As fears of a U.S. recession loom due to President Donald Trump’s tariff plan, prediction platforms Polymarket and Kalshi are signaling heightened concerns about the economy taking a hit. Polymarket, a...

Read moreAs fears of a U.S. recession loom due to President Donald Trump’s tariff plan, prediction platforms Polymarket and Kalshi are signaling heightened concerns about the economy taking a hit.

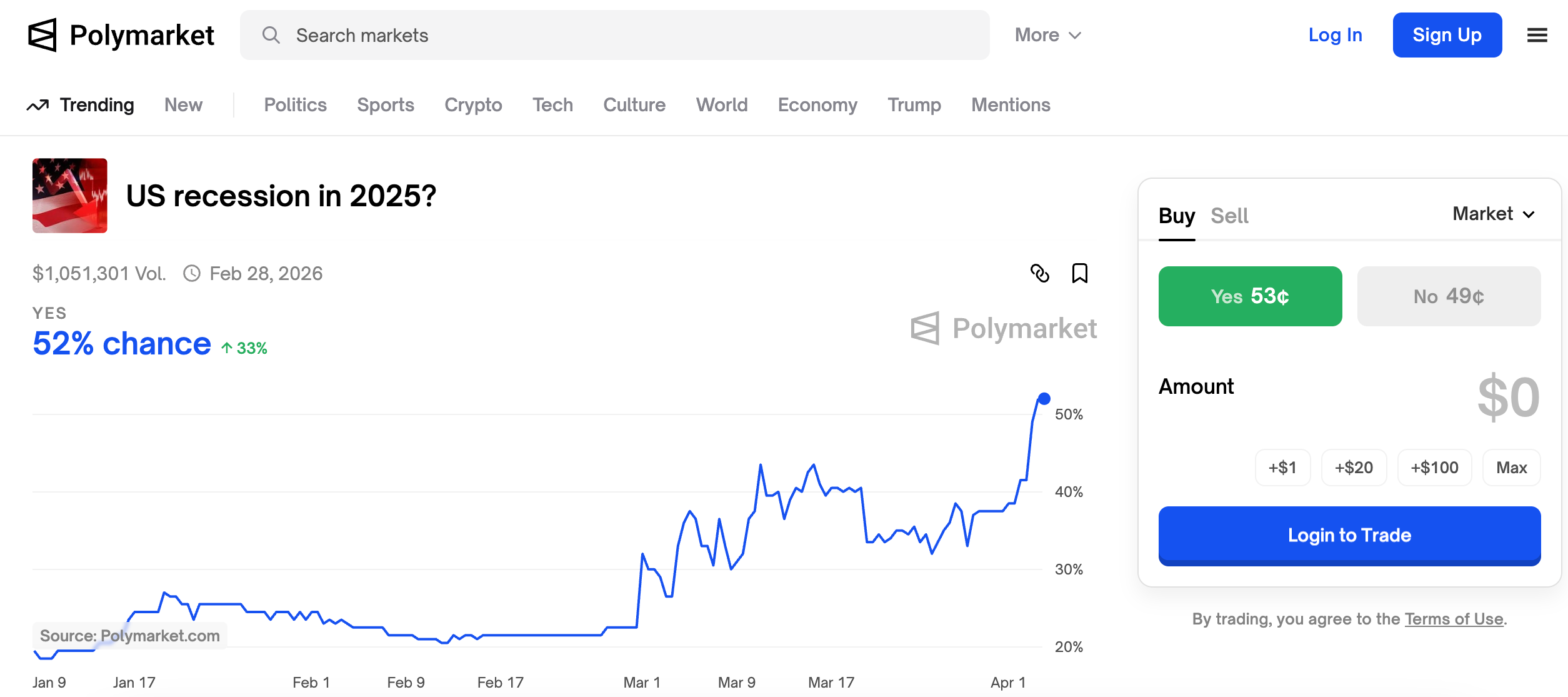

Polymarket, a decentralized prediction platform, has seen the chance of the country slipping into recession this year rise above 50% for the first time since the trading of the contract “US Recession in 2025” began earlier this year. The contract’s Yes shares surged to over 50 cents from 39 cents in less than 24 hours. The contract will resolve to Yes if the National Bureau of Economic Research (NBER) confirms a recession at any point before Dec. 31, or if there are back-to-back quarterly contractions in gross domestic product.

Similarly, Kalshi, a U.S.-based regulated prediction market, has also seen economic concerns among traders rise, with the probability of a 2025 recession increasing to 54% from 40%.

Financial markets, being forward-looking, could react to the rising odds of a U.S. recession by pushing risk assets like Bitcoin (BTC) and other cryptocurrencies lower. At the time of publication, S&P 500 futures were trading 3% lower, indicating severe risk aversion on Wall Street and suggesting bearish signals for Bitcoin, which was changing hands at $83,100, a 1.5% decrease in 24 hours.

The newly unveiled tariffs set a base rate of 10% on all imports, along with higher taxes on 60 nations identified as worst offenders. China, being the most heavily hit, will face a 34% levy on top of the existing 20% charge, totaling 54%. The base tariffs are set to take effect on April 5, with the higher reciprocal rates coming into play on April 9.

While the Trump administration aims for tariffs to address U.S. goods trade deficits, they could potentially contribute to domestic inflation and global instability in the short term. If China, the European Union, and other nations retaliate with higher tariffs, it could trigger a full-blown global trade war.

Despite the uncertainties surrounding tariffs, some experts believe that the impact may lead to an economic slowdown rather than a full recession. UBS, for example, states that while the threat of further tariff escalation remains a concern, their economic forecasts do not predict a recession in the U.S. Instead, they forecast slower economic growth compared to the previous year, with the U.S. economy expanding by around 2% this year.

As for financial markets, some observers suggest that the initial risk-off reaction may be short-lived and reversed by expectations of Federal Reserve interest rate cuts. Joseph Wang, from fedguy.com, states that tariffs are dovish and can lead to more rate cuts, as they are ultimately transitory and inflationary effects can be mitigated.

Traders are already pricing in a higher probability of the Fed cutting the benchmark borrowing cost in June, restarting the easing cycle that began in September of the previous year.

- [posts_like_dislike id=749]