Shiba Inu (SHIB), the meme token, has seen a significant bullish reversal pattern as speculation around ETFs drives BONK to higher levels. SHIB experienced a 5.2% surge in the last 24...

Read moretrillion

The most valuable startups in the world are not publicly traded. They are held in private portfolios, with strict capital requirements, long lockups, and limited deal flow access. Historically, only a...

Read moreThe most valuable startups in the world are not publicly traded. They are held in private portfolios, with strict capital requirements, long lockups, and limited deal flow access. Historically, only a select few, such as endowments, family offices, and well-connected institutional players, have had access to private markets.

Today, private markets remain exclusive. Traditional private equity demands minimum investments ranging from $250,000 to $25 million, while venture capital funds often require minimums of over $1 million. Accredited investor requirements further restrict access for the majority of Americans who do not meet these wealth thresholds.

However, blockchain technology is starting to break down these barriers. It is creating a new financial system that brings transparency, liquidity, and accessibility to what has traditionally been a secretive and illiquid space. Tokenization is revolutionizing private markets by converting real-world assets, such as shares in startups or private funds, into digital tokens with embedded compliance.

Imagine being able to invest in a basket of high-growth companies through a single, liquid asset on the blockchain. Investors no longer have to wait years for a potential exit, as secondary markets and liquidity protocols now allow for dynamic trading at fair prices. Tokenized vehicles also offer governance rights, performance incentives, and exposure to hard-to-access assets like pre-IPO unicorns or private equity funds.

This shift towards tokenization is not just about efficiency, but also about democratizing access. It opens up opportunities for smaller investors, global participants, and underserved regions to invest in private markets that were previously out of reach. With compliant issuance platforms and regulated secondary markets, access to private market assets is becoming a programmable right rather than a privilege.

The total volume of secondary market transactions hit record highs in 2024, reaching over $150 billion. However, this only represents about 1% of the total private market value, indicating significant room for growth. With tokenized private assets valued at approximately $14 billion against a total addressable market of $12 trillion, there is immense potential for further growth.

Despite the challenges of regulatory clarity and investor protection, the momentum towards tokenization in private markets is undeniable. The future financial system will be interoperable, inclusive, and transparent, blurring the lines between public and private, analog and digital, and developed and developing economies.

Tokenized private assets are not just a new asset class; they signify that the next trillion-dollar opportunity will not be isolated but integrated into a more accessible and liquid financial network. The gate is open, and the future of private markets is moving towards being on-chain.

- [posts_like_dislike id=1237]

Tags:AIbitcoinbtcCircleCoinbaseCryptoDonald TrumpETHEUFinancegoldIranIsraelJapanmemecoinS&P 500solanaTariffsTradingtrillionTrumpUSUSDCXRP

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis.

South Korea has long been known for its outsized influence on altcoin markets, from the XRP mania that drove a 400% rally last year to the present-day obsession with a token that proudly calls itself USELESS.

The USELESS phenomenon has ties to South Korean KOLs, Bradley Park, a Seoul-based analyst with DNTV Research, shared in an interview.

At the center of everything is Yeomyung, a Korean KOL and liquidity provider who aped into USELESS early, held through a 50% drawdown, and is now sitting on serious paper gains.

Park noted that his early conviction has inspired copy-trading among Korean retail investors. Even wallets tied to insiders on Solana’s Jupiter JUP are holding. The rise of USELESS reflects a broader evolution in Korean market behavior.

Another character in this story is Bonk Guy, an early promoter of BONK, who reappeared to tweet enthusiastically about USELESS after the price rebounded, though some Korean traders, including Park, have questioned his sincerity.

Park pointed to the rise of Hyperliquid, Kaia, and now Solana-based memecoins like USELESS as evidence that Korea is no longer a secondary market.

While XRP’s rally was underpinned by legal clarity in the U.S., USELESS feels like a reflection of where attention and exhaustion are flowing in today’s market, Park said.

