XRP experienced a 3.7% drop in the last 24 hours, falling from a daily high of $2.288 to close near $2.260 after facing resistance at the $2.33 level. Despite showing signs...

Read moredubai

The cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise. Norway-based crypto exchange Norwegian Block...

Read moreThe cryptocurrency bull run has slowed down after bitcoin (BTC) reached a record high above $110,000 last month. However, corporate adoption is still on the rise.

Norway-based crypto exchange Norwegian Block Exchange saw its shares surge over 100% after revealing the purchase of six BTC, valued at $633K at current prices. The company plans to increase its holdings to 10 BTC by the end of the month.

Classover Holdings Inc, a Nasdaq-listed educational technology company with a market capitalization of $63 million, entered into a securities purchase agreement with Solana Growth Ventures LLC for up to $500 million in senior secured convertible notes, with 80% of the proceeds allocated to purchasing Solana’s native token SOL.

Ripple’s stablecoin RLUSD received regulatory approval from the Dubai Financial Services Authority, allowing the stablecoin to support the Dubai Land Department’s blockchain initiative to tokenize real estate title deeds on the XRP Ledger.

Robinhood completed a $200 million all-cash acquisition of the Luxembourg-based crypto exchange Bitstamp, expanding its presence in Europe.

U.S.-listed spot bitcoin ETFs experienced a net outflow of $268 million on Monday, while Ethereum spot ETFs recorded a net inflow of $78.17 million. Meanwhile, the Japanese yen declined during Asian hours due to the Bank of Japan’s plans to halt its Japanese government bond purchases.

The dollar index remained under pressure due to trade uncertainty and rising concerns in the bond market over the U.S. deficit. Negative surprises in Monday’s ISM manufacturing surveys punctured the U.S. resilience story.

Focus today will be on April’s JOLTS report and durable goods orders. A soft labor market data could push the dollar back to its April lows, according to ING.

A U.S. House hearing on “The Future of Digital Assets” featured Aptos Labs CEO Avery Ching’s testimony, led by the Agriculture Committee. Stay informed!

In the cryptocurrency space, upcoming events include network upgrades on Pocket Network and Sia, congressional hearings, and the announcement of the 3-for-1 share split for ARK 21Shares Bitcoin ETF.

Conferences to watch out for include SXSW London, World Computer Summit 2025, Money20/20 Europe, Non Fungible Conference, Crypto Valley Conference, BTC Prague 2025, Bitcoin Policy Institute’s Bitcoin Policy Summit 2025, and Istanbul Blockchain Week.

Token events include governance votes, unlocks, and token launches across various platforms.

In the market, BTC and ETH prices saw some movement, while the CoinDesk 20 experienced a slight increase. Key market indicators also showed some fluctuations.

Derivatives positioning and crypto equities like MSTR, COIN, GLXY, MARA, and more displayed various performance measures.

ETF flows revealed daily and cumulative net flows for spot BTC and spot ETH ETFs.

Stay updated on overnight flows, technical analysis, and the latest news in the crypto and financial markets.

The content was written without any Coindesk attribution or HTML coding.

- [posts_like_dislike id=1101]

Tags:ADAAIAmericaBinancebitcoinbtcCanadaCoinbaseCryptoDonald TrumpdubaiETHEUFinancegoldGovernmentHealthIranJapanminerMoving AverageS&P 500StocksStrategyTradingtrillionTrumpUSWashington

By Francisco Rodrigues (All times ET unless indicated otherwise) Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets...

Read moreBy Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets contended with rising bond yields and renewed concerns over ballooning U.S. debt.

The largest cryptocurrency has gained around 3.8% in the last 24 hours while the broader CoinDesk 20 CD20 index rose 4.74%, continuing a trend of strength driven by mounting institutional demand and growing interest in crypto exposure.

The rally is unfolding against a backdrop of higher yields on U.S. and Japanese government bonds. The 10-year U.S. Treasury yield rose to 4.6%, while the 30-year topped 5%, driven by concerns over President Donald Trump’s tax bill that analysts estimate could add as much as $5 trillion to the country’s debt, according to Reuters.

