Parrot Press is thrilled to announce that Consensus, a prominent event in the crypto conference scene, will be hosted in Miami, Florida in 2026. Scheduled for May 5-7, the event will...

Read moreAmerica

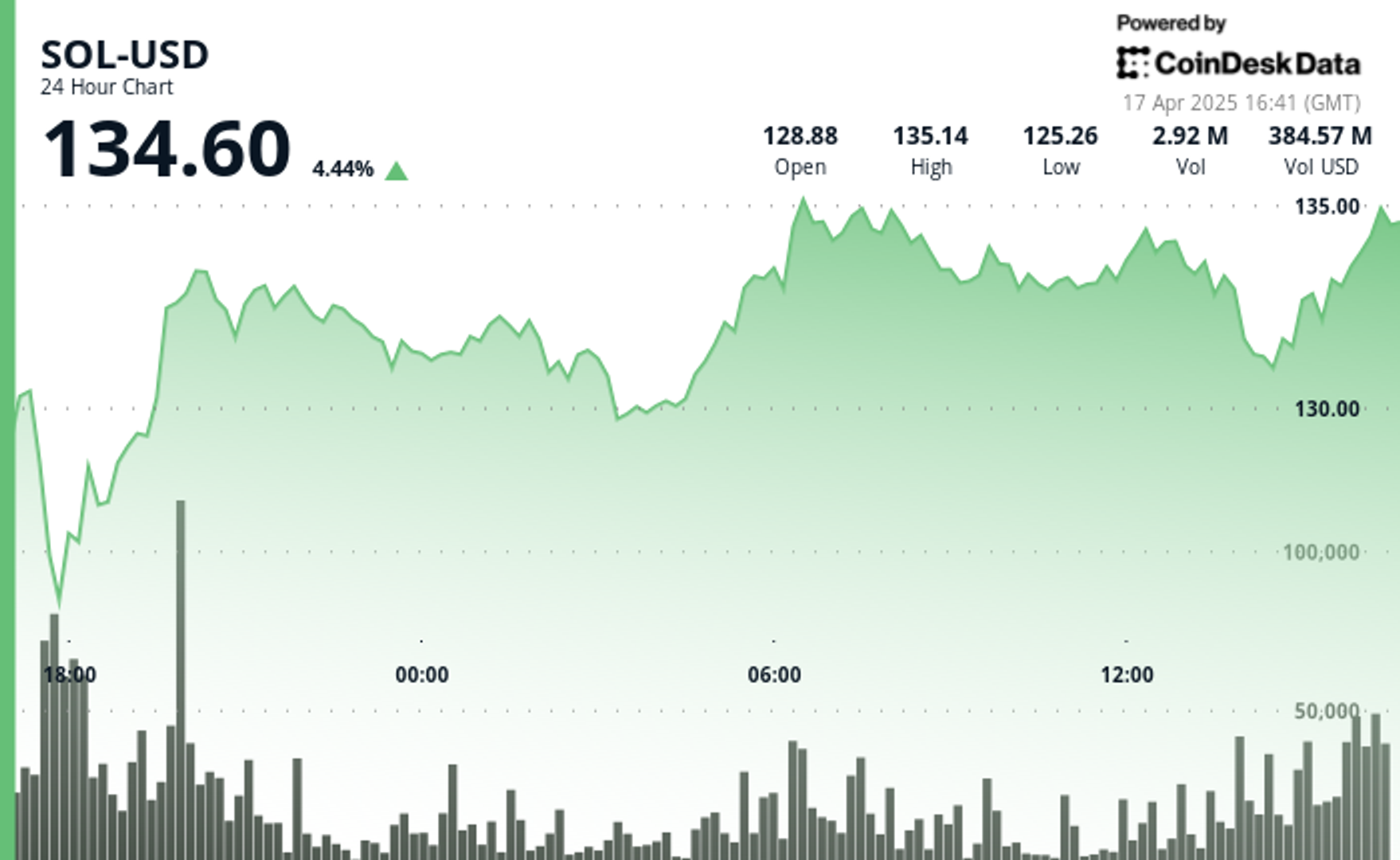

The global economic tensions and trade policy uncertainties are causing volatility in the cryptocurrency market, but SOL is handling these challenges better than many other options. The price of Solana token...