With no roadmap, no utility, and no pretense of building something bigger, it taps into a kind of memetic disillusionment: a collective shrug at traditional crypto promises, and an ironic bet on nothingness that appears to be more honest than many tokens claiming to change the world.

Trump Endorses GENIUS Act

President Donald Trump on Tuesday endorsed the GENIUS Act in a Truth Social post following its bipartisan passage in the Senate, calling it a major step toward U.S. leadership in the digital asset sector.

Trump urged the House of Representatives to pass the bill “lightning fast” and without amendments, stating it should be sent to his desk with “no delays, no add-ons.”

The message signals strong executive support for the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which introduces reserve and compliance requirements for dollar-backed stablecoin issuers.

Trump framed the legislation as key to enabling “massive investment” and “big innovation,” positioning the U.S. as a global leader in digital assets.

While the bill passed the Senate with significant bipartisan backing, its fate in the House remains uncertain.

Democratic lawmakers are weighing potential amendments, including stricter oversight for foreign-issued tokens and limitations on potential issuers.

However, the bill isn’t without its critics. In a recent CoinDesk editorial, Georgetown University finance professor James J. Angel argues that the GENIUS Act is a flawed piece of legislation.

News Roundup: Coinbase Unveils Coinbase Payments for Merchants

Coinbase unveiled Coinbase Payments on Wednesday, a new merchant-focused payments stack built on its Ethereum layer-2 network Base.

The product allows global ecommerce platforms like Shopify to accept USDC 24/7 without needing blockchain expertise, using tools like a gasless stablecoin checkout, an ecommerce API engine, and an onchain payments protocol.

Coinbase said the system is designed to replicate traditional payment rails while lowering costs and offering always-on settlement.

It also deepens its partnership with USDC issuer Circle, whose shares jumped 25% on the news, while Coinbase rallied 16%.

Coinbase says stablecoins processed $30 trillion in transactions last year, tripling from the year prior.

Market Movements:

- BTC: Bitcoin rebounded above $105,000 in a V-shaped recovery despite escalating Israel-Iran tensions, with strong ETF inflows and key support at $103,650 highlighting institutional confidence amid market volatility.

- ETH: Ethereum rebounded 4% to hold above $2,500 despite Middle East tensions, with record-high staking and accumulation signaling growing investor conviction amid market volatility.

- Gold: Gold slipped 0.19% to $3,383.11 after the Fed held rates steady at 4.25–4.5%, with Chair Powell signaling no imminent policy changes and emphasizing continued economic strength despite trade tensions.

- Nikkei 225: Japan’s Nikkei 225 slipped 0.27% on Thursday as Asia-Pacific markets traded mixed, weighed down by the Fed’s rate pause and ongoing Israel-Iran tensions.

- S&P 500: The S&P 500 dipped 0.03% to 5,980.87 after the Fed held rates steady, with Chair Powell signaling a wait-and-see approach amid uncertainty over Trump’s tariffs.

Elsewhere in Crypto:

- Crypto doesn’t have to be a market for lemons

- Are Criminals Really Switching From Crypto to Gold for Money Laundering?

- UK to Propose Restrictions on How Banks Can Deal With Crypto Next Year

- [posts_like_dislike id=1199]

Conduit, a company specializing in stablecoin-focused cross-border payments, announced a partnership with Brazil’s Braza Group to facilitate real-time foreign exchange swaps between the Brazilian real and major foreign currencies using stablecoins....

Read moreConduit, a company specializing in stablecoin-focused cross-border payments, announced a partnership with Brazil’s Braza Group to facilitate real-time foreign exchange swaps between the Brazilian real and major foreign currencies using stablecoins.

This service enables users to quickly convert Brazilian real to U.S. dollars or euros and settle transactions in minutes using stablecoins, in contrast to the traditional FX infrastructure where settlement can take several days.

