Circle (CRCL) made its highly anticipated debut on the New York Stock Exchange (NYSE) on Thursday, with shares opening at $69 and surging to over $100 at one point, marking a...

Read moreFinance

The crypto economy’s leverage is going through changes, not disappearing. According to Galaxy Research’s Q1 2025 report, total crypto-collateralized lending decreased by 4.9% to $39.07 billion, marking the first decline since...

Read moreThe crypto economy’s leverage is going through changes, not disappearing. According to Galaxy Research’s Q1 2025 report, total crypto-collateralized lending decreased by 4.9% to $39.07 billion, marking the first decline since late 2023. However, the report suggests that leverage is transforming rather than diminishing.

Decentralized finance (DeFi) lending experienced a downturn early in the quarter, dropping by as much as 21%, before bouncing back strongly in April and May. Aave’s integration of Pendle tokens, known for their yield-bearing structure and high loan-to-value ratios, led to a surge in fresh borrowing, with DeFi borrowing increasing by over 30% by late May, driven by Ethereum.

Centralized finance (CeFi) lending rose by 9.24% to $13.51 billion, with Tether, Ledn, and Two Prime leading the way. Galaxy points out that limited public disclosures make it difficult to gauge the full scope of centralized lending, with private desks, OTC platforms, and offshore credit providers potentially increasing the total by 50% or more.

Bitcoin treasury companies are emerging as new systemic leverage nodes, with firms like MSTR issuing billions in convertible debt to fund BTC purchases. As of May, total outstanding debt across treasury firms reached $12.7 billion, with a significant amount set to mature between 2027 and 2028.

In derivatives, CME’s increasing open interest in ether (ETH) futures indicates growing institutional involvement. Additionally, Hyperliquid, a new exchange, has gained a significant share of the perpetual futures market, showcasing the continued strength of retail-driven leverage.

The report highlights a more interconnected market structure, where stress in one venue or instrument could have a ripple effect across the ecosystem. Although leverage in the current crypto cycle may be more fragmented, it remains a powerful force in the market.

- [posts_like_dislike id=1113]

Tags:AIAmericaBinancebitcoinBlackrockbtcCoinbaseCryptoElon MuskETHEUEuropeFinancegoldJapanMicrostrategyStrategyTariffsTradingTrumpUSWashington

