Bitcoin’s price surge and its comparison to gold as a safe-haven asset is gaining traction as global markets face volatility. In Asian trading hours, BTC climbed above $87,000 alongside other cryptocurrencies...

Read morebtc

In today’s update for financial advisors, Todd Bendell from Amphibian Capital discusses bitcoin yield products as a strategy for increasing bitcoin holdings beyond just price appreciation. Following that, Rich Rines, an...

Read moreIn today’s update for financial advisors, Todd Bendell from Amphibian Capital discusses bitcoin yield products as a strategy for increasing bitcoin holdings beyond just price appreciation. Following that, Rich Rines, an initial Core DAO developer, offers advice to Bitcoin developers in the Ask an Expert section.

Financial advisors are invited to an exclusive event – Wealth Management Day on May 15th at Consensus Toronto, hosted by CoinDesk. Registered advisors will have their own day of networking and learning, gaining valuable insights about digital assets. Approved advisors will receive a complimentary 3-day Platinum Pass to Consensus. Apply now to secure your spot.

You’re currently reading Crypto for Advisors, a weekly newsletter by CoinDesk that unravels digital assets for financial advisors. Subscribe to receive it every Thursday.

The focus is shifting towards generating BTC-on-BTC yield for Bitcoin holders. Traditional methods of holding Bitcoin idly are being replaced by more institutional-grade strategies that aim to generate returns in Bitcoin, rather than just on Bitcoin. BTC-native yield opportunities offer various strategies, settled in BTC, to accumulate more Bitcoin over time without relying solely on price appreciation.

With evolving infrastructure, increased volatility, and growing institutional interest, Bitcoin is evolving. BTC-on-BTC yield offers a more productive strategy for Bitcoin holders, allowing them to accumulate more BTC without compromising their core principles.

In the Ask an Expert section, advice is provided on aligning early developer incentives with long-term protocol value, filtering for signal over noise, and utilizing lessons from Bitcoin’s design philosophy.

For further insights, check out CoinDesk’s Digital Assets Quarterly Report, read about Sweden’s exploration of using bitcoin as a reserve asset, and learn about the U.S. Department of Justice’s shift in crypto enforcement policies.

- [posts_like_dislike id=847]

Tags:AIAmericabitcoinbtcCoinbaseCryptoDonald TrumpdubaiETHEUgoldMoving AverageS&P 500solanaTariffsTradingTrumpUSXRP

By Parrot Press Staff President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy...

Read moreBy Parrot Press Staff

President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy away from risk assets, such as bitcoin (BTC) and other cryptocurrencies.

Federal Reserve Chairman Jerome Powell added fuel to the fire by stating late Wednesday that the central bank anticipates a rise in unemployment as the economy is likely to slow down and inflation is expected to increase. Powell mentioned that some of the tariffs imposed are likely to be paid by the public, further weighing on risk assets. This resulted in the Nasdaq dropping 1.17% and the S&P 500 decreasing by 2.24% before the closing bell. Despite this, bitcoin saw an increase of more than 1% in the past 24 hours. The CoinDesk 20 (CD20) index, which provides a broader market perspective, also saw a rise of 1.8%. However, the crypto market is more considered a gauge of risk rather than a safe haven, as reported by Coindesk.

According to Michael Brown, an analyst at Pepperstone, there is likely to be a growing demand for “assets which provide shelter from political incoherence and trade uncertainty,” as reported by The Telegraph. While bitcoin has outperformed the stock market, showing a 1% increase in the past month compared to the Nasdaq’s 8% drop, institutional investors are turning to gold as a safe haven investment.

Gold has seen an 11% increase over the last month and a 27% increase since the beginning of the year, reaching around $3,340 per troy ounce. A survey conducted by Bank of America’s Global Fund Manager revealed that 49% of fund managers view “long gold” as the most crowded trade on Wall Street, with 42% of them predicting it to be the best-performing asset of the year.

UBS analysts suggested that adding gold allocations has become more compelling due to the escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks, and diversification away from US assets and the US dollar, as reported by Investopedia.

