Securitize and RedStone have collaborated on a new whitepaper introducing a model for securely verifying Net Asset Value (NAV) data on-chain, specifically tailored for tokenized private funds. The Trusted Single Source...

Read moreFinance

BitMine Immersion Technologies (BMNR) announced securing $250 million through a private placement of common stock to establish an ether (ETH) treasury. The Las Vegas-based miner is set to become one of...

Read moreBitMine Immersion Technologies (BMNR) announced securing $250 million through a private placement of common stock to establish an ether (ETH) treasury. The Las Vegas-based miner is set to become one of the largest publicly traded holders of ETH when the deal closes on July 3.

The financing was priced at $4.50 a share and included investors like Founders Fund, Pantera Capital, Kraken, Galaxy Digital, and Republic. Lead investor MOZAYYX was advised by Cantor Fitzgerald, while ThinkEquity facilitated the deal.

BitMine’s decision to use ether as a primary reserve asset was driven by Ethereum’s dominance in stablecoin payments, tokenized assets, and decentralized financial applications. The company highlighted the benefits of having a direct ETH treasury position, providing access to staking and decentralized finance mechanisms on the Ethereum network.

Moreover, BitMine appointed Thomas Lee, Fundstrat founder known for his crypto research and optimism, as the Chairman of the Board of Directors, signaling a shift in leadership. Lee emphasized the significance of the round in showcasing the blending of traditional financial services and crypto, introducing a new performance metric: ether per share.

In a similar move, SharpLink Gaming (SBET) recently expanded its Ethereum treasury to 188,478 ETH with a $30 million purchase. While most companies focus on bitcoin treasuries, BitMine’s announcement has propelled its shares to nearly triple in premarket trading, reaching close to $14.

- [posts_like_dislike id=1267]

The most valuable startups in the world are not publicly traded. They are held in private portfolios, with strict capital requirements, long lockups, and limited deal flow access. Historically, only a...

Read moreThe most valuable startups in the world are not publicly traded. They are held in private portfolios, with strict capital requirements, long lockups, and limited deal flow access. Historically, only a select few, such as endowments, family offices, and well-connected institutional players, have had access to private markets.

Today, private markets remain exclusive. Traditional private equity demands minimum investments ranging from $250,000 to $25 million, while venture capital funds often require minimums of over $1 million. Accredited investor requirements further restrict access for the majority of Americans who do not meet these wealth thresholds.

However, blockchain technology is starting to break down these barriers. It is creating a new financial system that brings transparency, liquidity, and accessibility to what has traditionally been a secretive and illiquid space. Tokenization is revolutionizing private markets by converting real-world assets, such as shares in startups or private funds, into digital tokens with embedded compliance.

Imagine being able to invest in a basket of high-growth companies through a single, liquid asset on the blockchain. Investors no longer have to wait years for a potential exit, as secondary markets and liquidity protocols now allow for dynamic trading at fair prices. Tokenized vehicles also offer governance rights, performance incentives, and exposure to hard-to-access assets like pre-IPO unicorns or private equity funds.

This shift towards tokenization is not just about efficiency, but also about democratizing access. It opens up opportunities for smaller investors, global participants, and underserved regions to invest in private markets that were previously out of reach. With compliant issuance platforms and regulated secondary markets, access to private market assets is becoming a programmable right rather than a privilege.

The total volume of secondary market transactions hit record highs in 2024, reaching over $150 billion. However, this only represents about 1% of the total private market value, indicating significant room for growth. With tokenized private assets valued at approximately $14 billion against a total addressable market of $12 trillion, there is immense potential for further growth.

Despite the challenges of regulatory clarity and investor protection, the momentum towards tokenization in private markets is undeniable. The future financial system will be interoperable, inclusive, and transparent, blurring the lines between public and private, analog and digital, and developed and developing economies.

Tokenized private assets are not just a new asset class; they signify that the next trillion-dollar opportunity will not be isolated but integrated into a more accessible and liquid financial network. The gate is open, and the future of private markets is moving towards being on-chain.

- [posts_like_dislike id=1237]

North Korean hacking groups have been targeting the crypto sector for quite some time now. The $625 million Ronin bridge exploit in 2022 served as an early warning sign, but the...

Read moreNorth Korean hacking groups have been targeting the crypto sector for quite some time now. The $625 million Ronin bridge exploit in 2022 served as an early warning sign, but the threat has continued to evolve over the years.