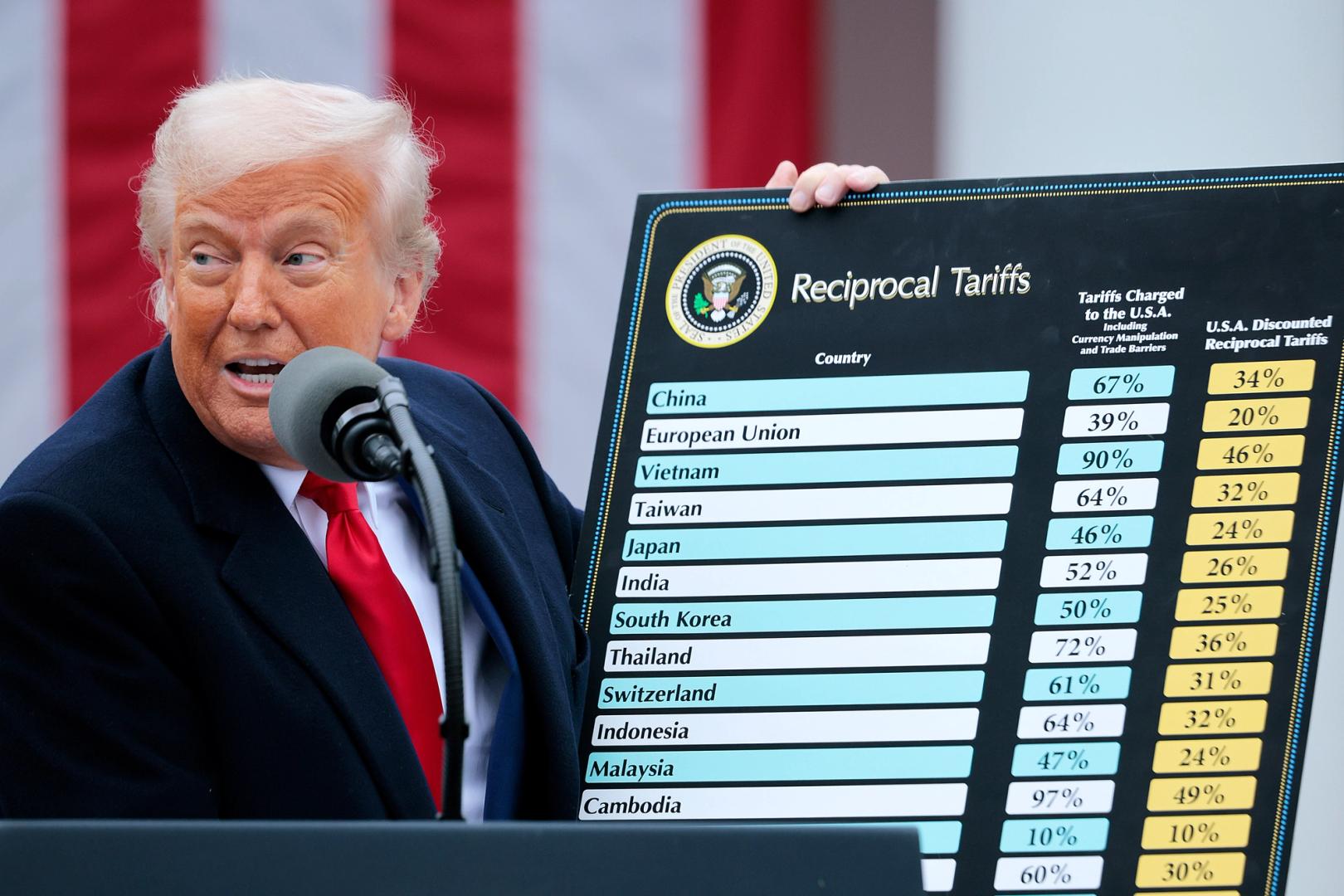

The recent TACO tease, implying “Trump Always Chickens Out” on tariffs, likely didn’t go down well with the President, who raised the stakes in the ongoing trade war on Friday, leading...

Read moreThe recent TACO tease, implying “Trump Always Chickens Out” on tariffs, likely didn’t go down well with the President, who raised the stakes in the ongoing trade war on Friday, leading to broad-based risk aversion.

On Friday, Trump said that on June 4, the U.S. tariffs on imported aluminum and steel would go from 25% to 50%, triggering a broad-based risk-off move across global markets. Bitcoin has since traded in the range of $103,000-$106,000, with little to no excitement in the broader crypto market. Notably, BlackRock’s spot bitcoin ETF (IBIT) registered an outflow of $430 million, ending a prolonged inflows streak.

“Tariff tensions will likely dominate the macro narrative through June, with meaningful policy deadlines only kicking in from 8 July. In the absence of fresh catalysts, BTC could remain rangebound, with the $100k and $110k levels critical to watch given their status as strikes with the highest month-end open interest,” Singapore-based trading firm QCP Capital said.

ETFs are becoming increasingly important to the market. Data shared by FalconX’s David Lawant shows that the cumulative trading volume in the 11 spot BTC ETFs listed in the U.S. is now well over 40% of the spot volume. The data supports the “Bitcoin ETFs are the new marginal buyer” hypothesis, according to Bitwise’s Head of Research – Europe, Andre Dragosch.

Meanwhile, on-chain data tracked by Glassnode showed a drop in momentum buyers alongside a sharp rise in profit takers last week. “This trend often shows near local tops, as traders begin locking in gains instead of building exposure,” Glassnode said.

High-stakes crypto trader James Wynn opened a fresh BTC long trade with 40x leverage and a liquidation price of $104,580, according to blockchain sleuth Lookonchain.

In other news, Japan’s “MicroStrategy” Metaplanet announced an additional purchase of 1,088 BTC, and billionaire entrepreneur Elon Musk announced a new XChat with Bitcoin-like encryption.

