Blockchain platform Self Chain recently made headlines after announcing the termination of its CEO, Ravindra Kumar, following allegations of a $50 million over-the-counter (OTC) scam. The news of the allegations surfaced...

Read moreTelegram

North Korean hacking groups have been targeting the crypto sector for quite some time now. The $625 million Ronin bridge exploit in 2022 served as an early warning sign, but the...

Read moreNorth Korean hacking groups have been targeting the crypto sector for quite some time now. The $625 million Ronin bridge exploit in 2022 served as an early warning sign, but the threat has continued to evolve over the years.

In 2025, North Korean-affiliated attackers have been involved in various campaigns aimed at draining value and compromising key players in Web3. They have targeted assets worth $1.5 billion at Bybit through credential-harvesting efforts, with millions already laundered. Additionally, they have launched malware attacks on MetaMask and Trust Wallet users, tried to infiltrate exchanges using fake job applicants, and established shell companies in the U.S. to target crypto developers.

While the media often focuses on major theft incidents, the truth is that the weakest link in Web3 is not smart contracts, but human error.

Nation-state attackers no longer need to exploit vulnerabilities in Solidity. They now target the operational weaknesses of decentralized teams, such as poor key management, lack of onboarding processes, unverified contributors pushing code from personal devices, and treasury governance conducted through platforms like Discord. Despite the industry’s emphasis on resilience and censorship resistance, many protocols remain vulnerable to sophisticated adversaries.

At Oak Security, where we have conducted over 600 audits across various ecosystems, we consistently observe this gap in security. Teams invest heavily in smart contract audits but overlook fundamental operational security practices. This oversight often leads to compromised contributor accounts, governance capture, and preventable losses.

Despite significant resources directed towards smart contract security in the DeFi space, many projects still neglect basic operational security protocols. The assumption that passing a code audit guarantees protocol safety is not just naive but also perilous.

The focus has shifted from smart contract exploits to targeting individuals operating the system. Many DeFi teams lack dedicated security leads and manage large treasuries without formal accountability for operational security. This lack of oversight is concerning.

OPSEC failures extend beyond attacks from state-sponsored groups. In May 2025, Coinbase revealed that an overseas support agent, bribed by cybercriminals, unlawfully accessed customer data, leading to a costly remediation process. Binance and Kraken also faced similar social engineering attacks. These incidents were not caused by coding errors but by insider corruption and human error.

The vulnerabilities are systemic across the industry, with contributors onboarded through unsecure platforms like Discord or Telegram, code changes made from unvetted devices, and sensitive discussions held in unencrypted tools. Without proper security measures in place, teams are ill-equipped to handle security breaches effectively.

What the DeFi sector can learn from traditional financial institutions is the importance of a strong security culture. Banks and payment companies operate under the assumption of inevitable attacks and have layered defenses to mitigate risks. DeFi teams need to adopt a similar mindset and invest in structured security programs and tools for key management.

Decentralization should not be an excuse for negligence in operational security. Web3 platforms must prioritize cybersecurity practices to prevent malicious actors from exploiting vulnerabilities. Culture and disciplined security practices will play a crucial role in safeguarding the future of decentralized finance.

- [posts_like_dislike id=1213]

Nobitex, a prominent Iranian cryptocurrency exchange, has reportedly been targeted in a hack resulting in a loss of $90 million to an Israel-linked hacking activist group known as Gonjeshke Darande. The...

Read moreNobitex, a prominent Iranian cryptocurrency exchange, has reportedly been targeted in a hack resulting in a loss of $90 million to an Israel-linked hacking activist group known as Gonjeshke Darande. The hack was revealed in a blog post by Elliptic, a blockchain security firm.

The hacking group issued a warning, stating that Nobitex’s internal data and source code would be made public and any remaining assets on the exchange would be at risk. This attack comes shortly after the group targeted Iran’s state-owned lender, Bank Sepah.