Braza, the owner of Brazil’s largest FX bank with $67 billion in transactions processed last year, introduced its own real-pegged stablecoin BBRL on the XRP Ledger earlier in the year. BBRL tokens are minted by Braza when a payment originates in Brazil. Conduit then exchanges the BBRL for dollar- or euro-pegged stablecoins and transfers the funds to the recipient’s bank or wallet abroad.

Stablecoins, cryptocurrencies with values tied to fiat currencies, have become a rapidly growing sector in the crypto industry. Their use in cross-border payments and remittances is expanding, especially in developing markets where traditional banking methods can be costly or unreliable.

Citi, a global bank, predicts that the stablecoin sector could grow from $250 billion to $1.6 trillion by 2030. Lawmakers in the U.S. are also advancing stablecoin-specific regulations to encourage businesses and financial institutions to explore the use of stablecoins for payments.

CEO of Conduit, Kirill Gertman, stated, “Creating seamless on-ramps between fiat and digital currencies, along with on-chain stablecoin FX swaps, has the potential to revolutionize cross-border payments.” Conduit provides the infrastructure that connects blockchains with traditional financial systems. The startup, based in Boston, recently secured $36 million in funding and reported an annualized transaction volume of $10 billion.

Find out more about Conduit’s expansion of stablecoin-based cross-border payments beyond SWIFT here.

- [posts_like_dislike id=1159]

The cryptocurrency market is currently experiencing increased volatility due to a growing feud between President Donald Trump and former Department of Government Efficiency head, Elon Musk, regarding the state of the...

Read moreThe cryptocurrency market is currently experiencing increased volatility due to a growing feud between President Donald Trump and former Department of Government Efficiency head, Elon Musk, regarding the state of the U.S. economy.