In 2025, North Korean-affiliated attackers have been involved in various campaigns aimed at draining value and compromising key players in Web3. They have targeted assets worth $1.5 billion at Bybit through credential-harvesting efforts, with millions already laundered. Additionally, they have launched malware attacks on MetaMask and Trust Wallet users, tried to infiltrate exchanges using fake job applicants, and established shell companies in the U.S. to target crypto developers.

While the media often focuses on major theft incidents, the truth is that the weakest link in Web3 is not smart contracts, but human error.

Nation-state attackers no longer need to exploit vulnerabilities in Solidity. They now target the operational weaknesses of decentralized teams, such as poor key management, lack of onboarding processes, unverified contributors pushing code from personal devices, and treasury governance conducted through platforms like Discord. Despite the industry’s emphasis on resilience and censorship resistance, many protocols remain vulnerable to sophisticated adversaries.

At Oak Security, where we have conducted over 600 audits across various ecosystems, we consistently observe this gap in security. Teams invest heavily in smart contract audits but overlook fundamental operational security practices. This oversight often leads to compromised contributor accounts, governance capture, and preventable losses.

Despite significant resources directed towards smart contract security in the DeFi space, many projects still neglect basic operational security protocols. The assumption that passing a code audit guarantees protocol safety is not just naive but also perilous.

The focus has shifted from smart contract exploits to targeting individuals operating the system. Many DeFi teams lack dedicated security leads and manage large treasuries without formal accountability for operational security. This lack of oversight is concerning.

OPSEC failures extend beyond attacks from state-sponsored groups. In May 2025, Coinbase revealed that an overseas support agent, bribed by cybercriminals, unlawfully accessed customer data, leading to a costly remediation process. Binance and Kraken also faced similar social engineering attacks. These incidents were not caused by coding errors but by insider corruption and human error.

The vulnerabilities are systemic across the industry, with contributors onboarded through unsecure platforms like Discord or Telegram, code changes made from unvetted devices, and sensitive discussions held in unencrypted tools. Without proper security measures in place, teams are ill-equipped to handle security breaches effectively.

What the DeFi sector can learn from traditional financial institutions is the importance of a strong security culture. Banks and payment companies operate under the assumption of inevitable attacks and have layered defenses to mitigate risks. DeFi teams need to adopt a similar mindset and invest in structured security programs and tools for key management.

Decentralization should not be an excuse for negligence in operational security. Web3 platforms must prioritize cybersecurity practices to prevent malicious actors from exploiting vulnerabilities. Culture and disciplined security practices will play a crucial role in safeguarding the future of decentralized finance.

- [posts_like_dislike id=1213]

Tags:ADAAIAmericaArgentinabitcoinbtcCanadaCryptoDonald TrumpETHEUEuropeFinanceIranIsraelTradingTrumpUS

By Francisco Rodrigues (All times ET unless indicated otherwise) Risk assets, including cryptocurrencies, let out a collective sigh of relief following President Donald Trump’s announcement that he would not immediately involve...

Read moreBy Francisco Rodrigues (All times ET unless indicated otherwise)

Risk assets, including cryptocurrencies, let out a collective sigh of relief following President Donald Trump’s announcement that he would not immediately involve the U.S. in the Israel-Iran conflict. He mentioned that he might wait for two more weeks before making a decision on U.S. involvement.

Bitcoin (BTC) is currently trading around $106,000, up 0.9% in the last 24 hours. The broader CoinDesk 20 index has also seen a gain of 0.77%. In traditional markets, oil prices experienced a 1.7% drop after a three-week rally, while European stock indexes showed growth. U.S. equity futures are slightly higher compared to the previous day.

Trump’s statement has reduced the likelihood of immediate U.S. military action, as per the prediction market Polymarket, dropping from about 70% to 40%. If the timeframe is extended to next month, the odds are now at 62%, down from 90% on June 17.

“While the immediate prospect of a U.S. intervention in Iran may have diminished, the fact this is reportedly a two-week hiatus means it will remain a live issue for the markets going into next week,” commented AJ Bell investment analyst Dan Coatsworth in an interview with Yahoo Finance.

Despite the relative stability of the crypto market, analysts see varying risks. Glassnode, a blockchain analytics company, noted that subdued on-chain activity could indicate a more mature market, one that is dominated by institutions making large, infrequent transactions.