Binance’s founder CZ said on X that now might be a good time to develop a dark pool-style perpetual-focused decentralized exchange, noting that real-time order visibility can lead to MEV attacks and malicious liquidations.

In traditional markets, gold looked to break out of its recent consolidation, hinting at the next leg higher as Bank of America and Morgan Stanley forecast continued dollar weakness. Friday’s U.S. nonfarm payrolls release will be closely watched for signs of labor market weakness. Stay Alert!

What to Watch

Crypto

June 3, 1 p.m.: The Shannon hard fork network upgrade will get activated on the Pocket Network (POKT).

June 4, 10 a.m.: U.S. House Financial Services Committee will hold a hearing on “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

June 6: Sia (SC) is set to activate Phase 1 of its V2 hard fork, the largest upgrade in the project’s history. Phase 2 will get activated on July 6.

June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable on “DeFi and the American Spirit”

June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto market structure bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

Macro

June 2, 1 p.m.: Federal Reserve Chair Jerome H. Powell will deliver a speech at the Federal Reserve Board’s International Finance Division 75th Anniversary Conference in Washington. Livestream link.

June 2, 9:45 a.m.: S&P Global releases (Final) May U.S. Manufacturing PMI data. Manufacturing PMI Est. 52.3 vs. Prev. 50.2

June 2, 10 a.m.: The Institute for Supply Management (ISM) releases May Manufacturing PMI. Manufacturing PMI Est. 49.5 vs. Prev. 48.7

June 3: South Koreans will vote to choose a new president following the ouster of Yoon Suk Yeol, who was dismissed after briefly declaring martial law in December 2024.

June 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labor market data. Job Openings Est. 7.10M vs. Prev. 7.192M Job Quits Prev. 3.332M

June 3, 1 p.m.: Federal Reserve Governor Lisa D. Cook will deliver a speech on economic outlook at the Peter McColough Series on International Economics in New York. Livestream link.

June 4, 12:01 a.m.: U.S. tariffs on imported steel and aluminum will increase from 25% to 50%, according to a Friday evening Truth Social post by President Trump.

Earnings (Estimates based on FactSet data)

None in the near future.

Token Events

Governance votes & calls

Sui DAO is voting on moving to recover approximately $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 and Unichain support in Oku. The goal is to expand V4 adoption, support hook developers, and improve tools for LPs and traders. Voting ends June 6.

June 4, 6:30 p.m.: Synthetix to host a community call.

June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

June 5: Ethena (ENA) to unlock 0.7% of its circulating supply worth $14.18 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $57.11 million.

June 13: Immutable (IMX) to unlock 1.33% of its circulating supply worth $13.24 million.

June 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $17.11 million.

June 15: Sei (SEI) to unlock 1.04% of its circulating supply worth $10.64 million.

Token Launches

June 3: Bondex (BDXN) to be listed on Binance, Bybit, Coinlist, and others.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN).

Conferences

Day 1 of 6: SXSW London

June 3: World Computer Summit 2025 (Zurich)

June 3-5: Money20/20 Europe 2025 (Amsterdam)

June 4-6: Non Fungible Conference (Lisbon)

June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

June 19-21: BTC Prague 2025

June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

June 26-27: Istanbul Blockchain Week

Token Talk

While You Were Sleeping

In the Ether

Derivatives Positioning

Market Movements

Bitcoin Stats

Technical Analysis

Crypto Equities

ETF Flows

Overnight Flows

Chart of the Day

Bitcoin Stats

- [posts_like_dislike id=1095]

By SEO Writer for The Parrot Press Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news...

Read moreBy SEO Writer for The Parrot Press

Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news was followed by Nvidia’s upbeat earnings report, boosting positive sentiment in the market.

Large Bitcoin wallets holding over 10,000 BTC have transitioned to selling from buying as the cryptocurrency nears its all-time high. Additionally, an increase in exchange deposits indicates selling pressure. The options market data hints at potential volatility leading up to Friday’s monthly settlement.