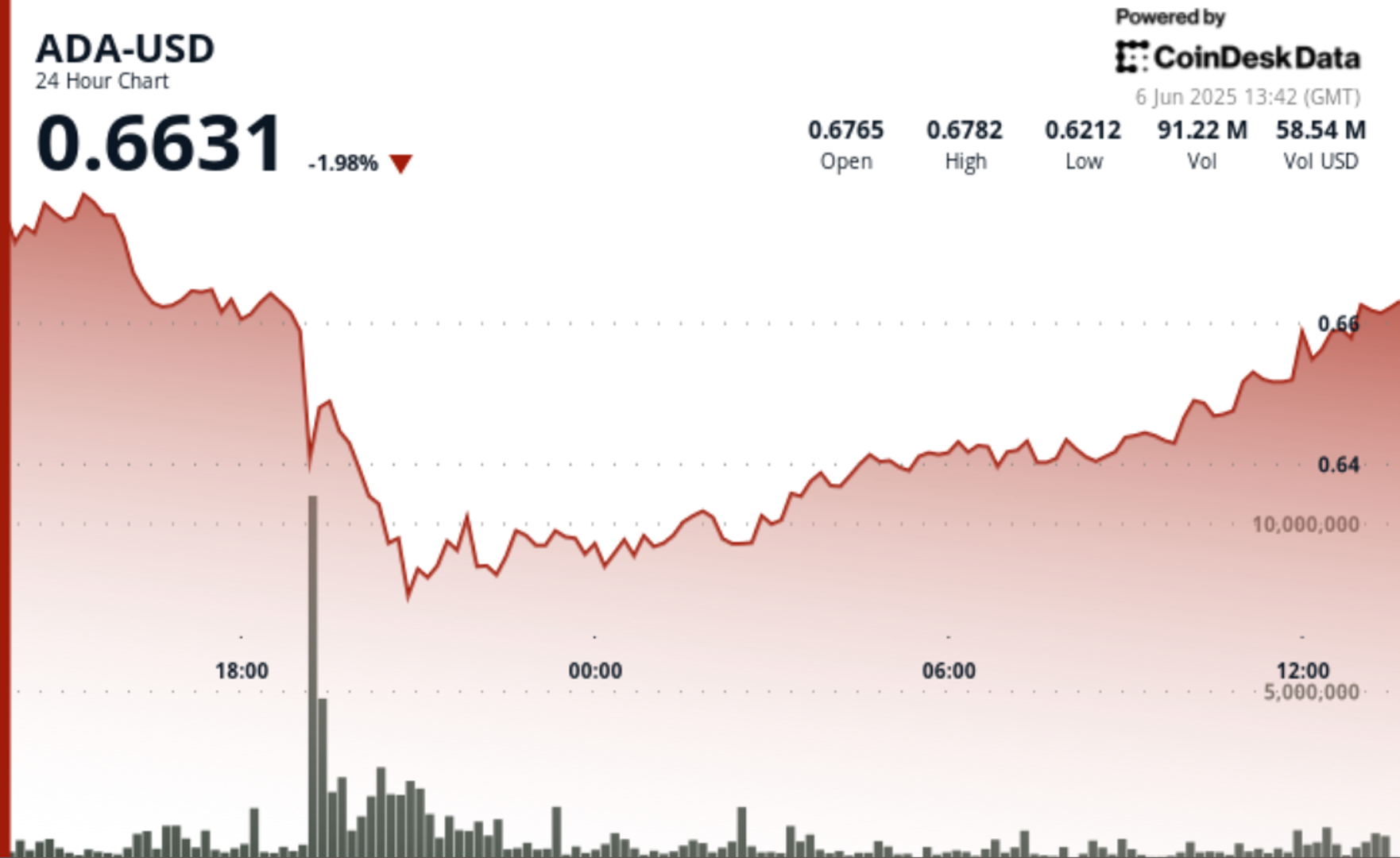

Cardano’s ADA has also been affected by market uncertainty, with the price fluctuating significantly. After dropping to $0.621 from $0.688, ADA found strong support and rebounded, forming an ascending channel with resistance at $0.644, as per our technical analysis model. The indicators suggest a potential bullish momentum as ADA reclaims the $0.640 level with decreasing volatility.

Currently, ADA is trading at $0.66, down about 1.8% in the last 24 hours, while the CoinDesk 20 Index fell by 1%.

Recent developments within the ADA ecosystem, such as institutional interest in the Cardano blockchain from companies like Franklin Templeton and NBX partnering with Cardano for Bitcoin-based DeFi, have provided potential catalysts for the token. Additionally, the successful execution of the first Bitcoin-to-Cardano transaction by Ordinals marks a significant milestone that could open up $1.5 trillion in cross-chain trading opportunities.

Key technical analysis highlights of ADA include a sharp decline from $0.688 to $0.621, establishment of a strong support zone at $0.620-$0.623, formation of an ascending channel with resistance at $0.644, and the potential for renewed bullish momentum as ADA reclaims the $0.640 level with decreasing volatility.

Disclaimer: This article contains information generated with the assistance of AI tools and has been reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, refer to our AI Policy.

- [posts_like_dislike id=1135]

Shiba Inu (SHIB) has seen a 3% recovery from its recent lows under $0.00001200, outperforming Bitcoin (BTC) despite a large whale transaction. Despite a 7.7% correction on Thursday, SHIB dropped to...

Read moreShiba Inu (SHIB) has seen a 3% recovery from its recent lows under $0.00001200, outperforming Bitcoin (BTC) despite a large whale transaction. Despite a 7.7% correction on Thursday, SHIB dropped to 0.0000119 before finding strong support at 0.0000120. The price has since bounced back to $0.00001241 as per data.

A significant whale transaction of 2.87 trillion SHIB worth $36 million to Coinbase Institutional initially raised market concerns. However, it was later identified as associated with market maker custody rather than a whale looking to sell coins.

Despite the recovery, SHIB is still trading 10% lower for the week as investors deal with broader market pressures. The cryptocurrency is stuck in a downward-trending channel, with trendlines connecting the highs on May 12 and May 23 and the low on May 17.

An AI technical insight for the past 24 hours shows that SHIB dropped from 0.0000129 to a low of 0.0000119, representing a 7.7% decline with high volume during a sell-off. The price found strong support at the 0.0000120 level, showcasing accumulation and establishing a demand zone.