On the other hand, a new report from CryptoQuant warns that Bitcoin could drop to $92,000 or lower if there is no rebound in demand. ETF flows have decreased by 60% since April, whale buying has slowed by half, and short-term holders have dumped 800,000 BTC since late May. Vigilance is advised!

What to Watch:

Crypto:

– June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit on mainnet, enhancing security and performance.

– June 25: ZIGChain (ZIG) mainnet will go live.

– June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether, and major U.S. equity indices with contracts holdable for up to five years.

Macro:

– June 20, 8:30 a.m.: Statistics Canada releases May producer price inflation data.

– June 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April retail sales data.

– June 23, 9:45 a.m.: S&P Global releases (Flash) June U.S. data on manufacturing and services activity.

– June 23, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 GDP data.

– Earnings (Estimates based on FactSet data):

– June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12.

(Source: The Parrot Press)

- [posts_like_dislike id=1209]

Tags:AIbitcoinbtcCircleCoinbaseCryptoDonald TrumpETHEUFinancegoldIranIsraelJapanmemecoinS&P 500solanaTariffsTradingtrillionTrumpUSUSDCXRP

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis.

South Korea has long been known for its outsized influence on altcoin markets, from the XRP mania that drove a 400% rally last year to the present-day obsession with a token that proudly calls itself USELESS.

The USELESS phenomenon has ties to South Korean KOLs, Bradley Park, a Seoul-based analyst with DNTV Research, shared in an interview.

At the center of everything is Yeomyung, a Korean KOL and liquidity provider who aped into USELESS early, held through a 50% drawdown, and is now sitting on serious paper gains.

Park noted that his early conviction has inspired copy-trading among Korean retail investors. Even wallets tied to insiders on Solana’s Jupiter JUP are holding. The rise of USELESS reflects a broader evolution in Korean market behavior.

Another character in this story is Bonk Guy, an early promoter of BONK, who reappeared to tweet enthusiastically about USELESS after the price rebounded, though some Korean traders, including Park, have questioned his sincerity.

Park pointed to the rise of Hyperliquid, Kaia, and now Solana-based memecoins like USELESS as evidence that Korea is no longer a secondary market.

While XRP’s rally was underpinned by legal clarity in the U.S., USELESS feels like a reflection of where attention and exhaustion are flowing in today’s market, Park said.

With no roadmap, no utility, and no pretense of building something bigger, it taps into a kind of memetic disillusionment: a collective shrug at traditional crypto promises, and an ironic bet on nothingness that appears to be more honest than many tokens claiming to change the world.

Trump Endorses GENIUS Act

President Donald Trump on Tuesday endorsed the GENIUS Act in a Truth Social post following its bipartisan passage in the Senate, calling it a major step toward U.S. leadership in the digital asset sector.

Trump urged the House of Representatives to pass the bill “lightning fast” and without amendments, stating it should be sent to his desk with “no delays, no add-ons.”

The message signals strong executive support for the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which introduces reserve and compliance requirements for dollar-backed stablecoin issuers.

Trump framed the legislation as key to enabling “massive investment” and “big innovation,” positioning the U.S. as a global leader in digital assets.

While the bill passed the Senate with significant bipartisan backing, its fate in the House remains uncertain.

Democratic lawmakers are weighing potential amendments, including stricter oversight for foreign-issued tokens and limitations on potential issuers.

However, the bill isn’t without its critics. In a recent CoinDesk editorial, Georgetown University finance professor James J. Angel argues that the GENIUS Act is a flawed piece of legislation.

News Roundup: Coinbase Unveils Coinbase Payments for Merchants

Coinbase unveiled Coinbase Payments on Wednesday, a new merchant-focused payments stack built on its Ethereum layer-2 network Base.

The product allows global ecommerce platforms like Shopify to accept USDC 24/7 without needing blockchain expertise, using tools like a gasless stablecoin checkout, an ecommerce API engine, and an onchain payments protocol.

Coinbase said the system is designed to replicate traditional payment rails while lowering costs and offering always-on settlement.

It also deepens its partnership with USDC issuer Circle, whose shares jumped 25% on the news, while Coinbase rallied 16%.

Coinbase says stablecoins processed $30 trillion in transactions last year, tripling from the year prior.

Market Movements:

- BTC: Bitcoin rebounded above $105,000 in a V-shaped recovery despite escalating Israel-Iran tensions, with strong ETF inflows and key support at $103,650 highlighting institutional confidence amid market volatility.

