By SEO Writer for The Parrot Press Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news...

Read moreBy SEO Writer for The Parrot Press

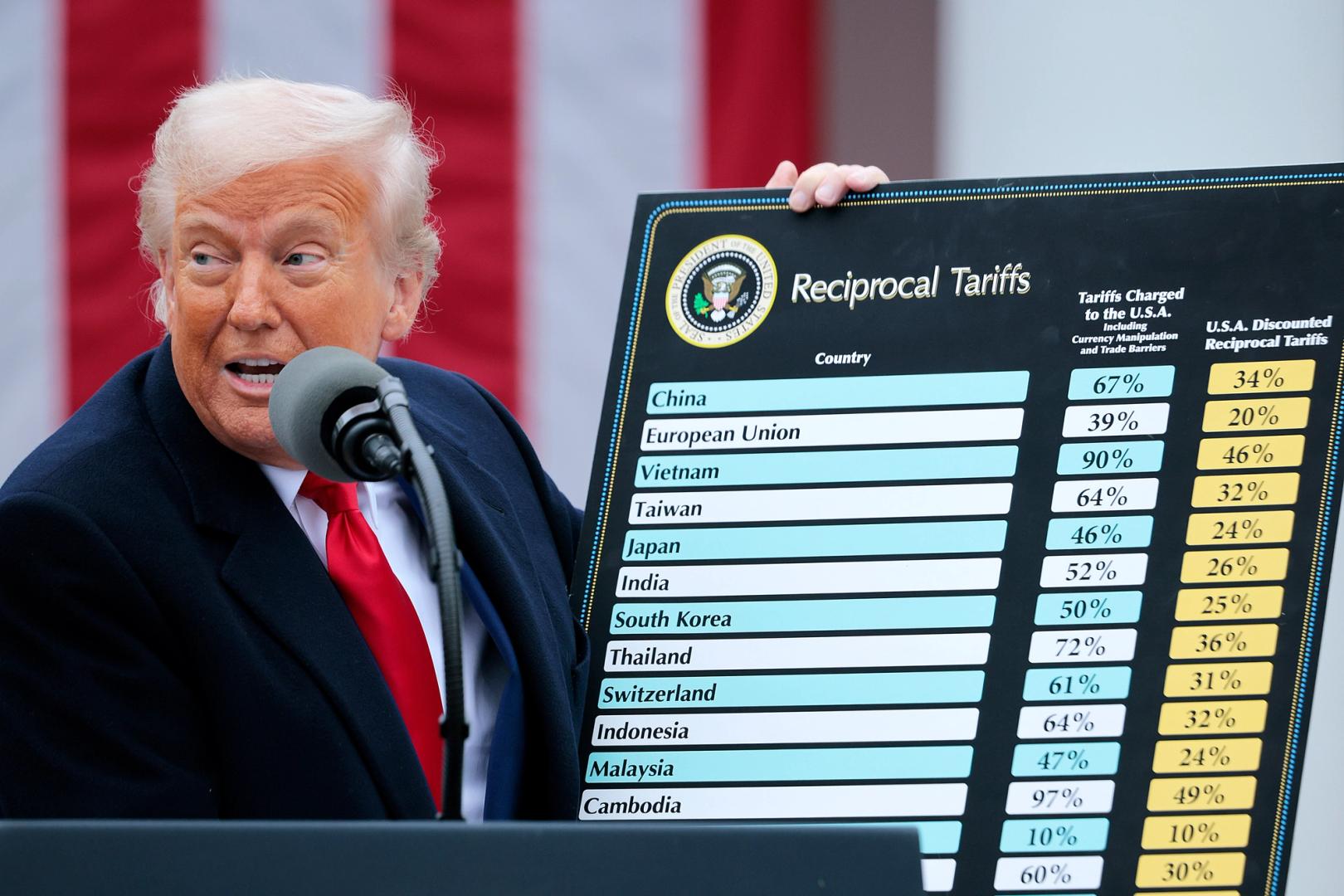

Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news was followed by Nvidia’s upbeat earnings report, boosting positive sentiment in the market.

Large Bitcoin wallets holding over 10,000 BTC have transitioned to selling from buying as the cryptocurrency nears its all-time high. Additionally, an increase in exchange deposits indicates selling pressure. The options market data hints at potential volatility leading up to Friday’s monthly settlement.

Ether, the second-largest cryptocurrency by market value, surged to $2,780, its highest level since February 24, supported by bullish signals from the derivatives market. The rise in the token’s price this week is attributed to SharpLink’s $425 million Treasury plan. Notably, U.S.-listed spot ether ETFs saw a net inflow of $84.89 million on Wednesday for the eighth consecutive day.

Canada-listed investment firm Sol Strategies has filed to raise up to $1 billion to boost its investment in the Solana ecosystem. Despite this, SOL remained flat at around $170.

