By Francisco Rodrigues (All times ET unless indicated otherwise) Risk assets, including cryptocurrencies, let out a collective sigh of relief following President Donald Trump’s announcement that he would not immediately involve...

Read moreCrypto

The crypto market experienced a slight decline on Thursday as various factors such as global trade deadlines, volatility, and macro guidance influenced prices. Bitcoin (BTC) was trading around $104,700, dropping 1.2%...

Read moreThe crypto market experienced a slight decline on Thursday as various factors such as global trade deadlines, volatility, and macro guidance influenced prices. Bitcoin (BTC) was trading around $104,700, dropping 1.2% in 24 hours, while ether (ETH) was below $2,860, down 1.8% for the day.

The current softness in prices is in line with the overall macroeconomic concerns following the recent FOMC meeting, where the Fed maintained rates unchanged but expressed a cautious approach sensitive to inflation.

According to Singapore-based QCP Capital, historical trends show that crypto markets tend to slow down during the June-July period. BTC implied volumes have dipped below 40%, removing the risk premium related to geopolitical tensions. Open interest in BTC and ETH derivatives remains steady, with options favoring puts over calls as traders prepare for potential short-term pullbacks.

Joel Kruger, a strategist at LMAX Group, believes that the technical outlook remains positive for BTC, with a possible move towards $145,000 if recent highs are surpassed. He also noted that ETH, although still below its 2021 peak, could target $3,400 once it clears $2,900.

The recent U.S. Senate approval of a stablecoin framework is seen as a positive step towards a more regulation-friendly environment for institutional cryptocurrency adoption, further strengthening institutional confidence.

Looking ahead, market participants are cautious due to month-end OPEX flows, rebalancing activities, and a lack of fresh catalysts, potentially keeping BTC trading in the $102,000-$108,000 range for now. However, with historical strength in crypto markets in the second half of the year, some experts are optimistic about a potential upside surprise.

Kruger concluded by saying, “The worst may be behind us, and the next leg up could catch many off guard.”

- [posts_like_dislike id=1207]

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. As Asia begins its trading day, bitcoin BTC is trading above $104,500 and has been relatively flat on the day with negligible market movement despite a possible looming war in the Middle East. Analysts are debating whether the crypto market’s current stillness is a sign of strength or if something more precarious is afoot.

Three new reports this week from CryptoQuant, Glassnode, and trading firm Flowdesk all point to low volatility, tight price action, and subdued on-chain activity. CryptoQuant has issued a warning that BTC could soon revisit $92,000 support or even fall as low as $81,000. Other reports see the same signals and arrive at different conclusions.

In its weekly on-chain update, Glassnode acknowledges that the Bitcoin blockchain is “quiet,” with transaction counts down, fees minimal, and miner revenue subdued. The derivatives market now dwarfs on-chain activity, with futures and options volumes regularly exceeding spot volumes.

Market maker and trading firm Flowdesk describes the market as “coiled.” While altcoin flows are thinning and market-making volumes are flat, there is a surge in tokenized assets and stablecoin growth.

A new report from Presto Research argues that Crypto Treasury Companies (CTCs) are a new form of financial engineering with less risk than many investors assume. Strategy and Metaplanet, two CTCs, have shown that BTC’s volatility can be used to their advantage.

Semler Scientific has unveiled an aggressive bitcoin accumulation roadmap, aiming to own 105,000 BTC by the end of 2027. The California-based medical device maker plans to use a mix of equity raises, debt financing, and operational cash flow to achieve this goal.

Market Movements:

– BTC: Bitcoin remains stuck below $105K despite strong ETF inflows, signs of institutional accumulation offset by short-term bearish momentum and macro volatility.

– ETH: Ethereum found support at $2,490 after a high-volume selloff broke key levels, consolidating in a tight range amid geopolitical tensions and macro uncertainty.

– Gold: Gold hovered near $3,366 on Thursday amid escalating geopolitical tensions; platinum retreated after hitting a near 10-year high.

