Bitcoin (BTC) closed June above $107,000 with a record monthly close, but its 2.5% gain was overshadowed by the euro’s 4% rise against the dollar. The euro’s strength led to increased...

Read moreAmerica

Bitcoin options recently expired, and the cryptocurrency has only dropped by 0.6% to nearly $107,000. This stability is reflected in the low volatility of bitcoin, with Deribit’s BTC Volatility Index hitting...

Read moreBitcoin options recently expired, and the cryptocurrency has only dropped by 0.6% to nearly $107,000. This stability is reflected in the low volatility of bitcoin, with Deribit’s BTC Volatility Index hitting its lowest level since late 2023. However, the broader crypto market, as indicated by the CoinDesk 20 index, is down 1.2%.

Deribit’s Chief Commercial Officer, Jean-David Péquignot, mentioned that the reduced volatility in bitcoin could be a signal that the market is gaining confidence in its role as a macro-hedge. Geopolitical tensions may have eased temporarily, but investors are still cautious and monitoring economic indicators like the U.S. personal consumption expenditures report for directional clues.

The market seems to be in a wait-and-see mode, with potential external catalysts like the NATO-Russia tensions having the potential to test the market’s resilience. Additionally, the anticipation of the U.S. Federal Reserve possibly announcing a successor to Fed Chair Jerome Powell led to a decline in the U.S. dollar index.

Equity markets, on the other hand, have been performing well, especially in Asia, which hit a three-year high amidst optimism over U.S.-China rare-earth trade agreements. However, the focus remains on the upcoming U.S. PCE report, which could impact the trend and potential rate cut decisions for July.

Looking ahead, the crypto market is gearing up for the introduction of spot-quoted futures by CME Group and Coinbase Derivatives launching perpetual-style crypto futures in the U.S. All eyes are also on several macroeconomic events and governance votes happening in the crypto space.

Stay tuned for more updates on market movements and token launches to make informed decisions in the evolving crypto landscape.

- [posts_like_dislike id=1253]

The most valuable startups in the world are not publicly traded. They are held in private portfolios, with strict capital requirements, long lockups, and limited deal flow access. Historically, only a...

Read moreThe most valuable startups in the world are not publicly traded. They are held in private portfolios, with strict capital requirements, long lockups, and limited deal flow access. Historically, only a select few, such as endowments, family offices, and well-connected institutional players, have had access to private markets.

Today, private markets remain exclusive. Traditional private equity demands minimum investments ranging from $250,000 to $25 million, while venture capital funds often require minimums of over $1 million. Accredited investor requirements further restrict access for the majority of Americans who do not meet these wealth thresholds.

However, blockchain technology is starting to break down these barriers. It is creating a new financial system that brings transparency, liquidity, and accessibility to what has traditionally been a secretive and illiquid space. Tokenization is revolutionizing private markets by converting real-world assets, such as shares in startups or private funds, into digital tokens with embedded compliance.

Imagine being able to invest in a basket of high-growth companies through a single, liquid asset on the blockchain. Investors no longer have to wait years for a potential exit, as secondary markets and liquidity protocols now allow for dynamic trading at fair prices. Tokenized vehicles also offer governance rights, performance incentives, and exposure to hard-to-access assets like pre-IPO unicorns or private equity funds.

This shift towards tokenization is not just about efficiency, but also about democratizing access. It opens up opportunities for smaller investors, global participants, and underserved regions to invest in private markets that were previously out of reach. With compliant issuance platforms and regulated secondary markets, access to private market assets is becoming a programmable right rather than a privilege.

The total volume of secondary market transactions hit record highs in 2024, reaching over $150 billion. However, this only represents about 1% of the total private market value, indicating significant room for growth. With tokenized private assets valued at approximately $14 billion against a total addressable market of $12 trillion, there is immense potential for further growth.

Despite the challenges of regulatory clarity and investor protection, the momentum towards tokenization in private markets is undeniable. The future financial system will be interoperable, inclusive, and transparent, blurring the lines between public and private, analog and digital, and developed and developing economies.

Tokenized private assets are not just a new asset class; they signify that the next trillion-dollar opportunity will not be isolated but integrated into a more accessible and liquid financial network. The gate is open, and the future of private markets is moving towards being on-chain.

- [posts_like_dislike id=1237]

Tags:ADAAIAmericaArgentinabitcoinbtcCanadaCryptoDonald TrumpETHEUEuropeFinanceIranIsraelTradingTrumpUS

By Francisco Rodrigues (All times ET unless indicated otherwise) Risk assets, including cryptocurrencies, let out a collective sigh of relief following President Donald Trump’s announcement that he would not immediately involve...