In Japan, yields on 30- and 40-year government bonds also hit record highs. The country’s debt-to-GDP ratio stands at 234%, QCP Capital said, and growing scrutiny coupled with weak demand for long-dated JGBs sent yields soaring.

That matters because higher yields — and thus higher returns — on investments that are considered relatively safe tend to lower the appeal of riskier assets like stocks, not to mention cryptocurrencies. While BTC, with its history of trading as a risky asset, hasn’t shown much sign of ebbing demand, it raises the question of how long the rally can continue.

Still, traders have been building large long positions in BTC options, with the most open interest now concentrated at the $110,000, $120,000 and even $300,000 calls for contracts expiring in late June in a sign of continuing bullish conviction.

U.S.-traded spot bitcoin exchange-traded funds have also been seeing significant demand. Total net inflows hit $1.6 billion over the week, and $4.24 billion so far in May, SoSoValue data shows. The inflows, coupled with bitcoin’s price rise, have seen the ETFs’ total net assets hit a record $129 billion.

There are, however, some muted signs of bearish activity.

“The largest block flow this week continues to be ETH December call spreads, while overnight BTC butterfly positions hint that some traders are positioning for consolidation around current levels,” Wintermute OTC trader Jake O. said.

Note, he’s talking about consolidation, not declines. And traditional participants may even be too bearish. While the U.S. endured a recent credit downgrade, markets are now pricing in a 6-level cut all the way down to BBB+.

On top of that, per Jake O., a recent equities market sell-off may not be a result of repositioning given higher bond yields, but rather profit-taking after nine consecutive positive sessions. Stay alert!

What to Watch

Crypto

May 22: Bitcoin Pizza Day.

May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

May 30: The second round of FTX repayments starts.

May 31 (TBC): Mezo mainnet launch.

Macro

Day 3 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

May 22, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail sales data.

May 23, 10 a.m.: The U.S. Census Bureau releases April new single-family homes data.

Earnings (Estimates based on FactSet data)

May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

Governance votes & calls

Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock between DAO decisions and execution so stETH holders can escrow tokens to pause proposals at 1% of TVL or fully block and “rage-quit” at 10%. Voting ends May 28.

Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

May 22: Official Trump to announce its “next Era” on the day of the dinner for its largest holders.

June 10: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.67 million.

June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $182.58 million.

June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.99 million.

June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $16.78 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $61.86 million.

Token Launches

June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

Day 3 of 7: Dutch Blockchain Week (Amsterdam)

Day 3 of 3: Avalanche Summit London

Day 3 of 3: Seamless Middle East Fintech 2025 (Dubai)

Day 2 of 2: Crypto Expo Dubai

Day 2 of 2: Cryptoverse Conference (Warsaw)

May 27-29: Bitcoin 2025 (Las Vegas)

May 27-30: Web Summit Vancouver

May 29: Stablecon (New York)

May 29-30: Litecoin Summit 2025 (Las Vegas)

May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

June 2-7: SXSW London

June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

June 19-21: BTC Prague 2025

Token Talk

By Shaurya Malwa

The HYPE token is in focus after a billion-dollar bitcoin trade boosted Hyperliquid’s fundamentals.

Pseudonymous trader James Wynn opened a $1.1 billion long on BTC using 40x leverage via Hyperliquid in one of the largest on-chain DEX trades ever recorded.

The position, tied to wallet “0x507,” was entered when BTC was priced at $108K and now sits on over $40 million in unrealized profit.

Wynn booked partial profits early Thursday by closing 540 BTC (~$60 million), to net $1.5 million.

His prior exits were followed by BTC declines, so traders are watching closely.

Hyperliquid runs on its custom L1, HyperEVM, using the HyperBFT consensus (200K+ TPS) with CEX-level features like real-time order books and deep liquidity — no KYC required.

