Bitcoin Treasury Corp. (BTCT) has recently acquired 292.80 bitcoins for C$43 million ($31.6 million) as part of its strategy to build a digital asset treasury. The Toronto-based company sees bitcoin as...

Read moreFinancial Markets

The cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise. Norway-based crypto exchange Norwegian Block...

Read moreThe cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise.

Norway-based crypto exchange Norwegian Block Exchange saw its shares surge over 100% after revealing the purchase of six BTC, valued at $633K at current prices. The company plans to increase its holdings to 10 BTC by the end of the month.

Classover Holdings Inc, a Nasdaq-listed educational technology company with a market capitalization of $63 million, entered into a securities purchase agreement with Solana Growth Ventures LLC for up to $500 million in senior secured convertible notes, with 80% of the proceeds allocated to purchasing Solana’s native token SOL.

Ripple’s stablecoin RLUSD received regulatory approval from the Dubai Financial Services Authority, allowing the stablecoin to support the Dubai Land Department’s blockchain initiative to tokenize real estate title deeds on the XRP Ledger.

Robinhood completed a $200 million all-cash acquisition of the Luxembourg-based crypto exchange Bitstamp, expanding its presence in Europe.

U.S.-listed spot bitcoin ETFs experienced a net outflow of $268 million on Monday, while Ethereum spot ETFs recorded a net inflow of $78.17 million. Meanwhile, the Japanese yen declined during Asian hours due to the Bank of Japan’s plans to halt its Japanese government bond purchases.

The dollar index remained under pressure due to trade uncertainty and rising concerns in the bond market over the U.S. deficit. Negative surprises in Monday’s ISM manufacturing surveys punctured the U.S. resilience story.

Focus today will be on April’s JOLTS report and durable goods orders. A soft labor market data could push the dollar back to its April lows, according to ING.

A U.S. House hearing on “The Future of Digital Assets” featured Aptos Labs CEO Avery Ching’s testimony, led by the Agriculture Committee. Stay informed!

In the cryptocurrency space, upcoming events include network upgrades on Pocket Network and Sia, congressional hearings, and the announcement of the 3-for-1 share split for ARK 21Shares Bitcoin ETF.

Conferences to watch out for include SXSW London, World Computer Summit 2025, Money20/20 Europe, Non Fungible Conference, Crypto Valley Conference, BTC Prague 2025, Bitcoin Policy Institute’s Bitcoin Policy Summit 2025, and Istanbul Blockchain Week.

Token events include governance votes, unlocks, and token launches across various platforms.

In the market, BTC and ETH prices saw some movement, while the CoinDesk 20 experienced a slight increase. Key market indicators also showed some fluctuations.

Derivatives positioning and crypto equities like MSTR, COIN, GLXY, MARA, and more displayed various performance measures.

ETF flows revealed daily and cumulative net flows for spot BTC and spot ETH ETFs.

Stay updated on overnight flows, technical analysis, and the latest news in the crypto and financial markets.

The content was written without any Coindesk attribution or HTML coding.

- [posts_like_dislike id=1101]

Tags:ADAAIAmericaBinancebitcoinbtcCanadaCoinbaseCryptoDonald TrumpdubaiETHEUFinancegoldGovernmentHealthIranJapanminerMoving AverageS&P 500StocksStrategyTradingtrillionTrumpUSWashington

By Francisco Rodrigues (All times ET unless indicated otherwise) Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets...

Read moreBy Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets contended with rising bond yields and renewed concerns over ballooning U.S. debt.

The largest cryptocurrency has gained around 3.8% in the last 24 hours while the broader CoinDesk 20 CD20 index rose 4.74%, continuing a trend of strength driven by mounting institutional demand and growing interest in crypto exposure.

The rally is unfolding against a backdrop of higher yields on U.S. and Japanese government bonds. The 10-year U.S. Treasury yield rose to 4.6%, while the 30-year topped 5%, driven by concerns over President Donald Trump’s tax bill that analysts estimate could add as much as $5 trillion to the country’s debt, according to Reuters.

In Japan, yields on 30- and 40-year government bonds also hit record highs. The country’s debt-to-GDP ratio stands at 234%, QCP Capital said, and growing scrutiny coupled with weak demand for long-dated JGBs sent yields soaring.