- ETH: Ethereum rebounded 4% to hold above $2,500 despite Middle East tensions, with record-high staking and accumulation signaling growing investor conviction amid market volatility.

- Gold: Gold slipped 0.19% to $3,383.11 after the Fed held rates steady at 4.25–4.5%, with Chair Powell signaling no imminent policy changes and emphasizing continued economic strength despite trade tensions.

- Nikkei 225: Japan’s Nikkei 225 slipped 0.27% on Thursday as Asia-Pacific markets traded mixed, weighed down by the Fed’s rate pause and ongoing Israel-Iran tensions.

- S&P 500: The S&P 500 dipped 0.03% to 5,980.87 after the Fed held rates steady, with Chair Powell signaling a wait-and-see approach amid uncertainty over Trump’s tariffs.

Elsewhere in Crypto:

- Crypto doesn’t have to be a market for lemons

- Are Criminals Really Switching From Crypto to Gold for Money Laundering?

- UK to Propose Restrictions on How Banks Can Deal With Crypto Next Year

- [posts_like_dislike id=1199]

Decentralized finance (DeFi) is undergoing a subtle transformation. While in the past, DeFi experienced a bull market filled with high yields and speculative excitement, the current growth is being driven by...

Read moreDecentralized finance (DeFi) is undergoing a subtle transformation. While in the past, DeFi experienced a bull market filled with high yields and speculative excitement, the current growth is being driven by the sector’s role as a backend financial layer for user-facing applications and the increasing participation of institutional investors, according to a recent report by analytics firm Artemis and on-chain yield platform Vaults.fyi.

The total value locked on major DeFi lending protocols, including Aave, Euler, Spark, and Morpho, has exceeded $50 billion and is steadily approaching $60 billion, marking a 60% growth over the past year. This growth is attributed to the rapid institutionalization of the sector and the development of advanced risk management tools.

A key trend highlighted in the report is the integration of DeFi infrastructure into user-facing applications, creating a seamless experience for users. This trend, often referred to as the “DeFi mullet,” involves fintech front-end applications utilizing DeFi backend infrastructure to offer yield or loans. For example, Coinbase users can borrow against their Bitcoin holdings through the DeFi lender Morpho’s infrastructure. Bitget Wallet’s integration with Aave allows users to earn a 5% yield on USDC and USDT holdings within the wallet app, while PayPal is also offering yields on its PYUSD stablecoin without the DeFi element.

DeFi protocols are also introducing tokenized versions of traditional instruments, such as U.S. Treasuries and credit funds, known as real-world assets (RWA). These tokenized assets can serve as collateral, generate direct yield, or be included in more complex strategies. Additionally, investment strategy tokenization is becoming popular, with protocols like Pendle and Ethena managing significant value in tokenized stablecoin yield products.

Another significant trend noted in the report is the emergence of crypto-native asset managers. Firms like Gauntlet, Re7, and Steakhouse Financial are allocating capital across DeFi ecosystems using professionally managed strategies, similar to traditional asset managers. These asset managers are actively involved in DeFi protocol governance, adjusting risk parameters, and investing in structured yield products, tokenized RWAs, and modular lending markets.

Overall, the DeFi sector is experiencing substantial growth and evolving towards a more sophisticated financial ecosystem with various opportunities for users and investors alike.

- [posts_like_dislike id=1197]

Tags:AIAmazonAmericabitcoinbtcCEOChinaCircleCoinbaseCryptoETHEUFinancegoldIncomeJapanlibraMicrostrategymileiS&P 500StocksStrategyTelegramTradingTrumpTrump MediaUS

