The cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise. Norway-based crypto exchange Norwegian Block...

Read moreThe cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise.

Norway-based crypto exchange Norwegian Block Exchange saw its shares surge over 100% after revealing the purchase of six BTC, valued at $633K at current prices. The company plans to increase its holdings to 10 BTC by the end of the month.

Classover Holdings Inc, a Nasdaq-listed educational technology company with a market capitalization of $63 million, entered into a securities purchase agreement with Solana Growth Ventures LLC for up to $500 million in senior secured convertible notes, with 80% of the proceeds allocated to purchasing Solana’s native token SOL.

Ripple’s stablecoin RLUSD received regulatory approval from the Dubai Financial Services Authority, allowing the stablecoin to support the Dubai Land Department’s blockchain initiative to tokenize real estate title deeds on the XRP Ledger.

Robinhood completed a $200 million all-cash acquisition of the Luxembourg-based crypto exchange Bitstamp, expanding its presence in Europe.

U.S.-listed spot bitcoin ETFs experienced a net outflow of $268 million on Monday, while Ethereum spot ETFs recorded a net inflow of $78.17 million. Meanwhile, the Japanese yen declined during Asian hours due to the Bank of Japan’s plans to halt its Japanese government bond purchases.

The dollar index remained under pressure due to trade uncertainty and rising concerns in the bond market over the U.S. deficit. Negative surprises in Monday’s ISM manufacturing surveys punctured the U.S. resilience story.

Focus today will be on April’s JOLTS report and durable goods orders. A soft labor market data could push the dollar back to its April lows, according to ING.

A U.S. House hearing on “The Future of Digital Assets” featured Aptos Labs CEO Avery Ching’s testimony, led by the Agriculture Committee. Stay informed!

In the cryptocurrency space, upcoming events include network upgrades on Pocket Network and Sia, congressional hearings, and the announcement of the 3-for-1 share split for ARK 21Shares Bitcoin ETF.

Conferences to watch out for include SXSW London, World Computer Summit 2025, Money20/20 Europe, Non Fungible Conference, Crypto Valley Conference, BTC Prague 2025, Bitcoin Policy Institute’s Bitcoin Policy Summit 2025, and Istanbul Blockchain Week.

Token events include governance votes, unlocks, and token launches across various platforms.

In the market, BTC and ETH prices saw some movement, while the CoinDesk 20 experienced a slight increase. Key market indicators also showed some fluctuations.

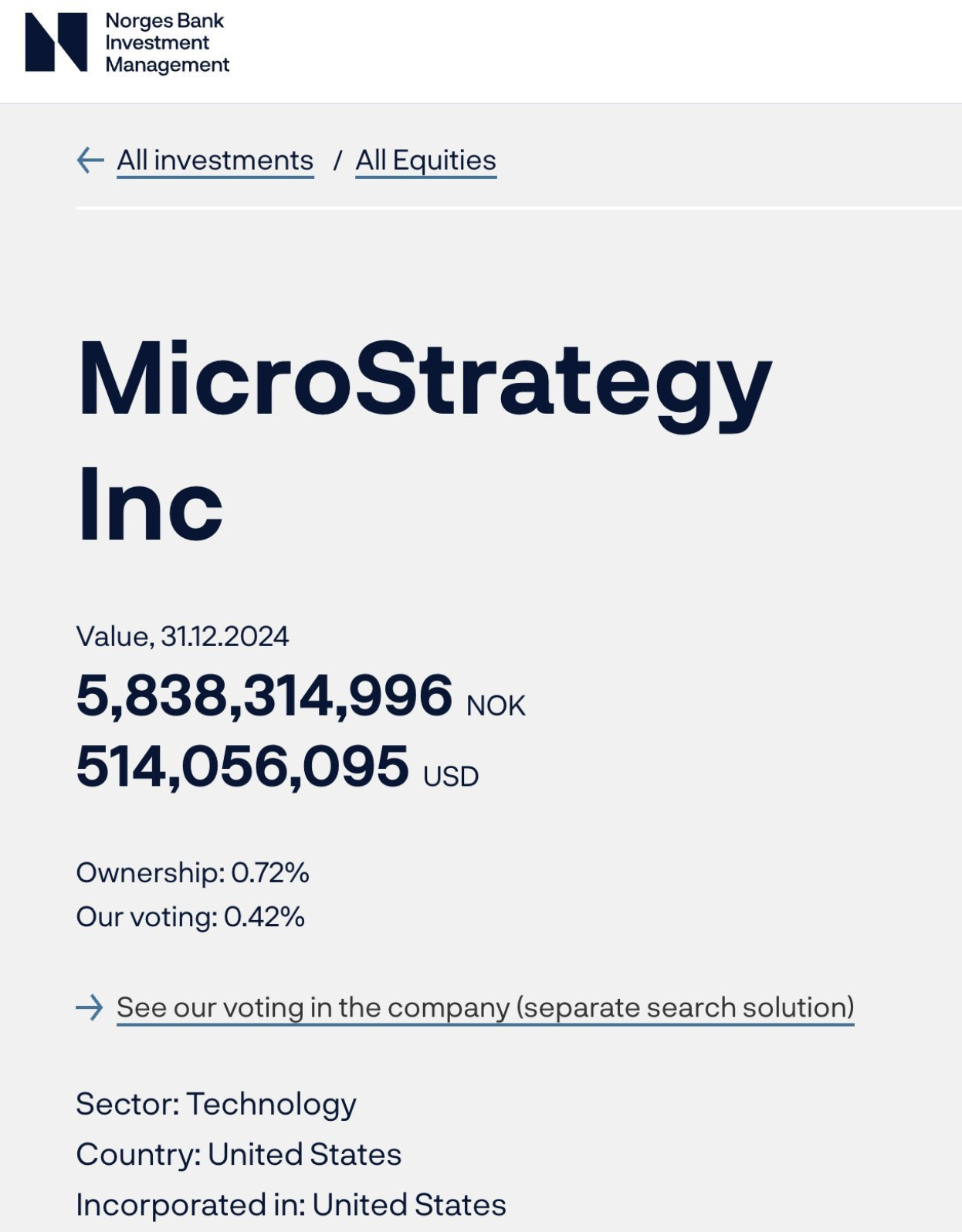

Derivatives positioning and crypto equities like MSTR, COIN, GLXY, MARA, and more displayed various performance measures.

ETF flows revealed daily and cumulative net flows for spot BTC and spot ETH ETFs.

Stay updated on overnight flows, technical analysis, and the latest news in the crypto and financial markets.

The content was written without any Coindesk attribution or HTML coding.

- [posts_like_dislike id=1101]