Bitcoin’s price surge and its comparison to gold as a safe-haven asset is gaining traction as global markets face volatility. In Asian trading hours, BTC climbed above $87,000 alongside other cryptocurrencies...

Read moreEU

Canary Capital is planning to launch an exchange-traded fund (ETF) that will track the price of Tron’s native token, TRX, as per a filing submitted to the Securities and Exchange Commission...

Read moreCanary Capital is planning to launch an exchange-traded fund (ETF) that will track the price of Tron’s native token, TRX, as per a filing submitted to the Securities and Exchange Commission (SEC). The hedge fund, Canary Capital, filed a Form S-1 for the Canary Staked TRX ETF on Friday. If approved, the fund will stake portions of its holdings through third-party providers, with BitGo serving as custodian for the assets. The fund will utilize CoinDesk Indices calculations to track TRX’s spot price. Details such as the proposed ticker and management fee for the ETF have not been disclosed yet.

Initially, issuers had included a staking feature in their applications for spot Ethereum (ETH) ETFs but later removed them from an amended filing to secure approval from the SEC. The regulatory environment under former Chair Gary Gensler was resistant to staking, but issuers are optimistic about adding the feature to their spot ether funds following the appointment of crypto-friendly Chair Paul Atkins.

Recently, the SEC postponed a decision on Grayscale’s request to allow staking in the Grayscale Ethereum Trust ETF (ETHE) and the Grayscale Ethereum Mini Trust ETF (ETH).

- [posts_like_dislike id=857]

Kyrgyzstan President Sadyr Japarov has taken a significant step towards the issuance of a central bank digital currency (CBDC), signing legislation that grants legal status to the proposed “digital som.” The...

Read moreKyrgyzstan President Sadyr Japarov has taken a significant step towards the issuance of a central bank digital currency (CBDC), signing legislation that grants legal status to the proposed “digital som.”

The central Asian nation is currently deliberating on whether to proceed with the launch of a CBDC. However, the recent amendments to the Constitutional Law of the Kyrgyz Republic ensure that the digital som will be recognized as legal tender if the central bank decides to move forward with the CBDC initiative.

According to a statement on the president’s website, the purpose of the Constitutional Law is to initiate a pilot project for a prototype of the national digital currency, the “digital som,” and establish a legal framework and status for it. The National Bank of the Kyrgyz Republic will now have the authority to develop and approve regulations for transactions conducted on the digital som platform.

Originally adopted on March 20 by Kyrgyzstan’s supreme council, these provisions are set to pave the way for the testing of the digital som later this year, as reported by local news outlet Trend News Agency. A final decision on the issuance of the CBDC is not expected until next year.

While the concept of CBDCs has sparked debates within the crypto community, several countries such as the U.K., Nigeria, Jamaica, and the Bahamas, along with the European Union, have been making strides towards introducing their own CBDCs. In contrast, countries like the U.S. have shown less enthusiasm for the idea of issuing a CBDC.

- [posts_like_dislike id=853]

Decentralized finance (DeFi) protocol Ethena and tokenization firm Securitize have announced their partnership with Arbitrum’s tech and data availability network Celestia for their upcoming Converge chain. This Ethereum-compatible blockchain project is...

Read moreDecentralized finance (DeFi) protocol Ethena and tokenization firm Securitize have announced their partnership with Arbitrum’s tech and data availability network Celestia for their upcoming Converge chain. This Ethereum-compatible blockchain project is focused on real-world assets and is set to launch its mainnet in the second quarter of this year.

The Converge chain aims to have fast block times, allowing users to pay gas fees through Ethena’s USDe and USDtb tokens, while ensuring security through its Converge Validator Network. The project plans to launch a testnet in the coming weeks, followed by the mainnet before the end of Q2, according to Carlos Domingo, co-founder and CEO of Securitize.

The public rollout timeline will also depend on third-party integrations such as Anchorage and Fireblocks, as well as partnerships with other DeFi applications. Converge, unveiled last month, seeks to bridge the gap between tokenized real-world assets (RWA) and the DeFi space, leveraging Ethena and Securitize’s existing ecosystems.

Ethena has established itself as a DeFi powerhouse with its USDe stablecoin, while Securitize has tokenized assets worth billions from traditional finance giants. The Converge chain’s performance is supported by a custom sequencer for an Arbitrum-powered blockchain and Celestia as the data availability layer. This combination aims to enhance throughput on EVM-based networks.