Ether, the second-largest cryptocurrency by market value, surged to $2,780, its highest level since February 24, supported by bullish signals from the derivatives market. The rise in the token’s price this week is attributed to SharpLink’s $425 million Treasury plan. Notably, U.S.-listed spot ether ETFs saw a net inflow of $84.89 million on Wednesday for the eighth consecutive day.

Canada-listed investment firm Sol Strategies has filed to raise up to $1 billion to boost its investment in the Solana ecosystem. Despite this, SOL remained flat at around $170.

In other news, TON, PEPE, and FLOKI led the market while FARTCOIN, PI, and JUP experienced the most losses. Open interest in TON perpetual futures surged by 33% to $190 million, reaching its highest level since February 18.

Stablecoin issuer Circle froze wallets connected to the Libra token containing millions in USDC. Metaplanet issued $21 million in bonds to finance more Bitcoin purchases.

In traditional markets, some investment banks suggested that Trump has alternative tools to bypass the court ruling on tariffs. Yields on longer-duration Treasury notes increased, indicating strength in the dollar. Stay tuned for more updates!

What to Watch:

Crypto:

– May 30: The second round of FTX repayments start.

– May 31 (TBC): Mezo mainnet launch.

– June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable on “DeFi and the American Spirit”

Macro:

– Various economic releases and announcements scheduled for May 29-30.

Earnings:

– No significant earnings events in the near future.

Token Events:

Governance votes & calls:

– Various upcoming votes and calls for different tokens and platforms.

Unlocks:

– Schedule of upcoming token unlocks.

Token Launches:

– Information on upcoming token launches and deadlines.

Conferences:

– List of upcoming conferences and summits in the crypto and blockchain space.

Token Talk: An overview of major events and news in the token market.

Derivatives Positioning: Analysis of derivatives positions in the market.

Market Movements: Highlights of major market movements and performances.

Bitcoin Stats: Statistical data related to Bitcoin.

Technical Analysis: Insights into technical analysis of market trends.

Crypto Equities: Updates on crypto-related equities and their performance.

ETF Flows: Information on ETF flows related to Bitcoin and Ethereum.

Overnight Flows: Updates on overnight market movements and performance.

Chart of the Day: Featured chart highlighting market trends.

While You Were Sleeping: Summary of overnight news and developments.

In the Ether: A series of images illustrating various aspects of the cryptocurrency market.

- [posts_like_dislike id=1071]

Katana, a new decentralized finance (DeFi)-focused blockchain incubated by industry heavyweights Polygon and GSR, announced on Wednesday that its private mainnet has gone live. The new layer-2 blockchain aims to unify...

Read moreKatana, a new decentralized finance (DeFi)-focused blockchain incubated by industry heavyweights Polygon and GSR, announced on Wednesday that its private mainnet has gone live.

The new layer-2 blockchain aims to unify all liquidity in a set of protocols and collect yield from all potential sources, with the goal of powering a self-sustaining DeFi engine for long-term growth.

Marc Boiron, the CEO of Polygon Labs, highlighted that Katana emerged to address DeFi fragmentation, where digital assets are spread across various apps and ecosystems, creating challenges for certain types of investing.

Built using AggLayer, Polygon’s platform for building interoperable blockchains, Katana aims to establish a deep liquidity hub for every chain to tap into. This is key as many existing chains lack the necessary liquidity.

Katana aims to enhance blockchain liquidity by integrating with popular apps like Sushi, a major decentralized exchange, and Morpho, a popular decentralized lending ecosystem.

Polygon Labs, the team behind the layer-2 network, designed the chain with input from GSR, the crypto market-maker, which advised on user experience and provided on-chain liquidity to support the platform.

At this early stage, Katana is open to a limited group of users, offering a pre-deposit phase where users can park ETH, USDC, USDT, and WBTC for a chance to win KAT tokens, the network’s new governance and utility token. Further incentives for early deposits include a lootbox-style reward system.

Katana’s public mainnet is anticipated to launch at the end of June.

- [posts_like_dislike id=1069]

Cantor, the Wall Street investment bank, announced on Tuesday that it has completed the first transaction of its new bitcoin lending business. This initiative is part of Cantor’s plan to provide...