That matters because higher yields — and thus higher returns — on investments that are considered relatively safe tend to lower the appeal of riskier assets like stocks, not to mention cryptocurrencies. While BTC, with its history of trading as a risky asset, hasn’t shown much sign of ebbing demand, it raises the question of how long the rally can continue.

Still, traders have been building large long positions in BTC options, with the most open interest now concentrated at the $110,000, $120,000 and even $300,000 calls for contracts expiring in late June in a sign of continuing bullish conviction.

U.S.-traded spot bitcoin exchange-traded funds have also been seeing significant demand. Total net inflows hit $1.6 billion over the week, and $4.24 billion so far in May, SoSoValue data shows. The inflows, coupled with bitcoin’s price rise, have seen the ETFs’ total net assets hit a record $129 billion.

There are, however, some muted signs of bearish activity.

“The largest block flow this week continues to be ETH December call spreads, while overnight BTC butterfly positions hint that some traders are positioning for consolidation around current levels,” Wintermute OTC trader Jake O. said.

Note, he’s talking about consolidation, not declines. And traditional participants may even be too bearish. While the U.S. endured a recent credit downgrade, markets are now pricing in a 6-level cut all the way down to BBB+.

On top of that, per Jake O., a recent equities market sell-off may not be a result of repositioning given higher bond yields, but rather profit-taking after nine consecutive positive sessions. Stay alert!

What to Watch

Crypto

May 22: Bitcoin Pizza Day.

May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

May 30: The second round of FTX repayments starts.

May 31 (TBC): Mezo mainnet launch.

Macro

Day 3 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

May 22, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail sales data.

May 23, 10 a.m.: The U.S. Census Bureau releases April new single-family homes data.

Earnings (Estimates based on FactSet data)

May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

Governance votes & calls

Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock between DAO decisions and execution so stETH holders can escrow tokens to pause proposals at 1% of TVL or fully block and “rage-quit” at 10%. Voting ends May 28.

Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

May 22: Official Trump to announce its “next Era” on the day of the dinner for its largest holders.

June 10: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.67 million.

June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $182.58 million.

June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.99 million.

June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $16.78 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $61.86 million.

Token Launches

June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

Day 3 of 7: Dutch Blockchain Week (Amsterdam)

Day 3 of 3: Avalanche Summit London

Day 3 of 3: Seamless Middle East Fintech 2025 (Dubai)

Day 2 of 2: Crypto Expo Dubai

Day 2 of 2: Cryptoverse Conference (Warsaw)

May 27-29: Bitcoin 2025 (Las Vegas)

May 27-30: Web Summit Vancouver

May 29: Stablecon (New York)

May 29-30: Litecoin Summit 2025 (Las Vegas)

May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

June 2-7: SXSW London

June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

June 19-21: BTC Prague 2025

Token Talk

By Shaurya Malwa

The HYPE token is in focus after a billion-dollar bitcoin trade boosted Hyperliquid’s fundamentals.

Pseudonymous trader James Wynn opened a $1.1 billion long on BTC using 40x leverage via Hyperliquid in one of the largest on-chain DEX trades ever recorded.

The position, tied to wallet “0x507,” was entered when BTC was priced at $108K and now sits on over $40 million in unrealized profit.

Wynn booked partial profits early Thursday by closing 540 BTC (~$60 million), to net $1.5 million.

His prior exits were followed by BTC declines, so traders are watching closely.

Hyperliquid runs on its custom L1, HyperEVM, using the HyperBFT consensus (200K+ TPS) with CEX-level features like real-time order books and deep liquidity — no KYC required.

The platform’s permissionless design and lightning-fast execution are increasingly drawing capital from centralized venues to DeFi , and this trade could set a precedent for whale activity.

HYPE jumped 15% in the past 24 hours on renewed attention and usage-driven speculation.

Derivatives Positioning

Analyzing the liquidations heatmap of the BTC-USDT pair on Binance, the largest liquidations cluster around $108.5K and $106.9K with liquidations worth $143 million and $112.5 million, respectively.

Meanwhile, the options market swells post-breakout, with open interest on Deribit climbing above $34 billion, just shy of the all-time high of $35.9 billion set in December. The bulk of this positioning is centered on the 30 May expiry, which now holds over $9 billion in notional value to become a key date for potential volatility.