– Nikkei 225: Japan’s Nikkei 225 opened 0.24% higher Friday as Asia-Pacific markets mostly rose.

Elsewhere in Crypto:

– Visa Expands Stablecoin Reach in Europe, Middle East and Africa

– Why Pro-Israel Group’s $90M Crypto Hack Could Be a Hammer Blow for Iran’s Regime

– Solana Will Flip Ethereum, Anthony Scaramucci Predicts

- [posts_like_dislike id=1205]

In today’s Crypto for Advisors, Bryan Courchesne from DAIM provides information on tax planning for crypto trades. Although we are half a year away from tax season, there are many considerations...

Read moreIn today’s Crypto for Advisors, Bryan Courchesne from DAIM provides information on tax planning for crypto trades. Although we are half a year away from tax season, there are many considerations to track in order to be tax-ready.

Then, Saim Akif from Akif CPA breaks down the differences in tax treatment between crypto and equities/bonds in Ask an Expert.

Crypto Taxes Are Complicated, Don’t Let Them Derail Your Portfolio

As advisors focused on crypto, we’re familiar with the unique tax situations this asset class presents. For example, crypto is not subject to wash-sale rules, which allows for more efficient tax-loss harvesting. It also enables direct asset swaps, such as converting bitcoin (BTC) to ether (ETH) or ETH to Solana (SOL), without first selling into cash. These are just a couple of features that set crypto apart from traditional investments.

However, perhaps the most important thing for investors to consider is the sheer number of platforms they may use and how challenging it can be to track everything at tax time.

Tracking your crypto taxes isn’t just a year-end chore; it’s a year-round challenge, especially if you’re active on multiple centralized exchanges (CEXs) or decentralized platforms (DEXs). Every trade, swap, airdrop, staking reward, or bridging event can be a taxable event.

Centralized Exchange Trading

When using CEXs like Coinbase, Binance, or Kraken, you may receive year-end tax summaries, but those are often incomplete or inconsistent across platforms. One major challenge is tracking your cost basis across exchanges.

For example, if you buy Amazon stock in a Fidelity account and transfer it to Schwab, your cost basis transfers seamlessly and updates with each new trade. At tax time, Schwab can generate an accurate 1099 showing your gains and losses.

But in crypto, if you transfer assets from Kraken to Coinbase, your cost basis doesn’t automatically transfer with them. If you’re moving assets across multiple platforms, you’ll need to manually track every transaction, or you’ll face a major headache when filing taxes.

Decentralized Exchange Trading

Things get even more complicated when using DEXs. Apps like Coinbase Wallet (not to be confused with the Coinbase exchange) or Phantom connect you to decentralized trading platforms like Uniswap or Jupiter. These DEXs don’t issue tax forms or track your cost basis, so it’s entirely up to you to log and reconcile every transaction.

Miss a single token swap or forget to record the fair market value of a liquidity pool withdrawal, and your tax report could be inaccurate. That could trigger IRS scrutiny or lead to missed deductions. While some apps can calculate gains and losses from a single wallet address, they often struggle when assets are transferred between addresses, making them less useful for active users.

And here’s the kicker: if you’re actively trading on DEXs, chances are you’re not even making money. But even losses must be reported correctly to qualify for a deduction. If not, you risk losing the write-off or, worse, facing an audit.

Unless you’re a full-time crypto trader, the time and effort required to track every transaction isn’t just stressful, it can cost you real money.

What steps can I take to make sure I’m tax ready?

There are, however, several ways to prepare properly for crypto taxes:

Use crypto tax software from the beginning. Even then, you’ll want to double-check that the reported activity makes sense and adjust as needed.

Hire a crypto tax specialist or work with a crypto-focused advisor who understands the landscape.

Download all transaction logs and see if your CPA or advisor can help build a cost basis and determine your realized gains and losses.