Read moreCantor, the Wall Street investment bank, announced on Tuesday that it has completed the first transaction of its new bitcoin lending business. This initiative is part of Cantor’s plan to provide $2 billion in financing to support bitcoin investors. The first companies to benefit from this credit facility include Maple Finance, a crypto lender with assets over $1.8 billion, and FalconX, a digital asset prime brokerage.

The launch of this business was first announced by Cantor in July, with the goal of creating a platform to meet the financing needs of bitcoin investors. Christian Wall, co-CEO and global head of fixed income at Cantor, expressed excitement about supporting institutions holding bitcoin in accessing diverse funding sources to drive long-term growth and success.

In addition to its bitcoin lending business, Cantor Fitzgerald also manages the U.S. Treasuries stockpile that backs Tether’s $142 billion stablecoin USDT. The firm’s former CEO, Howard Lutnick, who now serves as the Secretary of Commerce, has been a strong advocate for integrating bitcoin into traditional finance.

- [posts_like_dislike id=1063]

Centrifuge, a tokenized asset platform, has announced its expansion of services on the Solana blockchain, starting with the $400 million tokenized U.S. Treasury fund managed by Anemoy (JTRSY). This expansion is...

Read moreCentrifuge, a tokenized asset platform, has announced its expansion of services on the Solana blockchain, starting with the $400 million tokenized U.S. Treasury fund managed by Anemoy (JTRSY).

This expansion is based on Centrifuge’s token standard, known as “deRWA tokens,” which enables token holders to freely transfer and use tokenized instruments across decentralized finance (DeFi) protocols.

The deJTRSY token can now be swapped, lent, or used as collateral on Solana DeFi platforms like Raydium, Kamino, and Lulo, allowing Solana users to earn yield from short-term Treasuries.

This move highlights the increasing presence of Solana in the tokenized real-world asset (RWA) space, which brings traditional financial instruments onto the blockchain. According to projections by Boston Consulting Group and Ripple, the tokenized asset market could reach $18.9 trillion by 2033.

Recently, the Solana Foundation partnered with blockchain tech firm R3 to bring real-world assets to Solana, and a tokenized fund of Apollo credit assets issued by Securitize is also being introduced to Solana-based DeFi protocols.

Centrifuge’s CEO, Bhaji Illuminati, emphasized the importance of giving real-world assets utility onchain and making them usable across the DeFi ecosystem.

Overall, these developments showcase the growing interest and adoption of tokenization efforts on Solana, especially within the traditional finance sector.

For more information, learn about Major TradFi Institutions pursuing Tokenization Efforts on Solana.

- [posts_like_dislike id=1045]

Tags:AIAmericaAppleBinanceBlackrockCryptoEUEuropeFinancegoldRobinhoodS&P 500solanaStocksTeslaTradingUS

Kraken is set to introduce tokenized shares of popular U.S. stocks such as Nvidia, Apple, and Tesla, as well as over 50 other stocks and exchange-traded funds (ETFs), according to a...

Read moreKraken is set to introduce tokenized shares of popular U.S. stocks such as Nvidia, Apple, and Tesla, as well as over 50 other stocks and exchange-traded funds (ETFs), according to a report by the Wall Street Journal.

These tokenized assets, named “xStocks,” will be built on the Solana SOL blockchain and will be open for trading 24/7 to investors globally. Some of the ETFs included in this offering are the SPDR S&P 500 ETF (SPY) and the SPDR Gold Shares (GLD).

Backed Finance will hold the real shares representing the stocks, allowing investors to redeem them at a 1:1 ratio for their cash value.

In April, Kraken initially unveiled over 11,000 U.S.-listed stocks and ETFs for trading in 10 states through its subsidiary Kraken Securities. This recent expansion now includes tokenized versions of more than 50 stocks and ETFs available to customers outside of the U.S., starting with regions like Europe, Latin America, Africa, and Asia.

Kraken’s move places it in direct competition with platforms like Robinhood (HOOD) and makes it the first exchange to successfully offer tokenized shares of major U.S. stocks. Binance previously attempted to launch tokenized U.S. stocks in 2021 but eventually abandoned the plans due to regulatory uncertainty.