The network will utilize Ethena’s USDe and USDtb tokens as gas tokens for transaction costs and will support both permissionless and permissioned applications. Additionally, the Converge Validator Network (CVN) will act as the chain’s security council, with validators required to stake ENA, Ethena’s governance token.

Overall, the partnership between Ethena, Securitize, and the Converge chain is expected to drive growth in USDe, USDtb, and other related products, bringing new opportunities in the DeFi space.

- [posts_like_dislike id=839]

Tags:AIAmericabitcoinbtcCoinbaseCryptoDonald TrumpdubaiETHEUgoldMoving AverageS&P 500solanaTariffsTradingTrumpUSXRP

By Parrot Press Staff President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy...

Read moreBy Parrot Press Staff

President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy away from risk assets, such as bitcoin (BTC) and other cryptocurrencies.

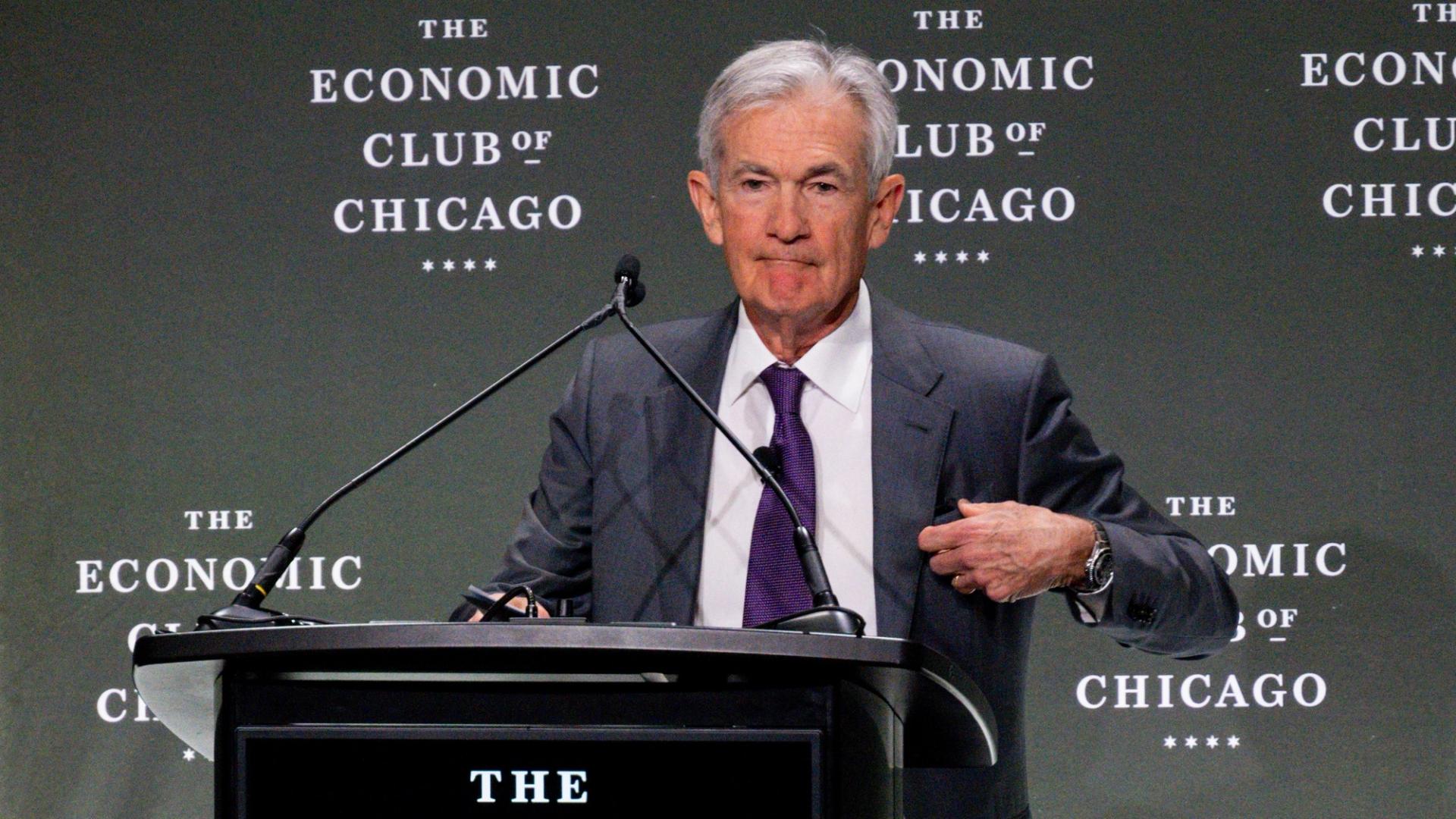

Federal Reserve Chairman Jerome Powell added fuel to the fire by stating late Wednesday that the central bank anticipates a rise in unemployment as the economy is likely to slow down and inflation is expected to increase. Powell mentioned that some of the tariffs imposed are likely to be paid by the public, further weighing on risk assets. This resulted in the Nasdaq dropping 1.17% and the S&P 500 decreasing by 2.24% before the closing bell. Despite this, bitcoin saw an increase of more than 1% in the past 24 hours. The CoinDesk 20 (CD20) index, which provides a broader market perspective, also saw a rise of 1.8%. However, the crypto market is more considered a gauge of risk rather than a safe haven, as reported by Coindesk.

According to Michael Brown, an analyst at Pepperstone, there is likely to be a growing demand for “assets which provide shelter from political incoherence and trade uncertainty,” as reported by The Telegraph. While bitcoin has outperformed the stock market, showing a 1% increase in the past month compared to the Nasdaq’s 8% drop, institutional investors are turning to gold as a safe haven investment.

Gold has seen an 11% increase over the last month and a 27% increase since the beginning of the year, reaching around $3,340 per troy ounce. A survey conducted by Bank of America’s Global Fund Manager revealed that 49% of fund managers view “long gold” as the most crowded trade on Wall Street, with 42% of them predicting it to be the best-performing asset of the year.

UBS analysts suggested that adding gold allocations has become more compelling due to the escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks, and diversification away from US assets and the US dollar, as reported by Investopedia.