In a Telegram channel, ZachXBT, an on-chain investigator, flagged suspicious outflows totaling $81.7 million in various cryptocurrencies like Tron, Bitcoin, and Dogecoin. The stolen funds were traced to a wallet with a provocative vanity address.

Nobitex, which is recognized as Iran’s largest exchange, has acknowledged the hack but has not confirmed the exact amount of stolen funds.

Elliptic mentioned that the hack does not seem to be financially motivated as the funds were sent to vanity addresses through complex cryptographic methods. The firm suggested that the hackers might not have the private keys to access the funds and instead have burned them to send a political message to Nobitex.

It is still unclear what method was utilized by Gonjeshke Darande for the hack. This incident comes amidst increasing cyber and physical attacks between Iran and Israel.

Gonjeshke Darande has previously been linked to coordinated attacks on Iranian infrastructure, including steel factories and gas stations. With the threat of the source code leak, Nobitex is not only facing financial loss but also a credibility crisis. Users who have not withdrawn their funds may potentially lose everything, according to the hackers’ subsequent threats.

- [posts_like_dislike id=1191]

Telegram’s native token TON saw a decrease of 8% within a 24-hour period, falling from $3.20 to a low of $2.93 due to significant selling pressure. This drop was more severe...

Read moreTelegram’s native token TON saw a decrease of 8% within a 24-hour period, falling from $3.20 to a low of $2.93 due to significant selling pressure. This drop was more severe compared to other cryptocurrencies in the CoinDesk 20 index, which includes the top 20 coins by market capitalization excluding stablecoins and memecoins, as it experienced a 6.2% decrease during the same time frame.

The decline in TON’s value followed Israel’s attack on Iranian facilities and military leadership late on Thursday night.

Technical analysis of TON reveals the following points:

– TON went through an 8.4% correction, dropping from $3.20 to a low of $2.93 in 24 hours.

– An above-average volume of 3.36 million led to a strong resistance at the $3.09 level.

– A significant volume spike of 7.74 million established a high-volume support zone around $2.94.

– The price consolidated between $2.95-$2.99, showing signs of stabilization in recent price action.

– TON showed a recovery in the last hour, rising from $2.95 to $2.96, representing a 0.3% gain.

– Strong buying interest was evident with 284,843 units traded, establishing support at $2.96.

– Minor pullbacks found support quickly, indicating persistent buyer interest.

Please note that parts of this content were assisted by AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, you can refer to our AI Policy.

- [posts_like_dislike id=1173]

Tags:AIAmericabitcoinBlackrockbtcChinaCoinbaseCryptoETHEUgoldsolanaStrategyTelegramTradingTrumpTrump MediaUS

By James Van Straten (All times ET unless indicated otherwise) Bitcoin treasury-holding companies are an essential factor driving momentum as the largest cryptocurrency by market cap hovers just below the $110,000...

Read moreBy James Van Straten (All times ET unless indicated otherwise)