Read moreBy Francisco Rodrigues (All times ET unless indicated otherwise)

Risk assets, including cryptocurrencies, let out a collective sigh of relief following President Donald Trump’s announcement that he would not immediately involve the U.S. in the Israel-Iran conflict. He mentioned that he might wait for two more weeks before making a decision on U.S. involvement.

Bitcoin (BTC) is currently trading around $106,000, up 0.9% in the last 24 hours. The broader CoinDesk 20 index has also seen a gain of 0.77%. In traditional markets, oil prices experienced a 1.7% drop after a three-week rally, while European stock indexes showed growth. U.S. equity futures are slightly higher compared to the previous day.

Trump’s statement has reduced the likelihood of immediate U.S. military action, as per the prediction market Polymarket, dropping from about 70% to 40%. If the timeframe is extended to next month, the odds are now at 62%, down from 90% on June 17.

“While the immediate prospect of a U.S. intervention in Iran may have diminished, the fact this is reportedly a two-week hiatus means it will remain a live issue for the markets going into next week,” commented AJ Bell investment analyst Dan Coatsworth in an interview with Yahoo Finance.

Despite the relative stability of the crypto market, analysts see varying risks. Glassnode, a blockchain analytics company, noted that subdued on-chain activity could indicate a more mature market, one that is dominated by institutions making large, infrequent transactions.

On the other hand, a new report from CryptoQuant warns that Bitcoin could drop to $92,000 or lower if there is no rebound in demand. ETF flows have decreased by 60% since April, whale buying has slowed by half, and short-term holders have dumped 800,000 BTC since late May. Vigilance is advised!

What to Watch:

Crypto:

– June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit on mainnet, enhancing security and performance.

– June 25: ZIGChain (ZIG) mainnet will go live.

– June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether, and major U.S. equity indices with contracts holdable for up to five years.

Macro:

– June 20, 8:30 a.m.: Statistics Canada releases May producer price inflation data.

– June 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April retail sales data.

– June 23, 9:45 a.m.: S&P Global releases (Flash) June U.S. data on manufacturing and services activity.

– June 23, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 GDP data.

– Earnings (Estimates based on FactSet data):

– June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12.

(Source: The Parrot Press)

- [posts_like_dislike id=1209]

Tags:AIAmericabitcoinBlackrockbtcChinaCoinbaseCryptoETHEUgoldsolanaStrategyTelegramTradingTrumpTrump MediaUS

By James Van Straten (All times ET unless indicated otherwise) Bitcoin treasury-holding companies are an essential factor driving momentum as the largest cryptocurrency by market cap hovers just below the $110,000...

Read moreBy James Van Straten (All times ET unless indicated otherwise)