During the recovery phase, an ascending support trendline formed, with the price stabilizing around 0.0000122, approximately 4.9% above the period low. SHIB demonstrated a significant recovery pattern in the last hour, climbing with notable volume spikes. Substantial accumulation occurred with exceptionally high volume at 07:55.

There was a clear resistance zone at 0.0000123, which was successfully breached during the final minutes of the period.

- [posts_like_dislike id=1127]

Last month, we delved into how bond market activity is casting doubt on the stability of the U.S. government’s financial strength, shaking up the long-held belief in fiscal stability. Now, tech...

Read moreLast month, we delved into how bond market activity is casting doubt on the stability of the U.S. government’s financial strength, shaking up the long-held belief in fiscal stability.

Now, tech billionaire Elon Musk has sounded the alarm on Twitter regarding President Donald Trump’s significant tax bill, which could increase the fiscal deficit by $2.4 trillion over a decade.

This comes amid mounting concerns that investors are shifting away from U.S. assets towards alternative options like bitcoin and gold. As of FY 2024, the fiscal deficit stood at $1.8 trillion, while the national debt now sits at a staggering $36 trillion, with annual interest payments totaling $1.13 trillion.

Musk’s public declaration of fiscal worry could catalyze a further move away from U.S. assets. Corporate adoption of bitcoin and other tokens like XRP has been on the rise, potentially fueled by these concerns.

Additionally, investors troubled by the government’s fiscal condition may demand higher inflation-adjusted yields to lend money. This could keep yields elevated, adding complexity to the fiscal situation and economic growth prospects.

In theory, the government has been bankrupt for years, as evidenced by continuous increases to the debt ceiling. The current debt limit stands at a whopping $36 trillion, suggesting a facade of control over the country’s financial health.

Bitcoin believers have long warned of the fragility of the debt-based fiat system, advocating for a rethink of traditional monetary models. With government debt surpassing 100% of GDP in advanced economies, the ability of debt-based fiat money to spur growth is diminishing.

Economist Russel Napier suggests that governments may resort to higher inflation levels to reduce debt-to-GDP ratios in order to manage their debt burden. This could drive increased interest in assets like bitcoin and gold.

Alternatively, curtailing fiscal spending could be the key to decreasing debt ratios and reviving the effectiveness of the debt-based fiat system in promoting growth.

If governments fail to address growing debt concerns, the era of debt-based fiat currency could be in jeopardy, potentially leading to a broader exploration of alternative financial systems like blockchain and cryptocurrencies.

The future remains uncertain, but the evolving financial landscape is set to provide interesting developments in the coming years.

- [posts_like_dislike id=1119]

Centrifuge, a tokenized asset platform, has announced its expansion of services on the Solana blockchain, starting with the $400 million tokenized U.S. Treasury fund managed by Anemoy (JTRSY). This expansion is...

Read moreCentrifuge, a tokenized asset platform, has announced its expansion of services on the Solana blockchain, starting with the $400 million tokenized U.S. Treasury fund managed by Anemoy (JTRSY).

This expansion is based on Centrifuge’s token standard, known as “deRWA tokens,” which enables token holders to freely transfer and use tokenized instruments across decentralized finance (DeFi) protocols.

The deJTRSY token can now be swapped, lent, or used as collateral on Solana DeFi platforms like Raydium, Kamino, and Lulo, allowing Solana users to earn yield from short-term Treasuries.

This move highlights the increasing presence of Solana in the tokenized real-world asset (RWA) space, which brings traditional financial instruments onto the blockchain. According to projections by Boston Consulting Group and Ripple, the tokenized asset market could reach $18.9 trillion by 2033.

Recently, the Solana Foundation partnered with blockchain tech firm R3 to bring real-world assets to Solana, and a tokenized fund of Apollo credit assets issued by Securitize is also being introduced to Solana-based DeFi protocols.

