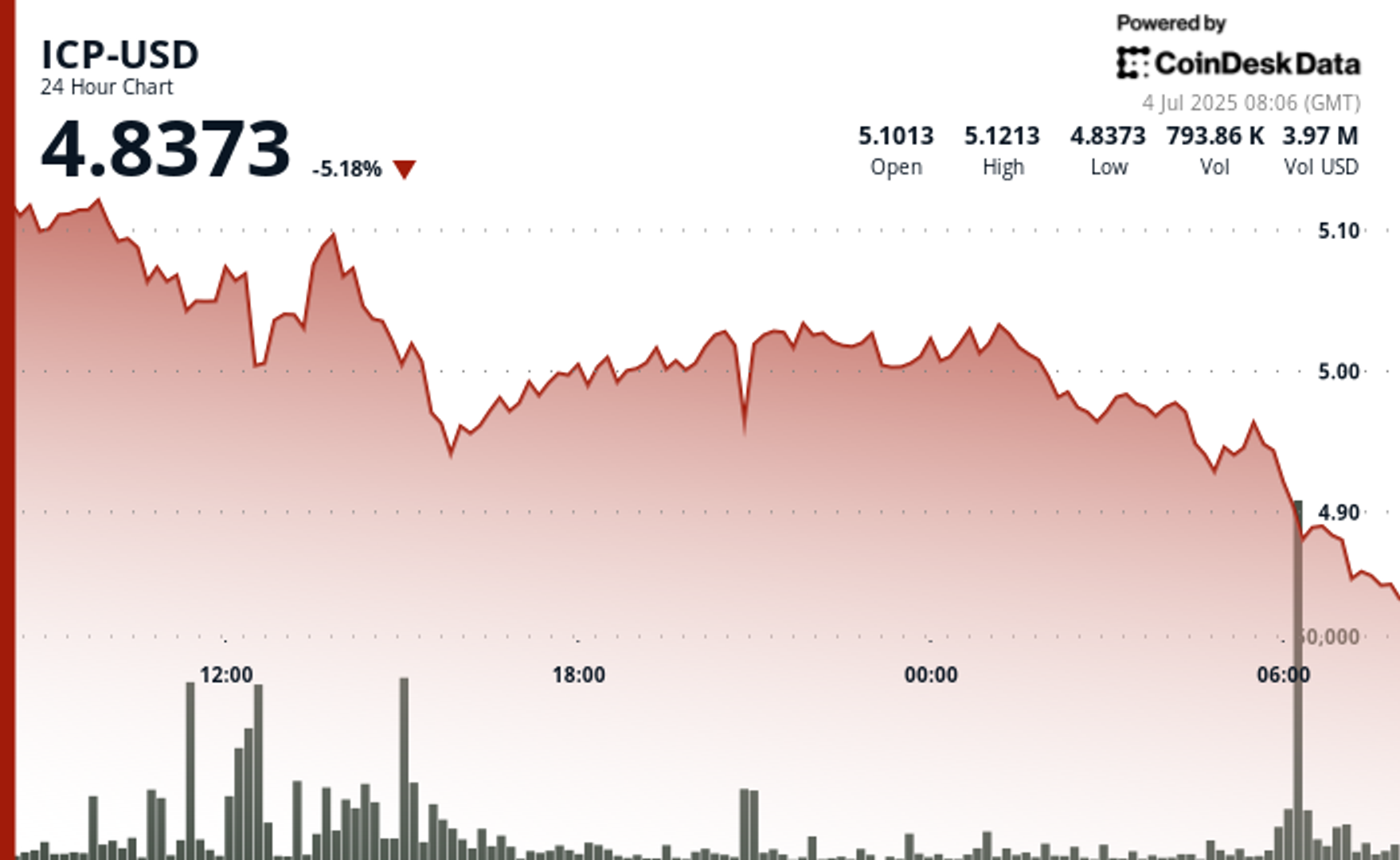

Internet Computer Protocol (ICP) has seen a 5.18% decline in the last 24 hours, trading at $4.8373. This drop is more significant than the broader crypto market, as evidenced by the...

