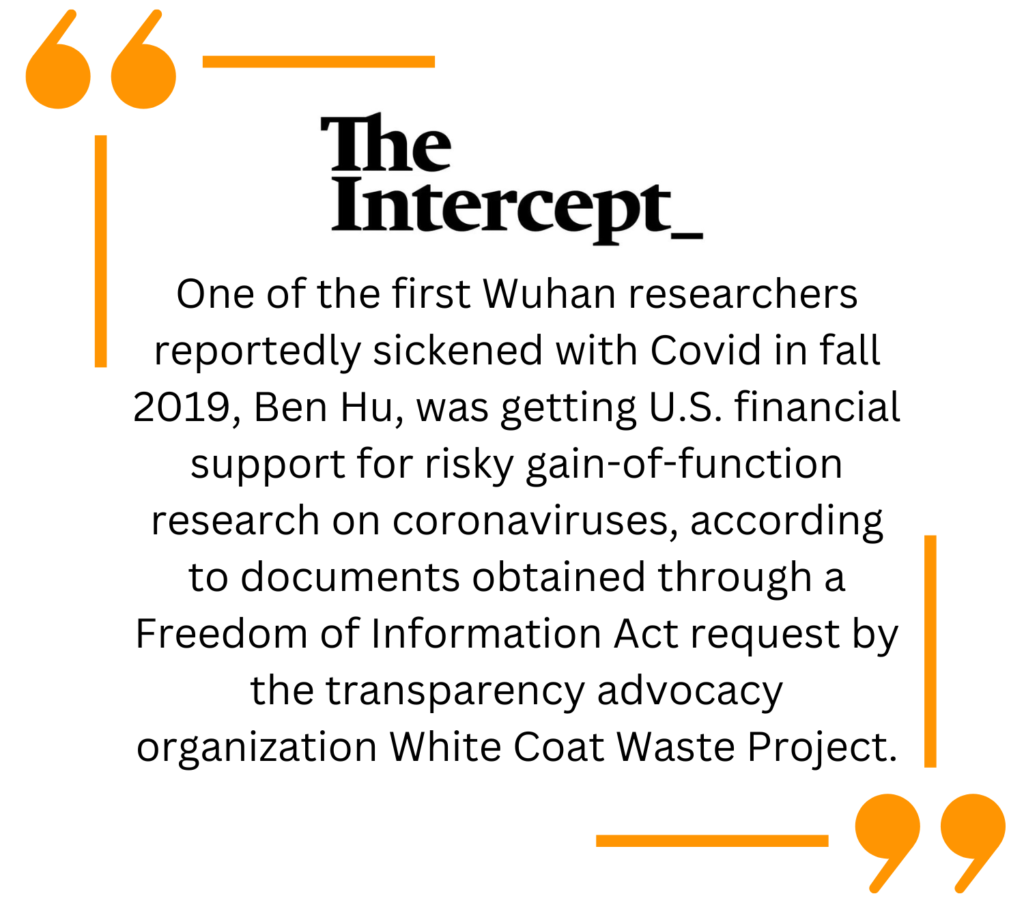

A recent investigation by the White Coat Waste Project (WCW) has uncovered new evidence linking U.S. government funding to Ben Hu, the Wuhan Institute of Virology (WIV) researcher now identified as “Patient Zero”—the first known person to fall ill with COVID-19.

Newly-leaked U.S. intelligence, combined with a Freedom of Information Act (FOIA) investigation led by WCW, suggests that Hu and his colleagues at the Wuhan Lab were working on dangerous gain-of-function research on coronaviruses—experiments that were partially funded by American taxpayers through grants from the National Institutes of Allergy and Infectious Diseases (NIAID) and the United States Agency for International Development (USAID).

Connecting the Dots: U.S. Tax Dollars and Wuhan’s Risky Research

Since 2019, WCW has followed the money trail leading to China’s Wuhan Lab, exposing how U.S. taxpayer funds were funneled into reckless animal experiments. In 2021, a FOIA lawsuit filed by WCW revealed official receipts proving that the U.S. government was funding Ben Hu’s gain-of-function research on bat coronaviruses.

Now, a newly-leaked U.S. intelligence report identifies Hu as the first known individual to contract COVID-19 at the Wuhan Lab—further solidifying the lab-leak theory.

What Do the Documents Reveal?

- Ben Hu, now confirmed as “Patient Zero,” was the lead scientist conducting high-risk gain-of-function experiments on coronaviruses at the Wuhan Lab.

- The U.S. government allocated over $41 million in taxpayer funds to the lab through NIAID and USAID grants.

- Federal accounting records confirm that Hu was a primary recipient of these grants, despite U.S. policies restricting gain-of-function research.

- In November 2019, Hu and two other Wuhan researchers—Yu Ping and Yan Zhu—became severely ill with COVID-like symptoms, months before China publicly acknowledged the outbreak.

- Reports indicate that one Wuhan researcher’s wife died in December 2019 from a mysterious respiratory illness resembling COVID-19.

Without WCW’s investigation, Hu’s research would have continued receiving U.S. taxpayer funding until 2024. However, due to public pressure and congressional scrutiny, WCW helped terminate these grants in early 2020.

Why This Matters: A Cover-Up Exposed

The revelations expose a disturbing chain of events:

- U.S. tax dollars funded Wuhan Lab researchers, including Hu, to conduct high-risk experiments on bat coronaviruses.

- Ben Hu and his colleagues became sick with a COVID-like illness in late 2019, months before the official outbreak was reported.

- Their identities and medical histories were kept secret by both the Chinese Communist Party (CCP) and U.S. authorities.

- Leaked intelligence and FOIA documents now confirm their involvement in taxpayer-funded gain-of-function experiments.