Centrifuge’s CEO, Bhaji Illuminati, emphasized the importance of giving real-world assets utility onchain and making them usable across the DeFi ecosystem.

Overall, these developments showcase the growing interest and adoption of tokenization efforts on Solana, especially within the traditional finance sector.

For more information, learn about Major TradFi Institutions pursuing Tokenization Efforts on Solana.

- [posts_like_dislike id=1045]

Tags:ADAAIAmericaBinancebitcoinbtcCanadaCoinbaseCryptoDonald TrumpdubaiETHEUFinancegoldGovernmentHealthIranJapanminerMoving AverageS&P 500StocksStrategyTradingtrillionTrumpUSWashington

By Francisco Rodrigues (All times ET unless indicated otherwise) Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets...

Read moreBy Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets contended with rising bond yields and renewed concerns over ballooning U.S. debt.

The largest cryptocurrency has gained around 3.8% in the last 24 hours while the broader CoinDesk 20 CD20 index rose 4.74%, continuing a trend of strength driven by mounting institutional demand and growing interest in crypto exposure.

The rally is unfolding against a backdrop of higher yields on U.S. and Japanese government bonds. The 10-year U.S. Treasury yield rose to 4.6%, while the 30-year topped 5%, driven by concerns over President Donald Trump’s tax bill that analysts estimate could add as much as $5 trillion to the country’s debt, according to Reuters.

In Japan, yields on 30- and 40-year government bonds also hit record highs. The country’s debt-to-GDP ratio stands at 234%, QCP Capital said, and growing scrutiny coupled with weak demand for long-dated JGBs sent yields soaring.

That matters because higher yields — and thus higher returns — on investments that are considered relatively safe tend to lower the appeal of riskier assets like stocks, not to mention cryptocurrencies. While BTC, with its history of trading as a risky asset, hasn’t shown much sign of ebbing demand, it raises the question of how long the rally can continue.

Still, traders have been building large long positions in BTC options, with the most open interest now concentrated at the $110,000, $120,000 and even $300,000 calls for contracts expiring in late June in a sign of continuing bullish conviction.

U.S.-traded spot bitcoin exchange-traded funds have also been seeing significant demand. Total net inflows hit $1.6 billion over the week, and $4.24 billion so far in May, SoSoValue data shows. The inflows, coupled with bitcoin’s price rise, have seen the ETFs’ total net assets hit a record $129 billion.

There are, however, some muted signs of bearish activity.

“The largest block flow this week continues to be ETH December call spreads, while overnight BTC butterfly positions hint that some traders are positioning for consolidation around current levels,” Wintermute OTC trader Jake O. said.

Note, he’s talking about consolidation, not declines. And traditional participants may even be too bearish. While the U.S. endured a recent credit downgrade, markets are now pricing in a 6-level cut all the way down to BBB+.

On top of that, per Jake O., a recent equities market sell-off may not be a result of repositioning given higher bond yields, but rather profit-taking after nine consecutive positive sessions. Stay alert!

What to Watch

Crypto

May 22: Bitcoin Pizza Day.

May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

May 30: The second round of FTX repayments starts.

May 31 (TBC): Mezo mainnet launch.

Macro

Day 3 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

May 22, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail sales data.

May 23, 10 a.m.: The U.S. Census Bureau releases April new single-family homes data.

Earnings (Estimates based on FactSet data)

May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

Governance votes & calls

Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock between DAO decisions and execution so stETH holders can escrow tokens to pause proposals at 1% of TVL or fully block and “rage-quit” at 10%. Voting ends May 28.

Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

May 22: Official Trump to announce its “next Era” on the day of the dinner for its largest holders.

June 10: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.67 million.

June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $182.58 million.

June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.99 million.

June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $16.78 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $61.86 million.