As adoption increases, tax reporting will undoubtedly evolve — in the meantime keeping track of your trade activity is important to be ready for tax season.

– Bryan Courchesne, CEO, DAIM

Ask an Expert

Q. Why are advisors watching crypto closely?

Institutional crypto inflows have surged to $35 billion. While crypto is more volatile than traditional assets, major cryptocurrencies like bitcoin, have historically outperformed other traditional asset classes since 2012.

Q. How is crypto being treated differently from equities/bonds from a tax side?

Crypto differs fundamentally from equities and bonds. Advisors must track each wallet separately for cost basis (starting Jan 2025). Unlike traditional 1099s, clients often get little to no reporting support from exchanges, especially for self-custodied assets.

Q. Do you have any special insights for CPAs and tax advisors?

Compliance isn’t optional anymore. Starting with 2025 returns:

Wallet-level cost basis reporting is mandatory.

IRS Form 1099-DA will begin showing up in 2026.

Exchanges often don’t support reporting for self-custodied assets.

Smart tax professionals are combining tax reporting, audit defence, and DeFi accounting into premium advisory services.

– Saim Akif, founder, Akif CPA

Keep Reading

Spanish banking giant BBVA tells wealthy clients to invest 3 to 7% of their portfolio in bitcoin.

The U.S. Senate passed the Genius Act, paving the way for stablecoin adoption.

Thailand to exempt capital gains on crypto investments for 5-years.

CoinDesk Overnight Rates (CDOR) become available to support stablecoin money markets based on Aave.

- [posts_like_dislike id=1203]