Read moreThe global economic tensions and trade policy uncertainties are causing volatility in the cryptocurrency market, but SOL is handling these challenges better than many other options. The price of Solana token rose more than 4% on Thursday, outperforming the broader market gauge. The $125-$127 range has emerged as a critical support zone for SOL, while the $133.50-$133.60 area is a significant resistance level.

According to blockchain data, over 32 million SOL (more than 5% of the total supply) has accumulated at the $129.79 level, making it a crucial pivot point for future price movements.

Key highlights from the technical analysis include SOL establishing a strong support zone between $125-$127, showing resilience by recovering 4.5% from its recent low, and reclaiming the top spot in DEX activity. The launch of the first spot Solana ETFs in North America has also boosted institutional interest in SOL.

Volume analysis indicates strong accumulation during a surge in the afternoon of April 16th, with over 3 million units traded as the price surpassed the $130 resistance level. However, SOL experienced a significant downward correction towards the end of trading, dropping from $134.11 to $130.81.

The article was created with AI tools and reviewed by the editorial team to ensure accuracy. External references used in the article are listed for further information.

- [posts_like_dislike id=851]

Tags:AIAmericabitcoinbtcCoinbaseCryptoDonald TrumpdubaiETHEUgoldMoving AverageS&P 500solanaTariffsTradingTrumpUSXRP

By Parrot Press Staff President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy...

Read moreBy Parrot Press Staff

President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy away from risk assets, such as bitcoin (BTC) and other cryptocurrencies.