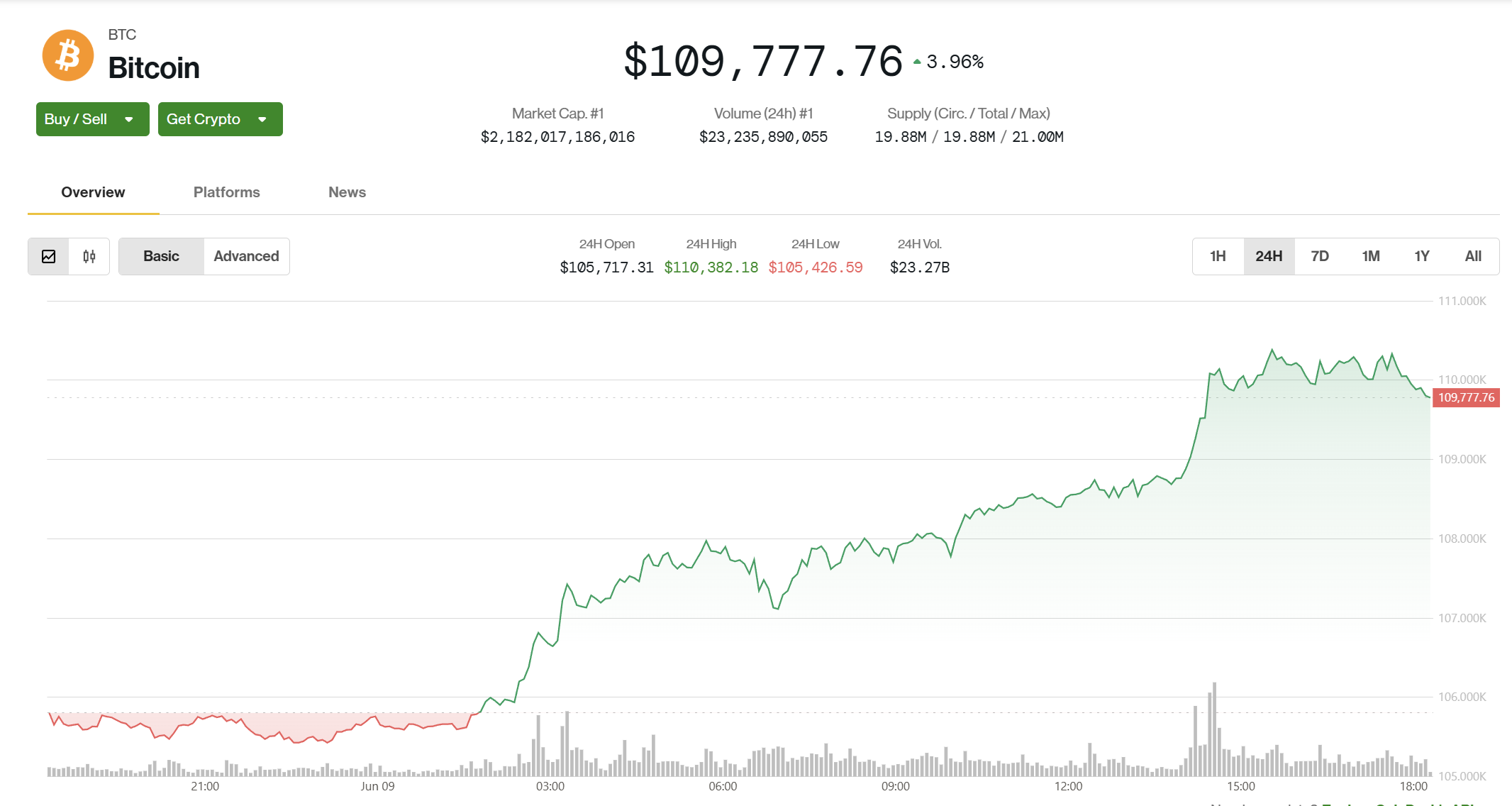

Bitcoin treasury-holding companies are an essential factor driving momentum as the largest cryptocurrency by market cap hovers just below the $110,000 mark, showing a 2% increase in the past 24 hours and standing just 2% away from its previous record high set last month.

Despite this, Bitcoin is lagging behind the broader market, as indicated by the CoinDesk 20 Index, which has grown by 3.4%, and Ethereum (ETH), which has surged by over 6%, according to CoinDesk data.

As per BitcoinTreasuries.net, the number of publicly listed companies holding Bitcoin as a treasury asset has climbed to 126, marking a growth of 22 within a month. Together, these companies possess approximately 819,000 BTC, representing a 3.25% increase during the same timeframe.

Insights from Matthew Sigel, who serves as the head of digital assets research at VanEck, emphasize the escalating institutional interest in Bitcoin. He highlights that companies such as Strategy (MSTR), Cantor Equity Partners (CEP), Asset Entities (ASST), Semler Scientific (SMLR), Kindly (NAKA), and Trump Media & Technology Group (DJT) have a combined capital-raising potential of $76 billion. This sum accounts for 56% of the assets under management of all Bitcoin ETFs and 169% of the total net inflows into these ETFs over the past 16 months.