A Growing Consensus on the Lab-Leak Theory

For years, government agencies and media outlets dismissed the lab-leak theory as a conspiracy. However, scientific experts, intelligence agencies, and most Americans now recognize that COVID-19 likely originated from a Wuhan laboratory accident.

Even the U.S. State Department acknowledged in January 2021 that Wuhan researchers involved in coronavirus experiments were hospitalized in late 2019 with symptoms resembling COVID-19.

With the latest intelligence confirming their identities and funding sources, the pieces of the puzzle are coming together.

What Happens Next?

Next week, the Biden Administration is expected to declassify additional intelligence on COVID-19’s origins. Meanwhile, WCW continues to work with lawmakers, including Sen. Roger Marshall (R-KS), to ensure that U.S. tax dollars never again fund dangerous gain-of-function research—especially in foreign labs with questionable safety practices.

The Fight to End Wasteful and Dangerous Research

WCW is committed to exposing reckless government spending on risky animal experiments. From investigating Dr. Fauci’s controversial Beagle experiments (#BeagleGate) to tracking U.S. taxpayer funding of the Wuhan Lab’s coronavirus research, WCW is leading the charge to defund wasteful and dangerous government projects.

Take Action

- At TheParrotPress we have made available below the full FOIA documents obtained by WCW.

- Urge lawmakers to ban taxpayer funding for gain-of-function research.

- Support White Coat Waste Project (WCW)’s mission by visiting their site.

- [posts_like_dislike id=265]

In a surprising and bold move, the President of El Salvador has extended an offer to the United States: outsource a portion of its prison system to El Salvador in exchange...

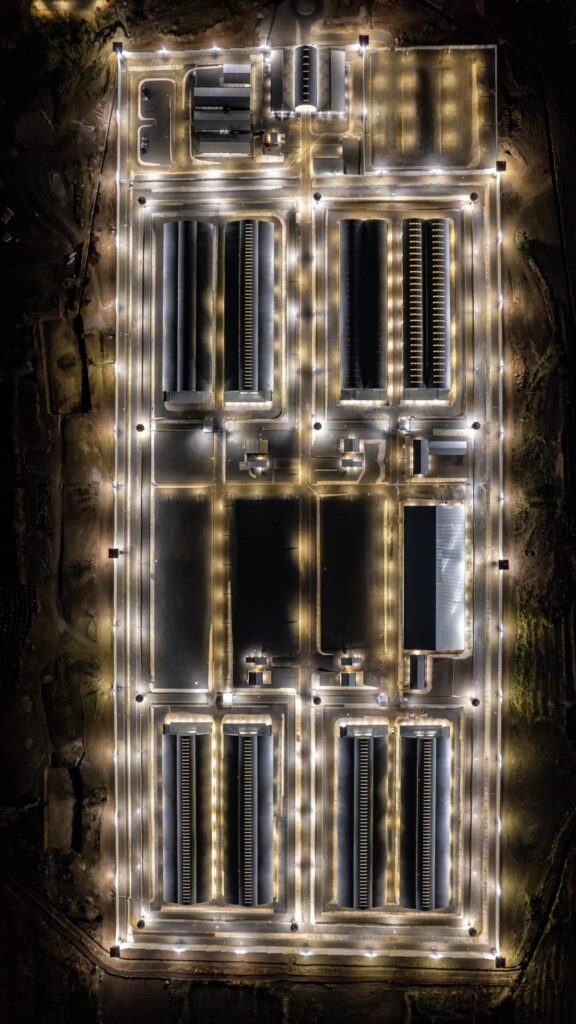

Read moreIn a surprising and bold move, the President of El Salvador has extended an offer to the United States: outsource a portion of its prison system to El Salvador in exchange for a fee. The proposal suggests that El Salvador’s state-of-the-art Centro de Confinamiento del Terrorismo (CECOT)—one of the world’s largest and most secure mega-prisons—could house convicted criminals from the U.S., including U.S. citizens, at a significantly lower cost than maintaining them in American prisons.

A Cost-Effective Solution for the U.S.

The United States has long struggled with overcrowding, high costs, and inefficiencies in its prison system. As of recent estimates, the U.S. spends tens of thousands of dollars per inmate annually, creating a heavy financial burden on federal and state governments. El Salvador’s offer presents a potential alternative—transferring convicted criminals to CECOT for a fee that would be relatively low for the U.S. but financially impactful for El Salvador.

What Makes El Salvador’s Mega-Prison Unique?

CECOT, which was inaugurated in 2023, has gained international attention for its high-security measures, strict conditions, and capacity to hold up to 40,000 inmates. Built primarily to house gang members and organized crime offenders, the facility boasts cutting-edge surveillance systems, around-the-clock security, and extreme measures to prevent escape or internal violence.

By leveraging this infrastructure, El Salvador hopes to generate revenue while maintaining the sustainability of its prison system, which has expanded dramatically due to the country’s aggressive crackdown on crime.

Potential Controversies and Legal Hurdles

While the proposal may appear beneficial from a financial standpoint, it raises significant legal, ethical, and political concerns. Would the U.S. Constitution allow for American citizens to serve their sentences in foreign prisons? How would human rights organizations react, given past criticisms of El Salvador’s harsh prison conditions? And would there be bipartisan political support for outsourcing a core part of the American criminal justice system?

Moreover, prisoner rehabilitation and reintegration efforts in the U.S. differ significantly from El Salvador’s punitive, high-discipline approach, leading to concerns about whether inmates would receive fair treatment and access to rehabilitation programs.

A Precedent for International Prison Outsourcing?

Although this idea may seem radical, prison outsourcing is not unprecedented. Countries such as Norway have previously rented prison space from the Netherlands, and the U.S. itself has used private prisons and even immigration detention outsourcing. However, outsourcing to a foreign nation with a vastly different judicial and correctional system would be uncharted territory for the U.S.