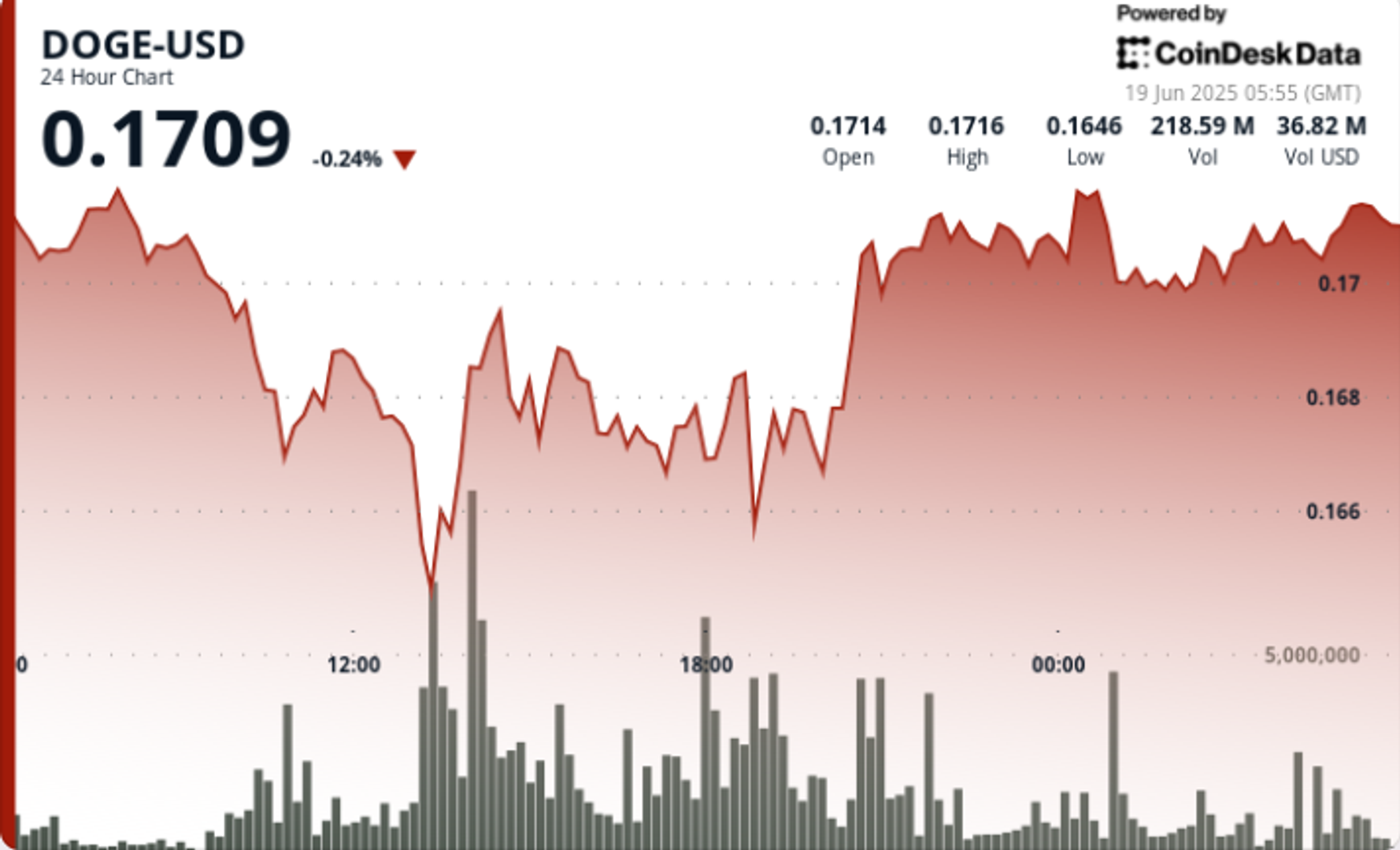

Dogecoin (DOGE) showed resilience by bouncing back from an intraday low of $0.164 to close near $0.171, marking a 4.7% increase amid overall market weakness. This recovery hints at the possibility...

Read moreDogecoin (DOGE) showed resilience by bouncing back from an intraday low of $0.164 to close near $0.171, marking a 4.7% increase amid overall market weakness. This recovery hints at the possibility of institutional investors quietly accumulating at lower levels as traders prepare for continued market volatility.

In recent news, Dogecoin’s rebound follows a period of intense selling pressure triggered by heightened geopolitical tensions between Israel and Iran. The broader market correction led to mass liquidations, causing DOGE to briefly drop over 7% intraday on Wednesday.

Despite ongoing macroeconomic challenges, such as the U.S. Federal Reserve’s tight monetary policy and balance sheet reduction, Dogecoin remains a highly liquid asset in the crypto space. With a daily turnover of approximately $1.37 billion and a market cap exceeding $24.7 billion, DOGE continues to attract attention.

Technical indicators suggest that DOGE has entered oversold territory, while social sentiment data from LunarCrush indicates an 86% positive sentiment among more than 16,000 mentions. This suggests that community confidence in Dogecoin remains strong despite the price fluctuations.

Moving forward, DOGE’s short-term performance may be influenced by regulatory developments, including a potential decision on a U.S. spot ETF, as well as increasing adoption on DeFi platforms like Coinbase’s Base network, where wrapped DOGE is gaining popularity.

In terms of price action, DOGE experienced a significant drop during the 13:00 hour, reaching $0.164 on a volume spike of 591 million units, the highest of the day. However, a strong bounce back pushed prices above $0.171, bringing the memecoin to a near-term equilibrium.

The price has since consolidated between $0.170 and $0.1696, with indications of accumulation at lower levels through small volume bursts. Technical analysis reveals that DOGE has recovered 4.7%, rising from $0.164 to $0.171, and is currently approaching oversold territory with an RSI of 33.29.

While technical patterns point to a potential bearish signal with a descending triangle formation, reduced volatility suggests a degree of stabilization in the market. Key resistance levels for DOGE include $0.172, $0.1750, and $0.1820, with potential support levels at $0.1640 and $0.150 in a risk-off scenario.