A spokesperson from Kraken mentioned to the Wall Street Journal that the exchange is actively collaborating with regulators to ensure the legal offering of xStocks in each jurisdiction, taking into account the varying regulatory landscapes.

Tokenization, the process of converting real-world assets into blockchain tokens, has gained popularity in the crypto sphere. Companies like Ondo Finance, BlackRock, and Franklin Templeton have been early adopters of tokenization, contributing to the overall tokenization market reaching a market cap of $65 billion as of May.

- [posts_like_dislike id=1041]

Tags:ADAAIAmericaBinancebitcoinbtcCanadaCoinbaseCryptoDonald TrumpdubaiETHEUFinancegoldGovernmentHealthIranJapanminerMoving AverageS&P 500StocksStrategyTradingtrillionTrumpUSWashington

By Francisco Rodrigues (All times ET unless indicated otherwise) Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets...

Read moreBy Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets contended with rising bond yields and renewed concerns over ballooning U.S. debt.

The largest cryptocurrency has gained around 3.8% in the last 24 hours while the broader CoinDesk 20 CD20 index rose 4.74%, continuing a trend of strength driven by mounting institutional demand and growing interest in crypto exposure.

The rally is unfolding against a backdrop of higher yields on U.S. and Japanese government bonds. The 10-year U.S. Treasury yield rose to 4.6%, while the 30-year topped 5%, driven by concerns over President Donald Trump’s tax bill that analysts estimate could add as much as $5 trillion to the country’s debt, according to Reuters.

In Japan, yields on 30- and 40-year government bonds also hit record highs. The country’s debt-to-GDP ratio stands at 234%, QCP Capital said, and growing scrutiny coupled with weak demand for long-dated JGBs sent yields soaring.

That matters because higher yields — and thus higher returns — on investments that are considered relatively safe tend to lower the appeal of riskier assets like stocks, not to mention cryptocurrencies. While BTC, with its history of trading as a risky asset, hasn’t shown much sign of ebbing demand, it raises the question of how long the rally can continue.

Still, traders have been building large long positions in BTC options, with the most open interest now concentrated at the $110,000, $120,000 and even $300,000 calls for contracts expiring in late June in a sign of continuing bullish conviction.

U.S.-traded spot bitcoin exchange-traded funds have also been seeing significant demand. Total net inflows hit $1.6 billion over the week, and $4.24 billion so far in May, SoSoValue data shows. The inflows, coupled with bitcoin’s price rise, have seen the ETFs’ total net assets hit a record $129 billion.

There are, however, some muted signs of bearish activity.

“The largest block flow this week continues to be ETH December call spreads, while overnight BTC butterfly positions hint that some traders are positioning for consolidation around current levels,” Wintermute OTC trader Jake O. said.

Note, he’s talking about consolidation, not declines. And traditional participants may even be too bearish. While the U.S. endured a recent credit downgrade, markets are now pricing in a 6-level cut all the way down to BBB+.

On top of that, per Jake O., a recent equities market sell-off may not be a result of repositioning given higher bond yields, but rather profit-taking after nine consecutive positive sessions. Stay alert!

What to Watch

Crypto

May 22: Bitcoin Pizza Day.

May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

May 30: The second round of FTX repayments starts.

May 31 (TBC): Mezo mainnet launch.

Macro

Day 3 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

May 22, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail sales data.

May 23, 10 a.m.: The U.S. Census Bureau releases April new single-family homes data.

Earnings (Estimates based on FactSet data)

May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

Governance votes & calls

Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock between DAO decisions and execution so stETH holders can escrow tokens to pause proposals at 1% of TVL or fully block and “rage-quit” at 10%. Voting ends May 28.

Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

May 22: Official Trump to announce its “next Era” on the day of the dinner for its largest holders.

June 10: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.67 million.

June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $182.58 million.

June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.99 million.

June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $16.78 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $61.86 million.