What Comes Next?

It remains to be seen whether the U.S. government will formally consider or respond to this proposal. If accepted, it could mark a historic shift in international prison management—one with profound implications for both nations.

For now, El Salvador has made its offer clear: it is willing to take in convicted criminals from the United States in exchange for a fee that could help sustain its own correctional system. Whether Washington will entertain this proposal or dismiss it as an impractical and controversial idea remains to be seen.

Would you support outsourcing U.S. inmates to El Salvador? Let us know your thoughts.

- [posts_like_dislike id=266]

In an unprecedented move, Elon Musk has handpicked a team of 22-year-old, highly skilled, and incredibly focused autistic engineers to lead a radical transformation of the federal government’s bureaucracy. At the...

Read moreIn an unprecedented move, Elon Musk has handpicked a team of 22-year-old, highly skilled, and incredibly focused autistic engineers to lead a radical transformation of the federal government’s bureaucracy. At the helm of the Department of Government Efficiency (DOGE), these young minds are rewriting the rules, driving efficiency in an area traditionally resistant to innovation. Their mission? To break down the layers of inefficiency that have long plagued the federal system and force accountability at the highest levels.

This isn’t your average government initiative. These engineers, most of whom have been diagnosed with autism, possess an extraordinary level of cognitive ability—capable of hyperfocus, pattern recognition, and problem-solving on a scale that seems almost otherworldly. While most of their peers are still finding their way in the workforce, these young professionals have already made an indelible mark on one of the most complex bureaucratic institutions in the world.

The task at hand is daunting: to streamline government operations, review outdated processes, and challenge entrenched systems. But Musk’s decision to place these 22-year-olds at the forefront of reform has paid off in ways no one expected. They’ve allegedly forced high-level General Services Administration (GSA) employees to not only justify their roles but meticulously review the code they’ve written, essentially subjecting decades-old processes to rigorous, data-driven scrutiny.

Despite their youth, the impact of their work is palpable. “They’re not just optimizing systems—they’re completely dismantling them and rebuilding them in real time,” said one anonymous government insider. “While older bureaucrats are tied up in red tape and internal politics, this group has no time for that. They go straight to the core of the problem and fix it, no questions asked.”

Their methods, while effective, are unconventional. These engineers aren’t satisfied with small improvements; they aim to revolutionize entire sectors of government, applying the kind of efficiency-driven mindset typically reserved for Silicon Valley startups, not federal agencies. They scrutinize every line of code, every process, every expenditure, ensuring that nothing is left unchecked.

“They think in terms of maximum efficiency. If there’s a bottleneck, they’ll find it, and they’ll fix it—no matter how many decades that bottleneck has been in place,” one insider said.

What makes their approach even more remarkable is their background. Many in the team have been diagnosed with autism, a condition that often leads to enhanced focus, meticulous attention to detail, and an ability to identify patterns others might overlook. These traits have made them uniquely suited for the task at hand—transforming a bureaucracy that’s often slow to adapt to the demands of the modern world.

“Their attention to detail is unreal,” said a former government contractor. “They can spot inefficiencies in a mountain of paperwork that would take others weeks to even notice. It’s like they’re able to see the matrix.”

But the team’s unorthodox methods have raised eyebrows within traditional government circles. GSA employees who once coasted on decades-old systems are now being forced to justify their existence, all while these young engineers ruthlessly cut through the red tape. It’s a power shift that has rattled the core of the federal bureaucracy, and many are left wondering how long it can last.

Under Musk’s leadership, this 22-year-old team is showing the world what happens when unbridled talent meets government inefficiency—and they’re proving that age doesn’t matter when you’re out to change the system.

- [posts_like_dislike id=233]

The Department of Government Efficiency (DOGE) is reportedly being led by Elon Musk and a team of highly skilled yet inexperienced 20-year-old autistic engineers, according to Wired. Under Musk’s leadership, these...

Read moreThe Department of Government Efficiency (DOGE) is reportedly being led by Elon Musk and a team of highly skilled yet inexperienced 20-year-old autistic engineers, according to Wired. Under Musk’s leadership, these young programmers are radically disrupting the federal bureaucracy, allegedly forcing high-level General Services Administration (GSA) employees to justify their work by meticulously reviewing the code they’ve written.

Despite their limited professional backgrounds, these individuals have been granted A-suite level clearance, a designation typically reserved for top government officials and executives. In a striking example of their rapid ascent, one of these engineers is said to have only recently graduated high school. Their presence signals a dramatic shift in how government operations are being evaluated, with technical efficiency and software development taking precedence over tenure or experience in the agency.

Musk, known for his aggressive approach to efficiency and automation, has reportedly given these engineers broad authority to cut through bureaucratic inefficiencies, challenging long-standing norms within the government. The stark contrast between these young technocrats and long-serving bureaucrats has created an unprecedented dynamic. Imagine spending three decades navigating government procedures, building a career in federal administration, only to find yourself answering to—or even being dismissed by—a 17-year-old autistic coder wielding nothing but a laptop and technical expertise.