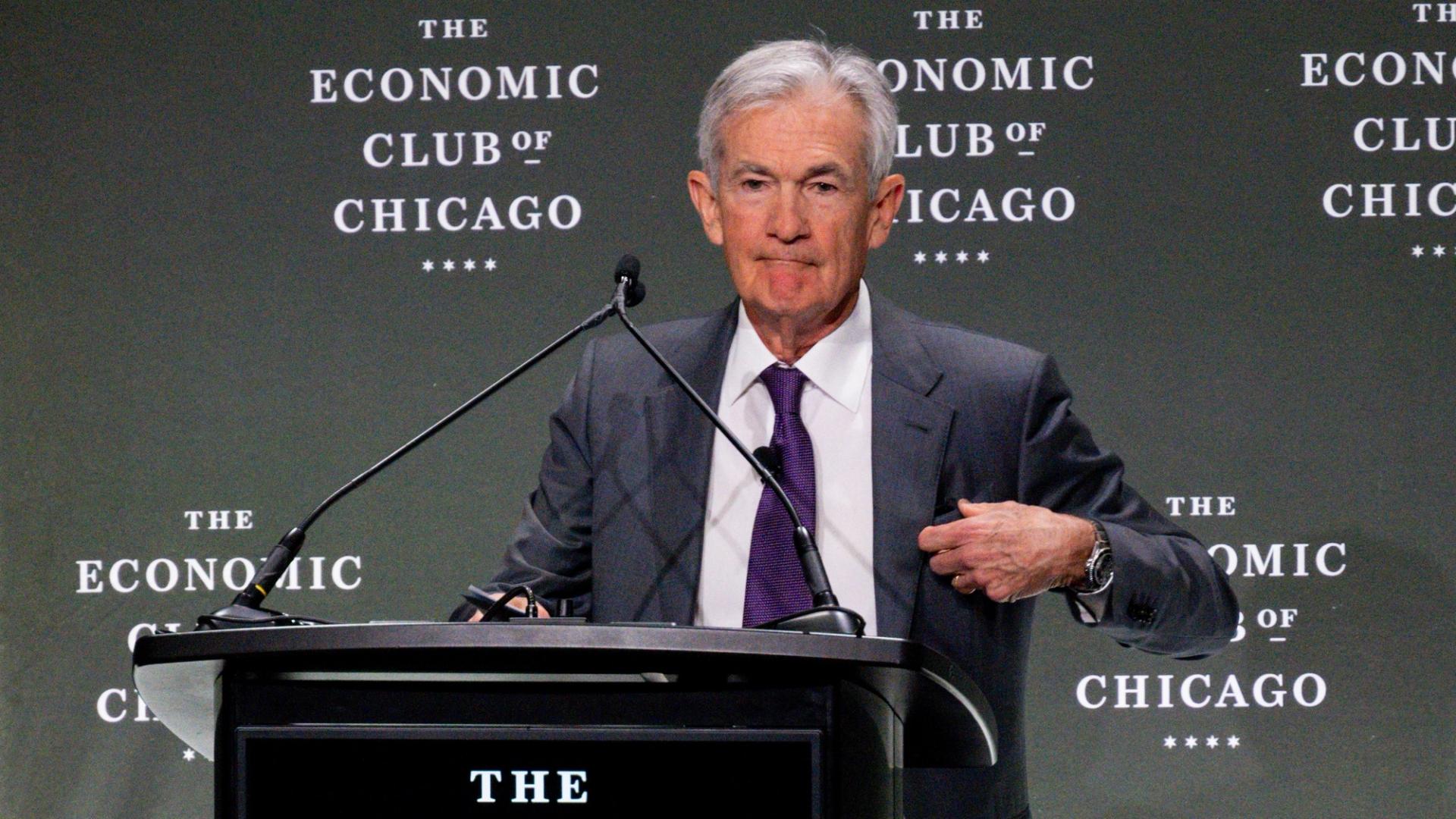

Federal Reserve Chairman Jerome Powell added fuel to the fire by stating late Wednesday that the central bank anticipates a rise in unemployment as the economy is likely to slow down and inflation is expected to increase. Powell mentioned that some of the tariffs imposed are likely to be paid by the public, further weighing on risk assets. This resulted in the Nasdaq dropping 1.17% and the S&P 500 decreasing by 2.24% before the closing bell. Despite this, bitcoin saw an increase of more than 1% in the past 24 hours. The CoinDesk 20 (CD20) index, which provides a broader market perspective, also saw a rise of 1.8%. However, the crypto market is more considered a gauge of risk rather than a safe haven, as reported by Coindesk.

According to Michael Brown, an analyst at Pepperstone, there is likely to be a growing demand for “assets which provide shelter from political incoherence and trade uncertainty,” as reported by The Telegraph. While bitcoin has outperformed the stock market, showing a 1% increase in the past month compared to the Nasdaq’s 8% drop, institutional investors are turning to gold as a safe haven investment.

Gold has seen an 11% increase over the last month and a 27% increase since the beginning of the year, reaching around $3,340 per troy ounce. A survey conducted by Bank of America’s Global Fund Manager revealed that 49% of fund managers view “long gold” as the most crowded trade on Wall Street, with 42% of them predicting it to be the best-performing asset of the year.

UBS analysts suggested that adding gold allocations has become more compelling due to the escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks, and diversification away from US assets and the US dollar, as reported by Investopedia.

Gold fund flows have reached $80 billion so far this year, while data from SoSoValue indicates that spot bitcoin ETFs have seen $5.25 billion net inflows in January, with net outflows occurring since the rise in uncertainty. In the month of April alone, over $900 million has exited these funds, following net outflows of $3.56 billion in February and $767 million in March. It is advised to stay alert in such an uncertain market environment.

In the latest Token Events updates, EigenLayer is implementing slashing on Ethereum mainnet, Pepecoin is undergoing its second halving, BNB Chain will be undergoing the opBNB mainnet hardfork, and Coinbase Derivatives will be listing XRP futures pending approval by the U.S. Commodity Futures Trading Commission.

Various conferences and events, such as CoinDesk’s Consensus in Toronto on May 14-16, NexTech Week Tokyo, Money20/20 Asia in Bangkok, Crypto Horizons 2025 in Dubai, and many more are scheduled to take place in the upcoming days.

In other news, Raydium’s LaunchLab platform has gone live, competing with Pump.fun and introducing a perceived competing platform to the Solana ecosystem. This has led to over 1,750 tokens being created shortly after LaunchLab’s debut, driving the price of Raydium’s RAY token up by as much as 10%.

On the technical analysis front, Bitcoin has rebounded off the golden pocket zone, showing strong buyer interest. It has broken out of the daily downtrend that has been in place since February, indicating a potential shift in structure. BTC is currently sitting below the daily 50 and 200 exponential moving averages, which act as important decision points for the price direction.

Overall, the market is seeing fluctuations due to economic uncertainty, geopolitical risks, and trade concerns, highlighting the importance of diversification and following market trends closely.