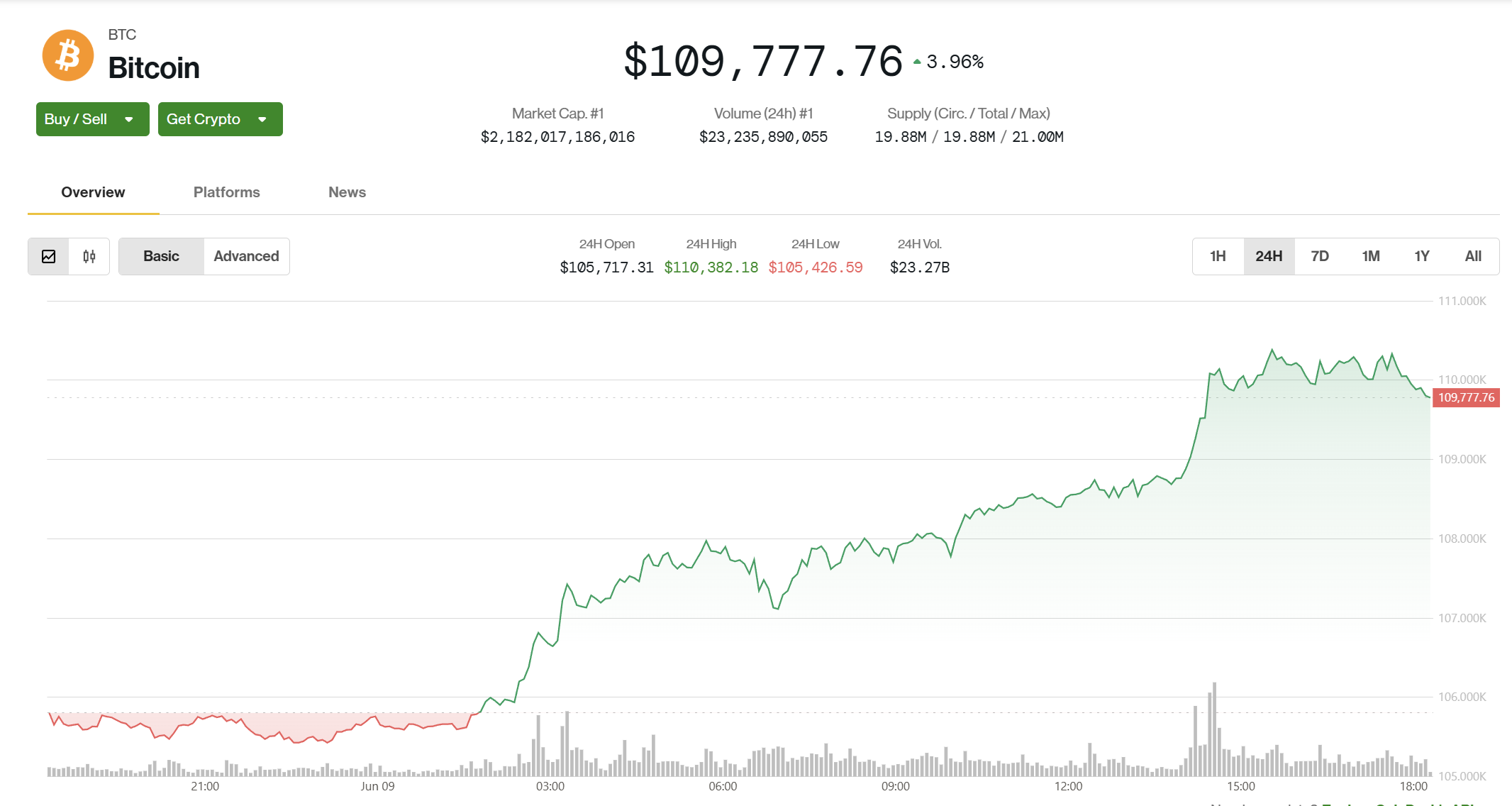

Bitcoin treasury-holding companies are an essential factor driving momentum as the largest cryptocurrency by market cap hovers just below the $110,000 mark, showing a 2% increase in the past 24 hours and standing just 2% away from its previous record high set last month.

Despite this, Bitcoin is lagging behind the broader market, as indicated by the CoinDesk 20 Index, which has grown by 3.4%, and Ethereum (ETH), which has surged by over 6%, according to CoinDesk data.

As per BitcoinTreasuries.net, the number of publicly listed companies holding Bitcoin as a treasury asset has climbed to 126, marking a growth of 22 within a month. Together, these companies possess approximately 819,000 BTC, representing a 3.25% increase during the same timeframe.

Insights from Matthew Sigel, who serves as the head of digital assets research at VanEck, emphasize the escalating institutional interest in Bitcoin. He highlights that companies such as Strategy (MSTR), Cantor Equity Partners (CEP), Asset Entities (ASST), Semler Scientific (SMLR), Kindly (NAKA), and Trump Media & Technology Group (DJT) have a combined capital-raising potential of $76 billion. This sum accounts for 56% of the assets under management of all Bitcoin ETFs and 169% of the total net inflows into these ETFs over the past 16 months.

Further displaying institutional support, BlackRock’s iShares Bitcoin Trust (IBIT) has achieved a significant milestone by becoming the fastest fund to exceed $70 billion in assets under management, achieving this feat in just 341 days. This surpasses the previous record held by SPDR Gold Shares (GLD) which took 1,691 days. IBIT experienced $2.7 billion in trading volume on Monday alone, positioning it as the sixth highest in daily volume among all ETFs.

However, institutional influence is not the only factor impacting Bitcoin. A recent Telegram note from QCP Capital pointed out one-year lows in implied volatility and a trend of subdued price action, highlighting that Bitcoin has been “stuck in a tight range” as the middle of the year approaches. The note mentions that a decisive break below $100,000 or above $110,000 is necessary to reignite broader market interest.

Looking ahead, U.S. Consumer Price Index (CPI) data set to release on Wednesday and any updates from the U.S.-China trade discussions in London may provide clearer market direction. It’s advised to stay vigilant!

In the realm of cryptocurrency, some key events to watch include:

– June 10: U.S. House Financial Services Committee hearing for Markup of Various Measures, including the crypto market structure bill, the Digital Asset Market Clarity (CLARITY) Act.

– June 11: Stratis (STRAX) activates a mainnet hard fork at block 2,587,200 to enable the Masternode Staking protocol.

– June 12: Coinbase’s State of Crypto Summit 2025 (New York). Livestream link available.

– June 16: 21Shares executes a 3-for-1 share split for ARK 21Shares Bitcoin ETF (ARKB), with ticker and NAV remaining unchanged.

– June 16: Brazil’s B3 exchange launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator.