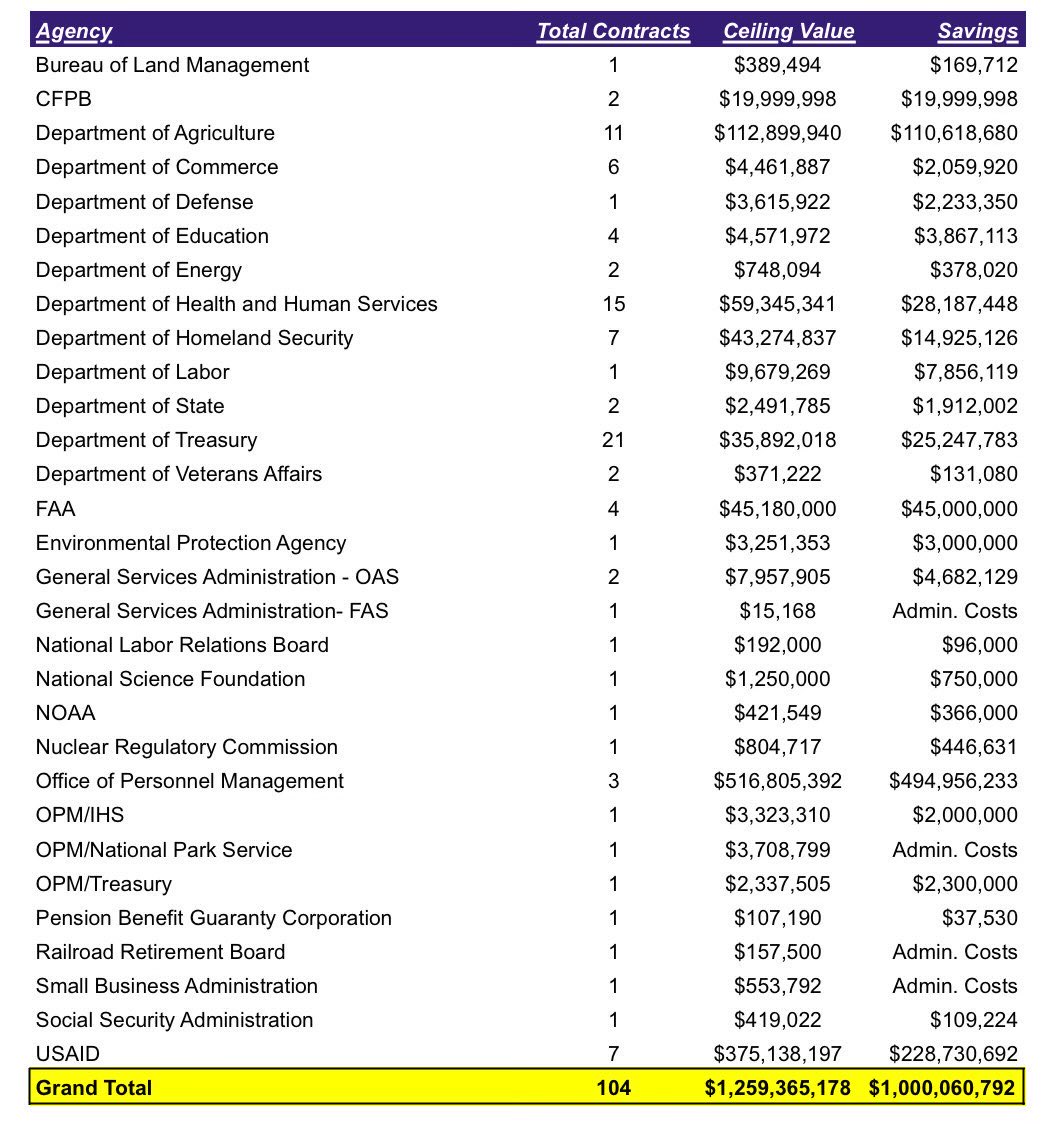

You might ask—how efficient is this team? In less than a week, Musk’s efficiency team successfully terminated 22 government leases, relocating agencies from underutilized “ghost buildings” into existing office space. The result? An impressive $44.6 million in taxpayer savings—up from just $1.6 million a few days prior. And the numbers continue to improve at a dramatic pace, with the total savings up to 1B!

Musk’s involvement has only added to the controversy surrounding DOGE, raising questions about the future of traditional public sector roles, the role of automation in government oversight, and whether this Silicon Valley-inspired approach can truly deliver on the promise of a leaner, more effective administration. Some see it as a much-needed shake-up, while others fear it could lead to chaos and instability in essential government functions.

- [posts_like_dislike id=217]

