President Donald Trump sparked excitement within the crypto industry by instructing his administration to establish cryptocurrencies as a long-term investment for the U.S. government. However, progress on this front has been...

Read moreUnited States

Coinbase Derivatives and Nodal Clear are teaming up to incorporate the USDC stablecoin as collateral in regulated U.S. futures markets, with the goal of rolling out the new framework in 2026....

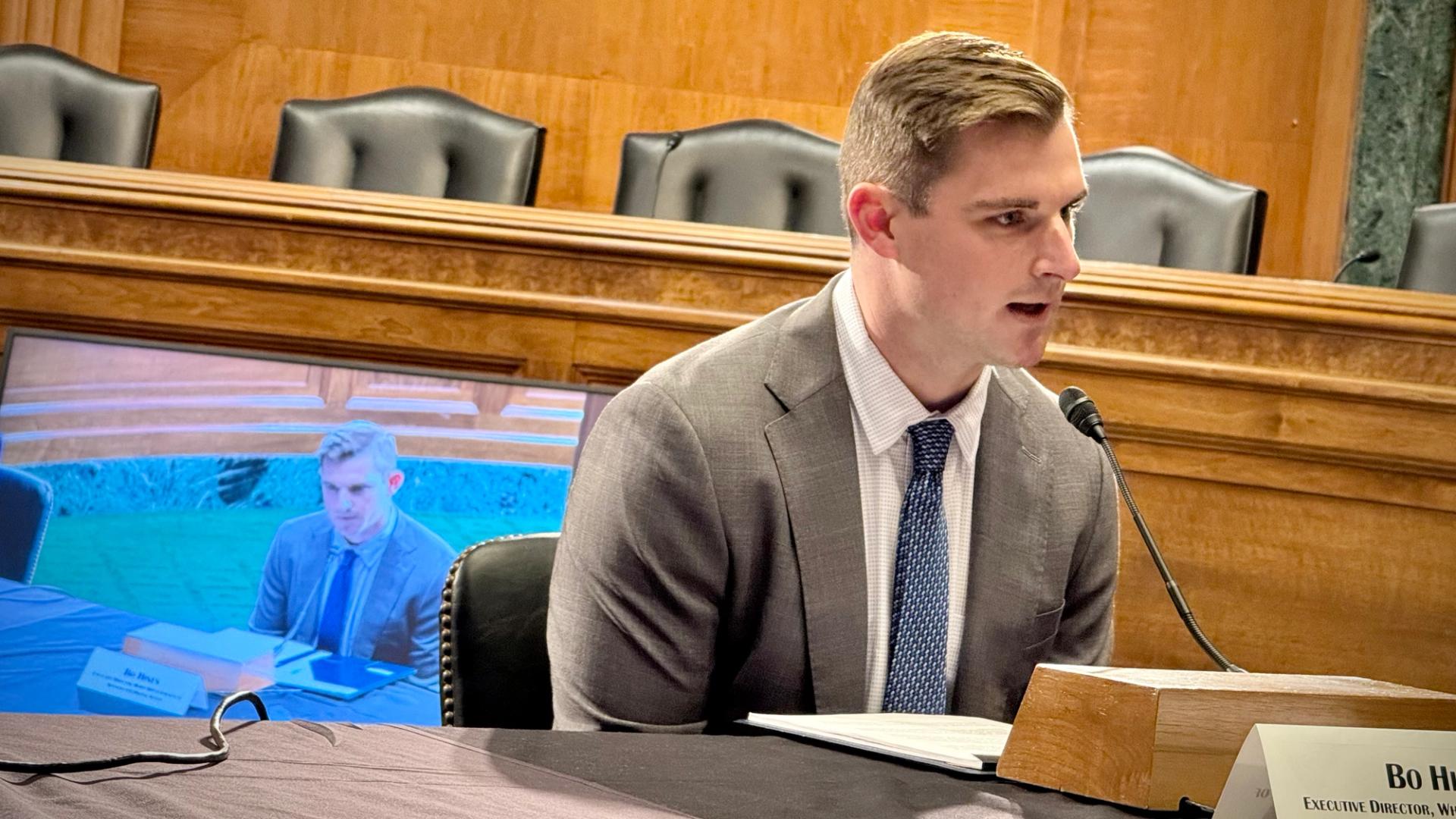

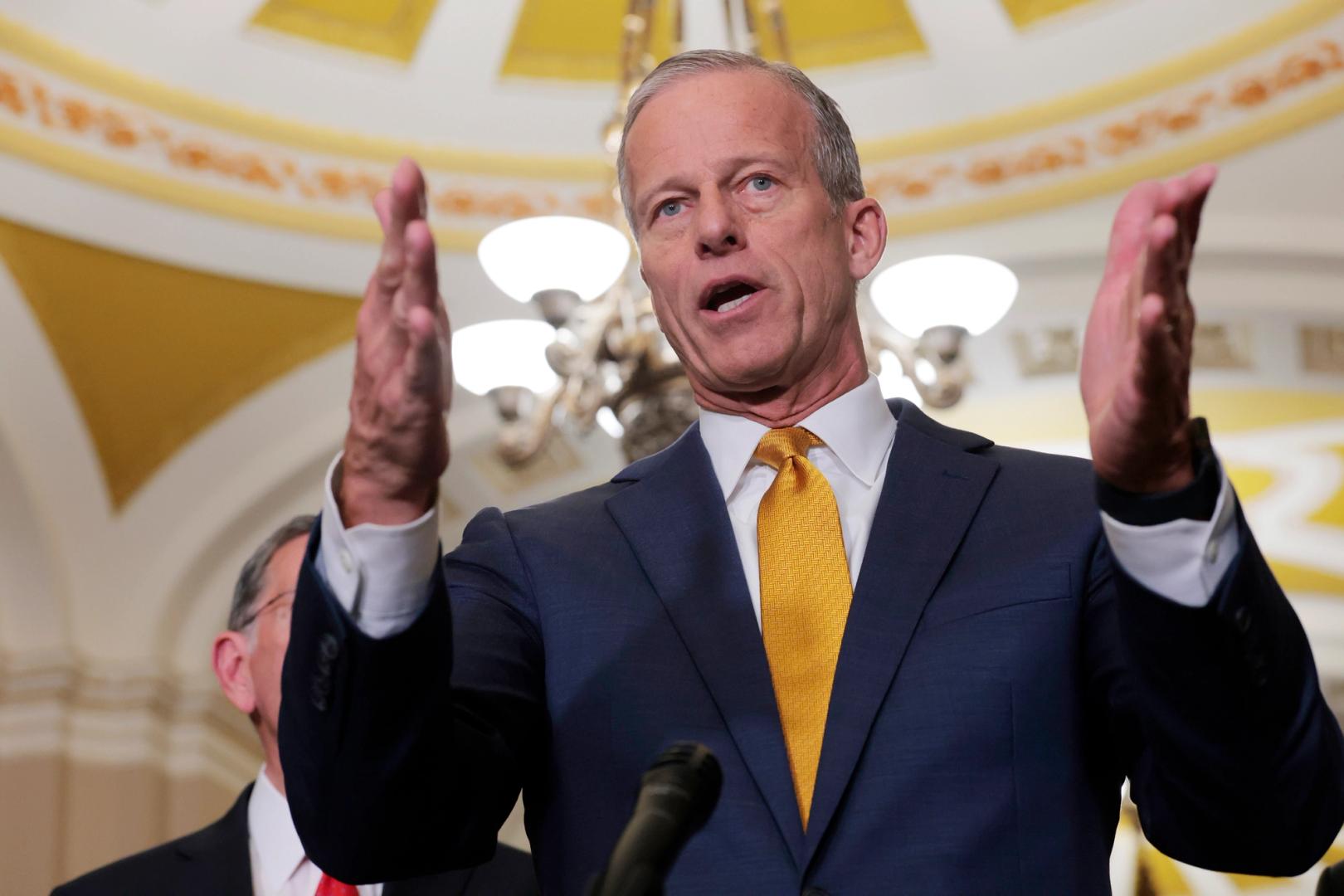

Read moreThe GENIUS Act, a crucial piece of U.S. stablecoin regulation, is set to be voted on this week with the expectation that it will become law in the coming months, according...

Read moreWalmart and Amazon are reportedly considering launching their own stablecoins in the United States, as per a report by the Wall Street Journal. These corporate digital tokens, tied to the U.S....

Read moreDuring Justin Sun’s last visit to the United States, he held the title of Grenada’s WTO ambassador and faced challenges with former President Biden’s stance on cryptocurrency. However, times have changed...

Read moreTelegram has recently shut down numerous channels linked to suspected Chinese crypto-crime marketplaces following new research findings from Elliptic. The closure comes on the heels of a report released by the...

Read moreThe U.S. Senate is gearing up to vote on legislation that would establish regulations for the issuers of stablecoins, marking a significant milestone as the chamber delves into the world of...

Read moreSam Altman’s innovative blockchain project, World, is set to launch in the United States, with plans to deploy 7,500 eye-scanning “orbs” in cities across the nation by the end of the...

Read moreChina has announced a significant 84% tariff on all imports from the United States, effective from April 10, 2025. This decision comes as a direct response to the U.S. increasing its...

Read moreBitcoin’s recent dip below $92,000 amid Trump’s renewed trade war announcements has sparked concerns among investors about the sustainability of the current bull market. However, historical data and strong demand fundamentals...

Read more