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

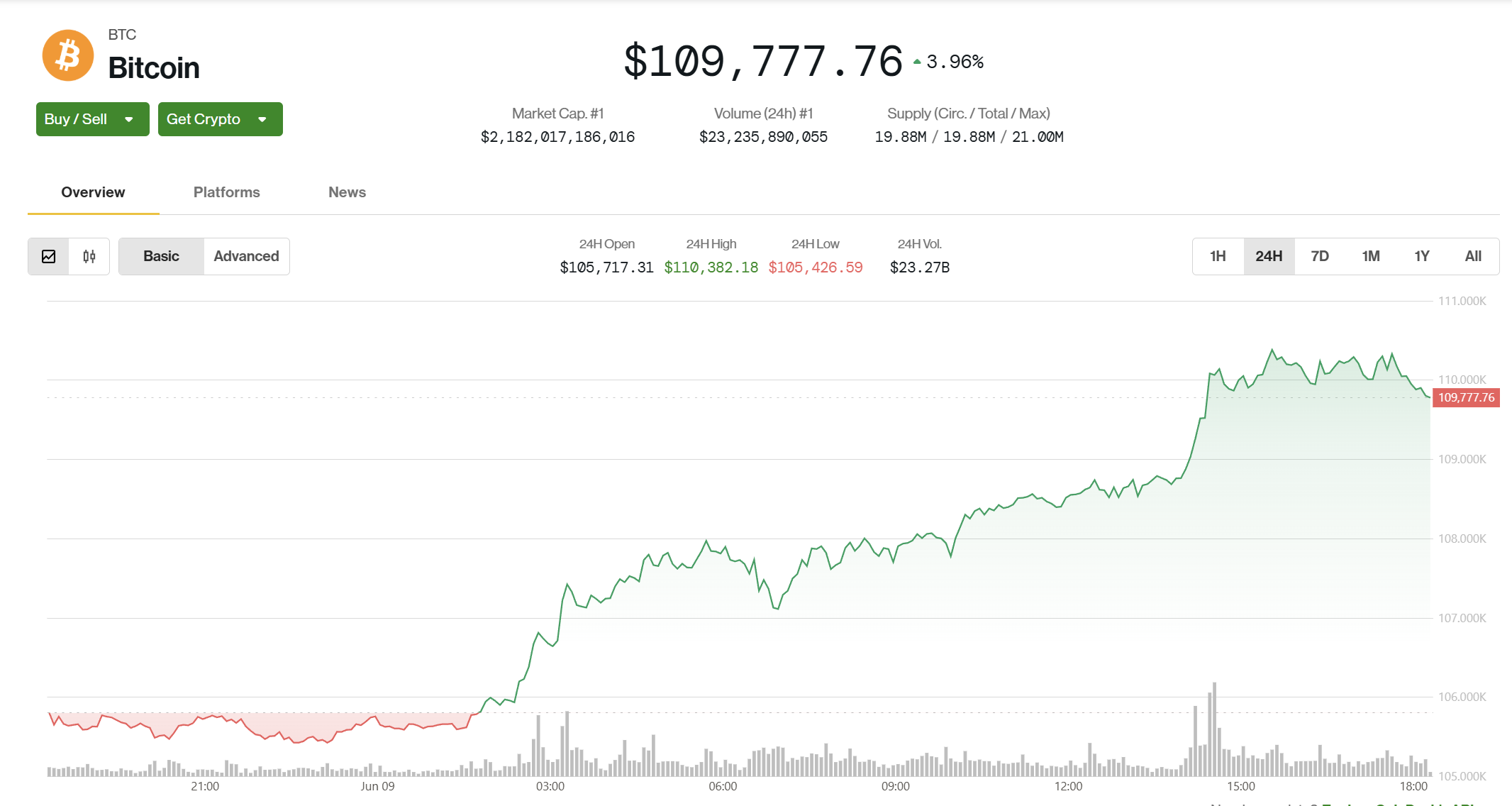

Bitcoin is trading below $110,000, changing hands at $109.7K, as Asia continues its trading week.

The move challenges a prevailing market narrative of summer stagnation, coming on the heels of a note from QCP Capital that emphasized suppressed volatility and a lack of immediate catalysts.

A recent Telegram note from QCP pointed to one-year lows in implied volatility and a pattern of subdued price action, noting that BTC had been “stuck in a tight range” as summer approaches.

A clean break below $100K or above $110K, they wrote, would be needed to “reawaken broader market interest.”

Even so, QCP warned that recent macro developments had failed to spark directional conviction.

“Even as US equities rallied and gold sold off in the wake of Friday’s stronger-than-expected jobs report, BTC remained conspicuously unmoved, caught in the cross-currents without a clear macro anchor,” the note said. “Without a compelling narrative to spark the next leg higher, signs of fatigue are emerging. Perpetual open interest is softening, and spot BTC ETF inflows have started to taper.”

That context makes the current move all the more surprising.

Over the weekend, Bitcoin surged 3.26% from $105,393 to $108,801, with hourly volume spiking to 2.5x the 24-hour average, according to CoinDesk Research’s technical analysis model. BTC broke decisively above $106,500, establishing new support at $107,600, and continued upward into Monday’s session, reaching $110,169.