- [posts_like_dislike id=837]

Tags:ADAAIAmericaAppleBinancebitcoinbtcCanadaCoinbaseCommunicationCryptodubaiETHEUFinancegoldJapanminerMoving AverageRobinhoodS&P 500solanaStrategyTeslaTradingTrumpUSXRP

By [Your Name] (All times ET unless indicated otherwise) Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its...

Read moreBy [Your Name] (All times ET unless indicated otherwise)

Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its “Liberation Day” high. To put the move into perspective, bitcoin dominance — which measures BTC’s share of the total cryptocurrency market cap — is approaching 64%, a level not seen since January 2021.

In contrast, the Nasdaq 100 is still 5% away from its own Liberation Day high, underscoring bitcoin’s relative strength versus U.S. equities.

According to X account Cheddar Flow, the S&P 500 has just formed a “death cross” — a traditionally bearish signal that occurs when the 50-day moving average falls below the 200-day moving average. The last time this happened was March 15, 2022, when S&P 500 initially rose by 11% in the following week, only to be followed by a 20% decline. Bearish sentiment is also reflected in the options market, where investors are reportedly buying large volumes of NVDA puts, signaling expectations of lower prices.

In a Bloomberg interview on Monday, Treasury Secretary Scott Bessent reaffirmed confidence in the U.S. bond market, dismissing concerns that foreign nations are dumping Treasuries.

“I am not seeing a dumping of U.S. Treasuries,” Bessent said. “The Treasury has lots of tools, but we’re a long way from needing them.” He also emphasized the enduring status of the U.S. dollar as the world’s reserve currency, despite the DXY index — which measures the dollar’s value against a basket of major trading partners — falling below 100 and dropping over 10% in recent weeks.

Bessent also confirmed that the Trump administration is seeking a new Federal Reserve Chair to replace Jerome Powell, with interviews set to begin later in the year. He concluded the interview by suggesting that the VIX (S&P 500 volatility index) may have peaked after the largest one-day percentage drop in its history last week. Stay alert!

What to Watch:

Crypto:

April 15: The first SmarDEX (SDEX) halving means the SDEX token’s distribution will be cut by 50% for the next 12 months.

April 16: HashKey Chain (HSK) mainnet upgrade enhances network stability and fee control capabilities.

April 17: EigenLayer (EIGEN) activates slashing on Ethereum mainnet, enforcing penalties for operator misconduct.

April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing block rewards to 15,625 PEP per block.

April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

April 21: Coinbase Derivatives will list XRP futures pending approval by the Commodity Futures Trading Commission (CFTC).

Macro:

April 15, 8:30 a.m.: Statistics Canada releases March consumer price inflation data.

Core Inflation Rate MoM Prev. 0.7%

Core Inflation Rate YoY Prev. 2.7%

Inflation Rate MoM Est. 0.6% vs. Prev. 1.1%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.6%

April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail sales data.

Retail Sales MoM Est. 1.4% vs. Prev. 0.2%

Retail Sales YoY Prev. 3.1%

April 16, 9:45 a.m.: Bank of Canada releases its latest interest rate decision, followed by a press conference 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

April 16, 1:30 p.m.: Fed Chair Jerome H. Powell will deliver an “Economic Outlook” speech. Livestream link.

April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential construction data.

Housing Starts Est. 1.42M vs. Prev. 1.501M

Housing Starts MoM Prev. 11.2%

April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 12.

Initial Jobless Claims Est. 226K vs. Prev. 223K

April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March consumer price index (CPI) data.

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

Inflation Rate MoM Prev. -0.1%

Inflation Rate YoY Prev. 3.7%

Earnings (Estimates based on FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events:

Governance votes & calls

Venus DAO is discussing the forced liquidation of the remaining debt owed by a BNB bridge exploiter account that “supplied extraneously minted BNB to Venus and generated an over-collateralized debt position.”

Aave DAO is discussing taking further steps to deprecate Synthetix’s sUSD on Aave V3 Optimism over technical developments that have “compromised its ability to consistently maintain its peg.”

GMX DAO is discussing the establishment of a GMX reserve on Solana, which would involve bridging $500,000 in GMX to the blockchain and transferring the funds to the GMX-Solana Treasury.

