Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. As Asia begins its trading day, bitcoin BTC is trading above $104,500 and has been relatively flat on the day with negligible market movement despite a possible looming war in the Middle East. Analysts are debating whether the crypto market’s current stillness is a sign of strength or if something more precarious is afoot.

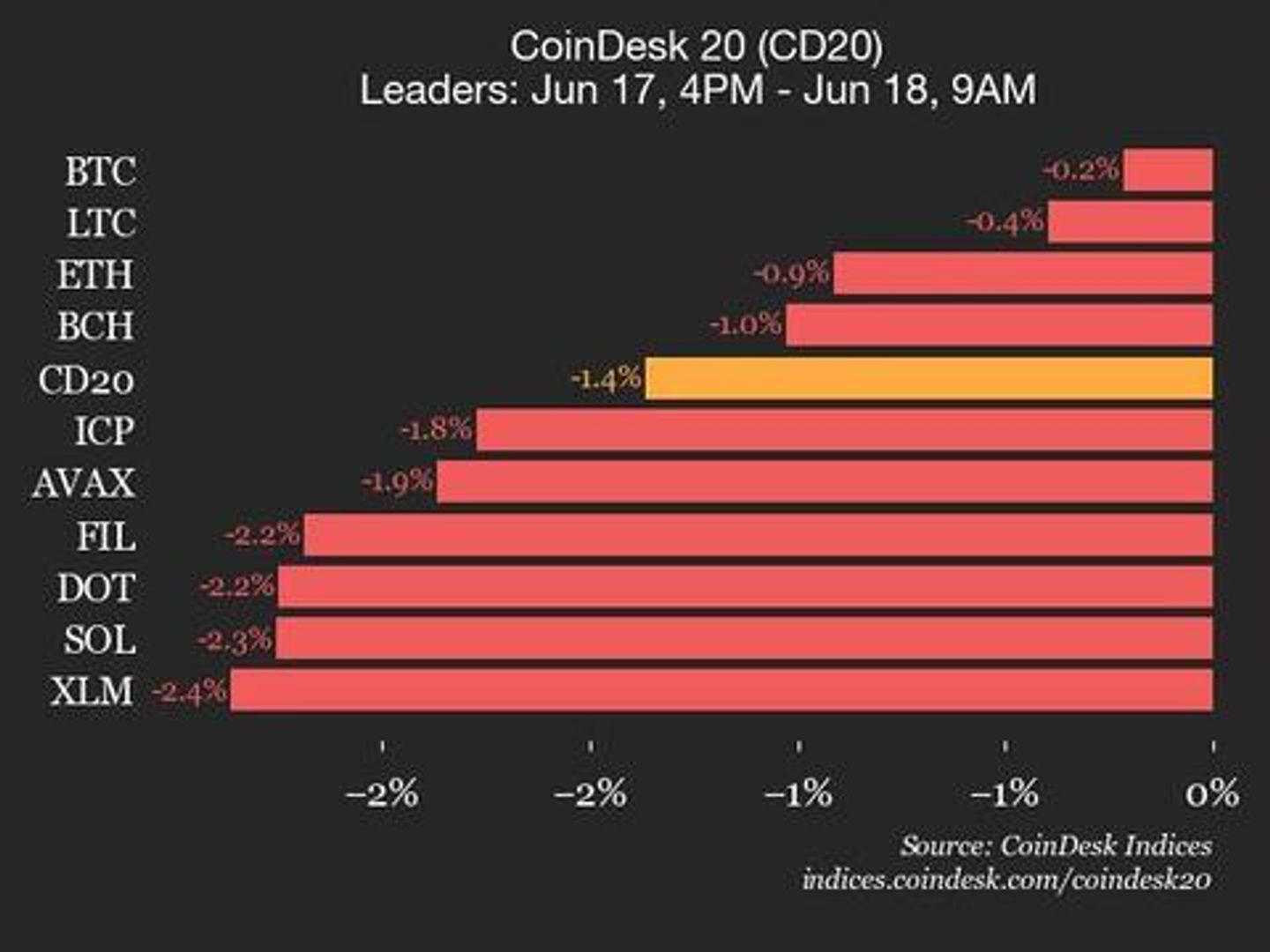

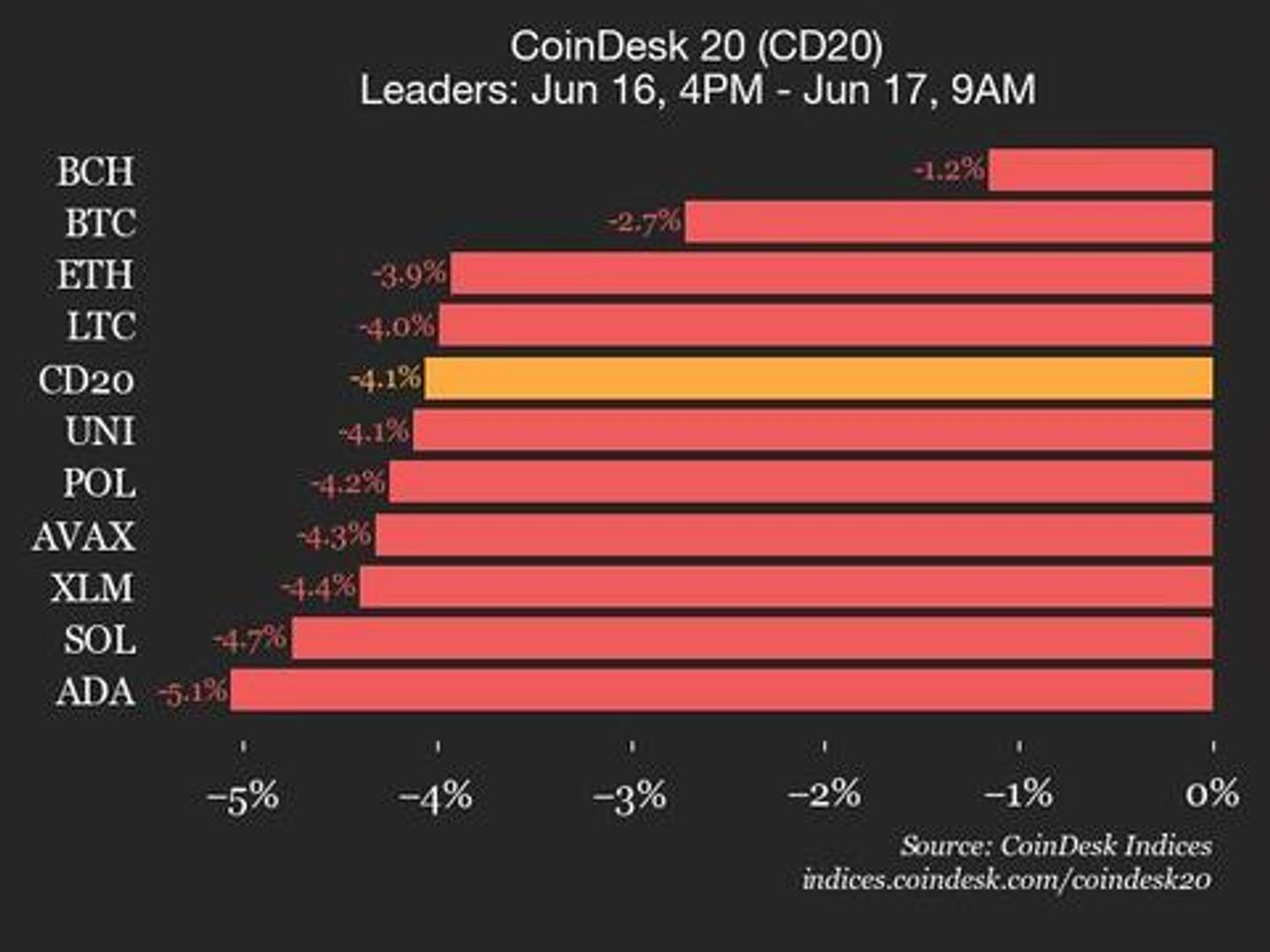

Three new reports this week from CryptoQuant, Glassnode, and trading firm Flowdesk all point to low volatility, tight price action, and subdued on-chain activity. CryptoQuant has issued a warning that BTC could soon revisit $92,000 support or even fall as low as $81,000. Other reports see the same signals and arrive at different conclusions.

In its weekly on-chain update, Glassnode acknowledges that the Bitcoin blockchain is “quiet,” with transaction counts down, fees minimal, and miner revenue subdued. The derivatives market now dwarfs on-chain activity, with futures and options volumes regularly exceeding spot volumes.

Market maker and trading firm Flowdesk describes the market as “coiled.” While altcoin flows are thinning and market-making volumes are flat, there is a surge in tokenized assets and stablecoin growth.