Bullish sentiment is clearly in control, with traders aggressively targeting upside via calls. Strikes at $100K, $120K and $150K have attracted particularly large open interest, reflecting growing conviction in a continued rally.

Put/call ratios underscore this shift in sentiment — the 24-hour volume ratio has dropped to 0.49, while the open interest ratio sits at 0.60, indicating a meaningful tilt toward bullish exposure following BTC’s move above $110K.

Near-term options activity is also picking up, with weekly and monthly contracts seeing notable inflows. Traders appear to be positioning for further momentum or short-term price swings in the wake of the breakout.

Market Movements

BTC is up 1.19% from 4 p.m. ET Wednesday at $110,690.36 (24hrs: +4.05%)

ETH is up 6.19% at $2,662.72 (24hrs: +5.23%)

CoinDesk 20 is up 3.64% at 3,348.63 (24hrs: +4.88%)

Ether CESR Composite Staking Rate is unchanged at 3.03%

BTC funding rate is at 0.03% (10.95% annualized) on Binance

DXY is up 0.25% at 99.81

Gold is down 0.26% at $3,305.6/oz

Silver is down 0.83% at $33.17/oz

Nikkei 225 closed -0.84% at 36,985.87

Hang Seng closed -1.19% at 23,544.31

FTSE is down 0.68% at 8,726.62

Euro Stoxx 50 is down 0.96% at 5,402.31

DJIA closed on Wednesday -0.91% at 41,860.44

S&P 500 closed -1.61% at 5,844.61

Nasdaq closed -1.41% at 18,872.64

S&P/TSX Composite Index closed -0.83% at 25,839.17

S&P 40 Latin America closed -1.31% at 2,597.38

U.S. 10-year Treasury rate is down 2 bps at 4.58%

E-mini S&P 500 futures are unchanged at 5,865.50

E-mini Nasdaq-100 futures are up 0.15% at 21,188.50

E-mini Dow Jones Industrial Average Index futures are down 0.17% at 41,875.00

Bitcoin Stats:

BTC Dominance: 63.90 (-0.62%)

Ethereum to bitcoin ratio: 0.02409 (3.52%)

Hashrate (seven-day moving average): 875 EH/s

Hashprice (spot): $58.24

Total Fees: 7.89 BTC / $847,124

CME Futures Open Interest: 160,740 BTC

BTC priced in gold: 33.4 oz

BTC vs gold market cap: 9.47%

Technical Analysis

Bitcoin reached a new all-time high of $111,875 this morning, breaking decisively above the previous peak just above $109,000 set in January.

With a confirmed close above that level and no sign of a swing failure pattern, the bias remains firmly tilted toward continued upside. In the near term, BTC may encounter resistance around the $112,000–$113,000 range, aligning with a trendline drawn from the prior highs in December and January.

However, last week’s consolidation above $100,000 — and the successful reclaim of the previous all-time high — suggest this area is now acting as short-term support.

A pullback below $100,000, especially into the weekly order block, would likely represent a healthy correction within the broader uptrend and could offer a compelling reentry opportunity if further downside is seen.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $402.69 (-3.41%), up 1.73% at $409.67 in pre-market

Coinbase Global (COIN): closed at $258.99 (-0.91%), up 2.78% at $266.20

Galaxy Digital Holdings (GLXY): closed at C$31 (+1.57%)

MARA Holdings (MARA): closed at $15.84 (-2.16%), up 4.42% at $16.54

Riot Platforms (RIOT): closed at $8.84 (-1.01%), up 3.39% at $9.14

Core Scientific (CORZ): closed at $10.78 (-1.28%), up 1.48% at $10.94

CleanSpark (CLSK): closed at $10.11 (+4.23%), up 4.65% at $10.58

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.75 (-1.33%)

Semler Scientific (SMLR): closed at $44.89 (+7.19%), up 6.01% at $47.59

Exodus Movement (EXOD): closed at $32.76 (-5.07%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $607.1 million

Cumulative net flows: $43.35 billion

Total BTC holdings ~ 1.19 million

Spot ETH ETFs

Daily net flow: $0.6 million

Cumulative net flows: $2.61 billion

Total ETH holdings ~ 3.49 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Top 20 digital assets’ prices and volumes

Chart of the day

Bitcoin adoption

- [posts_like_dislike id=1033]

Bitcoin experienced a breakout earlier this week, causing traders to set their sights on the $100,000 level in the coming days. However, this euphoric trade may be short-lived as May’s seasonality...