Gold fund flows have reached $80 billion so far this year, while data from SoSoValue indicates that spot bitcoin ETFs have seen $5.25 billion net inflows in January, with net outflows occurring since the rise in uncertainty. In the month of April alone, over $900 million has exited these funds, following net outflows of $3.56 billion in February and $767 million in March. It is advised to stay alert in such an uncertain market environment.

In the latest Token Events updates, EigenLayer is implementing slashing on Ethereum mainnet, Pepecoin is undergoing its second halving, BNB Chain will be undergoing the opBNB mainnet hardfork, and Coinbase Derivatives will be listing XRP futures pending approval by the U.S. Commodity Futures Trading Commission.

Various conferences and events, such as CoinDesk’s Consensus in Toronto on May 14-16, NexTech Week Tokyo, Money20/20 Asia in Bangkok, Crypto Horizons 2025 in Dubai, and many more are scheduled to take place in the upcoming days.

In other news, Raydium’s LaunchLab platform has gone live, competing with Pump.fun and introducing a perceived competing platform to the Solana ecosystem. This has led to over 1,750 tokens being created shortly after LaunchLab’s debut, driving the price of Raydium’s RAY token up by as much as 10%.

On the technical analysis front, Bitcoin has rebounded off the golden pocket zone, showing strong buyer interest. It has broken out of the daily downtrend that has been in place since February, indicating a potential shift in structure. BTC is currently sitting below the daily 50 and 200 exponential moving averages, which act as important decision points for the price direction.

Overall, the market is seeing fluctuations due to economic uncertainty, geopolitical risks, and trade concerns, highlighting the importance of diversification and following market trends closely.

- [posts_like_dislike id=837]

The beginning of 2025 brought a reality check for digital assets, shifting from optimism to macroeconomic challenges. Bitcoin hit a new all-time high of $109,356 before ending the quarter down by...

Read moreThe beginning of 2025 brought a reality check for digital assets, shifting from optimism to macroeconomic challenges. Bitcoin hit a new all-time high of $109,356 before ending the quarter down by 11.6%, while altcoins like the CoinDesk Memecoin Index (CDMEME) and the CoinDesk 80 (CD80) faced even larger declines.

The gap between bitcoin and the rest of the market continues to widen, driven by institutional behavior favoring liquid and regulated large-cap assets. Bitcoin dominance rose to 62.2% in Q1, its highest level since February 2021, despite a drop in its total market capitalization. Capital flowed out of speculative assets and into bitcoin amidst macro volatility and geopolitical uncertainty.

The CoinDesk 20 Index (CD20) fell 23.2% in Q1 but outperformed major digital assets. XRP was the sole CD20 constituent with a positive return, driven by the dismissal of the SEC’s case against Ripple and growth in its RLUSD stablecoin.

Ether, on the other hand, underperformed due to user activity migration to Layer 2s. Public companies added nearly 100,000 BTC to their holdings in Q1, demonstrating bitcoin’s macro asset role. The launch of the U.S. Strategic Bitcoin Reserve and introduction of a Digital Asset Stockpile by the Treasury highlighted bitcoin’s legitimacy.

Looking ahead to Q2, altcoin ETF optimism remains high with Solana and XRP leading the way. The market is consolidating into assets with liquidity, narratives, and institutional relevance, indicating a shift towards structural factors over sentiment alone.

For more insights, including full index performance and constituent details, you can access the complete Digital Assets Quarterly Report.

- [posts_like_dislike id=831]

Tokens linked to artificial intelligence (AI) performed poorly compared to major cryptocurrencies in the last 24 hours. This relative weakness coincided with unusual activity in put options related to Nvidia (NVDA)...

Read moreTokens linked to artificial intelligence (AI) performed poorly compared to major cryptocurrencies in the last 24 hours. This relative weakness coincided with unusual activity in put options related to Nvidia (NVDA) shares, the chipmaker that recently announced plans to manufacture its AI supercomputers in the U.S.

Bitcoin (BTC), the leading cryptocurrency by market capitalization, saw a 0.6% increase in value to $85,500 over the past day. Meanwhile, TAO, the token associated with Bittensor’s blockchain-based machine learning network, traded 3.6% lower at $239, and Render Network’s RNDR token was down 1.7% at $3.93, according to data from Coingecko. Other tokens like FET, SEI, and GRT also experienced a 2% decline.