The breakout coincides with a tense macro backdrop: US-China trade talks in London and a $22 billion U.S. Treasury bond auction later this week have injected uncertainty into global markets. While these events could drive fresh volatility, QCP cautioned that recent headlines have mostly led to “knee-jerk reactions” that quickly fade.

The question now is whether BTC’s move above $110K has true staying power, or whether the rally is running ahead of the fundamentals.

A ‘Massive Shift’ in Institutional Staking May Drive ETH’s Next Rally

Ethereum’s critics have long highlighted centralization risks, but that narrative is fading as institutional adoption accelerates, infrastructure matures, and recent protocol upgrades directly address past limitations.

“Market participants will pay for decentralization because it’s in their economic interest from a security and principal protection standpoint,” Mara Schmiedt, CEO of institutional Ethereum staking platform Alluvial, told CoinDesk. “If you look at [decentralization metrics] all of these things have massively improved over the last couple of years.”

There’s currently $492 million worth of ETH staked by Liquid Collective – a protocol co-founded by Alluvial to facilitate institutional staking

While this figure may appear modest compared to Ethereum’s total staked volume of around $93 billion, what’s interesting is that it originates predominantly from institutional investors.

“We’re really on the cusp of a truly massive shift for Ethereum, driven by regulatory momentum and the ability to unlock the advantages of secure staking,” she noted.

Central to Ethereum’s institutional readiness is the recent Pectra upgrade, a significant development Schmiedt describes as both “massive” and “underappreciated.”

“I think Pectra has been a massive upgrade. I actually think it’s been underappreciated, just in terms of the tremendous amount of change it introduces into the staking mechanics,” Schmiedt said.

Additionally, Execution Layer triggerable withdrawals—a key component of Pectra—provide institutional participants, including ETF issuers, a crucial compatibility upgrade.

This feature enables partial validator exits directly from Ethereum’s execution layer, aligning with institutional operational requirements such as T+1 redemption timelines.

“EL triggerable withdrawals create a much more effective path to exit for large-scale market participants,” Schmiedt added.

Ultimately, Schmiedt said, “I think we’ll see that a lot more [ETH] in institutional portfolios going forward.”

News Roundup

Trump Media May Be the Cheapest Bitcoin Play Among Public Stocks, NYDIG Says

Trump Media (DJT) may be one of the cheapest ways to get bitcoin exposure in public markets, according to a new report from NYDIG, CoinDesk recently reported.

As a growing number of companies adopt MicroStrategy’s strategy of stacking BTC on their balance sheets, analysts are rethinking how to value these so-called bitcoin treasury firms.

While the commonly used modified net asset value (mNAV) metric suggests that investors are paying a premium for BTC exposure, NYDIG’s Greg Cipolaro argues mNAV alone is “woefully deficient.” Instead, he points to the equity premium to NAV, which factors in debt, cash, and enterprise value, as a more accurate gauge.

By that measure, Trump Media and Semler Scientific (SMLR) rank as the most undervalued of eight companies analyzed, trading at equity premiums of -16% and -10% respectively, despite both showing mNAVs above 1.1. In other words, their shares are worth less than the value of the bitcoin they hold.

That’s in stark contrast to MicroStrategy (MSTR), which rose nearly 5% Monday as bitcoin crossed $110,000, while DJT and SMLR remained mostly flat—making them potentially overlooked vehicles for BTC exposure.

Circle Stock Nearly Quadruples Post-IPO as Bitwise and ProShares File Competing ETFs

Two major ETF issuers, Bitwise and ProShares, filed proposals on June 6 to launch exchange-traded funds tied to Circle (CRCL), whose stock has nearly quadrupled since its IPO late last week, CoinDesk previously reported.

ProShares is aiming for a leveraged product that delivers 2x the daily performance of CRCL. At the same time, Bitwise plans a covered call fund that generates income by selling options against held shares, two very different ways to capitalize on the stock’s explosive rise.

CRCL surged another 9% Monday in volatile trading, continuing to draw interest from both traditional finance and crypto investors. The proposed ETFs have an effective date of August 20, pending SEC approval. If approved, they would further blur the lines between crypto and conventional finance, giving investors new tools to play one of the hottest post-IPO names of the year.

Market Movements:

- BTC: Bitcoin is trading at $109,795 after a 3.26% breakout fueled by institutional buying, elevated volume, and macro uncertainty from US-China trade talks and an upcoming $22B Treasury auction.