Read moreBitcoin experienced a breakout earlier this week, causing traders to set their sights on the $100,000 level in the coming days. However, this euphoric trade may be short-lived as May’s seasonality approaches.

Jeff Mei, COO at BTSE, mentioned that historically, the next few months have been weak for financial markets, with many investors following the “Sell in May and Walk Away” adage. Despite this trend, Mei noted that Bitcoin has been performing well, reaching $97K and other growth stocks making a comeback in recent weeks. While weak GDP numbers from the US may pose some risk, Mei mentioned that rate cuts could potentially lead to a rebound.

The “Sell in May and go away” saying is a common seasonal strategy in traditional financial markets. It suggests that investors should sell their holdings at the start of May and return around November to capitalize on underperforming summer markets.

Historically, US stock markets have shown weaker performance from May through October compared to November through April. This trend has become a rule-of-thumb for some investors. Bitcoin also shows recurring seasonal patterns, influenced by macro cycles, institutional flows, and retail sentiment.

While past performance doesn’t guarantee future outcomes, data shows that May months with negative returns for Bitcoin are often followed by more declines in June. This suggests that crypto markets may react to macro and seasonal sentiment similar to equities, especially with more institutional capital entering the space.

Traders may exercise caution based on historical price seasonality and fading momentum after strong Q1 rallies. Altcoins, especially meme coins, may be vulnerable to pullbacks due to recent hype-driven rallies and speculative flows.

Vugar Usi Zade, COO at crypto exchange Bitget, mentioned that since 1950, the S&P 500 has delivered an average gain of just 1.8% from May through October. Meanwhile, Bitcoin’s average Q2 returns stand at 26%, but with a median of only 7.5%, indicating outlier-driven performance and recurring volatility.

As Q3 approaches, the average return for Bitcoin drops to 6%, with a slightly negative median. Zade highlighted that caution is advised heading into May, as historical data shows that Q4 tends to be Bitcoin’s strongest seasonal period.

In conclusion, while cryptocurrency markets are not bound by traditional Wall Street calendars, market psychology still responds to narratives. The “Sell in May” strategy could potentially become a self-fulfilling prophecy if technical indicators weaken and sentiment shifts.

- [posts_like_dislike id=925]

SoftBank, the Japanese investment giant with $308.7 billion in assets under management, has re-entered the world of cryptocurrency by supporting a new bitcoin investment vehicle called Twenty One Capital. This venture...

Read moreSoftBank, the Japanese investment giant with $308.7 billion in assets under management, has re-entered the world of cryptocurrency by supporting a new bitcoin investment vehicle called Twenty One Capital. This venture includes partnerships with Tether, Bitfinex, and Cantor Fitzgerald, marking another step towards institutional adoption of crypto assets. Some experts see SoftBank as similar to a Japanese sovereign wealth fund, showcasing the growing interest from traditional financial institutions in the crypto space.

On the other hand, this move may feel like déjà-vu for some as SoftBank founder Masayoshi Son previously incurred a significant loss from a personal bitcoin investment back in 2019. Despite the potential profits he could have made if he had held onto his bitcoin investment until now, he sold in early 2018, resulting in a reported $130 million loss.

Given this history, the question arises whether history will repeat itself or if things will turn out differently this time. In a recent development, SoftBank, OpenAI, and Oracle announced a $100 billion initiative to build AI infrastructure in the U.S., which initially led to a positive outlook for Oracle (ORCL) stock. However, since the announcement, ORCL stock has dropped by 28%, compared to the overall 12% decline in the Nasdaq during the same period.

While various factors contribute to this market underperformance, some analysts have linked Oracle’s selloff to SoftBank’s involvement in the AI infrastructure project. According to Quinn Thompson, founder of crypto hedge fund Lekker Capital, investors tend to sell when SoftBank enters an asset they own. The correlation between SoftBank’s participation and the decline in ORCL stock highlights the complex and interconnected nature of financial markets.

In conclusion, while SoftBank’s foray back into the crypto world with Twenty One Capital is a notable development, past experiences and possible market correlations suggest a cautious approach may be warranted.

- [posts_like_dislike id=881]

The financial markets are currently experiencing a meltdown, with every drop strengthening expectations that the Fed will step in to offer support. Bitcoin (BTC), the leading cryptocurrency by market value, has...