The platform’s permissionless design and lightning-fast execution are increasingly drawing capital from centralized venues to DeFi , and this trade could set a precedent for whale activity.

HYPE jumped 15% in the past 24 hours on renewed attention and usage-driven speculation.

Derivatives Positioning

Analyzing the liquidations heatmap of the BTC-USDT pair on Binance, the largest liquidations cluster around $108.5K and $106.9K with liquidations worth $143 million and $112.5 million, respectively.

Meanwhile, the options market swells post-breakout, with open interest on Deribit climbing above $34 billion, just shy of the all-time high of $35.9 billion set in December. The bulk of this positioning is centered on the 30 May expiry, which now holds over $9 billion in notional value to become a key date for potential volatility.

Bullish sentiment is clearly in control, with traders aggressively targeting upside via calls. Strikes at $100K, $120K and $150K have attracted particularly large open interest, reflecting growing conviction in a continued rally.

Put/call ratios underscore this shift in sentiment — the 24-hour volume ratio has dropped to 0.49, while the open interest ratio sits at 0.60, indicating a meaningful tilt toward bullish exposure following BTC’s move above $110K.

Near-term options activity is also picking up, with weekly and monthly contracts seeing notable inflows. Traders appear to be positioning for further momentum or short-term price swings in the wake of the breakout.

Market Movements

BTC is up 1.19% from 4 p.m. ET Wednesday at $110,690.36 (24hrs: +4.05%)

ETH is up 6.19% at $2,662.72 (24hrs: +5.23%)

CoinDesk 20 is up 3.64% at 3,348.63 (24hrs: +4.88%)

Ether CESR Composite Staking Rate is unchanged at 3.03%

BTC funding rate is at 0.03% (10.95% annualized) on Binance

DXY is up 0.25% at 99.81

Gold is down 0.26% at $3,305.6/oz

Silver is down 0.83% at $33.17/oz

Nikkei 225 closed -0.84% at 36,985.87

Hang Seng closed -1.19% at 23,544.31

FTSE is down 0.68% at 8,726.62

Euro Stoxx 50 is down 0.96% at 5,402.31

DJIA closed on Wednesday -0.91% at 41,860.44

S&P 500 closed -1.61% at 5,844.61

Nasdaq closed -1.41% at 18,872.64

S&P/TSX Composite Index closed -0.83% at 25,839.17

S&P 40 Latin America closed -1.31% at 2,597.38

U.S. 10-year Treasury rate is down 2 bps at 4.58%

E-mini S&P 500 futures are unchanged at 5,865.50

E-mini Nasdaq-100 futures are up 0.15% at 21,188.50

E-mini Dow Jones Industrial Average Index futures are down 0.17% at 41,875.00

Bitcoin Stats:

BTC Dominance: 63.90 (-0.62%)

Ethereum to bitcoin ratio: 0.02409 (3.52%)

Hashrate (seven-day moving average): 875 EH/s

Hashprice (spot): $58.24

Total Fees: 7.89 BTC / $847,124

CME Futures Open Interest: 160,740 BTC

BTC priced in gold: 33.4 oz

BTC vs gold market cap: 9.47%

Technical Analysis

Bitcoin reached a new all-time high of $111,875 this morning, breaking decisively above the previous peak just above $109,000 set in January.

With a confirmed close above that level and no sign of a swing failure pattern, the bias remains firmly tilted toward continued upside. In the near term, BTC may encounter resistance around the $112,000–$113,000 range, aligning with a trendline drawn from the prior highs in December and January.

However, last week’s consolidation above $100,000 — and the successful reclaim of the previous all-time high — suggest this area is now acting as short-term support.