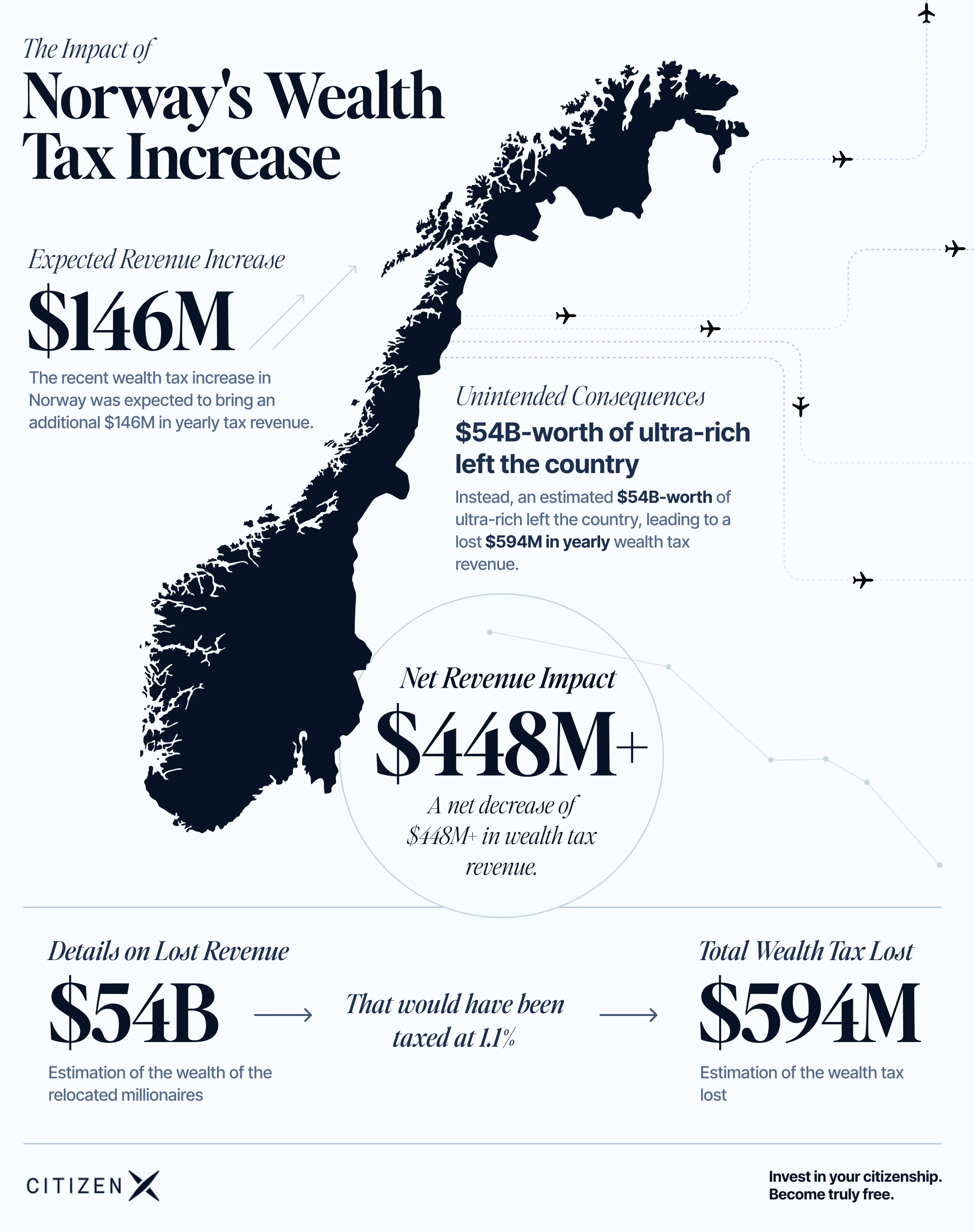

In just two years, Norway has managed to drive thousands of its wealthiest citizens out of the country and into Switzerland, taking hundreds of billions of dollars with them. How? By...

Read moreIn just two years, Norway has managed to drive thousands of its wealthiest citizens out of the country and into Switzerland, taking hundreds of billions of dollars with them. How? By implementing one of the most punishing tax regimes in Europe.

The Tax Hike That Started It All

In 2022, Norway cranked up its wealth tax to 1.1%—the highest in Europe—and slapped a 38% capital gains tax on top of it. These changes made it nearly impossible to preserve wealth within the country, forcing entrepreneurs, investors, and business owners to make a brutal choice: stay and watch their fortune evaporate or flee before it’s too late.

The Tax Trap Explained

Let’s break it down:

- Suppose you have $100 million in taxable wealth.

- You’re immediately hit with a $1.1 million wealth tax every year.

- Where do you get that cash? You’re forced to sell assets.

- But selling triggers the 38% capital gains tax, leaving you with just $682,000—not even enough to cover the original tax bill!

- To fully pay the government, you actually need to sell nearly $1.8 million worth of assets.

This creates a vicious cycle: every year, you lose part of your fortune just to stay afloat. Over time, wealth isn’t just taxed—it’s systematically dismantled.

For business owners, it’s even worse. To cover these taxes, they must sell company shares, eventually losing control of the very businesses they built. Startups hit with sky-high valuations must borrow money just to pay tax on income they haven’t even earned yet.

The Great Norwegian Exodus

Faced with these crushing policies, 5,000 Norwegians packed their bags and moved to Switzerland—including 500 of the wealthiest individuals in the country.

But those who hesitated paid a steep price. The government, realizing it was losing its top taxpayers, doubled down with an EXIT TAX.

Norway’s Financial Berlin Wall

Under this new rule, if you try to leave Norway, you must pay 38% of the market value of all your assets—a massive penalty just for wanting to relocate.

This means that if you didn’t escape in time, your wealth is now locked in. The government has essentially built a financial Berlin Wall—making it as painful as possible to leave.

At The Parrot Press, we don’t have much sympathy for billionaires, but when you push innovation away, you’re also pushing wealth and technological progress aside. Moreover, the extra income generated from such policies doesn’t lead to meaningful development. Instead, it’s more likely to fund luxurious dinners for politicians and cover the expenses of their newly appointed staff.

Norway Didn’t Even Need the Money

Here’s the real kicker: Norway isn’t even financially desperate.

- Only 18% of the government’s revenue comes from private citizens.

- The country’s sovereign wealth fund—the largest in the world—holds a staggering $1.6 TRILLION (or $320,000 per citizen).

- Even if Norway completely stopped collecting taxes, it could still fund government spending for an entire decade.

This wasn’t about necessity. It was about control, which seems to already be backfiring!

- [posts_like_dislike id=214]