Read moreThe financial markets are currently experiencing a meltdown, with every drop strengthening expectations that the Fed will step in to offer support. Bitcoin (BTC), the leading cryptocurrency by market value, has seen an 8% decrease trading at $75,800. US stocks are also facing a rough patch, with S&P 500 futures down by roughly 5% on Monday alone, and an overall loss of approaching 15%.

Traders are betting on the Fed taking similar action as in the past and intervening in the current financial crisis with rate cuts and other stimulus measures. The CME FedWatch Tool indicates that the federal funds futures market is pricing in as many as five rate cuts by 2025. There’s a 61% probability of a 25 basis point cut at the upcoming May 7 meeting, which would bring the target range to 4.25-4.50%. By the end of the year, the market predicts the fed funds rate could drop as low as 3.00-3.25%.

The risk-off sentiment, combined with concerns about slowed growth and the bets on Fed rate cuts, have caused Treasury yields to plummet. The 10-year yield, a crucial benchmark for the US economy, has dropped to 3.923%. This decline in yields is believed to make it easier for the Treasury to refinance trillions of dollars in debt over the next year.

The Trump administration’s strategy of focusing on short-term Treasury bills, rather than longer-dated coupon issuance, is believed to be a contributing factor to this refinancing urgency. While this approach may have initially supported liquidity, it has resulted in a significant amount of expensive short-term debt that now needs to be rolled over.

- [posts_like_dislike id=775]

Reports from Trade The News suggest that Beijing may be considering implementing monetary stimulus measures sooner rather than later in response to President Donald Trump’s tariffs impacting the Chinese economy. This...

Read moreReports from Trade The News suggest that Beijing may be considering implementing monetary stimulus measures sooner rather than later in response to President Donald Trump’s tariffs impacting the Chinese economy. This news follows Trump’s recent statement that a trade deal with China will only happen if the trade deficit is addressed. In the wake of these developments, financial markets have been volatile, with bitcoin dropping below $80K after the announcement of significant reciprocal tariffs by Trump.

Goldman Sachs has revised its forecast, now anticipating a total of 130 basis points in Fed rate cuts for 2025, up from 105 basis points projected last week. Additionally, the Reserve Bank of Australia is expected to make four rate cuts in response to the current economic climate.

- [posts_like_dislike id=773]