Data from Convex Value showed increased activity in Nvidia short-dated put options on Monday, particularly in the $100 strike puts expiring on April 17, April 25, and May 2. There was also interest in the $60 put expiring on April 17, as well as the $50 and $85 strike puts expiring on May 16.

Convex Value described the trading in out-of-the-money put options below Nvidia’s current spot price of $110 as unusual, suggesting that these could be protective plays. According to an analyst at the platform, buying put options is a way for traders to hedge against potential market declines or profit from bearish scenarios.

Merlin Capital, a Substack-based analytics service, hinted at insider knowledge with a post on X saying, “Someone knows something.” This suggests that there may be information influencing the recent options activity surrounding Nvidia’s stock.

- [posts_like_dislike id=823]

Tags:ADAAIAmericaAppleBinancebitcoinbtcCanadaCoinbaseCommunicationCryptodubaiETHEUFinancegoldJapanminerMoving AverageRobinhoodS&P 500solanaStrategyTeslaTradingTrumpUSXRP

By [Your Name] (All times ET unless indicated otherwise) Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its...

Read moreBy [Your Name] (All times ET unless indicated otherwise)

Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its “Liberation Day” high. To put the move into perspective, bitcoin dominance — which measures BTC’s share of the total cryptocurrency market cap — is approaching 64%, a level not seen since January 2021.

In contrast, the Nasdaq 100 is still 5% away from its own Liberation Day high, underscoring bitcoin’s relative strength versus U.S. equities.

According to X account Cheddar Flow, the S&P 500 has just formed a “death cross” — a traditionally bearish signal that occurs when the 50-day moving average falls below the 200-day moving average. The last time this happened was March 15, 2022, when S&P 500 initially rose by 11% in the following week, only to be followed by a 20% decline. Bearish sentiment is also reflected in the options market, where investors are reportedly buying large volumes of NVDA puts, signaling expectations of lower prices.

In a Bloomberg interview on Monday, Treasury Secretary Scott Bessent reaffirmed confidence in the U.S. bond market, dismissing concerns that foreign nations are dumping Treasuries.

“I am not seeing a dumping of U.S. Treasuries,” Bessent said. “The Treasury has lots of tools, but we’re a long way from needing them.” He also emphasized the enduring status of the U.S. dollar as the world’s reserve currency, despite the DXY index — which measures the dollar’s value against a basket of major trading partners — falling below 100 and dropping over 10% in recent weeks.

Bessent also confirmed that the Trump administration is seeking a new Federal Reserve Chair to replace Jerome Powell, with interviews set to begin later in the year. He concluded the interview by suggesting that the VIX (S&P 500 volatility index) may have peaked after the largest one-day percentage drop in its history last week. Stay alert!

What to Watch:

Crypto:

April 15: The first SmarDEX (SDEX) halving means the SDEX token’s distribution will be cut by 50% for the next 12 months.

April 16: HashKey Chain (HSK) mainnet upgrade enhances network stability and fee control capabilities.

April 17: EigenLayer (EIGEN) activates slashing on Ethereum mainnet, enforcing penalties for operator misconduct.

April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing block rewards to 15,625 PEP per block.

April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

April 21: Coinbase Derivatives will list XRP futures pending approval by the Commodity Futures Trading Commission (CFTC).

Macro:

April 15, 8:30 a.m.: Statistics Canada releases March consumer price inflation data.

Core Inflation Rate MoM Prev. 0.7%

Core Inflation Rate YoY Prev. 2.7%

Inflation Rate MoM Est. 0.6% vs. Prev. 1.1%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.6%

April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail sales data.

Retail Sales MoM Est. 1.4% vs. Prev. 0.2%

Retail Sales YoY Prev. 3.1%

April 16, 9:45 a.m.: Bank of Canada releases its latest interest rate decision, followed by a press conference 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

April 16, 1:30 p.m.: Fed Chair Jerome H. Powell will deliver an “Economic Outlook” speech. Livestream link.

April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential construction data.

Housing Starts Est. 1.42M vs. Prev. 1.501M

Housing Starts MoM Prev. 11.2%

April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 12.

Initial Jobless Claims Est. 226K vs. Prev. 223K

April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March consumer price index (CPI) data.

