BitMine Immersion Technologies (BMNR) announced securing $250 million through a private placement of common stock to establish an ether (ETH) treasury. The Las Vegas-based miner is set to become one of...

Read moreminer

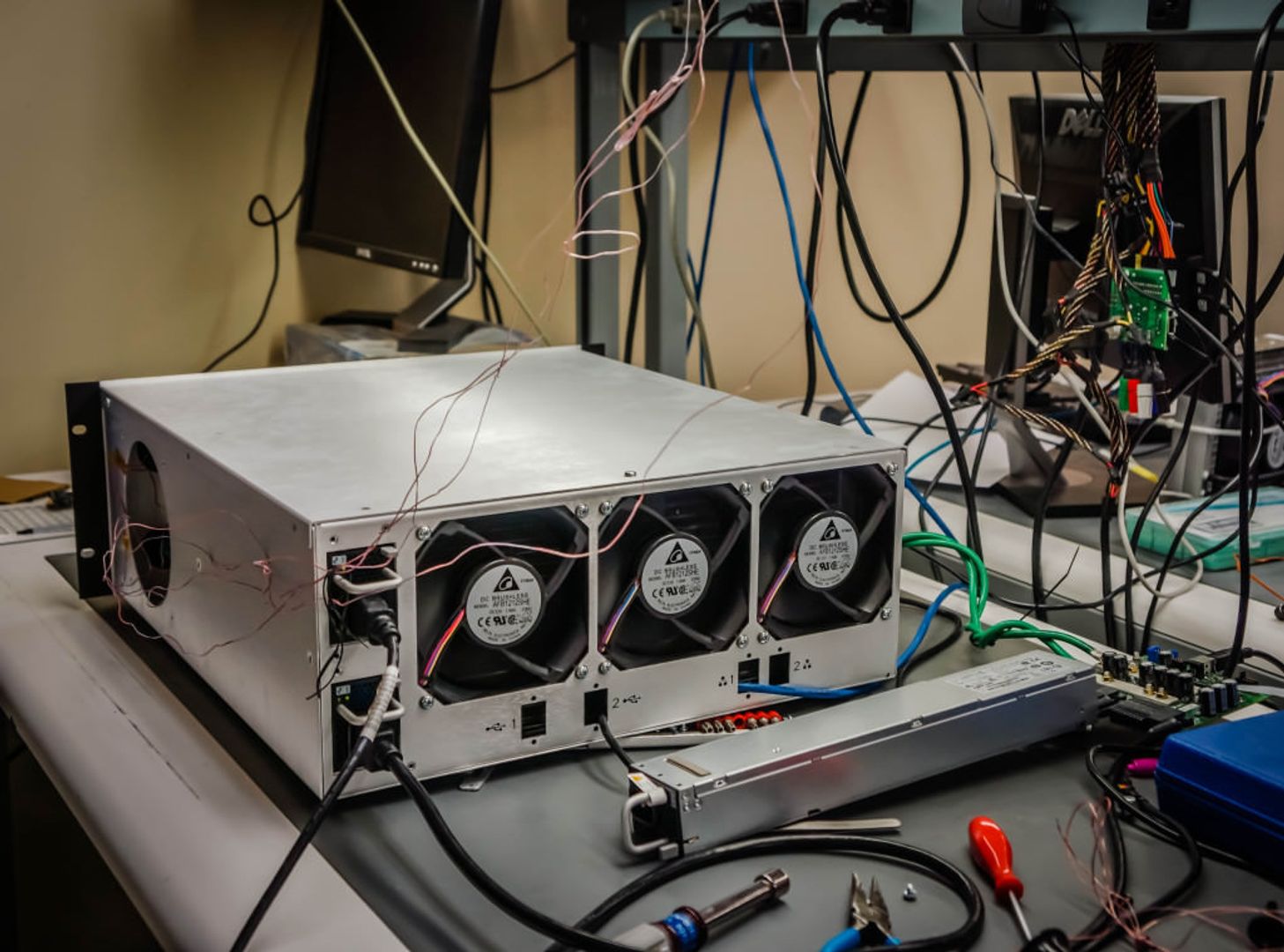

Bitcoin miner revenues have dropped to their lowest levels in two months, but miners are not panicking yet despite the decrease in profitability. Daily mining revenue hit $34 million on June...