A pullback below $100,000, especially into the weekly order block, would likely represent a healthy correction within the broader uptrend and could offer a compelling reentry opportunity if further downside is seen.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $402.69 (-3.41%), up 1.73% at $409.67 in pre-market

Coinbase Global (COIN): closed at $258.99 (-0.91%), up 2.78% at $266.20

Galaxy Digital Holdings (GLXY): closed at C$31 (+1.57%)

MARA Holdings (MARA): closed at $15.84 (-2.16%), up 4.42% at $16.54

Riot Platforms (RIOT): closed at $8.84 (-1.01%), up 3.39% at $9.14

Core Scientific (CORZ): closed at $10.78 (-1.28%), up 1.48% at $10.94

CleanSpark (CLSK): closed at $10.11 (+4.23%), up 4.65% at $10.58

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.75 (-1.33%)

Semler Scientific (SMLR): closed at $44.89 (+7.19%), up 6.01% at $47.59

Exodus Movement (EXOD): closed at $32.76 (-5.07%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $607.1 million

Cumulative net flows: $43.35 billion

Total BTC holdings ~ 1.19 million

Spot ETH ETFs

Daily net flow: $0.6 million

Cumulative net flows: $2.61 billion

Total ETH holdings ~ 3.49 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Top 20 digital assets’ prices and volumes

Chart of the day

Bitcoin adoption

- [posts_like_dislike id=1033]

Tags:AIAmericabitcoinbtcCoinbaseCryptoDonald TrumpdubaiETHEUgoldMoving AverageS&P 500solanaTariffsTradingTrumpUSXRP

By Parrot Press Staff President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy...

Read moreBy Parrot Press Staff

President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy away from risk assets, such as bitcoin (BTC) and other cryptocurrencies.