Further displaying institutional support, BlackRock’s iShares Bitcoin Trust (IBIT) has achieved a significant milestone by becoming the fastest fund to exceed $70 billion in assets under management, achieving this feat in just 341 days. This surpasses the previous record held by SPDR Gold Shares (GLD) which took 1,691 days. IBIT experienced $2.7 billion in trading volume on Monday alone, positioning it as the sixth highest in daily volume among all ETFs.

However, institutional influence is not the only factor impacting Bitcoin. A recent Telegram note from QCP Capital pointed out one-year lows in implied volatility and a trend of subdued price action, highlighting that Bitcoin has been “stuck in a tight range” as the middle of the year approaches. The note mentions that a decisive break below $100,000 or above $110,000 is necessary to reignite broader market interest.

Looking ahead, U.S. Consumer Price Index (CPI) data set to release on Wednesday and any updates from the U.S.-China trade discussions in London may provide clearer market direction. It’s advised to stay vigilant!

In the realm of cryptocurrency, some key events to watch include:

– June 10: U.S. House Financial Services Committee hearing for Markup of Various Measures, including the crypto market structure bill, the Digital Asset Market Clarity (CLARITY) Act.

– June 11: Stratis (STRAX) activates a mainnet hard fork at block 2,587,200 to enable the Masternode Staking protocol.

– June 12: Coinbase’s State of Crypto Summit 2025 (New York). Livestream link available.

– June 16: 21Shares executes a 3-for-1 share split for ARK 21Shares Bitcoin ETF (ARKB), with ticker and NAV remaining unchanged.

– June 16: Brazil’s B3 exchange launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator.

Stay informed and watch out for these upcoming events in the crypto space.

- [posts_like_dislike id=1145]

Tags:AIAmazonAmericabitcoinbtcCEOChinaCircleCoinbaseCryptoETHEUFinancegoldIncomeJapanlibraMicrostrategymileiS&P 500StocksStrategyTelegramTradingTrumpTrump MediaUS

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin is trading below $110,000, changing hands at $109.7K, as Asia continues its trading week.

The move challenges a prevailing market narrative of summer stagnation, coming on the heels of a note from QCP Capital that emphasized suppressed volatility and a lack of immediate catalysts.

A recent Telegram note from QCP pointed to one-year lows in implied volatility and a pattern of subdued price action, noting that BTC had been “stuck in a tight range” as summer approaches.

A clean break below $100K or above $110K, they wrote, would be needed to “reawaken broader market interest.”

Even so, QCP warned that recent macro developments had failed to spark directional conviction.

“Even as US equities rallied and gold sold off in the wake of Friday’s stronger-than-expected jobs report, BTC remained conspicuously unmoved, caught in the cross-currents without a clear macro anchor,” the note said. “Without a compelling narrative to spark the next leg higher, signs of fatigue are emerging. Perpetual open interest is softening, and spot BTC ETF inflows have started to taper.”

That context makes the current move all the more surprising.

Over the weekend, Bitcoin surged 3.26% from $105,393 to $108,801, with hourly volume spiking to 2.5x the 24-hour average, according to CoinDesk Research’s technical analysis model. BTC broke decisively above $106,500, establishing new support at $107,600, and continued upward into Monday’s session, reaching $110,169.

The breakout coincides with a tense macro backdrop: US-China trade talks in London and a $22 billion U.S. Treasury bond auction later this week have injected uncertainty into global markets. While these events could drive fresh volatility, QCP cautioned that recent headlines have mostly led to “knee-jerk reactions” that quickly fade.

The question now is whether BTC’s move above $110K has true staying power, or whether the rally is running ahead of the fundamentals.