Token Launches

June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

Day 3 of 7: Dutch Blockchain Week (Amsterdam)

Day 3 of 3: Avalanche Summit London

Day 3 of 3: Seamless Middle East Fintech 2025 (Dubai)

Day 2 of 2: Crypto Expo Dubai

Day 2 of 2: Cryptoverse Conference (Warsaw)

May 27-29: Bitcoin 2025 (Las Vegas)

May 27-30: Web Summit Vancouver

May 29: Stablecon (New York)

May 29-30: Litecoin Summit 2025 (Las Vegas)

May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

June 2-7: SXSW London

June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

June 19-21: BTC Prague 2025

Token Talk

By Shaurya Malwa

The HYPE token is in focus after a billion-dollar bitcoin trade boosted Hyperliquid’s fundamentals.

Pseudonymous trader James Wynn opened a $1.1 billion long on BTC using 40x leverage via Hyperliquid in one of the largest on-chain DEX trades ever recorded.

The position, tied to wallet “0x507,” was entered when BTC was priced at $108K and now sits on over $40 million in unrealized profit.

Wynn booked partial profits early Thursday by closing 540 BTC (~$60 million), to net $1.5 million.

His prior exits were followed by BTC declines, so traders are watching closely.

Hyperliquid runs on its custom L1, HyperEVM, using the HyperBFT consensus (200K+ TPS) with CEX-level features like real-time order books and deep liquidity — no KYC required.

The platform’s permissionless design and lightning-fast execution are increasingly drawing capital from centralized venues to DeFi , and this trade could set a precedent for whale activity.

HYPE jumped 15% in the past 24 hours on renewed attention and usage-driven speculation.

Derivatives Positioning

Analyzing the liquidations heatmap of the BTC-USDT pair on Binance, the largest liquidations cluster around $108.5K and $106.9K with liquidations worth $143 million and $112.5 million, respectively.

Meanwhile, the options market swells post-breakout, with open interest on Deribit climbing above $34 billion, just shy of the all-time high of $35.9 billion set in December. The bulk of this positioning is centered on the 30 May expiry, which now holds over $9 billion in notional value to become a key date for potential volatility.

Bullish sentiment is clearly in control, with traders aggressively targeting upside via calls. Strikes at $100K, $120K and $150K have attracted particularly large open interest, reflecting growing conviction in a continued rally.

Put/call ratios underscore this shift in sentiment — the 24-hour volume ratio has dropped to 0.49, while the open interest ratio sits at 0.60, indicating a meaningful tilt toward bullish exposure following BTC’s move above $110K.

Near-term options activity is also picking up, with weekly and monthly contracts seeing notable inflows. Traders appear to be positioning for further momentum or short-term price swings in the wake of the breakout.

Market Movements

BTC is up 1.19% from 4 p.m. ET Wednesday at $110,690.36 (24hrs: +4.05%)

ETH is up 6.19% at $2,662.72 (24hrs: +5.23%)

CoinDesk 20 is up 3.64% at 3,348.63 (24hrs: +4.88%)

Ether CESR Composite Staking Rate is unchanged at 3.03%

BTC funding rate is at 0.03% (10.95% annualized) on Binance

DXY is up 0.25% at 99.81

Gold is down 0.26% at $3,305.6/oz

Silver is down 0.83% at $33.17/oz

Nikkei 225 closed -0.84% at 36,985.87

Hang Seng closed -1.19% at 23,544.31

FTSE is down 0.68% at 8,726.62

Euro Stoxx 50 is down 0.96% at 5,402.31

DJIA closed on Wednesday -0.91% at 41,860.44

S&P 500 closed -1.61% at 5,844.61

Nasdaq closed -1.41% at 18,872.64

S&P/TSX Composite Index closed -0.83% at 25,839.17

S&P 40 Latin America closed -1.31% at 2,597.38

U.S. 10-year Treasury rate is down 2 bps at 4.58%

E-mini S&P 500 futures are unchanged at 5,865.50

E-mini Nasdaq-100 futures are up 0.15% at 21,188.50

E-mini Dow Jones Industrial Average Index futures are down 0.17% at 41,875.00

Bitcoin Stats:

BTC Dominance: 63.90 (-0.62%)

Ethereum to bitcoin ratio: 0.02409 (3.52%)

Hashrate (seven-day moving average): 875 EH/s

Hashprice (spot): $58.24

Total Fees: 7.89 BTC / $847,124

CME Futures Open Interest: 160,740 BTC

BTC priced in gold: 33.4 oz

BTC vs gold market cap: 9.47%

Technical Analysis

Bitcoin reached a new all-time high of $111,875 this morning, breaking decisively above the previous peak just above $109,000 set in January.