Treasure DAO is discussing handing the core contributor team the authority to wind down and close the Treasure Chain infrastructure on ZKsync and manage the primary MAGIC-ETH protocol-owned liquidity pool given the “crucial financial situation” of the protocol.

April 15, 10 a.m.: Injective to hold an X Spaces session with Guardian.

April 16, 7 a.m.: Aergo to host an Ask Me Anything (AMA) session on the future of decentralized artificial intelligence and the project.

April 16, 3 p.m.: Zcash to host a Town Hall on LockBox Distribution & Governance.

Unlocks

April 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $10.08 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $27.17 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating supply worth $325.97 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $82.60 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating supply worth $18.29 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating supply worth $10.07 million.

Token Launches

April 15: WalletConnect Token (WCT) to be listed on Binance, Bitget, AscendEX, BingX, BYDFi, LBank, Coinlist and others.

April 16: Badger (BADGER), Balacner (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT) and aelf (ELF) to be delisted from Binance.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 2 of 3: Morocco WEB3FEST GITEX Edition (Marrakech)

April 15: Strategic Bitcoin Reserve Summit (online)

Day 1 of 2: BUIDL Asia 2025 (Seoul)

Day 1 of 2: World Financial Innovation Series 2025 (Hanoi, Vietnam)

Day 1 of 3: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

Token Talk

Story Protocol’s IP tokens experienced a 20% drop and recovery within hours during an unusual trading session on Monday.

Trading volume surged on exchanges including Binance and OKX Spot, with $138 million recorded after the price rebound.

The sudden price movement was isolated from broader market trends, sparking speculation about insider activity or coordinated selling.

Also on Monday, MANTRA’s OM token plummeted over 90% in hours, dropping from around $6.30 to as low as 37 cents and wiping out over $5 billion in market capitalization.

The token has since rebounded slightly to trade around 63 cents.

Laser Digital, a Nomura-backed investor, was initially flagged for depositing $41 million in OM to OKX, but the company denied selling, clarifying it was collateral return from a financing trade. Shorooq Investors also denied selling.

Derivatives Positioning

BTC shorts have been liquidated on most exchanges in the past 24 hours, excluding BitMEX and Gate.io, according to Coinglass. The opposite is the case in ETH.

XRP’s perpetual futures open interest has dropped from 544.7 million XRP to 480 million XRP, diverging from the price recovery seen since Monday last week.

SUI, ONDO, ADA and APT have seen a notable increase in futures open interest in the past 24 hours. Of those, XMR is the only one with the positive OI-adjusted cumulative volume delta, representing net buying pressure.

On Deribit, short-dated BTC and ETH options continue to show a bias for protective puts, suggesting cautious sentiment.

Flows on OTC desk Paradigm have been mixed with both calls and puts bought in the April expiry.

Market Movements:

BTC is up 1.19% from 4 p.m. ET Monday at $85,877.18 (24hrs: +1.35%)

ETH is up 0.59% at $1,645.30 (24hrs: -1.97%)

CoinDesk 20 is up 0.99% at 2,519.69 (24hrs: +0.19%)

Ether CESR Composite Staking Rate is up 18 bps at 3.18%

BTC funding rate is at 0.0184% (6.7003% annualized) on Binance

DXY is unchanged at 99.70

Gold is up 1.26% at $3,245.30/oz

Silver is up 0.81% at $32.35/oz

Nikkei 225 closed +0.84% at 34,267.54

Hang Seng closed +0.23% at 21,466.27

FTSE is up 0.92% at 8,209.04

Euro Stoxx 50 is up 0.82% at 4,951.51

DJIA closed on Tuesday +0.78% at 40,524.79

S&P 500 closed +0.79% at 5,405.97

Nasdaq closed +0.64% at 16,831.48

S&P/TSX Composite Index closed +1.18% at 23,866.50

S&P 40 Latin America closed +1.8% at 2,340.02

U.S. 10-year Treasury rate is up 1 bp at 4.39%

E-mini S&P 500 futures are up 0.12% at 5,447.25

E-mini Nasdaq-100 futures are up 0.26% at 18,983.25

E-mini Dow Jones Industrial Average Index futures are unchanged at 40,750.00

Bitcoin Stats:

BTC Dominance: 63.80 (0.16%)

Ethereum to bitcoin ratio: 0.01913 (-0.31%)

Hashrate (seven-day moving average): 896 EH/s

Hashprice (spot): $44.1 PH/s

Total Fees: 6.33 BTC / $536,017

CME Futures Open Interest: 134,730

BTC priced in gold: 26.6 oz

BTC vs gold market cap: 7.56%

Technical Analysis

On Monday, the bitcoin cash-bitcoin (BCH/BTC) ratio failed to penetrate the trendline characterizing the 12-month bear market.