Gold fund flows have reached $80 billion so far this year, while data from SoSoValue indicates that spot bitcoin ETFs have seen $5.25 billion net inflows in January, with net outflows occurring since the rise in uncertainty. In the month of April alone, over $900 million has exited these funds, following net outflows of $3.56 billion in February and $767 million in March. It is advised to stay alert in such an uncertain market environment.

In the latest Token Events updates, EigenLayer is implementing slashing on Ethereum mainnet, Pepecoin is undergoing its second halving, BNB Chain will be undergoing the opBNB mainnet hardfork, and Coinbase Derivatives will be listing XRP futures pending approval by the U.S. Commodity Futures Trading Commission.

Various conferences and events, such as CoinDesk’s Consensus in Toronto on May 14-16, NexTech Week Tokyo, Money20/20 Asia in Bangkok, Crypto Horizons 2025 in Dubai, and many more are scheduled to take place in the upcoming days.

In other news, Raydium’s LaunchLab platform has gone live, competing with Pump.fun and introducing a perceived competing platform to the Solana ecosystem. This has led to over 1,750 tokens being created shortly after LaunchLab’s debut, driving the price of Raydium’s RAY token up by as much as 10%.

On the technical analysis front, Bitcoin has rebounded off the golden pocket zone, showing strong buyer interest. It has broken out of the daily downtrend that has been in place since February, indicating a potential shift in structure. BTC is currently sitting below the daily 50 and 200 exponential moving averages, which act as important decision points for the price direction.

Overall, the market is seeing fluctuations due to economic uncertainty, geopolitical risks, and trade concerns, highlighting the importance of diversification and following market trends closely.

- [posts_like_dislike id=837]

Token debuts can be a controversial topic, often facing criticism for their poor execution which allows individuals to profit through front-running campaigns by supposedly having insider information about upcoming launches. The...

Read moreToken debuts can be a controversial topic, often facing criticism for their poor execution which allows individuals to profit through front-running campaigns by supposedly having insider information about upcoming launches.

The most recent example is the “Base is for everyone” token introduced by Coinbase’s Ethereum Layer 2 solution Base. Three crypto wallets acquired tokens before the official announcement, resulting in significant profits, according to blockchain sleuth Lookonchain.

Base announced the token’s debut through Zora, an on-chain social network, at around 19:30 UTC on Wednesday. The token quickly reached a market capitalization of over $15 million, bringing substantial gains to at least three crypto addresses that purchased coins before the official announcement.