With a confirmed close above that level and no sign of a swing failure pattern, the bias remains firmly tilted toward continued upside. In the near term, BTC may encounter resistance around the $112,000–$113,000 range, aligning with a trendline drawn from the prior highs in December and January.

However, last week’s consolidation above $100,000 — and the successful reclaim of the previous all-time high — suggest this area is now acting as short-term support.

A pullback below $100,000, especially into the weekly order block, would likely represent a healthy correction within the broader uptrend and could offer a compelling reentry opportunity if further downside is seen.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $402.69 (-3.41%), up 1.73% at $409.67 in pre-market

Coinbase Global (COIN): closed at $258.99 (-0.91%), up 2.78% at $266.20

Galaxy Digital Holdings (GLXY): closed at C$31 (+1.57%)

MARA Holdings (MARA): closed at $15.84 (-2.16%), up 4.42% at $16.54

Riot Platforms (RIOT): closed at $8.84 (-1.01%), up 3.39% at $9.14

Core Scientific (CORZ): closed at $10.78 (-1.28%), up 1.48% at $10.94

CleanSpark (CLSK): closed at $10.11 (+4.23%), up 4.65% at $10.58

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.75 (-1.33%)

Semler Scientific (SMLR): closed at $44.89 (+7.19%), up 6.01% at $47.59

Exodus Movement (EXOD): closed at $32.76 (-5.07%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $607.1 million

Cumulative net flows: $43.35 billion

Total BTC holdings ~ 1.19 million

Spot ETH ETFs

Daily net flow: $0.6 million

Cumulative net flows: $2.61 billion

Total ETH holdings ~ 3.49 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Top 20 digital assets’ prices and volumes

Chart of the day

Bitcoin adoption

- [posts_like_dislike id=1033]

A trader recently took a bold move by opening a $1.1 billion long position on bitcoin (BTC) with 40x leverage on the decentralized exchange (DEX) Hyperliquid. This rare instance of a...

Read moreA trader recently took a bold move by opening a $1.1 billion long position on bitcoin (BTC) with 40x leverage on the decentralized exchange (DEX) Hyperliquid. This rare instance of a ten-figure position entirely on a blockchain-based platform is linked to wallet address “0x507” belonging to the pseudonymous trader “James Wynn.”

According to Lookonchain data, the position was initiated at an entry price of $108,084, with a liquidation level just below $103,640, signaling a potential wipeout if BTC drops to that price. The trade is currently showing over $40 million in unrealized profit as of early Thursday.

In a strategic move, Wynn closed out 540 BTC (~$60M) during European morning hours to secure a $1.5 million profit. Previous exits by Wynn have led to sharp BTC pullbacks, which traders should watch out for, as noted by Lookonchain.

Hyperliquid operates on its own high-performance layer 1 blockchain called HyperEVM, offering features usually seen on centralized platforms such as real-time order books, deep liquidity, and minimal gas fees. The platform’s consensus mechanism, HyperBFT, can handle over 200,000 transactions per second, ensuring quick and transparent executions for traders.

Unlike centralized exchanges that require KYC or limit access, Hyperliquid permits anyone with a wallet to trade without restrictions. The platform’s speed and capital efficiency have made it popular, with the billion-dollar position potentially prompting other large players to explore onchain execution.

This move signifies a shift of capital from centralized finance to decentralized finance (DeFi), with whales now willing to make significant investments outside the traditional financial system. Additionally, the HYPE token of Hyperliquid has experienced a 15% increase in the past 24 hours due to rising demand.

- [posts_like_dislike id=1031]