- ETH: Ethereum rebounded 4.46% from a low of $2,480 to close at $2,581, with strong buying volume confirming support at $2,580 and setting up a potential breakout above $2,590.

- Gold: Gold is trading at $3,314.45, edging up 0.08% as investors watch US-China trade talks in London and a subdued dollar keeps prices attractive.

- Nikkei 225: Asia-Pacific markets rose Tuesday, with Japan’s Nikkei 225 up 0.51%, as investors awaited updates from ongoing U.S.-China trade talks.

- S&P 500: The S&P 500 closed slightly higher Monday, boosted by Amazon and Alphabet, as investors monitored U.S.-China trade talks.

Elsewhere in Crypto

- [posts_like_dislike id=1143]

IOST, a modular blockchain platform, has successfully completed a funding round, raising $21 million in strategic investments. The aim of this funding round is to support the expansion of its real-world...

Read moreIOST, a modular blockchain platform, has successfully completed a funding round, raising $21 million in strategic investments. The aim of this funding round is to support the expansion of its real-world asset (RWA) infrastructure into regulated markets. Leading the round were institutional investors DWF Labs, Presto, and Rollman Management Group. This influx of capital will allow IOST to accelerate product development, grow its validator network, and integrate with various ecosystems.

Tokenization, a key use case of blockchain technology, is garnering significant interest and investment from the traditional finance (TradFi) sector. IOST is set to focus its initial rollouts in Japan and throughout the Asia-Pacific region, where it is among the few public blockchains approved by the Japan Virtual Currency Exchange Association (JVCEA). Additionally, expansion plans are already underway in the Middle East, Europe, and North America.

IOST’s CEO, Blake Jeong, emphasized that this funding round signifies more than just capital raise; it showcases a dedication to constructing scalable and compliant infrastructure capable of supporting the next wave of tokenized assets. The protocol’s architecture includes a high-performance Layer 1 chain, EVM-compatible subnets, and a permissionless deployment model specifically designed for real-world asset issuance and compliant DeFi.

For further information, you can read more about the project’s developments in the recent launch of Plume’s Genesis Mainnet to bring real-world assets to DeFi.

- [posts_like_dislike id=1131]

Circle (CRCL) made its highly anticipated debut on the New York Stock Exchange (NYSE) on Thursday, with shares opening at $69 and surging to over $100 at one point, marking a...

Read moreCircle (CRCL) made its highly anticipated debut on the New York Stock Exchange (NYSE) on Thursday, with shares opening at $69 and surging to over $100 at one point, marking a more than 200% increase from the $31 price set the night before.

In its initial public offering, Circle sold approximately 34 million shares, raising $1.1 billion and achieving a valuation of $6.9 billion. This listing comes after previous attempts by the company, including a failed SPAC deal in 2021.

Ark Investment Management, led by Cathie Wood, expressed interest in purchasing up to $150 million worth of Circle shares, while BlackRock also plans to acquire 10% of the shares, as reported by SEC filings and Bloomberg.

Drawing comparisons to Coinbase’s volatile IPO on Nasdaq in 2021, where shares initially traded as high as $430 before dropping to $200 a month later, Circle’s debut was closely watched by investors. Despite this, other crypto-related stocks like Coinbase and MicroStrategy (MSTR) were trading lower on Thursday, along with bitcoin (BTC). Circle’s shares have since stabilized around $80 to $83 per share.

The IPO event occurred amidst a macroeconomic environment filled with uncertainty, with many companies reporting weak outlooks for the next quarter. However, Circle’s core business of issuing the USDC stablecoin has seen increased demand in 2025, partly due to progress in U.S. regulation surrounding stablecoins. Policymakers have been signaling closer steps towards establishing clearer rules, which could help promote and expand the use of stablecoins in mainstream finance.

A recent report by Deutsche Bank predicted that stablecoins are on the brink of becoming mainstream, citing their growing role in digital payments, cross-border settlements, and treasury management, while also reinforcing the dominance of the U.S. dollar globally. Circle’s IPO reflects investor confidence in this shift, betting not just on a crypto company but on stablecoins becoming integral financial infrastructure.

The debut of Circle’s shares on the NYSE signals a significant milestone for the company and the broader crypto industry, showcasing the potential for stablecoins to revolutionize the financial landscape.

- [posts_like_dislike id=1117]