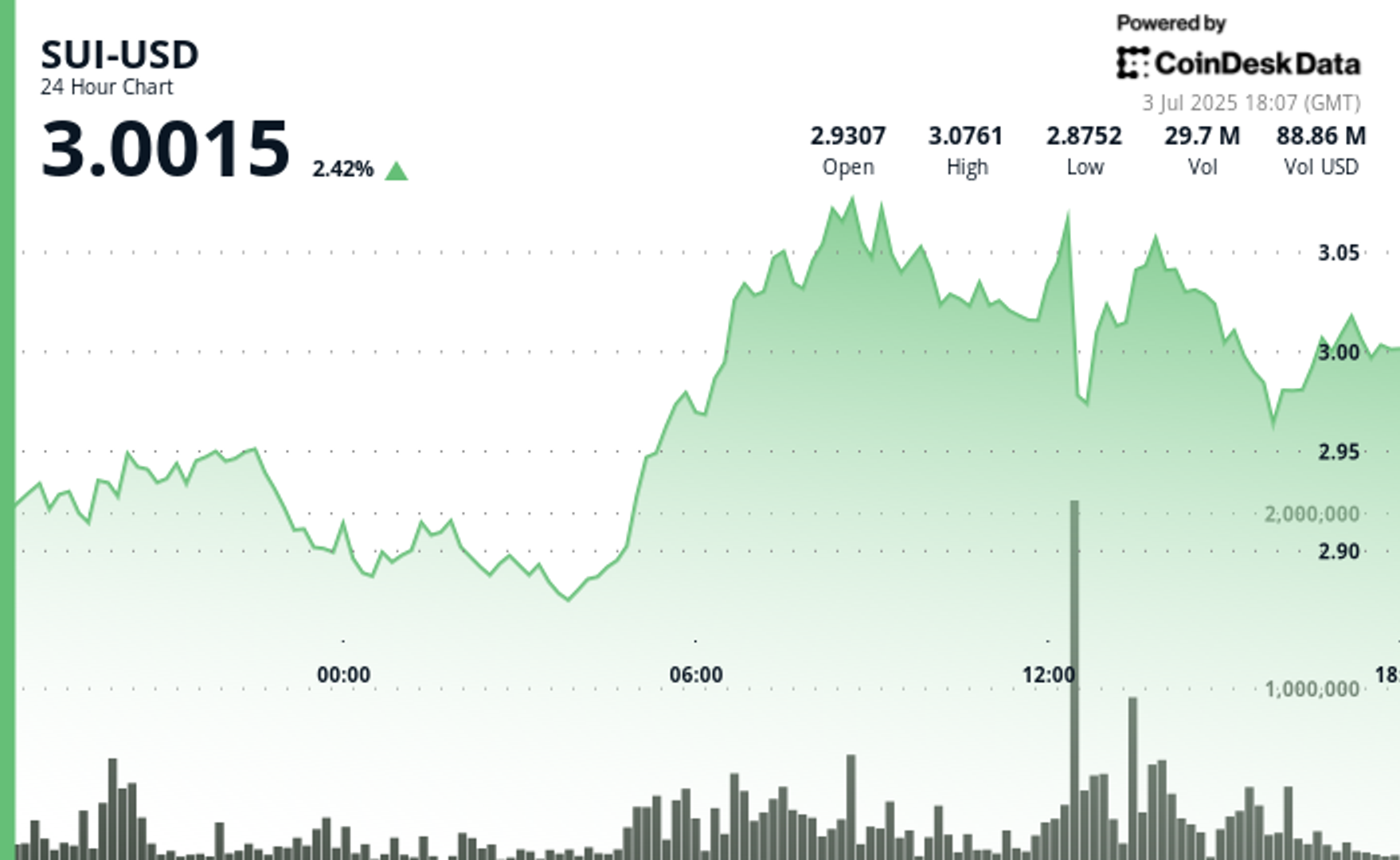

Read moreSUI is currently trading at $3, showing a 4% increase in the last 24 hours. The token’s price continues to rise following the announcement by Lion Group Holding Ltd. (LGHL) stating...

Read moreSolana’s on-chain fundamentals received a significant boost as DeFi Development Corp (DFDV) from Florida announced the purchase of 17,760 SOL tokens, expanding its treasury. The acquisition, totaling around $2.72 million, was...

Read moreBitmine Immersion (BMNR) is making waves in the world of cryptocurrency as the latest hot crypto proxy play. Under the leadership of Thomas Lee from Fundstrat, the company’s shares have more...

Read morePresident Donald Trump sparked excitement within the crypto industry by instructing his administration to establish cryptocurrencies as a long-term investment for the U.S. government. However, progress on this front has been...

Read moreShiba Inu (SHIB), the meme token, has seen a significant bullish reversal pattern as speculation around ETFs drives BONK to higher levels. SHIB experienced a 5.2% surge in the last 24...

Read moreTokenized equity offerings for OpenAI are reportedly being offered to Robinhood users in Europe without official authorization from the company, OpenAI stated in a social media post. OpenAI clarified that these...

Read moreREX Shares and Osprey Funds have announced Anchorage Digital as the exclusive custodian and staking partner for their recently launched REX-Osprey Solana + Staking ETF (SSK), the first crypto staking exchange-traded...

Read moreAccording to a report from CNBC, publicly traded companies are continuing to increase their bitcoin reserves, outpacing U.S. exchange-traded funds (ETFs) for the third consecutive quarter. In the three months leading...

Read moreSecuritize and RedStone have collaborated on a new whitepaper introducing a model for securely verifying Net Asset Value (NAV) data on-chain, specifically tailored for tokenized private funds. The Trusted Single Source...

Read more