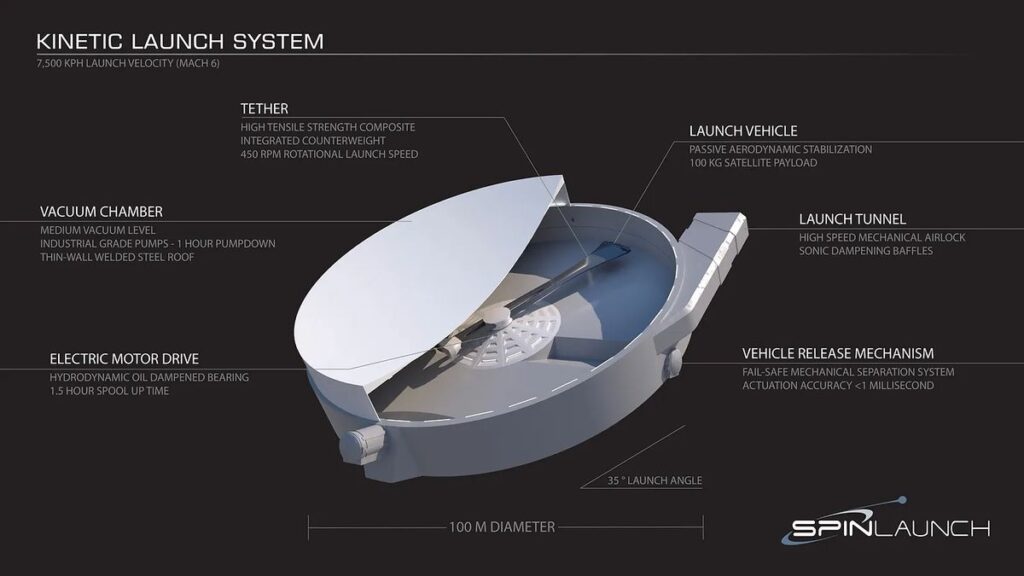

Tags:rocketspinlaunch

SpinLaunch is redefining spaceflight with a revolutionary catapult-like system that hurls satellites into orbit—completely rocket-free. Powered by a massive rotating arm, this electric-driven technology slashes costs, reduces emissions, and could transform...

Read moreSpinLaunch is redefining spaceflight with a revolutionary catapult-like system that hurls satellites into orbit—completely rocket-free.

Powered by a massive rotating arm, this electric-driven technology slashes costs, reduces emissions, and could transform satellite deployment.

Successful early tests pave the way for full-scale launches, with plans to send satellites up to 600 miles above Earth by 2026.

With support from NASA and Airbus, SpinLaunch is shaping the future of low-cost, eco-friendly space travel.

Source: Brighter Side of News

- [posts_like_dislike id=208]