A ‘Massive Shift’ in Institutional Staking May Drive ETH’s Next Rally

Ethereum’s critics have long highlighted centralization risks, but that narrative is fading as institutional adoption accelerates, infrastructure matures, and recent protocol upgrades directly address past limitations.

“Market participants will pay for decentralization because it’s in their economic interest from a security and principal protection standpoint,” Mara Schmiedt, CEO of institutional Ethereum staking platform Alluvial, told CoinDesk. “If you look at [decentralization metrics] all of these things have massively improved over the last couple of years.”

There’s currently $492 million worth of ETH staked by Liquid Collective – a protocol co-founded by Alluvial to facilitate institutional staking

While this figure may appear modest compared to Ethereum’s total staked volume of around $93 billion, what’s interesting is that it originates predominantly from institutional investors.

“We’re really on the cusp of a truly massive shift for Ethereum, driven by regulatory momentum and the ability to unlock the advantages of secure staking,” she noted.

Central to Ethereum’s institutional readiness is the recent Pectra upgrade, a significant development Schmiedt describes as both “massive” and “underappreciated.”

“I think Pectra has been a massive upgrade. I actually think it’s been underappreciated, just in terms of the tremendous amount of change it introduces into the staking mechanics,” Schmiedt said.

Additionally, Execution Layer triggerable withdrawals—a key component of Pectra—provide institutional participants, including ETF issuers, a crucial compatibility upgrade.

This feature enables partial validator exits directly from Ethereum’s execution layer, aligning with institutional operational requirements such as T+1 redemption timelines.

“EL triggerable withdrawals create a much more effective path to exit for large-scale market participants,” Schmiedt added.

Ultimately, Schmiedt said, “I think we’ll see that a lot more [ETH] in institutional portfolios going forward.”

News Roundup

Trump Media May Be the Cheapest Bitcoin Play Among Public Stocks, NYDIG Says

Trump Media (DJT) may be one of the cheapest ways to get bitcoin exposure in public markets, according to a new report from NYDIG, CoinDesk recently reported.

As a growing number of companies adopt MicroStrategy’s strategy of stacking BTC on their balance sheets, analysts are rethinking how to value these so-called bitcoin treasury firms.

While the commonly used modified net asset value (mNAV) metric suggests that investors are paying a premium for BTC exposure, NYDIG’s Greg Cipolaro argues mNAV alone is “woefully deficient.” Instead, he points to the equity premium to NAV, which factors in debt, cash, and enterprise value, as a more accurate gauge.

By that measure, Trump Media and Semler Scientific (SMLR) rank as the most undervalued of eight companies analyzed, trading at equity premiums of -16% and -10% respectively, despite both showing mNAVs above 1.1. In other words, their shares are worth less than the value of the bitcoin they hold.

That’s in stark contrast to MicroStrategy (MSTR), which rose nearly 5% Monday as bitcoin crossed $110,000, while DJT and SMLR remained mostly flat—making them potentially overlooked vehicles for BTC exposure.

Circle Stock Nearly Quadruples Post-IPO as Bitwise and ProShares File Competing ETFs

Two major ETF issuers, Bitwise and ProShares, filed proposals on June 6 to launch exchange-traded funds tied to Circle (CRCL), whose stock has nearly quadrupled since its IPO late last week, CoinDesk previously reported.

ProShares is aiming for a leveraged product that delivers 2x the daily performance of CRCL. At the same time, Bitwise plans a covered call fund that generates income by selling options against held shares, two very different ways to capitalize on the stock’s explosive rise.

CRCL surged another 9% Monday in volatile trading, continuing to draw interest from both traditional finance and crypto investors. The proposed ETFs have an effective date of August 20, pending SEC approval. If approved, they would further blur the lines between crypto and conventional finance, giving investors new tools to play one of the hottest post-IPO names of the year.