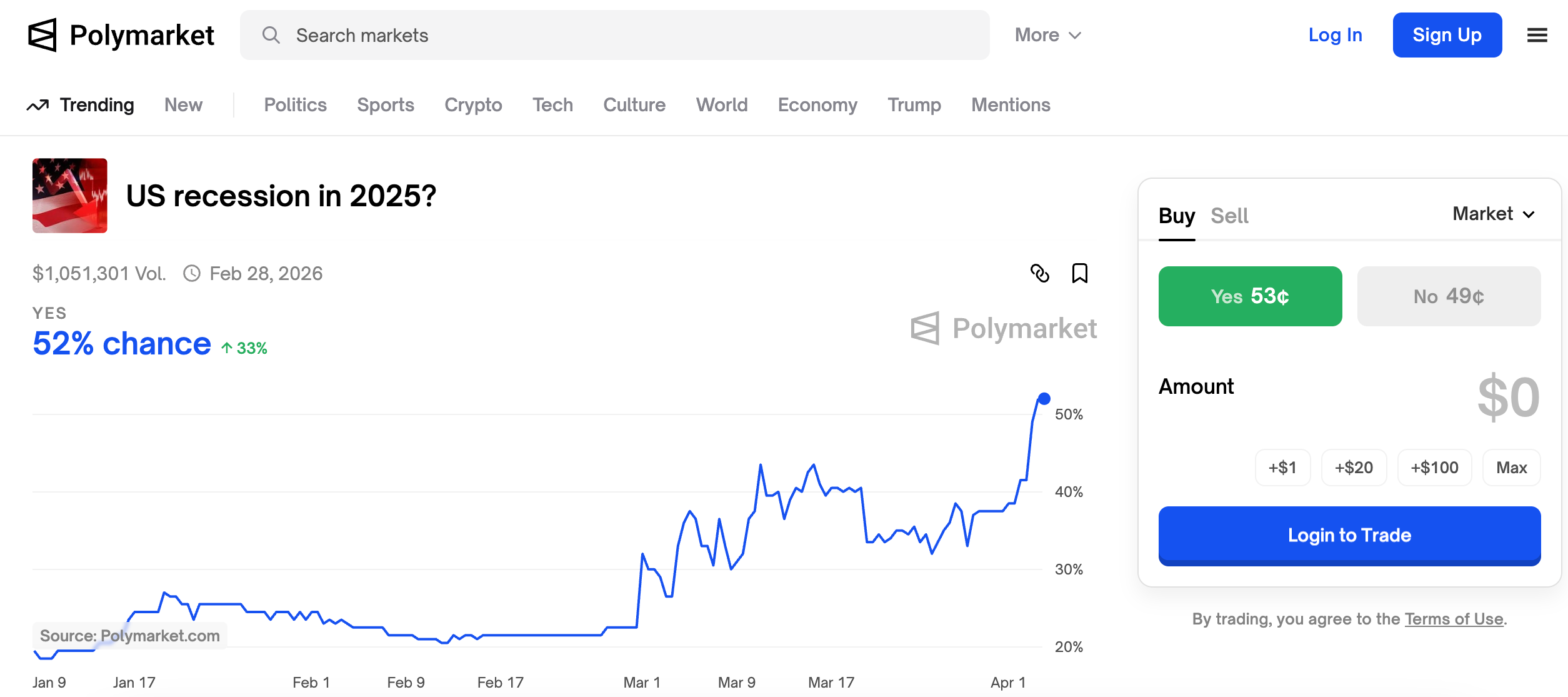

As fears of a U.S. recession loom due to President Donald Trump’s tariff plan, prediction platforms Polymarket and Kalshi are signaling heightened concerns about the economy taking a hit. Polymarket, a...

Read moreAs fears of a U.S. recession loom due to President Donald Trump’s tariff plan, prediction platforms Polymarket and Kalshi are signaling heightened concerns about the economy taking a hit.

Polymarket, a decentralized prediction platform, has seen the chance of the country slipping into recession this year rise above 50% for the first time since the trading of the contract “US Recession in 2025” began earlier this year. The contract’s Yes shares surged to over 50 cents from 39 cents in less than 24 hours. The contract will resolve to Yes if the National Bureau of Economic Research (NBER) confirms a recession at any point before Dec. 31, or if there are back-to-back quarterly contractions in gross domestic product.

Similarly, Kalshi, a U.S.-based regulated prediction market, has also seen economic concerns among traders rise, with the probability of a 2025 recession increasing to 54% from 40%.

Financial markets, being forward-looking, could react to the rising odds of a U.S. recession by pushing risk assets like Bitcoin (BTC) and other cryptocurrencies lower. At the time of publication, S&P 500 futures were trading 3% lower, indicating severe risk aversion on Wall Street and suggesting bearish signals for Bitcoin, which was changing hands at $83,100, a 1.5% decrease in 24 hours.

The newly unveiled tariffs set a base rate of 10% on all imports, along with higher taxes on 60 nations identified as worst offenders. China, being the most heavily hit, will face a 34% levy on top of the existing 20% charge, totaling 54%. The base tariffs are set to take effect on April 5, with the higher reciprocal rates coming into play on April 9.

While the Trump administration aims for tariffs to address U.S. goods trade deficits, they could potentially contribute to domestic inflation and global instability in the short term. If China, the European Union, and other nations retaliate with higher tariffs, it could trigger a full-blown global trade war.

Despite the uncertainties surrounding tariffs, some experts believe that the impact may lead to an economic slowdown rather than a full recession. UBS, for example, states that while the threat of further tariff escalation remains a concern, their economic forecasts do not predict a recession in the U.S. Instead, they forecast slower economic growth compared to the previous year, with the U.S. economy expanding by around 2% this year.

As for financial markets, some observers suggest that the initial risk-off reaction may be short-lived and reversed by expectations of Federal Reserve interest rate cuts. Joseph Wang, from fedguy.com, states that tariffs are dovish and can lead to more rate cuts, as they are ultimately transitory and inflationary effects can be mitigated.

Traders are already pricing in a higher probability of the Fed cutting the benchmark borrowing cost in June, restarting the easing cycle that began in September of the previous year.

- [posts_like_dislike id=749]