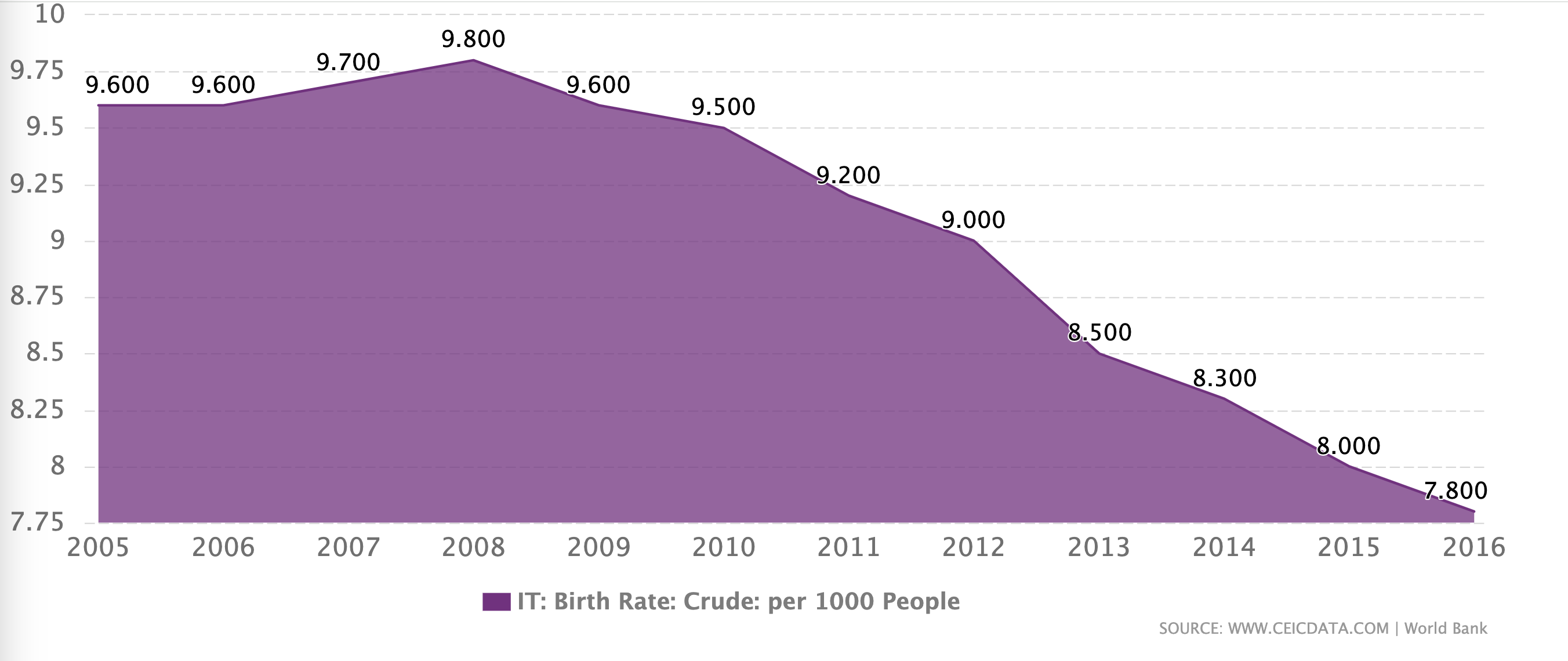

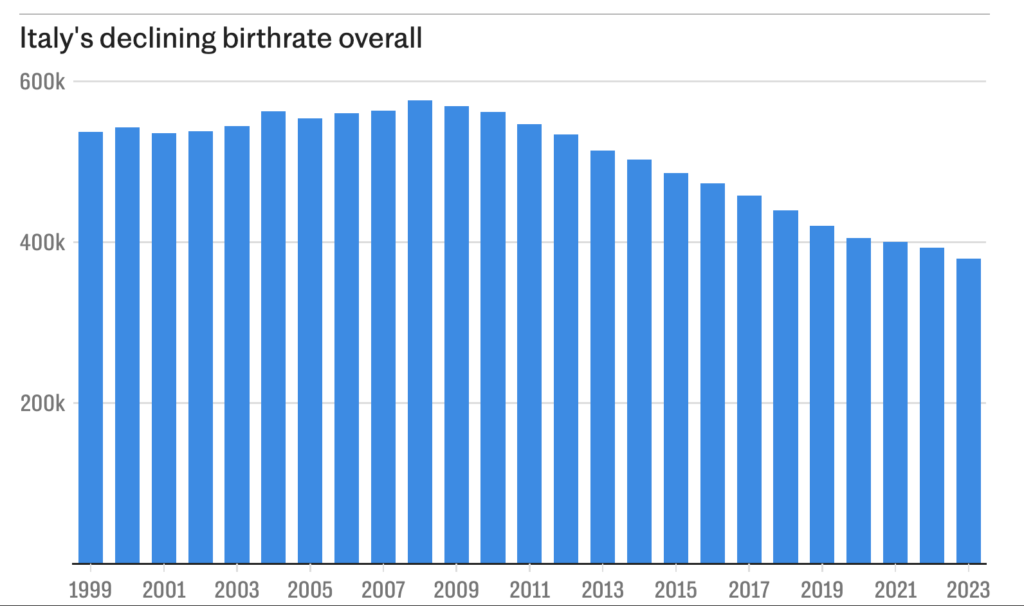

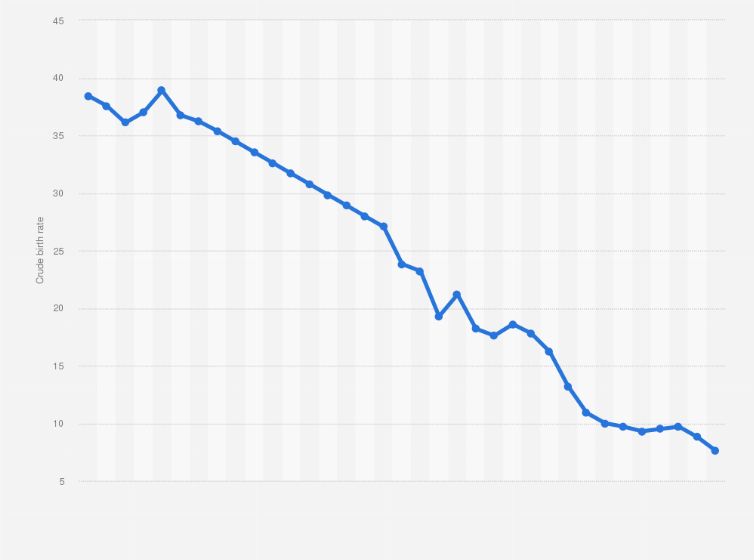

According to reports from The Telegraph, Italy’s birth rate crisis has reached what experts are calling an “irreversible” stage. The official figures for 2023 show that only 379,000 babies were born,...

Read moreAccording to reports from The Telegraph, Italy’s birth rate crisis has reached what experts are calling an “irreversible” stage. The official figures for 2023 show that only 379,000 babies were born, marking the lowest number in more than 160 years—since the country’s unification in 1861. Unfortunately, the decline in births is expected to continue into 2024 and beyond, exacerbating the already severe challenges.

Italy is facing an unprecedented demographic crisis that shows no signs of abating. The country’s population is shrinking rapidly, driven by a combination of low birth rates, an ageing population, and a mass exodus of young people seeking better opportunities abroad. In 2023, the situation reached a stark new low, with hundreds of Italian towns and villages registering no new births at all. This is a dramatic indicator of a broader national trend that is deeply troubling for the country’s future.

Fertility Rates at 1.2 per woman!

At present, Italy’s fertility rate stands at a mere 1.2 births per woman, far below the replacement level of 2.1, which is needed to maintain a stable population. This sharp drop in births, combined with one of the oldest populations in Europe, is putting enormous strain on the country’s economy and social systems. The workforce is shrinking while the number of retirees grows, creating a financial imbalance that threatens to undermine Italy’s economic future.

The demographic decline is particularly alarming because it is happening alongside the increasing costs of social welfare and healthcare, which are disproportionately benefitting an ageing population. The government has tried to combat the crisis with various incentives, such as offering financial support to families with children, providing tax breaks, and even proposing policies to make it easier for people to have children. However, these measures have largely failed to reverse the trend, leading experts to worry that the situation may be beyond repair.

So, what is driving this crisis? One of the primary factors is the economic uncertainty faced by many Italians, particularly young people. The country’s youth are burdened by high unemployment rates, precarious job markets, and unaffordable housing, making it difficult for many to envision a future in Italy. As a result, an increasing number of young Italians are choosing to leave the country for better opportunities elsewhere, contributing to the nation’s declining population. In fact, Italy has one of the highest emigration rates in Europe, with many leaving for more prosperous nations like Germany, the UK, or Switzerland.

Moreover, cultural factors also play a role. The changing social landscape, particularly among younger generations, has shifted priorities. Marriage and childbearing are no longer seen as the immediate goals for many, as individuals focus more on personal freedom, career ambitions, and education. In a society where the costs of raising children continue to climb and work-life balance is increasingly difficult to achieve, having a family is often not viewed as an attainable or desirable goal for many young people.

The impact of this demographic crisis is far-reaching. With fewer workers contributing to the economy and more retirees depending on pensions, Italy’s public finances are under severe pressure. Social welfare systems, healthcare infrastructure, and pension funds are all facing unsustainable demands. This, in turn, affects economic growth, innovation, and Italy’s position within the European Union. As the population continues to age, Italy may find it increasingly difficult to maintain its status as a major global economy.