Stay informed and watch out for these upcoming events in the crypto space.

- [posts_like_dislike id=1145]

Tags:AIAmazonAmericabitcoinbtcCEOChinaCircleCoinbaseCryptoETHEUFinancegoldIncomeJapanlibraMicrostrategymileiS&P 500StocksStrategyTelegramTradingTrumpTrump MediaUS

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin is trading below $110,000, changing hands at $109.7K, as Asia continues its trading week.

The move challenges a prevailing market narrative of summer stagnation, coming on the heels of a note from QCP Capital that emphasized suppressed volatility and a lack of immediate catalysts.

A recent Telegram note from QCP pointed to one-year lows in implied volatility and a pattern of subdued price action, noting that BTC had been “stuck in a tight range” as summer approaches.

A clean break below $100K or above $110K, they wrote, would be needed to “reawaken broader market interest.”

Even so, QCP warned that recent macro developments had failed to spark directional conviction.

“Even as US equities rallied and gold sold off in the wake of Friday’s stronger-than-expected jobs report, BTC remained conspicuously unmoved, caught in the cross-currents without a clear macro anchor,” the note said. “Without a compelling narrative to spark the next leg higher, signs of fatigue are emerging. Perpetual open interest is softening, and spot BTC ETF inflows have started to taper.”

That context makes the current move all the more surprising.

Over the weekend, Bitcoin surged 3.26% from $105,393 to $108,801, with hourly volume spiking to 2.5x the 24-hour average, according to CoinDesk Research’s technical analysis model. BTC broke decisively above $106,500, establishing new support at $107,600, and continued upward into Monday’s session, reaching $110,169.

The breakout coincides with a tense macro backdrop: US-China trade talks in London and a $22 billion U.S. Treasury bond auction later this week have injected uncertainty into global markets. While these events could drive fresh volatility, QCP cautioned that recent headlines have mostly led to “knee-jerk reactions” that quickly fade.

The question now is whether BTC’s move above $110K has true staying power, or whether the rally is running ahead of the fundamentals.

A ‘Massive Shift’ in Institutional Staking May Drive ETH’s Next Rally

Ethereum’s critics have long highlighted centralization risks, but that narrative is fading as institutional adoption accelerates, infrastructure matures, and recent protocol upgrades directly address past limitations.

“Market participants will pay for decentralization because it’s in their economic interest from a security and principal protection standpoint,” Mara Schmiedt, CEO of institutional Ethereum staking platform Alluvial, told CoinDesk. “If you look at [decentralization metrics] all of these things have massively improved over the last couple of years.”

There’s currently $492 million worth of ETH staked by Liquid Collective – a protocol co-founded by Alluvial to facilitate institutional staking

While this figure may appear modest compared to Ethereum’s total staked volume of around $93 billion, what’s interesting is that it originates predominantly from institutional investors.

“We’re really on the cusp of a truly massive shift for Ethereum, driven by regulatory momentum and the ability to unlock the advantages of secure staking,” she noted.

Central to Ethereum’s institutional readiness is the recent Pectra upgrade, a significant development Schmiedt describes as both “massive” and “underappreciated.”

“I think Pectra has been a massive upgrade. I actually think it’s been underappreciated, just in terms of the tremendous amount of change it introduces into the staking mechanics,” Schmiedt said.

Additionally, Execution Layer triggerable withdrawals—a key component of Pectra—provide institutional participants, including ETF issuers, a crucial compatibility upgrade.

This feature enables partial validator exits directly from Ethereum’s execution layer, aligning with institutional operational requirements such as T+1 redemption timelines.

“EL triggerable withdrawals create a much more effective path to exit for large-scale market participants,” Schmiedt added.

Ultimately, Schmiedt said, “I think we’ll see that a lot more [ETH] in institutional portfolios going forward.”

News Roundup

Trump Media May Be the Cheapest Bitcoin Play Among Public Stocks, NYDIG Says

Trump Media (DJT) may be one of the cheapest ways to get bitcoin exposure in public markets, according to a new report from NYDIG, CoinDesk recently reported.

As a growing number of companies adopt MicroStrategy’s strategy of stacking BTC on their balance sheets, analysts are rethinking how to value these so-called bitcoin treasury firms.

While the commonly used modified net asset value (mNAV) metric suggests that investors are paying a premium for BTC exposure, NYDIG’s Greg Cipolaro argues mNAV alone is “woefully deficient.” Instead, he points to the equity premium to NAV, which factors in debt, cash, and enterprise value, as a more accurate gauge.

By that measure, Trump Media and Semler Scientific (SMLR) rank as the most undervalued of eight companies analyzed, trading at equity premiums of -16% and -10% respectively, despite both showing mNAVs above 1.1. In other words, their shares are worth less than the value of the bitcoin they hold.