Token Launches

June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

Day 3 of 7: Dutch Blockchain Week (Amsterdam)

Day 3 of 3: Avalanche Summit London

Day 3 of 3: Seamless Middle East Fintech 2025 (Dubai)

Day 2 of 2: Crypto Expo Dubai

Day 2 of 2: Cryptoverse Conference (Warsaw)

May 27-29: Bitcoin 2025 (Las Vegas)

May 27-30: Web Summit Vancouver

May 29: Stablecon (New York)

May 29-30: Litecoin Summit 2025 (Las Vegas)

May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

June 2-7: SXSW London

June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

June 19-21: BTC Prague 2025

Token Talk

By Shaurya Malwa

The HYPE token is in focus after a billion-dollar bitcoin trade boosted Hyperliquid’s fundamentals.

Pseudonymous trader James Wynn opened a $1.1 billion long on BTC using 40x leverage via Hyperliquid in one of the largest on-chain DEX trades ever recorded.

The position, tied to wallet “0x507,” was entered when BTC was priced at $108K and now sits on over $40 million in unrealized profit.

Wynn booked partial profits early Thursday by closing 540 BTC (~$60 million), to net $1.5 million.

His prior exits were followed by BTC declines, so traders are watching closely.

Hyperliquid runs on its custom L1, HyperEVM, using the HyperBFT consensus (200K+ TPS) with CEX-level features like real-time order books and deep liquidity — no KYC required.

The platform’s permissionless design and lightning-fast execution are increasingly drawing capital from centralized venues to DeFi , and this trade could set a precedent for whale activity.

HYPE jumped 15% in the past 24 hours on renewed attention and usage-driven speculation.

Derivatives Positioning

Analyzing the liquidations heatmap of the BTC-USDT pair on Binance, the largest liquidations cluster around $108.5K and $106.9K with liquidations worth $143 million and $112.5 million, respectively.

Meanwhile, the options market swells post-breakout, with open interest on Deribit climbing above $34 billion, just shy of the all-time high of $35.9 billion set in December. The bulk of this positioning is centered on the 30 May expiry, which now holds over $9 billion in notional value to become a key date for potential volatility.

Bullish sentiment is clearly in control, with traders aggressively targeting upside via calls. Strikes at $100K, $120K and $150K have attracted particularly large open interest, reflecting growing conviction in a continued rally.

Put/call ratios underscore this shift in sentiment — the 24-hour volume ratio has dropped to 0.49, while the open interest ratio sits at 0.60, indicating a meaningful tilt toward bullish exposure following BTC’s move above $110K.

Near-term options activity is also picking up, with weekly and monthly contracts seeing notable inflows. Traders appear to be positioning for further momentum or short-term price swings in the wake of the breakout.

Market Movements

BTC is up 1.19% from 4 p.m. ET Wednesday at $110,690.36 (24hrs: +4.05%)

ETH is up 6.19% at $2,662.72 (24hrs: +5.23%)

CoinDesk 20 is up 3.64% at 3,348.63 (24hrs: +4.88%)

Ether CESR Composite Staking Rate is unchanged at 3.03%

BTC funding rate is at 0.03% (10.95% annualized) on Binance

DXY is up 0.25% at 99.81

Gold is down 0.26% at $3,305.6/oz

Silver is down 0.83% at $33.17/oz

Nikkei 225 closed -0.84% at 36,985.87

Hang Seng closed -1.19% at 23,544.31

FTSE is down 0.68% at 8,726.62

Euro Stoxx 50 is down 0.96% at 5,402.31

DJIA closed on Wednesday -0.91% at 41,860.44

S&P 500 closed -1.61% at 5,844.61

Nasdaq closed -1.41% at 18,872.64

S&P/TSX Composite Index closed -0.83% at 25,839.17

S&P 40 Latin America closed -1.31% at 2,597.38

U.S. 10-year Treasury rate is down 2 bps at 4.58%

E-mini S&P 500 futures are unchanged at 5,865.50

E-mini Nasdaq-100 futures are up 0.15% at 21,188.50

E-mini Dow Jones Industrial Average Index futures are down 0.17% at 41,875.00

Bitcoin Stats:

BTC Dominance: 63.90 (-0.62%)

Ethereum to bitcoin ratio: 0.02409 (3.52%)

Hashrate (seven-day moving average): 875 EH/s

Hashprice (spot): $58.24

Total Fees: 7.89 BTC / $847,124

CME Futures Open Interest: 160,740 BTC

BTC priced in gold: 33.4 oz

BTC vs gold market cap: 9.47%

Technical Analysis

Bitcoin reached a new all-time high of $111,875 this morning, breaking decisively above the previous peak just above $109,000 set in January.