According to Lookonchain, three wallets bought a significant amount of “Base is for everyone” before Base’s announcement and made a profit of approximately $666K. One wallet address invested 1.5 ETH to purchase 256.39 million units of the token and sold it for 108 ETH after the official announcement, earning $168,000 in just over an hour. Another address made a profit of $266,000, and a third address earned $231,800.

Following the announcement of another coin for FarCon poster, the token’s market capitalization dropped to less than $2 million, resulting in losses for those who invested in the Base is for Everyone token. However, valuations have since recovered, with the market capitalization of Base is for everyone surpassing $18.

Base clarified that the Base is for everyone coin is not the official cryptocurrency of Base, and the layer 2 did not directly sell them. The legal disclaimer on Zora also confirmed that Base will never sell these tokens.

The rapid rise and fall of these smaller tokens can create a negative wealth effect, benefiting only a select few while the majority face losses. This can lead to a drain of liquidity from the broader digital assets market. This year’s debut of LIBRA and TRUMP tokens resulted in the destruction of millions in investor wealth, marking a significant price top in bitcoin and the broader crypto market.

- [posts_like_dislike id=835]

The era of the crypto bull market appears to be coming to an end, signaling a winter of sustained losses and stagnation, as per insights from Coinbase’s institutional arm. David Duong,...

Read moreThe era of the crypto bull market appears to be coming to an end, signaling a winter of sustained losses and stagnation, as per insights from Coinbase’s institutional arm. David Duong, Coinbase Institutional’s global head of research, mentioned that the 200-day simple moving average (SMA) model indicates that Bitcoin’s recent sharp decline marks the beginning of a bear market cycle since late March. The COIN50 index, which includes the top 50 tokens by market capitalization, has also been consistently trading in bear market territory since the end of February.

Bitcoin slipped below its 200-day SMA on March 9, signaling a long-term shift to bearish momentum. Duong emphasized the challenges of defining a crypto bear market, where corrections of 20% or more are common. Contrarily, a 20% decline is typically used to characterize bear markets in traditional stock markets.

The report argued that the traditional 20% benchmark overlooks the impact of investor sentiment and portfolio adjustments triggered by smaller yet intense sell-offs. Bear markets are seen as fundamental changes in market structure, with deteriorating fundamentals and shrinking liquidity rather than just downward percentage movements.

In addition to the 200-day SMA, Duong highlighted bitcoin’s risk-adjusted performance measured in standard deviations (z-score) as an effective means of identifying crypto bear markets. The current z-score model indicates that the recent bull cycle ended in late February, categorizing subsequent activity as “neutral” and suggesting a need for a defensive risk assessment approach.

As the venture capital (VC) funding in the crypto space slows down, alternative cryptocurrencies may face a harsher winter ahead. While Bitcoin reached new highs this year, VC funding levels remain 50%-60% lower than in 2021-22, indicating a lack of enthusiasm for riskier investments.

Duong predicts that the crypto market may stabilize in mid-to-late 2Q25, paving the way for a better 3Q25.

- [posts_like_dislike id=829]

Tags:ADAAIAmericaAppleBinancebitcoinbtcCanadaCoinbaseCommunicationCryptodubaiETHEUFinancegoldJapanminerMoving AverageRobinhoodS&P 500solanaStrategyTeslaTradingTrumpUSXRP

By [Your Name] (All times ET unless indicated otherwise) Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its...

Read moreBy [Your Name] (All times ET unless indicated otherwise)

Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its “Liberation Day” high. To put the move into perspective, bitcoin dominance — which measures BTC’s share of the total cryptocurrency market cap — is approaching 64%, a level not seen since January 2021.

In contrast, the Nasdaq 100 is still 5% away from its own Liberation Day high, underscoring bitcoin’s relative strength versus U.S. equities.

According to X account Cheddar Flow, the S&P 500 has just formed a “death cross” — a traditionally bearish signal that occurs when the 50-day moving average falls below the 200-day moving average. The last time this happened was March 15, 2022, when S&P 500 initially rose by 11% in the following week, only to be followed by a 20% decline. Bearish sentiment is also reflected in the options market, where investors are reportedly buying large volumes of NVDA puts, signaling expectations of lower prices.

In a Bloomberg interview on Monday, Treasury Secretary Scott Bessent reaffirmed confidence in the U.S. bond market, dismissing concerns that foreign nations are dumping Treasuries.