Market Movements:

- BTC: Bitcoin is trading at $109,795 after a 3.26% breakout fueled by institutional buying, elevated volume, and macro uncertainty from US-China trade talks and an upcoming $22B Treasury auction.

- ETH: Ethereum rebounded 4.46% from a low of $2,480 to close at $2,581, with strong buying volume confirming support at $2,580 and setting up a potential breakout above $2,590.

- Gold: Gold is trading at $3,314.45, edging up 0.08% as investors watch US-China trade talks in London and a subdued dollar keeps prices attractive.

- Nikkei 225: Asia-Pacific markets rose Tuesday, with Japan’s Nikkei 225 up 0.51%, as investors awaited updates from ongoing U.S.-China trade talks.

- S&P 500: The S&P 500 closed slightly higher Monday, boosted by Amazon and Alphabet, as investors monitored U.S.-China trade talks.

Elsewhere in Crypto

- [posts_like_dislike id=1143]

OpenLedger, a blockchain protocol, has announced a commitment of $25 million to support developers in the AI and Web3 space. This funding will be made available through OpenCircle, a newly launched...

Read moreOpenLedger, a blockchain protocol, has announced a commitment of $25 million to support developers in the AI and Web3 space. This funding will be made available through OpenCircle, a newly launched platform aimed at helping developers create AI-focused protocols. The move comes at a time when there is a growing synergy between the blockchain and AI industries.

In a recent development, Telegram revealed a partnership with Elon Musk’s xAI to integrate the Grok AI chatbot into its messaging app, with the added feature of accepting the TON token for cryptocurrency payments.

Ram, a core contributor at OpenLedger, highlighted the importance of changing the current model of the AI industry, stating that “OpenCircle turns that model inside out. We’re building a system where anyone who contributes, whether through code, data, or compute, owns a piece of the value they help create.”

OpenLedger had previously secured $8 million in a seed funding round in 2024 with the goal of establishing itself as the “sovereign data blockchain for AI technology.” Additionally, the company partnered with Ether.fi, a restaking protocol with $6.5 billion in total value locked (TVL), to further advance AI model development and security.

- [posts_like_dislike id=1139]

Binance and Kraken, two of the biggest cryptocurrency exchanges globally, were recently targeted in social engineering attacks similar to those that impacted Coinbase. According to Bloomberg, hackers tried to bribe customer...

Read moreBinance and Kraken, two of the biggest cryptocurrency exchanges globally, were recently targeted in social engineering attacks similar to those that impacted Coinbase. According to Bloomberg, hackers tried to bribe customer support agents and provided instructions to contact them via Telegram. Fortunately, both exchanges were able to thwart the attempts and keep customer data secure.

These attacks mirrored the tactics used against Coinbase, which announced it could face significant costs for remediating the breach and reimbursing affected customers. In a separate incident, criminals stole customer data from Coinbase and demanded a $20 million ransom. The exchange has since terminated the employees involved and contacted law enforcement for further action.

Binance relied on internal systems, including AI bots, to detect and shut down bribery attempts before they escalated. Policies restricting access to customer data unless initiated by users also helped minimize the risk of security breaches.

Reports suggest that Coinbase noticed suspicious activity starting in January, with other exchanges warning of potential threats to its top clients as early as December.

- [posts_like_dislike id=1013]

Telegram has recently shut down numerous channels linked to suspected Chinese crypto-crime marketplaces following new research findings from Elliptic. The closure comes on the heels of a report released by the...

Read moreTelegram has recently shut down numerous channels linked to suspected Chinese crypto-crime marketplaces following new research findings from Elliptic. The closure comes on the heels of a report released by the blockchain analytics firm regarding the fast-growing Telegram-based marketplace known as Xinbi Guarantee.

According to Elliptic, Xinbi Guarantee, based in Colorado, has facilitated more than $8.4 billion in transactions using Tether’s USDT stablecoin since 2022. The platform provides services related to money laundering, running crypto scam operations, as well as other illegal activities like intimidation and sex trafficking. Elliptic’s report also reveals that there are around thirty similar marketplaces leveraging Telegram and stablecoin payments.