A potential move above the trendline could see breakout traders join the market, lifting BCH higher.

Crypto Equities

Strategy (MSTR): closed on Monday at $311.45 (+3.82%), up 0.62% at $313.38 in pre-market

Coinbase Global (COIN): closed at $176.58 (+0.62%), up 1.28% at $178.84

Galaxy Digital Holdings (GLXY): closed at C$15.81 (+3.47%)

MARA Holdings (MARA): closed at $12.95 (+3.52%), up 1.24% at $13.11

Riot Platforms (RIOT): closed at $7.01 (-0.71%), up 0.71% at $7.06

Core Scientific (CORZ): closed at $7.06 (-0.14%)

CleanSpark (CLSK): closed at $7.78 (+3.73%), up 1.29% at $7.88

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.70 (+1.44%), up 1.44% at $12.90

Semler Scientific (SMLR): closed at $34.26 (+1.48%)

Exodus Movement (EXOD): closed at $39.43 (-10.55%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $1.5 million

Cumulative net flows: $35.46 billion

Total BTC holdings ~1.11 million

Spot ETH ETFs

Daily net flow: -$6 million

Cumulative net flows: $2.28 billion

Total ETH holdings ~3.36 million

Source: Farside Investors

Overnight Flows

Chart of the Day Personalized: Disney’s Bob Iger to exit Apple’s board

In the Ether

**Insert interesting content about current events, stories, etc. in the crypto world**

That’s all for now, stay in-the-know with The Parrot Press for the latest updates and insights on the dynamic world of cryptocurrencies and finance!

- [posts_like_dislike id=821]

The evolving landscape of online prediction markets is challenging the traditional American legal framework of federalism, which seeks to balance state and federal authority. Kalshi, a key player in this new...

Read moreThe evolving landscape of online prediction markets is challenging the traditional American legal framework of federalism, which seeks to balance state and federal authority. Kalshi, a key player in this new frontier, has faced cease-and-desist orders from both Nevada and New Jersey for allegedly violating state gambling laws with its sports contracts. However, Kalshi argues that it operates as a prediction market, regulated by the Commodity Futures Trading Commission and the Commodities Exchange Act, not as a gambling venue.

Legal experts like Aaron Brogan believe that Kalshi has a strong case, citing the exclusive jurisdiction granted to the CFTC under the Commodity Exchange Act. Prediction markets such as Kalshi and Polymarket act as neutral intermediaries, matching orders without betting against users and have seen significant growth in the sports category.

Kalshi has self-certified its event contracts with the CFTC, following a process that allows federally regulated derivatives exchanges to list new products without pre-approval. The CFTC seems open to considering sports outcomes as commodities, rather than pure betting activities, endorsing the legitimacy of prediction markets.

Brogan acknowledges Nevada’s concerns about Kalshi’s operations but points out that their actions could inadvertently question the legitimacy of their own state-approved gambling markets. The outcome of Kalshi’s legal battles could have far-reaching implications for the future of American sports betting culture, potentially shifting towards prediction markets over traditional gambling companies.

As the litigation unfolds, it raises important questions about the balance of state and federal authority in the regulation of gambling in the digital age. Brogan sees the impending legal battles as crucial in determining who will prevail in this complex regulatory landscape.

- [posts_like_dislike id=783]

By: The Parrot Press Major coins reversed early gains after Beijing stepped up trade tensions by announcing retaliatory tariffs following President Donald Trump’s Wednesday decision to impose additional levies on China...

Read moreBy: The Parrot Press

Major coins reversed early gains after Beijing stepped up trade tensions by announcing retaliatory tariffs following President Donald Trump’s Wednesday decision to impose additional levies on China and other nations. Bitcoin dropped to $83,000 from $84,600, though the downside appeared limited, probably because the market’s worst fears have finally come true. Markets dislike uncertainty, and the anticipation of a looming threat often creates more anxiety and fear than the actual realization of that threat.