“I am not seeing a dumping of U.S. Treasuries,” Bessent said. “The Treasury has lots of tools, but we’re a long way from needing them.” He also emphasized the enduring status of the U.S. dollar as the world’s reserve currency, despite the DXY index — which measures the dollar’s value against a basket of major trading partners — falling below 100 and dropping over 10% in recent weeks.

Bessent also confirmed that the Trump administration is seeking a new Federal Reserve Chair to replace Jerome Powell, with interviews set to begin later in the year. He concluded the interview by suggesting that the VIX (S&P 500 volatility index) may have peaked after the largest one-day percentage drop in its history last week. Stay alert!

What to Watch:

Crypto:

April 15: The first SmarDEX (SDEX) halving means the SDEX token’s distribution will be cut by 50% for the next 12 months.

April 16: HashKey Chain (HSK) mainnet upgrade enhances network stability and fee control capabilities.

April 17: EigenLayer (EIGEN) activates slashing on Ethereum mainnet, enforcing penalties for operator misconduct.

April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing block rewards to 15,625 PEP per block.

April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

April 21: Coinbase Derivatives will list XRP futures pending approval by the Commodity Futures Trading Commission (CFTC).

Macro:

April 15, 8:30 a.m.: Statistics Canada releases March consumer price inflation data.

Core Inflation Rate MoM Prev. 0.7%

Core Inflation Rate YoY Prev. 2.7%

Inflation Rate MoM Est. 0.6% vs. Prev. 1.1%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.6%

April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail sales data.

Retail Sales MoM Est. 1.4% vs. Prev. 0.2%

Retail Sales YoY Prev. 3.1%

April 16, 9:45 a.m.: Bank of Canada releases its latest interest rate decision, followed by a press conference 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

April 16, 1:30 p.m.: Fed Chair Jerome H. Powell will deliver an “Economic Outlook” speech. Livestream link.

April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential construction data.

Housing Starts Est. 1.42M vs. Prev. 1.501M

Housing Starts MoM Prev. 11.2%

April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 12.

Initial Jobless Claims Est. 226K vs. Prev. 223K

April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March consumer price index (CPI) data.

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

Inflation Rate MoM Prev. -0.1%

Inflation Rate YoY Prev. 3.7%

Earnings (Estimates based on FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events:

Governance votes & calls

Venus DAO is discussing the forced liquidation of the remaining debt owed by a BNB bridge exploiter account that “supplied extraneously minted BNB to Venus and generated an over-collateralized debt position.”

Aave DAO is discussing taking further steps to deprecate Synthetix’s sUSD on Aave V3 Optimism over technical developments that have “compromised its ability to consistently maintain its peg.”

GMX DAO is discussing the establishment of a GMX reserve on Solana, which would involve bridging $500,000 in GMX to the blockchain and transferring the funds to the GMX-Solana Treasury.

Treasure DAO is discussing handing the core contributor team the authority to wind down and close the Treasure Chain infrastructure on ZKsync and manage the primary MAGIC-ETH protocol-owned liquidity pool given the “crucial financial situation” of the protocol.

April 15, 10 a.m.: Injective to hold an X Spaces session with Guardian.

April 16, 7 a.m.: Aergo to host an Ask Me Anything (AMA) session on the future of decentralized artificial intelligence and the project.

April 16, 3 p.m.: Zcash to host a Town Hall on LockBox Distribution & Governance.

Unlocks

April 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $10.08 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $27.17 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating supply worth $325.97 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $82.60 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating supply worth $18.29 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating supply worth $10.07 million.

Token Launches

April 15: WalletConnect Token (WCT) to be listed on Binance, Bitget, AscendEX, BingX, BYDFi, LBank, Coinlist and others.

April 16: Badger (BADGER), Balacner (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT) and aelf (ELF) to be delisted from Binance.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 2 of 3: Morocco WEB3FEST GITEX Edition (Marrakech)

April 15: Strategic Bitcoin Reserve Summit (online)

Day 1 of 2: BUIDL Asia 2025 (Seoul)

Day 1 of 2: World Financial Innovation Series 2025 (Hanoi, Vietnam)

Day 1 of 3: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

Token Talk

Story Protocol’s IP tokens experienced a 20% drop and recovery within hours during an unusual trading session on Monday.