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

Inflation Rate MoM Prev. -0.1%

Inflation Rate YoY Prev. 3.7%

Earnings (Estimates based on FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events:

Governance votes & calls

Venus DAO is discussing the forced liquidation of the remaining debt owed by a BNB bridge exploiter account that “supplied extraneously minted BNB to Venus and generated an over-collateralized debt position.”

Aave DAO is discussing taking further steps to deprecate Synthetix’s sUSD on Aave V3 Optimism over technical developments that have “compromised its ability to consistently maintain its peg.”

GMX DAO is discussing the establishment of a GMX reserve on Solana, which would involve bridging $500,000 in GMX to the blockchain and transferring the funds to the GMX-Solana Treasury.

Treasure DAO is discussing handing the core contributor team the authority to wind down and close the Treasure Chain infrastructure on ZKsync and manage the primary MAGIC-ETH protocol-owned liquidity pool given the “crucial financial situation” of the protocol.

April 15, 10 a.m.: Injective to hold an X Spaces session with Guardian.

April 16, 7 a.m.: Aergo to host an Ask Me Anything (AMA) session on the future of decentralized artificial intelligence and the project.

April 16, 3 p.m.: Zcash to host a Town Hall on LockBox Distribution & Governance.

Unlocks

April 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $10.08 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $27.17 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating supply worth $325.97 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $82.60 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating supply worth $18.29 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating supply worth $10.07 million.

Token Launches

April 15: WalletConnect Token (WCT) to be listed on Binance, Bitget, AscendEX, BingX, BYDFi, LBank, Coinlist and others.

April 16: Badger (BADGER), Balacner (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT) and aelf (ELF) to be delisted from Binance.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 2 of 3: Morocco WEB3FEST GITEX Edition (Marrakech)

April 15: Strategic Bitcoin Reserve Summit (online)

Day 1 of 2: BUIDL Asia 2025 (Seoul)

Day 1 of 2: World Financial Innovation Series 2025 (Hanoi, Vietnam)

Day 1 of 3: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

Token Talk

Story Protocol’s IP tokens experienced a 20% drop and recovery within hours during an unusual trading session on Monday.

Trading volume surged on exchanges including Binance and OKX Spot, with $138 million recorded after the price rebound.

The sudden price movement was isolated from broader market trends, sparking speculation about insider activity or coordinated selling.

Also on Monday, MANTRA’s OM token plummeted over 90% in hours, dropping from around $6.30 to as low as 37 cents and wiping out over $5 billion in market capitalization.

The token has since rebounded slightly to trade around 63 cents.

Laser Digital, a Nomura-backed investor, was initially flagged for depositing $41 million in OM to OKX, but the company denied selling, clarifying it was collateral return from a financing trade. Shorooq Investors also denied selling.

Derivatives Positioning

BTC shorts have been liquidated on most exchanges in the past 24 hours, excluding BitMEX and Gate.io, according to Coinglass. The opposite is the case in ETH.

XRP’s perpetual futures open interest has dropped from 544.7 million XRP to 480 million XRP, diverging from the price recovery seen since Monday last week.

SUI, ONDO, ADA and APT have seen a notable increase in futures open interest in the past 24 hours. Of those, XMR is the only one with the positive OI-adjusted cumulative volume delta, representing net buying pressure.

On Deribit, short-dated BTC and ETH options continue to show a bias for protective puts, suggesting cautious sentiment.

Flows on OTC desk Paradigm have been mixed with both calls and puts bought in the April expiry.

Market Movements:

BTC is up 1.19% from 4 p.m. ET Monday at $85,877.18 (24hrs: +1.35%)

ETH is up 0.59% at $1,645.30 (24hrs: -1.97%)

CoinDesk 20 is up 0.99% at 2,519.69 (24hrs: +0.19%)