Despite the government’s best efforts to address these issues, including providing financial incentives for families to have more children, experts remain skeptical that these efforts will have a lasting impact. The problem is multifaceted, requiring systemic changes to both the economy and the social fabric of the country. Some suggest that addressing the high cost of living, improving job security for young people, and making it easier for families to raise children in Italy could help reverse the trend. However, these solutions are not quick fixes and will require long-term commitment and policy shifts.

Despite government incentives, experts fear the trend may be irreversible.

Can Italy turn this around, or is it too late?

- [posts_like_dislike id=149]

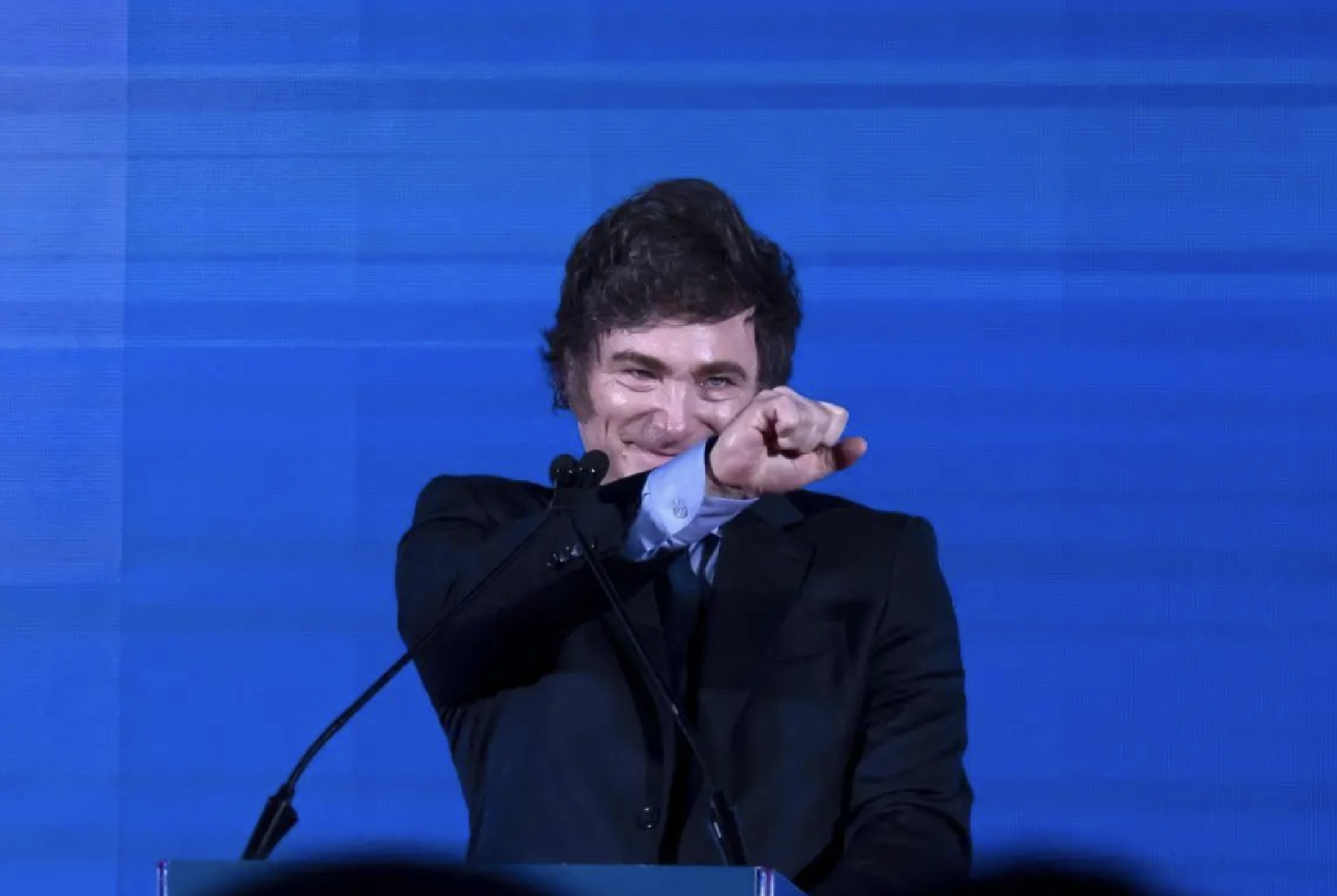

Ford has dramatically reduced vehicle prices in Argentina, slashing costs by up to 18% after President Javier Milei took an axe to the country’s steep automobile taxes. The libertarian leader eliminated...

Read moreFord has dramatically reduced vehicle prices in Argentina, slashing costs by up to 18% after President Javier Milei took an axe to the country’s steep automobile taxes. The libertarian leader eliminated the first tier of the “luxury tax” entirely and cut the second tier from 35% to 18%, a move expected to boost sales and encourage investment in the struggling auto sector.

Several of Ford’s most popular models are now significantly more affordable. The Bronco Sport and Kuga Hybrid saw 15.5% price reductions, while the iconic Mustang V8 dropped 18%. Even high-performance and electric models benefited—the Bronco V6 is now 13% cheaper, and the all-electric Mustang Mach-E is down 8.5%.

But Milei’s reforms don’t stop there. In a bid to modernize Argentina’s vehicle market and encourage sustainable transportation, his government is also eliminating import tariffs on 50,000 low-cost electric and hybrid vehicles per year. This measure is expected to drive further price drops, making Argentina a more attractive market for global automakers.

Ford’s South America President, Martín Galdeano, has praised the shift, citing lower financing costs, rising wages, and tax cuts as key factors revitalizing the industry. With these reforms, Argentina’s auto market is poised for a major resurgence, potentially attracting more foreign manufacturers looking to expand their footprint in Latin America.

- [posts_like_dislike id=140]