Read moreBitcoin miner revenues have dropped to their lowest levels in two months, but miners are not panicking yet despite the decrease in profitability. Daily mining revenue hit $34 million on June 22, the lowest since April, as reported in a recent update from CryptoQuant. This decline is a result of decreasing transaction fees and bitcoin’s price hovering near recent lows, giving miners less incentive to continue operating.

Hashrate has also experienced a 3.5% decline since June 16, the most significant drop in network computing power since July 2024. This reduction indicates the growing pressure on miners, especially after the halving event.

However, despite these challenges, the expected wave of miner capitulation has not materialized. Outflows from miner wallets have been minimal, dropping from 23,000 BTC per day in February to around 6,000 BTC currently. Even wallets linked to early Bitcoin miners have not shown significant activity, with only 150 BTC sold in 2025 compared to almost 10,000 BTC sold in 2024.

Miner reserves are actually increasing, with addresses holding between 100 and 1,000 BTC adding 4,000 BTC since March. This suggests that miners are holding onto their coins, either in anticipation of a price increase or in a strategic move to avoid selling at current prices.

Overall, it seems that miners are taking a long-term approach, potentially waiting for a market rebound. According to CryptoQuant, there is no significant selling pressure from miners at the current price levels.

- [posts_like_dislike id=1255]

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. As Asia begins its trading day, bitcoin BTC is trading above $104,500 and has been relatively flat on the day with negligible market movement despite a possible looming war in the Middle East. Analysts are debating whether the crypto market’s current stillness is a sign of strength or if something more precarious is afoot.

Three new reports this week from CryptoQuant, Glassnode, and trading firm Flowdesk all point to low volatility, tight price action, and subdued on-chain activity. CryptoQuant has issued a warning that BTC could soon revisit $92,000 support or even fall as low as $81,000. Other reports see the same signals and arrive at different conclusions.

In its weekly on-chain update, Glassnode acknowledges that the Bitcoin blockchain is “quiet,” with transaction counts down, fees minimal, and miner revenue subdued. The derivatives market now dwarfs on-chain activity, with futures and options volumes regularly exceeding spot volumes.

Market maker and trading firm Flowdesk describes the market as “coiled.” While altcoin flows are thinning and market-making volumes are flat, there is a surge in tokenized assets and stablecoin growth.

A new report from Presto Research argues that Crypto Treasury Companies (CTCs) are a new form of financial engineering with less risk than many investors assume. Strategy and Metaplanet, two CTCs, have shown that BTC’s volatility can be used to their advantage.

Semler Scientific has unveiled an aggressive bitcoin accumulation roadmap, aiming to own 105,000 BTC by the end of 2027. The California-based medical device maker plans to use a mix of equity raises, debt financing, and operational cash flow to achieve this goal.

Market Movements:

– BTC: Bitcoin remains stuck below $105K despite strong ETF inflows, signs of institutional accumulation offset by short-term bearish momentum and macro volatility.

– ETH: Ethereum found support at $2,490 after a high-volume selloff broke key levels, consolidating in a tight range amid geopolitical tensions and macro uncertainty.

– Gold: Gold hovered near $3,366 on Thursday amid escalating geopolitical tensions; platinum retreated after hitting a near 10-year high.

– Nikkei 225: Japan’s Nikkei 225 opened 0.24% higher Friday as Asia-Pacific markets mostly rose.

Elsewhere in Crypto:

– Visa Expands Stablecoin Reach in Europe, Middle East and Africa

– Why Pro-Israel Group’s $90M Crypto Hack Could Be a Hammer Blow for Iran’s Regime

– Solana Will Flip Ethereum, Anthony Scaramucci Predicts

- [posts_like_dislike id=1205]

The first quarter of 2025 was a standout period for U.S.-listed bitcoin mining companies, according to a research report from Wall Street bank JPMorgan. Four out of the five companies in...