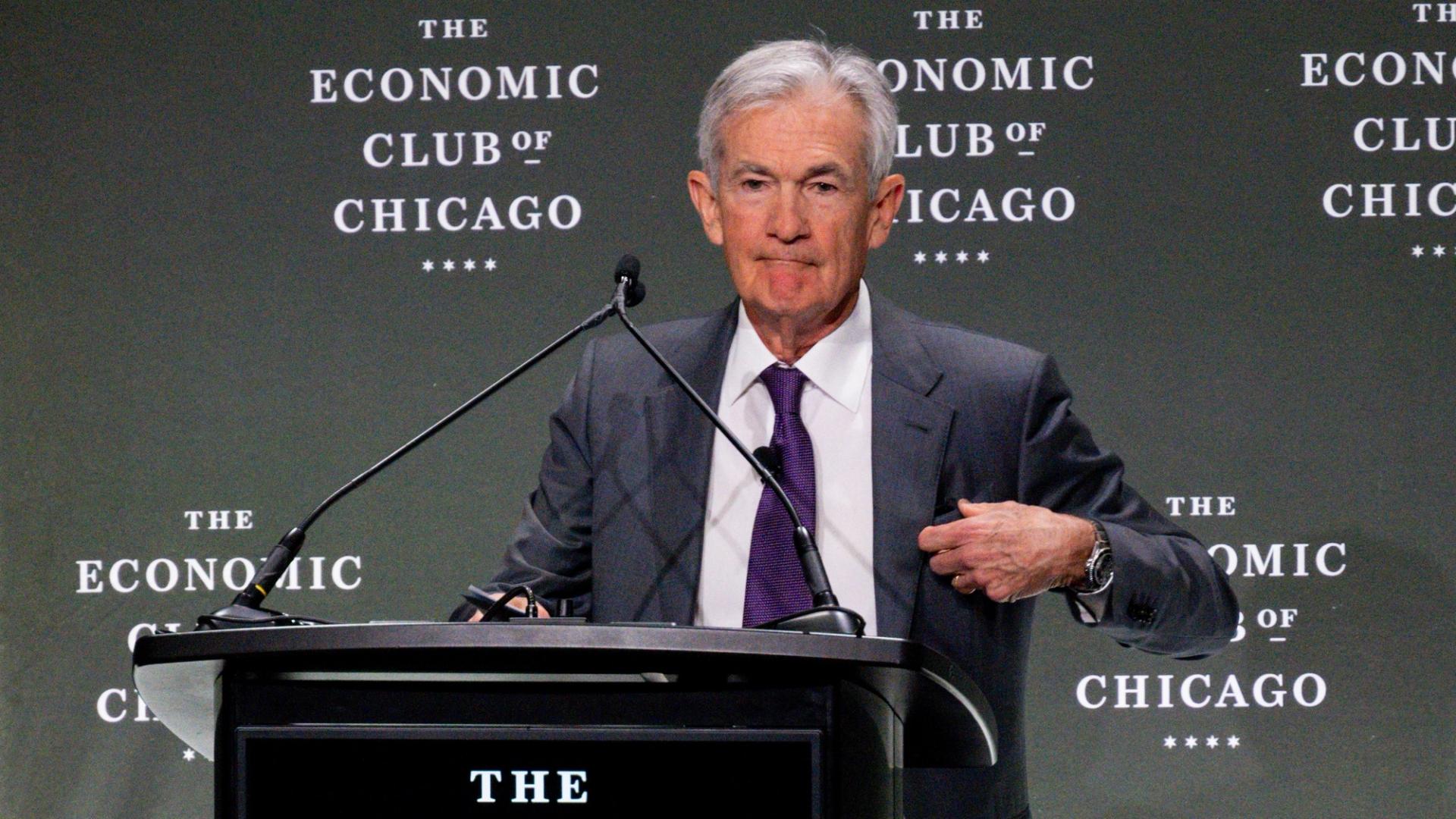

Federal Reserve Chairman Jerome Powell added fuel to the fire by stating late Wednesday that the central bank anticipates a rise in unemployment as the economy is likely to slow down and inflation is expected to increase. Powell mentioned that some of the tariffs imposed are likely to be paid by the public, further weighing on risk assets. This resulted in the Nasdaq dropping 1.17% and the S&P 500 decreasing by 2.24% before the closing bell. Despite this, bitcoin saw an increase of more than 1% in the past 24 hours. The CoinDesk 20 (CD20) index, which provides a broader market perspective, also saw a rise of 1.8%. However, the crypto market is more considered a gauge of risk rather than a safe haven, as reported by Coindesk.

According to Michael Brown, an analyst at Pepperstone, there is likely to be a growing demand for “assets which provide shelter from political incoherence and trade uncertainty,” as reported by The Telegraph. While bitcoin has outperformed the stock market, showing a 1% increase in the past month compared to the Nasdaq’s 8% drop, institutional investors are turning to gold as a safe haven investment.

Gold has seen an 11% increase over the last month and a 27% increase since the beginning of the year, reaching around $3,340 per troy ounce. A survey conducted by Bank of America’s Global Fund Manager revealed that 49% of fund managers view “long gold” as the most crowded trade on Wall Street, with 42% of them predicting it to be the best-performing asset of the year.

UBS analysts suggested that adding gold allocations has become more compelling due to the escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks, and diversification away from US assets and the US dollar, as reported by Investopedia.

Gold fund flows have reached $80 billion so far this year, while data from SoSoValue indicates that spot bitcoin ETFs have seen $5.25 billion net inflows in January, with net outflows occurring since the rise in uncertainty. In the month of April alone, over $900 million has exited these funds, following net outflows of $3.56 billion in February and $767 million in March. It is advised to stay alert in such an uncertain market environment.

In the latest Token Events updates, EigenLayer is implementing slashing on Ethereum mainnet, Pepecoin is undergoing its second halving, BNB Chain will be undergoing the opBNB mainnet hardfork, and Coinbase Derivatives will be listing XRP futures pending approval by the U.S. Commodity Futures Trading Commission.

Various conferences and events, such as CoinDesk’s Consensus in Toronto on May 14-16, NexTech Week Tokyo, Money20/20 Asia in Bangkok, Crypto Horizons 2025 in Dubai, and many more are scheduled to take place in the upcoming days.

In other news, Raydium’s LaunchLab platform has gone live, competing with Pump.fun and introducing a perceived competing platform to the Solana ecosystem. This has led to over 1,750 tokens being created shortly after LaunchLab’s debut, driving the price of Raydium’s RAY token up by as much as 10%.