Trading volume surged on exchanges including Binance and OKX Spot, with $138 million recorded after the price rebound.

The sudden price movement was isolated from broader market trends, sparking speculation about insider activity or coordinated selling.

Also on Monday, MANTRA’s OM token plummeted over 90% in hours, dropping from around $6.30 to as low as 37 cents and wiping out over $5 billion in market capitalization.

The token has since rebounded slightly to trade around 63 cents.

Laser Digital, a Nomura-backed investor, was initially flagged for depositing $41 million in OM to OKX, but the company denied selling, clarifying it was collateral return from a financing trade. Shorooq Investors also denied selling.

Derivatives Positioning

BTC shorts have been liquidated on most exchanges in the past 24 hours, excluding BitMEX and Gate.io, according to Coinglass. The opposite is the case in ETH.

XRP’s perpetual futures open interest has dropped from 544.7 million XRP to 480 million XRP, diverging from the price recovery seen since Monday last week.

SUI, ONDO, ADA and APT have seen a notable increase in futures open interest in the past 24 hours. Of those, XMR is the only one with the positive OI-adjusted cumulative volume delta, representing net buying pressure.

On Deribit, short-dated BTC and ETH options continue to show a bias for protective puts, suggesting cautious sentiment.

Flows on OTC desk Paradigm have been mixed with both calls and puts bought in the April expiry.

Market Movements:

BTC is up 1.19% from 4 p.m. ET Monday at $85,877.18 (24hrs: +1.35%)

ETH is up 0.59% at $1,645.30 (24hrs: -1.97%)

CoinDesk 20 is up 0.99% at 2,519.69 (24hrs: +0.19%)

Ether CESR Composite Staking Rate is up 18 bps at 3.18%

BTC funding rate is at 0.0184% (6.7003% annualized) on Binance

DXY is unchanged at 99.70

Gold is up 1.26% at $3,245.30/oz

Silver is up 0.81% at $32.35/oz

Nikkei 225 closed +0.84% at 34,267.54

Hang Seng closed +0.23% at 21,466.27

FTSE is up 0.92% at 8,209.04

Euro Stoxx 50 is up 0.82% at 4,951.51

DJIA closed on Tuesday +0.78% at 40,524.79

S&P 500 closed +0.79% at 5,405.97

Nasdaq closed +0.64% at 16,831.48

S&P/TSX Composite Index closed +1.18% at 23,866.50

S&P 40 Latin America closed +1.8% at 2,340.02

U.S. 10-year Treasury rate is up 1 bp at 4.39%

E-mini S&P 500 futures are up 0.12% at 5,447.25

E-mini Nasdaq-100 futures are up 0.26% at 18,983.25

E-mini Dow Jones Industrial Average Index futures are unchanged at 40,750.00

Bitcoin Stats:

BTC Dominance: 63.80 (0.16%)

Ethereum to bitcoin ratio: 0.01913 (-0.31%)

Hashrate (seven-day moving average): 896 EH/s

Hashprice (spot): $44.1 PH/s

Total Fees: 6.33 BTC / $536,017

CME Futures Open Interest: 134,730

BTC priced in gold: 26.6 oz

BTC vs gold market cap: 7.56%

Technical Analysis

On Monday, the bitcoin cash-bitcoin (BCH/BTC) ratio failed to penetrate the trendline characterizing the 12-month bear market.

A potential move above the trendline could see breakout traders join the market, lifting BCH higher.

Crypto Equities

Strategy (MSTR): closed on Monday at $311.45 (+3.82%), up 0.62% at $313.38 in pre-market

Coinbase Global (COIN): closed at $176.58 (+0.62%), up 1.28% at $178.84

Galaxy Digital Holdings (GLXY): closed at C$15.81 (+3.47%)

MARA Holdings (MARA): closed at $12.95 (+3.52%), up 1.24% at $13.11

Riot Platforms (RIOT): closed at $7.01 (-0.71%), up 0.71% at $7.06

Core Scientific (CORZ): closed at $7.06 (-0.14%)

CleanSpark (CLSK): closed at $7.78 (+3.73%), up 1.29% at $7.88

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.70 (+1.44%), up 1.44% at $12.90

Semler Scientific (SMLR): closed at $34.26 (+1.48%)

Exodus Movement (EXOD): closed at $39.43 (-10.55%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $1.5 million

Cumulative net flows: $35.46 billion

Total BTC holdings ~1.11 million

Spot ETH ETFs

Daily net flow: -$6 million

Cumulative net flows: $2.28 billion

Total ETH holdings ~3.36 million

Source: Farside Investors

Overnight Flows

Chart of the Day Personalized: Disney’s Bob Iger to exit Apple’s board

In the Ether

**Insert interesting content about current events, stories, etc. in the crypto world**

That’s all for now, stay in-the-know with The Parrot Press for the latest updates and insights on the dynamic world of cryptocurrencies and finance!