- [posts_like_dislike id=1201]

Tags:AIbitcoinbtcCircleCoinbaseCryptoDonald TrumpETHEUFinancegoldIranIsraelJapanmemecoinS&P 500solanaTariffsTradingtrillionTrumpUSUSDCXRP

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis.

South Korea has long been known for its outsized influence on altcoin markets, from the XRP mania that drove a 400% rally last year to the present-day obsession with a token that proudly calls itself USELESS.

The USELESS phenomenon has ties to South Korean KOLs, Bradley Park, a Seoul-based analyst with DNTV Research, shared in an interview.

At the center of everything is Yeomyung, a Korean KOL and liquidity provider who aped into USELESS early, held through a 50% drawdown, and is now sitting on serious paper gains.

Park noted that his early conviction has inspired copy-trading among Korean retail investors. Even wallets tied to insiders on Solana’s Jupiter JUP are holding. The rise of USELESS reflects a broader evolution in Korean market behavior.

Another character in this story is Bonk Guy, an early promoter of BONK, who reappeared to tweet enthusiastically about USELESS after the price rebounded, though some Korean traders, including Park, have questioned his sincerity.

Park pointed to the rise of Hyperliquid, Kaia, and now Solana-based memecoins like USELESS as evidence that Korea is no longer a secondary market.

While XRP’s rally was underpinned by legal clarity in the U.S., USELESS feels like a reflection of where attention and exhaustion are flowing in today’s market, Park said.

With no roadmap, no utility, and no pretense of building something bigger, it taps into a kind of memetic disillusionment: a collective shrug at traditional crypto promises, and an ironic bet on nothingness that appears to be more honest than many tokens claiming to change the world.

Trump Endorses GENIUS Act

President Donald Trump on Tuesday endorsed the GENIUS Act in a Truth Social post following its bipartisan passage in the Senate, calling it a major step toward U.S. leadership in the digital asset sector.

Trump urged the House of Representatives to pass the bill “lightning fast” and without amendments, stating it should be sent to his desk with “no delays, no add-ons.”

The message signals strong executive support for the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which introduces reserve and compliance requirements for dollar-backed stablecoin issuers.

Trump framed the legislation as key to enabling “massive investment” and “big innovation,” positioning the U.S. as a global leader in digital assets.

While the bill passed the Senate with significant bipartisan backing, its fate in the House remains uncertain.

Democratic lawmakers are weighing potential amendments, including stricter oversight for foreign-issued tokens and limitations on potential issuers.

However, the bill isn’t without its critics. In a recent CoinDesk editorial, Georgetown University finance professor James J. Angel argues that the GENIUS Act is a flawed piece of legislation.

News Roundup: Coinbase Unveils Coinbase Payments for Merchants

Coinbase unveiled Coinbase Payments on Wednesday, a new merchant-focused payments stack built on its Ethereum layer-2 network Base.

The product allows global ecommerce platforms like Shopify to accept USDC 24/7 without needing blockchain expertise, using tools like a gasless stablecoin checkout, an ecommerce API engine, and an onchain payments protocol.

Coinbase said the system is designed to replicate traditional payment rails while lowering costs and offering always-on settlement.

It also deepens its partnership with USDC issuer Circle, whose shares jumped 25% on the news, while Coinbase rallied 16%.

Coinbase says stablecoins processed $30 trillion in transactions last year, tripling from the year prior.

Market Movements:

- BTC: Bitcoin rebounded above $105,000 in a V-shaped recovery despite escalating Israel-Iran tensions, with strong ETF inflows and key support at $103,650 highlighting institutional confidence amid market volatility.

- ETH: Ethereum rebounded 4% to hold above $2,500 despite Middle East tensions, with record-high staking and accumulation signaling growing investor conviction amid market volatility.

- Gold: Gold slipped 0.19% to $3,383.11 after the Fed held rates steady at 4.25–4.5%, with Chair Powell signaling no imminent policy changes and emphasizing continued economic strength despite trade tensions.