On the technical analysis front, Bitcoin has rebounded off the golden pocket zone, showing strong buyer interest. It has broken out of the daily downtrend that has been in place since February, indicating a potential shift in structure. BTC is currently sitting below the daily 50 and 200 exponential moving averages, which act as important decision points for the price direction.

Overall, the market is seeing fluctuations due to economic uncertainty, geopolitical risks, and trade concerns, highlighting the importance of diversification and following market trends closely.

- [posts_like_dislike id=837]

Tags:ADAAIAmericaAppleBinancebitcoinbtcCanadaCoinbaseCommunicationCryptodubaiETHEUFinancegoldJapanminerMoving AverageRobinhoodS&P 500solanaStrategyTeslaTradingTrumpUSXRP

By [Your Name] (All times ET unless indicated otherwise) Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its...

Read moreBy [Your Name] (All times ET unless indicated otherwise)

Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its “Liberation Day” high. To put the move into perspective, bitcoin dominance — which measures BTC’s share of the total cryptocurrency market cap — is approaching 64%, a level not seen since January 2021.

In contrast, the Nasdaq 100 is still 5% away from its own Liberation Day high, underscoring bitcoin’s relative strength versus U.S. equities.

According to X account Cheddar Flow, the S&P 500 has just formed a “death cross” — a traditionally bearish signal that occurs when the 50-day moving average falls below the 200-day moving average. The last time this happened was March 15, 2022, when S&P 500 initially rose by 11% in the following week, only to be followed by a 20% decline. Bearish sentiment is also reflected in the options market, where investors are reportedly buying large volumes of NVDA puts, signaling expectations of lower prices.

In a Bloomberg interview on Monday, Treasury Secretary Scott Bessent reaffirmed confidence in the U.S. bond market, dismissing concerns that foreign nations are dumping Treasuries.

“I am not seeing a dumping of U.S. Treasuries,” Bessent said. “The Treasury has lots of tools, but we’re a long way from needing them.” He also emphasized the enduring status of the U.S. dollar as the world’s reserve currency, despite the DXY index — which measures the dollar’s value against a basket of major trading partners — falling below 100 and dropping over 10% in recent weeks.

Bessent also confirmed that the Trump administration is seeking a new Federal Reserve Chair to replace Jerome Powell, with interviews set to begin later in the year. He concluded the interview by suggesting that the VIX (S&P 500 volatility index) may have peaked after the largest one-day percentage drop in its history last week. Stay alert!

What to Watch:

Crypto:

April 15: The first SmarDEX (SDEX) halving means the SDEX token’s distribution will be cut by 50% for the next 12 months.

April 16: HashKey Chain (HSK) mainnet upgrade enhances network stability and fee control capabilities.

April 17: EigenLayer (EIGEN) activates slashing on Ethereum mainnet, enforcing penalties for operator misconduct.

April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing block rewards to 15,625 PEP per block.

April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

April 21: Coinbase Derivatives will list XRP futures pending approval by the Commodity Futures Trading Commission (CFTC).

Macro:

April 15, 8:30 a.m.: Statistics Canada releases March consumer price inflation data.

Core Inflation Rate MoM Prev. 0.7%

Core Inflation Rate YoY Prev. 2.7%

Inflation Rate MoM Est. 0.6% vs. Prev. 1.1%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.6%

April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail sales data.

Retail Sales MoM Est. 1.4% vs. Prev. 0.2%

Retail Sales YoY Prev. 3.1%

April 16, 9:45 a.m.: Bank of Canada releases its latest interest rate decision, followed by a press conference 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

April 16, 1:30 p.m.: Fed Chair Jerome H. Powell will deliver an “Economic Outlook” speech. Livestream link.

April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential construction data.

Housing Starts Est. 1.42M vs. Prev. 1.501M

Housing Starts MoM Prev. 11.2%

April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 12.

Initial Jobless Claims Est. 226K vs. Prev. 223K

April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March consumer price index (CPI) data.