A new report from Presto Research argues that Crypto Treasury Companies (CTCs) are a new form of financial engineering with less risk than many investors assume. Strategy and Metaplanet, two CTCs, have shown that BTC’s volatility can be used to their advantage.

Semler Scientific has unveiled an aggressive bitcoin accumulation roadmap, aiming to own 105,000 BTC by the end of 2027. The California-based medical device maker plans to use a mix of equity raises, debt financing, and operational cash flow to achieve this goal.

Market Movements:

– BTC: Bitcoin remains stuck below $105K despite strong ETF inflows, signs of institutional accumulation offset by short-term bearish momentum and macro volatility.

– ETH: Ethereum found support at $2,490 after a high-volume selloff broke key levels, consolidating in a tight range amid geopolitical tensions and macro uncertainty.

– Gold: Gold hovered near $3,366 on Thursday amid escalating geopolitical tensions; platinum retreated after hitting a near 10-year high.

– Nikkei 225: Japan’s Nikkei 225 opened 0.24% higher Friday as Asia-Pacific markets mostly rose.

Elsewhere in Crypto:

– Visa Expands Stablecoin Reach in Europe, Middle East and Africa

– Why Pro-Israel Group’s $90M Crypto Hack Could Be a Hammer Blow for Iran’s Regime

– Solana Will Flip Ethereum, Anthony Scaramucci Predicts

- [posts_like_dislike id=1205]