Despite the findings, Telegram has not yet responded to requests for comments. These marketplaces play a significant role in the global cyberscam crisis in Southeast Asia by equipping scammers with the necessary tools for large-scale fraud schemes.

Among these marketplaces, Huione Guarantee, identified by Chainalysis, offers services similar to Xinbi and is closely associated with Huione Group, linked to Cambodia’s ruling family. Elliptic estimates that Xinbi and Huione collectively account for $35 billion in illicit transactions.

In a recent move, the U.S. Treasury’s Financial Crimes Enforcement Network has designated Huione Group as a “primary money laundering concern,” citing its involvement in laundering at least $4 billion in illicit proceeds between 2021 and 2025.

Marketplaces like Xinbi and Huione are notorious for enabling widespread fraud across Southeast Asia, luring victims with the promise of well-paying IT jobs, only to enslave them and force them to partake in online pig butchering scams.

Elliptic’s research also highlights the sale of various items on Xinbi, including Starlink satellite internet equipment utilized by scam operations, fake IDs, and stolen personal information to target potential fraud victims. The report indicates a significant influx of funds from North Korean crypto heists and money laundering services, predominantly linked to pig butchering scams.

Furthermore, Elliptic discovered that approximately $220,000 in USDT originating from the $230 million WazirX theft in July was transferred to Xinbi, suggesting the involvement of vendors to help launder the stolen proceeds. Though the direct involvement of North Korean IT workers remains unclear, Elliptic suspects Chinese money laundering groups manage the funds by the time they enter platforms like Xinbi.

Notably, Xinbi stands out from similar marketplaces due to its association with the United States. The platform describes itself as an “investment and capital guarantee group company” registered as a Colorado-based corporation, despite its primary user base being fraudsters in Asia. This U.S. incorporation adds a layer of legitimacy to the marketplace, according to Elliptic.

Moreover, Robinson emphasized that the confidence inspired by a U.S. incorporation could help attract more customers to such marketplaces, despite the risk of exit scams. In January 2025, Xinbi Co., Ltd., the Colorado-based company associated with Xinbi, was flagged as delinquent for failing to file a periodic report.

- [posts_like_dislike id=985]

In the world of cryptocurrency, major coins saw little movement in the past day following a recent rally and subsequent profit-taking. Bitcoin (BTC) was trading above $93,000 during the Asian morning...

Read moreIn the world of cryptocurrency, major coins saw little movement in the past day following a recent rally and subsequent profit-taking. Bitcoin (BTC) was trading above $93,000 during the Asian morning hours on Friday, with traders expressing increased optimism for potential short-term gains.

QCP Capital shared in a Telegram broadcast that sentiment was growing more positive as BTC maintained its position above $90K. The focus was on call options at $95K strikes for end-April and end-May expiries, indicating a desire for further upside.

Despite the optimism, QCP Capital remained cautious given the impact of macroeconomic factors on market sentiment. They anticipate Bitcoin trading in a range of $90K to $94.5K as it approaches the coveted $100K mark.

In the cryptocurrency market, some major coins like XRP, BNB, and SOL were relatively stable, while DOGE, ADA, and SHIB experienced gains ranging from 4% to 5%. The CoinDesk 20 index, which tracks the largest tokens by market capitalization, saw a 1.2% increase.

Outside of the major coins, Sui Network’s SUI surged over 62% for the week, driven by the upcoming release of a payment card running on the Mastercard network by ecosystem company xPortal. Data from DefiLlama revealed that the total value locked on the Sui Network surpassed $1.6 billion, marking a 9% increase in 24 hours. The decentralized exchange (DEX) on the Sui Network also saw a significant boost in trading volume, reaching $599 million in 24 hours, a 35% increase from the previous week.

- [posts_like_dislike id=887]