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

Inflation Rate MoM Prev. -0.1%

Inflation Rate YoY Prev. 3.7%

Earnings (Estimates based on FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events:

Governance votes & calls

Venus DAO is discussing the forced liquidation of the remaining debt owed by a BNB bridge exploiter account that “supplied extraneously minted BNB to Venus and generated an over-collateralized debt position.”

Aave DAO is discussing taking further steps to deprecate Synthetix’s sUSD on Aave V3 Optimism over technical developments that have “compromised its ability to consistently maintain its peg.”

GMX DAO is discussing the establishment of a GMX reserve on Solana, which would involve bridging $500,000 in GMX to the blockchain and transferring the funds to the GMX-Solana Treasury.

Treasure DAO is discussing handing the core contributor team the authority to wind down and close the Treasure Chain infrastructure on ZKsync and manage the primary MAGIC-ETH protocol-owned liquidity pool given the “crucial financial situation” of the protocol.

April 15, 10 a.m.: Injective to hold an X Spaces session with Guardian.

April 16, 7 a.m.: Aergo to host an Ask Me Anything (AMA) session on the future of decentralized artificial intelligence and the project.

April 16, 3 p.m.: Zcash to host a Town Hall on LockBox Distribution & Governance.

Unlocks

April 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $10.08 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $27.17 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating supply worth $325.97 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $82.60 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating supply worth $18.29 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating supply worth $10.07 million.

Token Launches

April 15: WalletConnect Token (WCT) to be listed on Binance, Bitget, AscendEX, BingX, BYDFi, LBank, Coinlist and others.

April 16: Badger (BADGER), Balacner (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT) and aelf (ELF) to be delisted from Binance.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 2 of 3: Morocco WEB3FEST GITEX Edition (Marrakech)

April 15: Strategic Bitcoin Reserve Summit (online)

Day 1 of 2: BUIDL Asia 2025 (Seoul)

Day 1 of 2: World Financial Innovation Series 2025 (Hanoi, Vietnam)

Day 1 of 3: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

Token Talk

Story Protocol’s IP tokens experienced a 20% drop and recovery within hours during an unusual trading session on Monday.

Trading volume surged on exchanges including Binance and OKX Spot, with $138 million recorded after the price rebound.

The sudden price movement was isolated from broader market trends, sparking speculation about insider activity or coordinated selling.

Also on Monday, MANTRA’s OM token plummeted over 90% in hours, dropping from around $6.30 to as low as 37 cents and wiping out over $5 billion in market capitalization.

The token has since rebounded slightly to trade around 63 cents.

Laser Digital, a Nomura-backed investor, was initially flagged for depositing $41 million in OM to OKX, but the company denied selling, clarifying it was collateral return from a financing trade. Shorooq Investors also denied selling.

Derivatives Positioning

BTC shorts have been liquidated on most exchanges in the past 24 hours, excluding BitMEX and Gate.io, according to Coinglass. The opposite is the case in ETH.

XRP’s perpetual futures open interest has dropped from 544.7 million XRP to 480 million XRP, diverging from the price recovery seen since Monday last week.

SUI, ONDO, ADA and APT have seen a notable increase in futures open interest in the past 24 hours. Of those, XMR is the only one with the positive OI-adjusted cumulative volume delta, representing net buying pressure.

On Deribit, short-dated BTC and ETH options continue to show a bias for protective puts, suggesting cautious sentiment.

Flows on OTC desk Paradigm have been mixed with both calls and puts bought in the April expiry.