Since Trump took office on Jan. 20, markets have been wrestling with the threat of tariffs and a global trade war. That damped investor risk appetite, causing the BTC price to tumble from a record high over $109,000 to below $80,000 last month.

This week, Trump announced sweeping tariffs on 180 nations, with higher levies on China, the European Union and Southeast Asia. The effective U.S. tariff rate is now above the level of around 20% set by the 1930’s Smoot-Hawley Tariff Act.

This so-called tariffagedon moment marks the end of lingering uncertainty and could be liberating for markets, mainly because bond yields have dropped across the advanced world in the aftermath, pricing in disinflation. That’s contrary to the popular narrative that tariffs would lead to stagflation — high inflation plus low growth — forcing the Fed to keep interest rates elevated.

The yield on the benchmark U.S. 10-year bond yield has dropped below 4% for the first time since October and yields have fallen sharply in the U.K., Germany and Japan. Plus, oil has declined sharply this week on prospects of higher supply from OPEC countries.

All this bodes well for Fed rate cut bets and risk assets, including cryptocurrencies. The same can be said for Friday’s March jobs report, which, if it beats estimates, will likely be seen as backward-looking, failing to account for this week’s Trump tariffs, while a weak print will only add to Fed rate cuts.

With the major macro uncertainty behind us, the crypto market could return to focusing on positive developments, such as USDC issuer Circle’s IPO filing and technological advancements.

On Thursday, Coinbase Derivatives submitted documentation to the CFTC to self-certify futures for XRP. In addition, Ethereum developers chose May 7 as the date for the Pectra upgrade to go live on the mainnet.

Elsewhere, the SEC acknowledged Fidelity’s filing for a spot exchange-traded fund tied to SOL, which takes it closer to approval. A lot is happening within the industry, so stay alert!

- [posts_like_dislike id=761]

It seems that hopes of dogecoin (DOGE) being included in the U.S. Department of Government Efficiency (D.O.G.E.) were dashed as Elon Musk, the department’s figurehead, dismissed any plans of adding the...

Read moreIt seems that hopes of dogecoin (DOGE) being included in the U.S. Department of Government Efficiency (D.O.G.E.) were dashed as Elon Musk, the department’s figurehead, dismissed any plans of adding the memecoin during a speech at the America PAC town hall in Green Bay, Wisconsin. According to Musk, there are no intentions for the government to utilize dogecoin or anything related to it.

Initially considering naming the department as the Government Efficiency Commission, Musk decided on Department of Government Efficiency after internet suggestions. This decision has not affected DOGE prices, which have decreased by 3.5% in the past 24 hours along with the broader market drop. Despite the lack of solid plans to include the token in the controversial non-governmental agency, its introduction in August led to the emergence of various namesake tokens and initiated a multi-month rally in dogecoin.

While the official site briefly displayed a dogecoin logo following Trump’s inauguration, rumors persisted about the joke token potentially playing a role in the new agency. D.O.G.E aims to enhance the efficiency of government spending of taxpayer money and streamline spending-related departments. Since its formal launch in January, it has reportedly saved an estimated $130 billion, with data indicating an average saving of $840 for taxpayers.

- [posts_like_dislike id=731]

By Angelica Jones The cryptocurrency market continues to slide as investors brace for the impact of President Donald Trump’s reciprocal tariffs, set to go into effect on April 2, coupled with...

Read moreBy Angelica Jones

The cryptocurrency market continues to slide as investors brace for the impact of President Donald Trump’s reciprocal tariffs, set to go into effect on April 2, coupled with key macroeconomic data expected later on Friday.

Bitcoin (BTC) has experienced a 2.5% drop in the last 24 hours, a relatively mild decline compared to the almost 6% slide in ether (ETH), 5.5% in XRP, and 7% in dogecoin (DOGE). The broader CoinDesk 20 Index (CD20) also dropped by 4.65%, while gold reached new highs.

The notable increase in exposure to gold has been beneficial for tokens backed by the precious metal, with CoinDesk Data’s latest stablecoin report revealing a climb to a $1.4 billion market capitalization in March.

It’s evident that traders are taking steps to reduce risk exposure ahead of the release of the U.S. personal consumption expenditure (PCE) report. This data could influence Federal Reserve interest rate decisions and impact risk appetite moving forward.