Read moreThe first quarter of 2025 was a standout period for U.S.-listed bitcoin mining companies, according to a research report from Wall Street bank JPMorgan. Four out of the five companies in their coverage reported record revenue and profits. Overall, the miners made a gross profit of approximately $2.0 billion with gross margins reaching 53%, compared to $1.7 billion and 50% in the previous quarter.

MARA Holdings continued its streak as the top bitcoin miner in the bank’s coverage universe for the ninth consecutive quarter. Meanwhile, IREN emerged as the top earner in terms of gross profit for the first time, with the lowest all-in cash cost per coin at around $36,400. In contrast, MARA had the highest cost per coin at approximately $72,600.

The five mining companies tracked by the bank raised only $310 million in equity during the quarter, a significant drop from the previous quarter. CleanSpark did not raise any equity during this period. The bank estimated that the companies collectively spent $1.8 billion on power, an increase of $50 million from the previous quarter.

JPMorgan has an overweight rating on CleanSpark, IREN, and Riot Platforms, and a neutral rating for Cipher Mining and MARA.

This information was originally sourced from a Coindesk article discussing raised price targets for bitcoin miners to reflect improved industry economics.

- [posts_like_dislike id=1171]

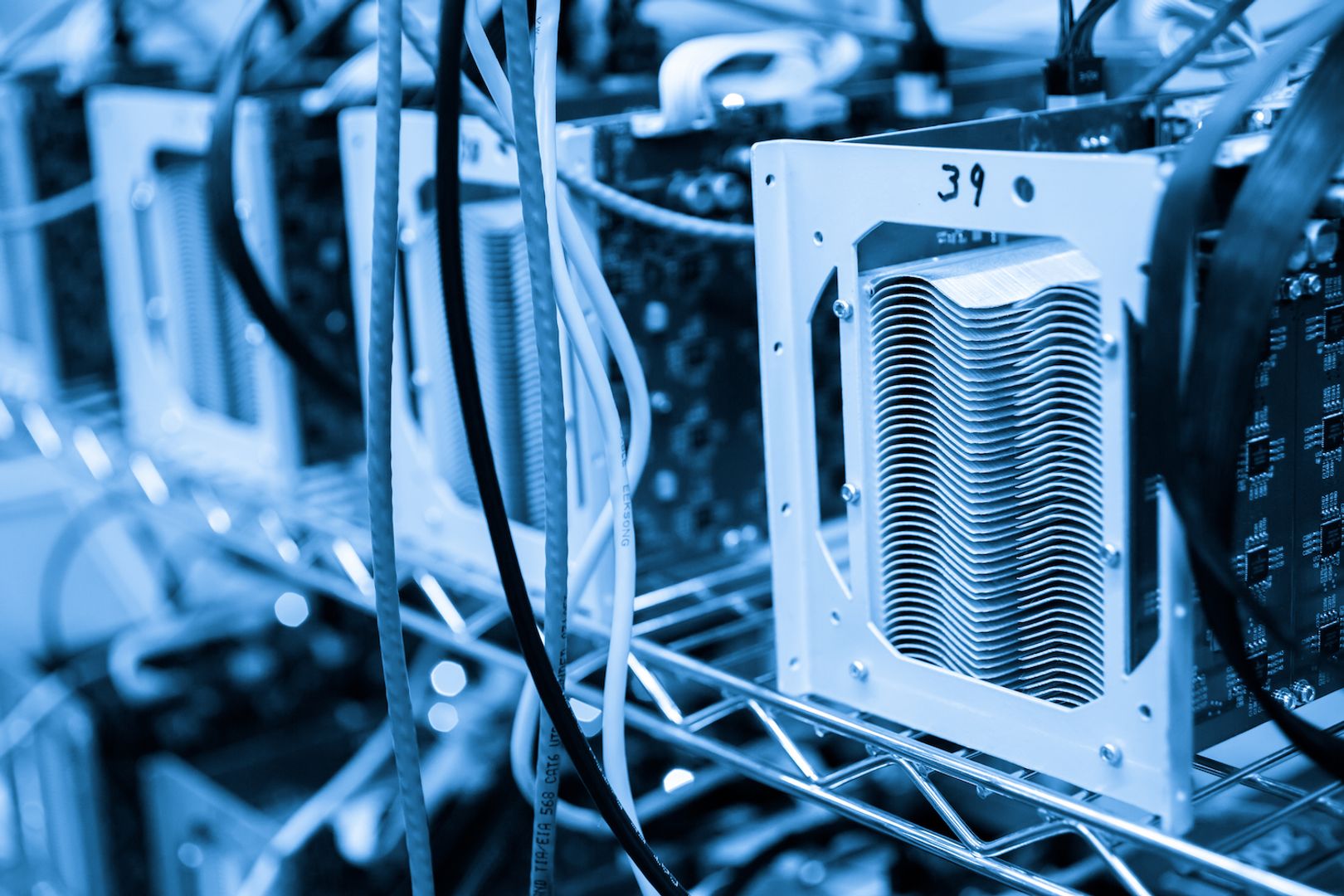

This week, Bitmain, a leading bitcoin BTC rig manufacturer, introduced its newest mining rig, the Antminer S23 Hydro, at the World Digital Mining Summit. Set to hit the market in early...

Read moreThis week, Bitmain, a leading bitcoin BTC rig manufacturer, introduced its newest mining rig, the Antminer S23 Hydro, at the World Digital Mining Summit. Set to hit the market in early 2026, this machine boasts an energy efficiency of 9.7 joules per terahash (J/TH), setting a new standard in mining technology. To put this in perspective, the first bitcoin ASIC miner released in 2013 consumed approximately 1,200 J/TH.

However, the launch of the S23 Hydro comes at a time of upheaval in the mining industry, as noted by analysts at TheMinerMag in a recent report. Historically, major efficiency upgrades were typically rolled out during bearish market conditions, giving miners a competitive edge leading up to bitcoin halving events. This rollout, however, deviates from that pattern as bitcoin recently surged past $100,000, yet miner profitability has not experienced a parallel increase.