That’s in stark contrast to MicroStrategy (MSTR), which rose nearly 5% Monday as bitcoin crossed $110,000, while DJT and SMLR remained mostly flat—making them potentially overlooked vehicles for BTC exposure.

Circle Stock Nearly Quadruples Post-IPO as Bitwise and ProShares File Competing ETFs

Two major ETF issuers, Bitwise and ProShares, filed proposals on June 6 to launch exchange-traded funds tied to Circle (CRCL), whose stock has nearly quadrupled since its IPO late last week, CoinDesk previously reported.

ProShares is aiming for a leveraged product that delivers 2x the daily performance of CRCL. At the same time, Bitwise plans a covered call fund that generates income by selling options against held shares, two very different ways to capitalize on the stock’s explosive rise.

CRCL surged another 9% Monday in volatile trading, continuing to draw interest from both traditional finance and crypto investors. The proposed ETFs have an effective date of August 20, pending SEC approval. If approved, they would further blur the lines between crypto and conventional finance, giving investors new tools to play one of the hottest post-IPO names of the year.

Market Movements:

- BTC: Bitcoin is trading at $109,795 after a 3.26% breakout fueled by institutional buying, elevated volume, and macro uncertainty from US-China trade talks and an upcoming $22B Treasury auction.

- ETH: Ethereum rebounded 4.46% from a low of $2,480 to close at $2,581, with strong buying volume confirming support at $2,580 and setting up a potential breakout above $2,590.

- Gold: Gold is trading at $3,314.45, edging up 0.08% as investors watch US-China trade talks in London and a subdued dollar keeps prices attractive.

- Nikkei 225: Asia-Pacific markets rose Tuesday, with Japan’s Nikkei 225 up 0.51%, as investors awaited updates from ongoing U.S.-China trade talks.

- S&P 500: The S&P 500 closed slightly higher Monday, boosted by Amazon and Alphabet, as investors monitored U.S.-China trade talks.

Elsewhere in Crypto

- [posts_like_dislike id=1143]

IOST, a modular blockchain platform, has successfully completed a funding round, raising $21 million in strategic investments. The aim of this funding round is to support the expansion of its real-world...

Read moreIOST, a modular blockchain platform, has successfully completed a funding round, raising $21 million in strategic investments. The aim of this funding round is to support the expansion of its real-world asset (RWA) infrastructure into regulated markets. Leading the round were institutional investors DWF Labs, Presto, and Rollman Management Group. This influx of capital will allow IOST to accelerate product development, grow its validator network, and integrate with various ecosystems.

Tokenization, a key use case of blockchain technology, is garnering significant interest and investment from the traditional finance (TradFi) sector. IOST is set to focus its initial rollouts in Japan and throughout the Asia-Pacific region, where it is among the few public blockchains approved by the Japan Virtual Currency Exchange Association (JVCEA). Additionally, expansion plans are already underway in the Middle East, Europe, and North America.

IOST’s CEO, Blake Jeong, emphasized that this funding round signifies more than just capital raise; it showcases a dedication to constructing scalable and compliant infrastructure capable of supporting the next wave of tokenized assets. The protocol’s architecture includes a high-performance Layer 1 chain, EVM-compatible subnets, and a permissionless deployment model specifically designed for real-world asset issuance and compliant DeFi.

For further information, you can read more about the project’s developments in the recent launch of Plume’s Genesis Mainnet to bring real-world assets to DeFi.

- [posts_like_dislike id=1131]

The cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise. Norway-based crypto exchange Norwegian Block...

Read moreThe cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise.

Norway-based crypto exchange Norwegian Block Exchange saw its shares surge over 100% after revealing the purchase of six BTC, valued at $633K at current prices. The company plans to increase its holdings to 10 BTC by the end of the month.

Classover Holdings Inc, a Nasdaq-listed educational technology company with a market capitalization of $63 million, entered into a securities purchase agreement with Solana Growth Ventures LLC for up to $500 million in senior secured convertible notes, with 80% of the proceeds allocated to purchasing Solana’s native token SOL.

Ripple’s stablecoin RLUSD received regulatory approval from the Dubai Financial Services Authority, allowing the stablecoin to support the Dubai Land Department’s blockchain initiative to tokenize real estate title deeds on the XRP Ledger.

Robinhood completed a $200 million all-cash acquisition of the Luxembourg-based crypto exchange Bitstamp, expanding its presence in Europe.

U.S.-listed spot bitcoin ETFs experienced a net outflow of $268 million on Monday, while Ethereum spot ETFs recorded a net inflow of $78.17 million. Meanwhile, the Japanese yen declined during Asian hours due to the Bank of Japan’s plans to halt its Japanese government bond purchases.