Ether CESR Composite Staking Rate is up 18 bps at 3.18%

BTC funding rate is at 0.0184% (6.7003% annualized) on Binance

DXY is unchanged at 99.70

Gold is up 1.26% at $3,245.30/oz

Silver is up 0.81% at $32.35/oz

Nikkei 225 closed +0.84% at 34,267.54

Hang Seng closed +0.23% at 21,466.27

FTSE is up 0.92% at 8,209.04

Euro Stoxx 50 is up 0.82% at 4,951.51

DJIA closed on Tuesday +0.78% at 40,524.79

S&P 500 closed +0.79% at 5,405.97

Nasdaq closed +0.64% at 16,831.48

S&P/TSX Composite Index closed +1.18% at 23,866.50

S&P 40 Latin America closed +1.8% at 2,340.02

U.S. 10-year Treasury rate is up 1 bp at 4.39%

E-mini S&P 500 futures are up 0.12% at 5,447.25

E-mini Nasdaq-100 futures are up 0.26% at 18,983.25

E-mini Dow Jones Industrial Average Index futures are unchanged at 40,750.00

Bitcoin Stats:

BTC Dominance: 63.80 (0.16%)

Ethereum to bitcoin ratio: 0.01913 (-0.31%)

Hashrate (seven-day moving average): 896 EH/s

Hashprice (spot): $44.1 PH/s

Total Fees: 6.33 BTC / $536,017

CME Futures Open Interest: 134,730

BTC priced in gold: 26.6 oz

BTC vs gold market cap: 7.56%

Technical Analysis

On Monday, the bitcoin cash-bitcoin (BCH/BTC) ratio failed to penetrate the trendline characterizing the 12-month bear market.

A potential move above the trendline could see breakout traders join the market, lifting BCH higher.

Crypto Equities

Strategy (MSTR): closed on Monday at $311.45 (+3.82%), up 0.62% at $313.38 in pre-market

Coinbase Global (COIN): closed at $176.58 (+0.62%), up 1.28% at $178.84

Galaxy Digital Holdings (GLXY): closed at C$15.81 (+3.47%)

MARA Holdings (MARA): closed at $12.95 (+3.52%), up 1.24% at $13.11

Riot Platforms (RIOT): closed at $7.01 (-0.71%), up 0.71% at $7.06

Core Scientific (CORZ): closed at $7.06 (-0.14%)

CleanSpark (CLSK): closed at $7.78 (+3.73%), up 1.29% at $7.88

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.70 (+1.44%), up 1.44% at $12.90

Semler Scientific (SMLR): closed at $34.26 (+1.48%)

Exodus Movement (EXOD): closed at $39.43 (-10.55%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $1.5 million

Cumulative net flows: $35.46 billion

Total BTC holdings ~1.11 million

Spot ETH ETFs

Daily net flow: -$6 million

Cumulative net flows: $2.28 billion

Total ETH holdings ~3.36 million

Source: Farside Investors

Overnight Flows

Chart of the Day Personalized: Disney’s Bob Iger to exit Apple’s board

In the Ether

**Insert interesting content about current events, stories, etc. in the crypto world**

That’s all for now, stay in-the-know with The Parrot Press for the latest updates and insights on the dynamic world of cryptocurrencies and finance!

- [posts_like_dislike id=821]

This is a daily technical analysis by our analyst and Chartered Market Technician here at The Parrot Press. In markets, finding the best entry point is crucial, as timing and levels...

Read moreThis is a daily technical analysis by our analyst and Chartered Market Technician here at The Parrot Press. In markets, finding the best entry point is crucial, as timing and levels can greatly impact the success of traders by influencing risk-reward ratios in their favor.

Bitcoin’s near-term outlook may seem positive with increased demand for bullish bets in the options market. However, the cryptocurrency is currently close to key resistance levels that have limited upside potential in recent months, making the risk-reward profile less appealing for those looking to take advantage of bullish prospects.

BTC has been testing the lower boundary of the “Ichimoku cloud” around $85K since Saturday. Developed by a Japanese journalist in the 1960s, the Ichimoku cloud is a technical analysis tool that provides a comprehensive view of market momentum, support, and resistance levels.

The indicator consists of five lines: Leading Span A, Leading Span B, Conversion Line or Tenkan-Sen (T), Base Line or Kijun-Sen (K), and a lagging closing price line. The space between Leading Span A and B forms the Ichimoku Cloud, with its upper and lower boundaries acting as potential support and resistance levels based on the price’s position relative to the cloud.

Back in early February, BTC dropped below $100K and traded below the Ichimoku Cloud. Since then, the lower boundary of the cloud has acted as a strong resistance level, limiting any recovery attempts.