Market Movements:

BTC is up 1.19% from 4 p.m. ET Monday at $85,877.18 (24hrs: +1.35%)

ETH is up 0.59% at $1,645.30 (24hrs: -1.97%)

CoinDesk 20 is up 0.99% at 2,519.69 (24hrs: +0.19%)

Ether CESR Composite Staking Rate is up 18 bps at 3.18%

BTC funding rate is at 0.0184% (6.7003% annualized) on Binance

DXY is unchanged at 99.70

Gold is up 1.26% at $3,245.30/oz

Silver is up 0.81% at $32.35/oz

Nikkei 225 closed +0.84% at 34,267.54

Hang Seng closed +0.23% at 21,466.27

FTSE is up 0.92% at 8,209.04

Euro Stoxx 50 is up 0.82% at 4,951.51

DJIA closed on Tuesday +0.78% at 40,524.79

S&P 500 closed +0.79% at 5,405.97

Nasdaq closed +0.64% at 16,831.48

S&P/TSX Composite Index closed +1.18% at 23,866.50

S&P 40 Latin America closed +1.8% at 2,340.02

U.S. 10-year Treasury rate is up 1 bp at 4.39%

E-mini S&P 500 futures are up 0.12% at 5,447.25

E-mini Nasdaq-100 futures are up 0.26% at 18,983.25

E-mini Dow Jones Industrial Average Index futures are unchanged at 40,750.00

Bitcoin Stats:

BTC Dominance: 63.80 (0.16%)

Ethereum to bitcoin ratio: 0.01913 (-0.31%)

Hashrate (seven-day moving average): 896 EH/s

Hashprice (spot): $44.1 PH/s

Total Fees: 6.33 BTC / $536,017

CME Futures Open Interest: 134,730

BTC priced in gold: 26.6 oz

BTC vs gold market cap: 7.56%

Technical Analysis

On Monday, the bitcoin cash-bitcoin (BCH/BTC) ratio failed to penetrate the trendline characterizing the 12-month bear market.

A potential move above the trendline could see breakout traders join the market, lifting BCH higher.

Crypto Equities

Strategy (MSTR): closed on Monday at $311.45 (+3.82%), up 0.62% at $313.38 in pre-market

Coinbase Global (COIN): closed at $176.58 (+0.62%), up 1.28% at $178.84

Galaxy Digital Holdings (GLXY): closed at C$15.81 (+3.47%)

MARA Holdings (MARA): closed at $12.95 (+3.52%), up 1.24% at $13.11

Riot Platforms (RIOT): closed at $7.01 (-0.71%), up 0.71% at $7.06

Core Scientific (CORZ): closed at $7.06 (-0.14%)

CleanSpark (CLSK): closed at $7.78 (+3.73%), up 1.29% at $7.88

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.70 (+1.44%), up 1.44% at $12.90

Semler Scientific (SMLR): closed at $34.26 (+1.48%)

Exodus Movement (EXOD): closed at $39.43 (-10.55%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $1.5 million

Cumulative net flows: $35.46 billion

Total BTC holdings ~1.11 million

Spot ETH ETFs

Daily net flow: -$6 million

Cumulative net flows: $2.28 billion

Total ETH holdings ~3.36 million

Source: Farside Investors

Overnight Flows

Chart of the Day Personalized: Disney’s Bob Iger to exit Apple’s board

In the Ether

**Insert interesting content about current events, stories, etc. in the crypto world**

That’s all for now, stay in-the-know with The Parrot Press for the latest updates and insights on the dynamic world of cryptocurrencies and finance!

- [posts_like_dislike id=821]

Tags:air arabiadubai

Dubai’s stock index climbed 0.8% to 5,362 points, reaching its highest level since May 2014, driven by strong earnings from salik (+3.4%) and Air Arabia (+4.4%). Air Arabia reported a 56%...

Read moreDubai’s stock index climbed 0.8% to 5,362 points, reaching its highest level since May 2014, driven by strong earnings from salik (+3.4%) and Air Arabia (+4.4%).

Air Arabia reported a 56% jump in Q4 profit, while salik exceeded earnings expectations, fueling investor confidence. analysts predict continued market growth amid strong corporate performance.

Meanwhile, Abu Dhabi’s stock index slipped 0.3%, weighed down by losses in adnoc drilling (-1.4%) and Alpha Dhabi (-1.5%).

Stay updated on the latest dubai stock market news, investment trends, and corporate earnings.

Source: Reuters

- [posts_like_dislike id=418]