- [posts_like_dislike id=821]

This is a daily technical analysis by our analyst and Chartered Market Technician here at The Parrot Press. In markets, finding the best entry point is crucial, as timing and levels...

Read moreThis is a daily technical analysis by our analyst and Chartered Market Technician here at The Parrot Press. In markets, finding the best entry point is crucial, as timing and levels can greatly impact the success of traders by influencing risk-reward ratios in their favor.

Bitcoin’s near-term outlook may seem positive with increased demand for bullish bets in the options market. However, the cryptocurrency is currently close to key resistance levels that have limited upside potential in recent months, making the risk-reward profile less appealing for those looking to take advantage of bullish prospects.

BTC has been testing the lower boundary of the “Ichimoku cloud” around $85K since Saturday. Developed by a Japanese journalist in the 1960s, the Ichimoku cloud is a technical analysis tool that provides a comprehensive view of market momentum, support, and resistance levels.

The indicator consists of five lines: Leading Span A, Leading Span B, Conversion Line or Tenkan-Sen (T), Base Line or Kijun-Sen (K), and a lagging closing price line. The space between Leading Span A and B forms the Ichimoku Cloud, with its upper and lower boundaries acting as potential support and resistance levels based on the price’s position relative to the cloud.

Back in early February, BTC dropped below $100K and traded below the Ichimoku Cloud. Since then, the lower boundary of the cloud has acted as a strong resistance level, limiting any recovery attempts.

With BTC now approaching this level again, bulls, especially those considering new bids, should proceed with caution. The immediate upside may be constrained by cloud resistance around $85K, while support is around $75K, approximately $10K lower than the current market rate. This situation presents an unfavorable risk-reward scenario for long positions.

The rejection at the Ichimoku Cloud on April 2 led to a significant sell-off, pushing BTC below $75K, similar to a pattern seen after the rejection on February 21. Therefore, the recent encounter with cloud resistance calls for close observation as it may lead to further selling pressure. A downturn from this level could bring attention back to the $75K level.

On the other hand, a potential break above $90K, signifying a breakout above the cloud, would indicate a continuation of the broader bull trend and a potential rally to new all-time highs.

- [posts_like_dislike id=817]

In 2022, the U.S. government imposed sanctions on Tornado Cash, an Ethereum-based crypto mixing service, sparking a debate that continues today. Tornado Cash allowed users to transfer crypto anonymously, but the...

Read moreIn 2022, the U.S. government imposed sanctions on Tornado Cash, an Ethereum-based crypto mixing service, sparking a debate that continues today. Tornado Cash allowed users to transfer crypto anonymously, but the government believed it facilitated money laundering. This led some Ethereum validators and block builders to avoid Tornado-linked transactions, causing the service to become slower and more costly.

Critics argued that complying with the sanctions amounted to censorship, undermining a core cypherpunk principle. President Donald Trump eventually lifted the sanctions in March, but the incident raised questions about the need for third-party apps for private transactions on the Ethereum network.

Crypto security researcher Pascal Caversaccio highlighted the lack of financial privacy on the Ethereum network due to publicly accessible transaction graphs. He proposed integrating privacy-preserving technologies at the protocol level to ensure users are private by default.

Ethereum developers have reignited discussions on making the network more private at its core. Some proposed interventions include encrypting the public mempool and implementing zero-knowledge cryptography for confidential transactions. Ethereum co-founder Vitalik Buterin also outlined a privacy-oriented roadmap, suggesting focusing on on-chain payments and anonymizing activity within applications.

If all suggestions are implemented, private transactions could become the default on Ethereum. The privacy debate comes ahead of Ethereum’s upcoming major upgrade, Pectra, which does not prioritize privacy. Developers are already planning the following upgrade, Fusaka, but the changes for that hard fork are still uncertain.

- [posts_like_dislike id=811]