Bitcoin traders are also looking towards a record-breaking $12.2 billion in BTC options set to expire on Deribit, with a max pain point at $85,000. Despite this, implied volatility remains low as the expiry is not expected to significantly impact the market.

As the trend of derisking gains momentum, spot bitcoin exchange-traded funds (ETFs) have seen consistent inflows since mid-March, adding nearly $1 billion over the past two weeks. In contrast, spot ether ETF outflows have remained consistent, with around $115 million exiting these funds during the same period.

Looking ahead, money managers are anticipated to continue reducing risk exposure, prompting Goldman Sachs to revise its gold price target upwards for the year to $3,300 per troy ounce, with the potential to reach $4,500 in an extreme scenario.

What to Watch:

Crypto:

April 1: Metaplanet (3350) 10-for-1 stock split becomes effective.

Macro:

March 28, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases February unemployment rate data.

Unemployment Rate Est. 6.8% vs. Prev. 6.5%

March 28, 8:00 a.m.: Mexico’s National Institute of Statistics and Geography releases February unemployment rate data.

Unemployment Rate Est. 2.6% vs. Prev. 2.7%

March 28, 8:30 a.m.: Statistics Canada releases January GDP data.

GDP MoM Est. 0.3% vs. Prev. 0.2%

March 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases February consumer income and expenditure data.

Stay alert for more updates!

- [posts_like_dislike id=711]

Hong Kong-based CK Hutchison Holdings has announced plans to sell a majority stake in Panama Ports Company (PPC) to a group of investors, including US financial giant BlackRock, in a deal...

Read moreHong Kong-based CK Hutchison Holdings has announced plans to sell a majority stake in Panama Ports Company (PPC) to a group of investors, including US financial giant BlackRock, in a deal worth nearly $23 billion.

Last month, Trump vowed to reclaim control, stating, “China is operating the Panama Canal… we’re taking it back.”

PPC holds the contract to operate the Balboa and Cristóbal ports until 2047. The sale of a 90% stake in the company is part of a larger restructuring of Hutchison Port’s global operations. However, the timing of the deal coincides with increasing pressure from former US President Donald Trump to reduce China’s influence over the Panama Canal.

The move follows a visit to Panama City last month by US Secretary of State Marco Rubio. During discussions with Panamanian President José Raúl Mulino, Rubio declared that any form of control by the Chinese Communist Party over the Panama Canal was “unacceptable,” vowing that the US would take “necessary measures to protect its rights.”

Despite the political backdrop, CK Hutchison maintains that the transaction is purely commercial. “I want to emphasize that this deal is entirely business-driven and unrelated to recent political developments,” said Frank Sixt, co-managing director of CK Hutchison.

Political and Economic Implications

Many in Panama remain skeptical. The country has recently accepted third-country migrants deported from the US under an agreement brokered by Rubio and has approved a controversial dam project aimed at improving the water supply for the Canal—moves seen as aligning with US interests.

Mauricio Claver-Carone, Trump’s former special envoy to Latin America, previously warned that Panama’s failure to maintain adequate water levels in the Canal could render it “obsolete,” further increasing tensions over its management.

“Trump never intended to take the Canal by force. He applied pressure where it hurt—on Panama’s economic lifeline,” said Nehemías Jaén, a former Panamanian diplomat. “Every concession made by Panama is a win for him.”

Public Reaction and Potential Fallout

Few Panamanians will mourn the exit of Panama Ports. Viral clips of the country’s comptroller general have revealed that the company failed to pay any fees to the government over the last three years, fueling public frustration.

“This is a positive step for Panama and global trade,” said Mario Perez Balladares, a transshipment company director, who expects port container volumes to rise following the decision.

However, the sale could have long-term consequences for Panama’s image as an investment hub. Just days before the deal was announced, Panama’s attorney general deemed the Balboa and Cristóbal port contracts unconstitutional, raising the possibility that the Supreme Court might annul them. With the ports now under US ownership, legal action seems unlikely, reinforcing concerns that Panamanian institutions bow to US influence rather than upholding their own laws.

“This sends a troubling message about Panama’s ability to enforce investor protections,” Jaén warned. “Panamanians don’t want to be seen as a US colony again.”

- [posts_like_dislike id=485]