With a confirmed close above that level and no sign of a swing failure pattern, the bias remains firmly tilted toward continued upside. In the near term, BTC may encounter resistance around the $112,000–$113,000 range, aligning with a trendline drawn from the prior highs in December and January.

However, last week’s consolidation above $100,000 — and the successful reclaim of the previous all-time high — suggest this area is now acting as short-term support.

A pullback below $100,000, especially into the weekly order block, would likely represent a healthy correction within the broader uptrend and could offer a compelling reentry opportunity if further downside is seen.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $402.69 (-3.41%), up 1.73% at $409.67 in pre-market

Coinbase Global (COIN): closed at $258.99 (-0.91%), up 2.78% at $266.20

Galaxy Digital Holdings (GLXY): closed at C$31 (+1.57%)

MARA Holdings (MARA): closed at $15.84 (-2.16%), up 4.42% at $16.54

Riot Platforms (RIOT): closed at $8.84 (-1.01%), up 3.39% at $9.14

Core Scientific (CORZ): closed at $10.78 (-1.28%), up 1.48% at $10.94

CleanSpark (CLSK): closed at $10.11 (+4.23%), up 4.65% at $10.58

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.75 (-1.33%)

Semler Scientific (SMLR): closed at $44.89 (+7.19%), up 6.01% at $47.59

Exodus Movement (EXOD): closed at $32.76 (-5.07%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $607.1 million

Cumulative net flows: $43.35 billion

Total BTC holdings ~ 1.19 million

Spot ETH ETFs

Daily net flow: $0.6 million

Cumulative net flows: $2.61 billion

Total ETH holdings ~ 3.49 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Top 20 digital assets’ prices and volumes

Chart of the day

Bitcoin adoption

- [posts_like_dislike id=1033]

SHIB’s impressive resilience in the recent trading session highlights a growing sense of investor confidence despite market fluctuations. The token’s ability to bounce back from a sudden drop to 0.0000143, supported...

Read moreSHIB’s impressive resilience in the recent trading session highlights a growing sense of investor confidence despite market fluctuations. The token’s ability to bounce back from a sudden drop to 0.0000143, supported by high volume, indicates more institutional accumulation rather than retail panic. With strong psychological support at 0.000015 and repeated tests of upper resistance levels, SHIB seems ready to continue its upward trend if current accumulation patterns persist.

Some key points from the technical analysis include SHIB showing resilience over the past 24 hours, rising from 0.0000146 to 0.0000150, a gain of 2.85% within a range of 0.00000081 (5.64%). The token experienced significant volatility at 17:00 when the price dropped to 0.0000143 before finding strong volume support. A massive volume spike of 2.83 trillion helped in the recovery process, which was nearly 4 times the average volume. Key resistance at 0.0000151 was tested twice during the period, and accumulation patterns were observed in the final hours. Elevated trading volumes supported the bullish momentum, especially during the 01:36 candle with nearly 80 billion in volume. The price surged significantly at 01:22, breaking above the 0.0000151 resistance level.

For further reading, you can check out these external references:

– “Analyst Says When This Shiba Inu Breakout Happens, You’ll Want a Piece of SHIB” from The Crypto Basic, published on May 21, 2025.

– “Shiba Inu (SHIB) Primed for Breakout as Accumulation and Burn Rate Surge” from Coin Edition, published on May 21, 2025.

- [posts_like_dislike id=1029]