- Nikkei 225: Japan’s Nikkei 225 slipped 0.27% on Thursday as Asia-Pacific markets traded mixed, weighed down by the Fed’s rate pause and ongoing Israel-Iran tensions.

- S&P 500: The S&P 500 dipped 0.03% to 5,980.87 after the Fed held rates steady, with Chair Powell signaling a wait-and-see approach amid uncertainty over Trump’s tariffs.

Elsewhere in Crypto:

- Crypto doesn’t have to be a market for lemons

- Are Criminals Really Switching From Crypto to Gold for Money Laundering?

- UK to Propose Restrictions on How Banks Can Deal With Crypto Next Year

- [posts_like_dislike id=1199]

Decentralized finance (DeFi) is undergoing a subtle transformation. While in the past, DeFi experienced a bull market filled with high yields and speculative excitement, the current growth is being driven by...

Read moreDecentralized finance (DeFi) is undergoing a subtle transformation. While in the past, DeFi experienced a bull market filled with high yields and speculative excitement, the current growth is being driven by the sector’s role as a backend financial layer for user-facing applications and the increasing participation of institutional investors, according to a recent report by analytics firm Artemis and on-chain yield platform Vaults.fyi.

The total value locked on major DeFi lending protocols, including Aave, Euler, Spark, and Morpho, has exceeded $50 billion and is steadily approaching $60 billion, marking a 60% growth over the past year. This growth is attributed to the rapid institutionalization of the sector and the development of advanced risk management tools.

A key trend highlighted in the report is the integration of DeFi infrastructure into user-facing applications, creating a seamless experience for users. This trend, often referred to as the “DeFi mullet,” involves fintech front-end applications utilizing DeFi backend infrastructure to offer yield or loans. For example, Coinbase users can borrow against their Bitcoin holdings through the DeFi lender Morpho’s infrastructure. Bitget Wallet’s integration with Aave allows users to earn a 5% yield on USDC and USDT holdings within the wallet app, while PayPal is also offering yields on its PYUSD stablecoin without the DeFi element.

DeFi protocols are also introducing tokenized versions of traditional instruments, such as U.S. Treasuries and credit funds, known as real-world assets (RWA). These tokenized assets can serve as collateral, generate direct yield, or be included in more complex strategies. Additionally, investment strategy tokenization is becoming popular, with protocols like Pendle and Ethena managing significant value in tokenized stablecoin yield products.

Another significant trend noted in the report is the emergence of crypto-native asset managers. Firms like Gauntlet, Re7, and Steakhouse Financial are allocating capital across DeFi ecosystems using professionally managed strategies, similar to traditional asset managers. These asset managers are actively involved in DeFi protocol governance, adjusting risk parameters, and investing in structured yield products, tokenized RWAs, and modular lending markets.

Overall, the DeFi sector is experiencing substantial growth and evolving towards a more sophisticated financial ecosystem with various opportunities for users and investors alike.

- [posts_like_dislike id=1197]

Nobitex, a prominent Iranian cryptocurrency exchange, has reportedly been targeted in a hack resulting in a loss of $90 million to an Israel-linked hacking activist group known as Gonjeshke Darande. The...

Read moreNobitex, a prominent Iranian cryptocurrency exchange, has reportedly been targeted in a hack resulting in a loss of $90 million to an Israel-linked hacking activist group known as Gonjeshke Darande. The hack was revealed in a blog post by Elliptic, a blockchain security firm.

The hacking group issued a warning, stating that Nobitex’s internal data and source code would be made public and any remaining assets on the exchange would be at risk. This attack comes shortly after the group targeted Iran’s state-owned lender, Bank Sepah.

In a Telegram channel, ZachXBT, an on-chain investigator, flagged suspicious outflows totaling $81.7 million in various cryptocurrencies like Tron, Bitcoin, and Dogecoin. The stolen funds were traced to a wallet with a provocative vanity address.