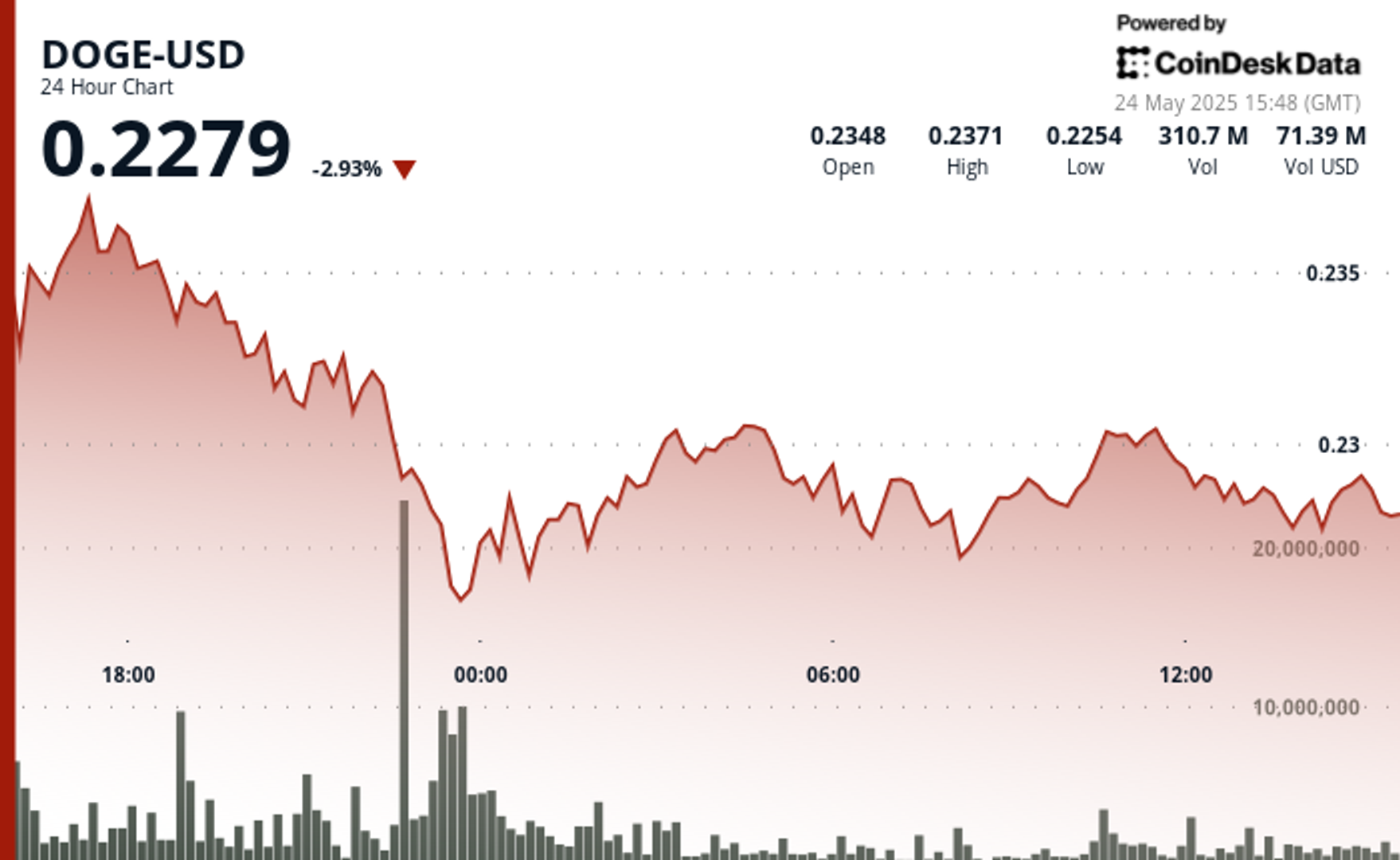

In other news, TON, PEPE, and FLOKI led the market while FARTCOIN, PI, and JUP experienced the most losses. Open interest in TON perpetual futures surged by 33% to $190 million, reaching its highest level since February 18.

Stablecoin issuer Circle froze wallets connected to the Libra token containing millions in USDC. Metaplanet issued $21 million in bonds to finance more Bitcoin purchases.

In traditional markets, some investment banks suggested that Trump has alternative tools to bypass the court ruling on tariffs. Yields on longer-duration Treasury notes increased, indicating strength in the dollar. Stay tuned for more updates!

What to Watch:

Crypto:

– May 30: The second round of FTX repayments start.

– May 31 (TBC): Mezo mainnet launch.

– June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable on “DeFi and the American Spirit”

Macro:

– Various economic releases and announcements scheduled for May 29-30.

Earnings:

– No significant earnings events in the near future.

Token Events:

Governance votes & calls:

– Various upcoming votes and calls for different tokens and platforms.

Unlocks:

– Schedule of upcoming token unlocks.

Token Launches:

– Information on upcoming token launches and deadlines.

Conferences:

– List of upcoming conferences and summits in the crypto and blockchain space.

Token Talk: An overview of major events and news in the token market.

Derivatives Positioning: Analysis of derivatives positions in the market.

Market Movements: Highlights of major market movements and performances.

Bitcoin Stats: Statistical data related to Bitcoin.

Technical Analysis: Insights into technical analysis of market trends.

Crypto Equities: Updates on crypto-related equities and their performance.

ETF Flows: Information on ETF flows related to Bitcoin and Ethereum.

Overnight Flows: Updates on overnight market movements and performance.

Chart of the Day: Featured chart highlighting market trends.

While You Were Sleeping: Summary of overnight news and developments.

In the Ether: A series of images illustrating various aspects of the cryptocurrency market.

- [posts_like_dislike id=1071]