The dollar index remained under pressure due to trade uncertainty and rising concerns in the bond market over the U.S. deficit. Negative surprises in Monday’s ISM manufacturing surveys punctured the U.S. resilience story.

Focus today will be on April’s JOLTS report and durable goods orders. A soft labor market data could push the dollar back to its April lows, according to ING.

A U.S. House hearing on “The Future of Digital Assets” featured Aptos Labs CEO Avery Ching’s testimony, led by the Agriculture Committee. Stay informed!

In the cryptocurrency space, upcoming events include network upgrades on Pocket Network and Sia, congressional hearings, and the announcement of the 3-for-1 share split for ARK 21Shares Bitcoin ETF.

Conferences to watch out for include SXSW London, World Computer Summit 2025, Money20/20 Europe, Non Fungible Conference, Crypto Valley Conference, BTC Prague 2025, Bitcoin Policy Institute’s Bitcoin Policy Summit 2025, and Istanbul Blockchain Week.

Token events include governance votes, unlocks, and token launches across various platforms.

In the market, BTC and ETH prices saw some movement, while the CoinDesk 20 experienced a slight increase. Key market indicators also showed some fluctuations.

Derivatives positioning and crypto equities like MSTR, COIN, GLXY, MARA, and more displayed various performance measures.

ETF flows revealed daily and cumulative net flows for spot BTC and spot ETH ETFs.

Stay updated on overnight flows, technical analysis, and the latest news in the crypto and financial markets.

The content was written without any Coindesk attribution or HTML coding.

- [posts_like_dislike id=1101]

Tags:AIAmericaBinancebitcoinBlackrockbtcCoinbaseCryptoElon MuskETHEUEuropeFinancegoldJapanMicrostrategyStrategyTariffsTradingTrumpUSWashington