Nobitex, which is recognized as Iran’s largest exchange, has acknowledged the hack but has not confirmed the exact amount of stolen funds.

Elliptic mentioned that the hack does not seem to be financially motivated as the funds were sent to vanity addresses through complex cryptographic methods. The firm suggested that the hackers might not have the private keys to access the funds and instead have burned them to send a political message to Nobitex.

It is still unclear what method was utilized by Gonjeshke Darande for the hack. This incident comes amidst increasing cyber and physical attacks between Iran and Israel.

Gonjeshke Darande has previously been linked to coordinated attacks on Iranian infrastructure, including steel factories and gas stations. With the threat of the source code leak, Nobitex is not only facing financial loss but also a credibility crisis. Users who have not withdrawn their funds may potentially lose everything, according to the hackers’ subsequent threats.

- [posts_like_dislike id=1191]

The rise of cryptocurrencies becoming mainstream is happening at a rapid pace. Deribit, a crypto derivatives exchange, has seen its Deribit Block Request-for-Quote (RFQ) interface achieve a trading volume of over...

Read moreThe rise of cryptocurrencies becoming mainstream is happening at a rapid pace. Deribit, a crypto derivatives exchange, has seen its Deribit Block Request-for-Quote (RFQ) interface achieve a trading volume of over $23 billion in less than four months since its launch in March.

Deribit is a well-known derivatives exchange that offers the biggest options market for traders of bitcoin BTC, ether ETH, Solana SOL, and XRP XRP. Along with futures and spot trading, the exchange introduced the block RFQ system in March. This system allows participants, usually institutions and high-volume traders, to request pricing for a single instrument trade or a multi-legged strategy involving spot, futures, or options. Market makers then respond with quotes, and the best quote for the bid and ask is provided to the taker, allowing for more efficient execution of large orders outside of the public order book systems.

The CEO of Deribit, Luuk Strijers, explains that the RFQ system caters to the needs of professional and agency trading operations by supporting complex structures and large volumes. The system has handled trades worth $883 million in March, and the trading volume has only increased since then, hitting $9.8 billion in May and surpassing $6 billion in the first half of June.

Furthermore, the percentage of block trades executed via Deribit’s RFQ has increased to 27.5% this month, up from 17% in April and 21% in May. This showcases the growing demand for such systems in the cryptocurrency market.

- [posts_like_dislike id=1185]

The GENIUS Act, a crucial piece of U.S. stablecoin regulation, is set to be voted on this week with the expectation that it will become law in the coming months, according...

Read moreThe GENIUS Act, a crucial piece of U.S. stablecoin regulation, is set to be voted on this week with the expectation that it will become law in the coming months, according to a research report from Wall Street broker Bernstein. Stablecoins are cryptocurrencies that are tied to another asset, such as the U.S. dollar or gold, and play a significant role in cryptocurrency markets, serving as a payment infrastructure and facilitating international money transfers.

Once the act is passed, Bernstein predicts that “stablecoins will transition from being the money rail of crypto to the money rail of the internet.” The act, officially known as the Guiding and Establishing National Innovation for U.S. Stablecoins Act, aims to bring stablecoin innovation back to the country and provide an advantage to U.S. regulated issuers. It mandates federal regulation for stablecoins with a market cap exceeding $10 billion, with the possibility of state regulation if it aligns with federal guidelines.

The bill treats stablecoins as digital cash and aims to promote broader mainstream adoption for payments beyond using these cryptocurrencies solely for settling digital assets. The GENIUS Act also restricts non-financial public companies from becoming stablecoin issuers, which could impact companies like Amazon and Walmart that were reportedly considering using stablecoins.

If e-commerce and tech platforms wish to utilize these cryptocurrencies, they will likely need to collaborate with regulated U.S. issuers instead of issuing their own stablecoins. Overall, the industry is expected to see stablecoins becoming more mainstream in 2025 after regulatory progress in the United States.

- [posts_like_dislike id=1183]