With BTC now approaching this level again, bulls, especially those considering new bids, should proceed with caution. The immediate upside may be constrained by cloud resistance around $85K, while support is around $75K, approximately $10K lower than the current market rate. This situation presents an unfavorable risk-reward scenario for long positions.

The rejection at the Ichimoku Cloud on April 2 led to a significant sell-off, pushing BTC below $75K, similar to a pattern seen after the rejection on February 21. Therefore, the recent encounter with cloud resistance calls for close observation as it may lead to further selling pressure. A downturn from this level could bring attention back to the $75K level.

On the other hand, a potential break above $90K, signifying a breakout above the cloud, would indicate a continuation of the broader bull trend and a potential rally to new all-time highs.

- [posts_like_dislike id=817]

Metaplanet Inc. (3350) recently added 319 bitcoin (BTC) to its treasury, purchasing them at an average price of $83,147 per coin. This acquisition increases the company’s total bitcoin holdings to 4,525...

Read moreMetaplanet Inc. (3350) recently added 319 bitcoin (BTC) to its treasury, purchasing them at an average price of $83,147 per coin. This acquisition increases the company’s total bitcoin holdings to 4,525 BTC, with a cost basis of $408.1 million and an average acquisition price of $90,194.

These transactions are part of Metaplanet’s strategic plan, initiated in December 2024, to utilize digital assets to drive shareholder value. The company measures its performance through BTC Yield, a metric that assesses bitcoin holding growth in relation to outstanding shares. As of April 14, the BTC yield for Q1 2025 was 95.6%, with a year-to-date figure of 6.5%.

Metaplanet has leveraged dynamic capital market activities, such as bond issuances and stock acquisition rights, to secure significant funds while minimizing dilution. Around 41.7% of the company’s “210 million plan” has been executed to date.

Please note that this content was created with the assistance of AI tools and has been reviewed by our team for accuracy and adherence to our editorial standards. For more information, refer to our full AI Policy.

- [posts_like_dislike id=815]

World Liberty Financial, a crypto venture backed by the family of U.S. President Donald Trump, has recently purchased $775,000 worth of SEI tokens as part of its altcoin accumulation strategy. The...

Read moreWorld Liberty Financial, a crypto venture backed by the family of U.S. President Donald Trump, has recently purchased $775,000 worth of SEI tokens as part of its altcoin accumulation strategy. The acquisition was made using USDC transferred from the project’s main wallet to a trading wallet that has been used for previous altcoin purchases, as revealed by data from Arkham Intelligence.

This purchase of SEI tokens adds to the company’s expanding portfolio, which already includes popular cryptocurrencies like bitcoin (BTC) and ether (ETH), as well as TRX, movement (MOVE), ondo (ONDO), and other tokens.

World Liberty Financial has refuted recent reports claiming that they sold ether or any other assets, following allegations that a wallet linked to the project had sold around $8 million worth of the second-largest cryptocurrency. Despite this, the price of SEI tokens surged after the purchase was made public, rising by over 27% in the past week to now trade at $0.178 per token.

- [posts_like_dislike id=813]

The U.S.-China trade war seems to be decreasing inflation in the U.S. economy, according to indicators in the financial market. This development is positive for risk assets like Bitcoin (BTC). Since...