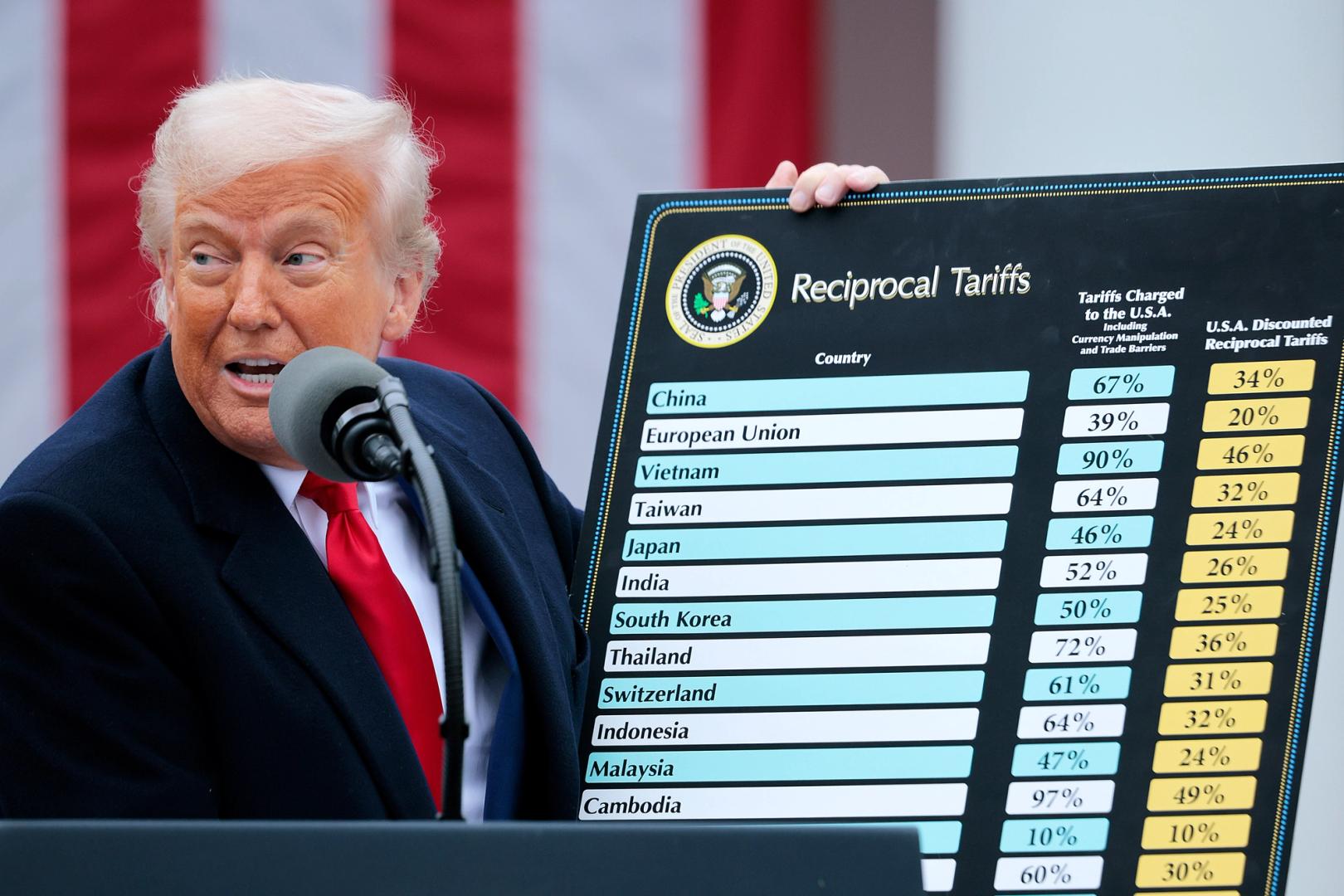

The recent TACO tease, implying “Trump Always Chickens Out” on tariffs, likely didn’t go down well with the President, who raised the stakes in the ongoing trade war on Friday, leading...

Read moreThe recent TACO tease, implying “Trump Always Chickens Out” on tariffs, likely didn’t go down well with the President, who raised the stakes in the ongoing trade war on Friday, leading to broad-based risk aversion.

On Friday, Trump said that on June 4, the U.S. tariffs on imported aluminum and steel would go from 25% to 50%, triggering a broad-based risk-off move across global markets. Bitcoin has since traded in the range of $103,000-$106,000, with little to no excitement in the broader crypto market. Notably, BlackRock’s spot bitcoin ETF (IBIT) registered an outflow of $430 million, ending a prolonged inflows streak.

“Tariff tensions will likely dominate the macro narrative through June, with meaningful policy deadlines only kicking in from 8 July. In the absence of fresh catalysts, BTC could remain rangebound, with the $100k and $110k levels critical to watch given their status as strikes with the highest month-end open interest,” Singapore-based trading firm QCP Capital said.

ETFs are becoming increasingly important to the market. Data shared by FalconX’s David Lawant shows that the cumulative trading volume in the 11 spot BTC ETFs listed in the U.S. is now well over 40% of the spot volume. The data supports the “Bitcoin ETFs are the new marginal buyer” hypothesis, according to Bitwise’s Head of Research – Europe, Andre Dragosch.

Meanwhile, on-chain data tracked by Glassnode showed a drop in momentum buyers alongside a sharp rise in profit takers last week. “This trend often shows near local tops, as traders begin locking in gains instead of building exposure,” Glassnode said.

High-stakes crypto trader James Wynn opened a fresh BTC long trade with 40x leverage and a liquidation price of $104,580, according to blockchain sleuth Lookonchain.

In other news, Japan’s “MicroStrategy” Metaplanet announced an additional purchase of 1,088 BTC, and billionaire entrepreneur Elon Musk announced a new XChat with Bitcoin-like encryption.

Binance’s founder CZ said on X that now might be a good time to develop a dark pool-style perpetual-focused decentralized exchange, noting that real-time order visibility can lead to MEV attacks and malicious liquidations.

In traditional markets, gold looked to break out of its recent consolidation, hinting at the next leg higher as Bank of America and Morgan Stanley forecast continued dollar weakness. Friday’s U.S. nonfarm payrolls release will be closely watched for signs of labor market weakness. Stay Alert!

What to Watch

Crypto

June 3, 1 p.m.: The Shannon hard fork network upgrade will get activated on the Pocket Network (POKT).

June 4, 10 a.m.: U.S. House Financial Services Committee will hold a hearing on “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

June 6: Sia (SC) is set to activate Phase 1 of its V2 hard fork, the largest upgrade in the project’s history. Phase 2 will get activated on July 6.

June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable on “DeFi and the American Spirit”

June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto market structure bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

Macro

June 2, 1 p.m.: Federal Reserve Chair Jerome H. Powell will deliver a speech at the Federal Reserve Board’s International Finance Division 75th Anniversary Conference in Washington. Livestream link.

June 2, 9:45 a.m.: S&P Global releases (Final) May U.S. Manufacturing PMI data. Manufacturing PMI Est. 52.3 vs. Prev. 50.2

June 2, 10 a.m.: The Institute for Supply Management (ISM) releases May Manufacturing PMI. Manufacturing PMI Est. 49.5 vs. Prev. 48.7

June 3: South Koreans will vote to choose a new president following the ouster of Yoon Suk Yeol, who was dismissed after briefly declaring martial law in December 2024.

June 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labor market data. Job Openings Est. 7.10M vs. Prev. 7.192M Job Quits Prev. 3.332M

June 3, 1 p.m.: Federal Reserve Governor Lisa D. Cook will deliver a speech on economic outlook at the Peter McColough Series on International Economics in New York. Livestream link.

June 4, 12:01 a.m.: U.S. tariffs on imported steel and aluminum will increase from 25% to 50%, according to a Friday evening Truth Social post by President Trump.

Earnings (Estimates based on FactSet data)

None in the near future.

Token Events

Governance votes & calls

Sui DAO is voting on moving to recover approximately $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 and Unichain support in Oku. The goal is to expand V4 adoption, support hook developers, and improve tools for LPs and traders. Voting ends June 6.

June 4, 6:30 p.m.: Synthetix to host a community call.

June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

June 5: Ethena (ENA) to unlock 0.7% of its circulating supply worth $14.18 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $57.11 million.

June 13: Immutable (IMX) to unlock 1.33% of its circulating supply worth $13.24 million.

June 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $17.11 million.

June 15: Sei (SEI) to unlock 1.04% of its circulating supply worth $10.64 million.

Token Launches

June 3: Bondex (BDXN) to be listed on Binance, Bybit, Coinlist, and others.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN).

Conferences

Day 1 of 6: SXSW London

June 3: World Computer Summit 2025 (Zurich)

June 3-5: Money20/20 Europe 2025 (Amsterdam)

June 4-6: Non Fungible Conference (Lisbon)

June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

June 19-21: BTC Prague 2025

June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

June 26-27: Istanbul Blockchain Week

Token Talk

While You Were Sleeping

In the Ether

Derivatives Positioning

Market Movements

Bitcoin Stats

Technical Analysis

Crypto Equities

ETF Flows

Overnight Flows

Chart of the Day

Bitcoin Stats

- [posts_like_dislike id=1095]

By SEO Writer for The Parrot Press Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news...

Read moreBy SEO Writer for The Parrot Press

Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news was followed by Nvidia’s upbeat earnings report, boosting positive sentiment in the market.

Large Bitcoin wallets holding over 10,000 BTC have transitioned to selling from buying as the cryptocurrency nears its all-time high. Additionally, an increase in exchange deposits indicates selling pressure. The options market data hints at potential volatility leading up to Friday’s monthly settlement.

Ether, the second-largest cryptocurrency by market value, surged to $2,780, its highest level since February 24, supported by bullish signals from the derivatives market. The rise in the token’s price this week is attributed to SharpLink’s $425 million Treasury plan. Notably, U.S.-listed spot ether ETFs saw a net inflow of $84.89 million on Wednesday for the eighth consecutive day.

Canada-listed investment firm Sol Strategies has filed to raise up to $1 billion to boost its investment in the Solana ecosystem. Despite this, SOL remained flat at around $170.

In other news, TON, PEPE, and FLOKI led the market while FARTCOIN, PI, and JUP experienced the most losses. Open interest in TON perpetual futures surged by 33% to $190 million, reaching its highest level since February 18.

Stablecoin issuer Circle froze wallets connected to the Libra token containing millions in USDC. Metaplanet issued $21 million in bonds to finance more Bitcoin purchases.

In traditional markets, some investment banks suggested that Trump has alternative tools to bypass the court ruling on tariffs. Yields on longer-duration Treasury notes increased, indicating strength in the dollar. Stay tuned for more updates!

What to Watch:

Crypto:

– May 30: The second round of FTX repayments start.

– May 31 (TBC): Mezo mainnet launch.

– June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable on “DeFi and the American Spirit”

Macro:

– Various economic releases and announcements scheduled for May 29-30.

Earnings:

– No significant earnings events in the near future.

Token Events:

Governance votes & calls:

– Various upcoming votes and calls for different tokens and platforms.

Unlocks:

– Schedule of upcoming token unlocks.

Token Launches:

– Information on upcoming token launches and deadlines.

Conferences:

– List of upcoming conferences and summits in the crypto and blockchain space.

Token Talk: An overview of major events and news in the token market.

Derivatives Positioning: Analysis of derivatives positions in the market.

Market Movements: Highlights of major market movements and performances.

Bitcoin Stats: Statistical data related to Bitcoin.

Technical Analysis: Insights into technical analysis of market trends.

Crypto Equities: Updates on crypto-related equities and their performance.

ETF Flows: Information on ETF flows related to Bitcoin and Ethereum.

Overnight Flows: Updates on overnight market movements and performance.

Chart of the Day: Featured chart highlighting market trends.

While You Were Sleeping: Summary of overnight news and developments.

In the Ether: A series of images illustrating various aspects of the cryptocurrency market.

- [posts_like_dislike id=1071]