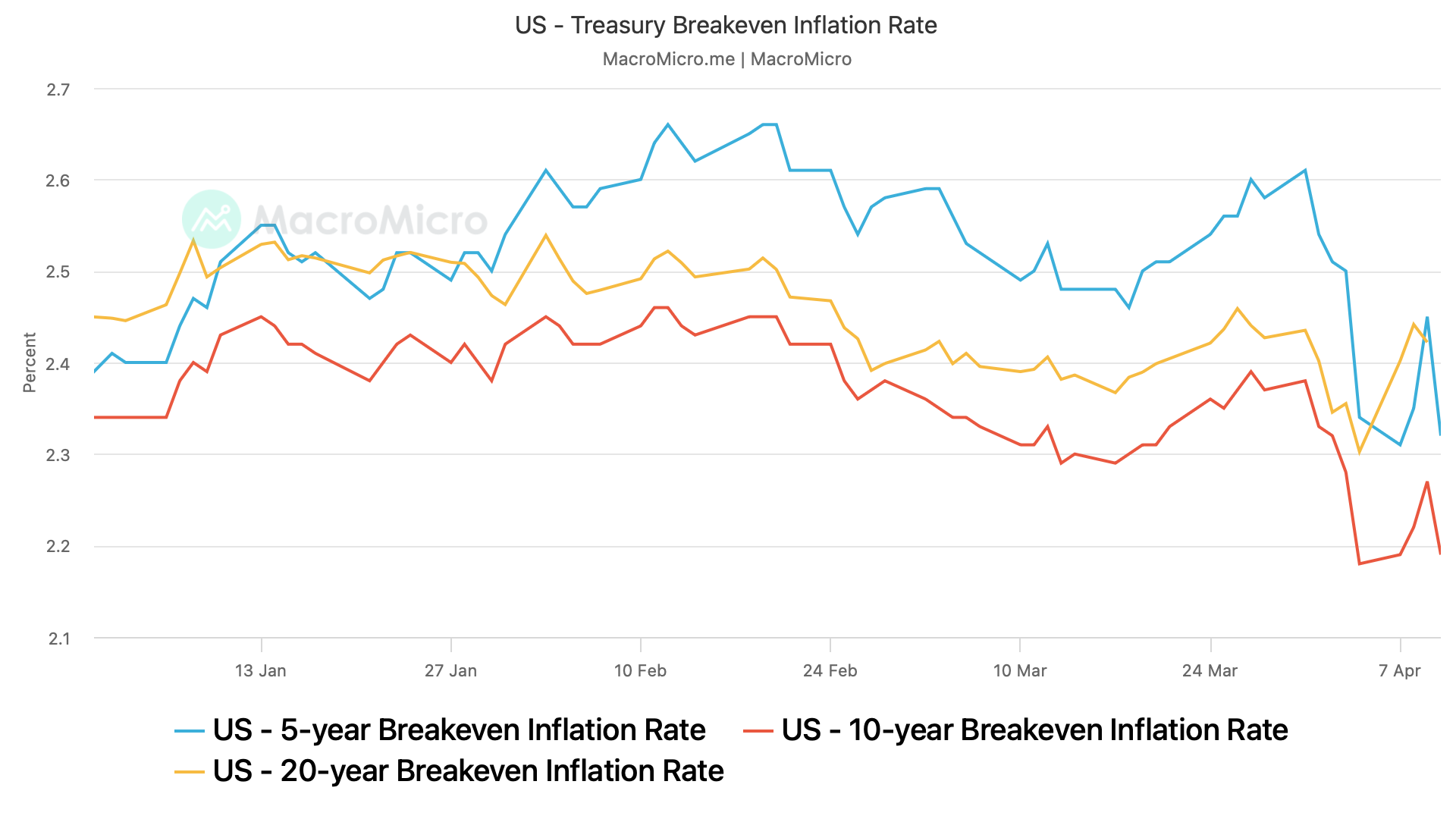

Read moreThe U.S.-China trade war seems to be decreasing inflation in the U.S. economy, according to indicators in the financial market. This development is positive for risk assets like Bitcoin (BTC).

Since President Donald Trump’s inauguration in January, the trade tensions between the U.S. and key trade partners, including China, have been escalating. The imposition of tariffs by both countries has raised concerns about potential inflation due to increased import costs being passed on to consumers in the U.S.

Despite fears of tariffs leading to higher inflation, market-based measures like breakevens suggest that tariffs could actually be disinflationary in the long term. This means that the Federal Reserve might be overly concerned about stagflation and could have room to cut interest rates.

Experts argue that tariffs are typically considered a one-time adjustment cost that can lead to disinflation in the long run. When producers pass on tariff increases to consumers, it initially raises inflation levels. However, without a corresponding increase in income, consumers may reduce their consumption, leading to potential price declines and inventory build-up.

In light of historical observations and current market trends, financial market turbulence may be more related to growth fears than inflation concerns. As a result, investors may anticipate a more dovish stance from the Federal Reserve, which could see a positive resurgence in risk assets.

- [posts_like_dislike id=803]