The crux of the problem lies in hashprice, according to the analysts. Despite the market rally, hashprice has remained depressed, dropping below $39/PH/s earlier this year. With diminishing profit margins, numerous large mining firms have halted their plans for expanding their hashrate.

Rather than driving network expansion, the Antminer S23 Hydro and similar models may be utilized to upgrade existing mining fleets. This represents a significant shift in approach. As older machines are phased out, the overall energy efficiency of the Bitcoin network could witness an improvement, potentially leading to a reduction in total power consumption – a first in the history of the protocol.

The launch of this new machine signifies a new era where efficiency gains are aimed at surviving in a market with tight profit margins, rather than solely focusing on growth. If hashprice fails to recover to the levels seen prior to the 2024 halving, where it was around $100/PH/s, miners could face greater challenges during future market downturns. While the Antminer S23 Hydro is cutting-edge in terms of technology, the economic landscape it enters is more uncertain than ever before.

- [posts_like_dislike id=1073]

Bitlayer, a Bitcoin Layer 2 platform based on the BitVM paradigm, has teamed up with Antpool, F2Pool, and SpiderPool, three of the world’s largest Bitcoin mining pools. This collaboration marks a...

Read moreBitlayer, a Bitcoin Layer 2 platform based on the BitVM paradigm, has teamed up with Antpool, F2Pool, and SpiderPool, three of the world’s largest Bitcoin mining pools. This collaboration marks a significant step towards enhancing the real-world adoption of BitVM, a revolutionary technology that aims to enable Bitcoin-native DeFi applications.

The Ethereum network has been a frontrunner in the world of Layer 1 blockchains, largely due to its support for Turing-complete smart contracts. In contrast, Bitcoin has struggled to keep pace due to technical constraints. Bitlayer’s BitVM paradigm addresses this issue by providing Bitcoin-equivalent security and Turing completeness without altering Bitcoin’s core protocol.

The partnership with these mining pools is crucial for realizing the vision of BitVM. These pools, which collectively represent over 36% of Bitcoin’s total hashrate, have agreed to support non-standard transactions (NSTs) as part of BitVM’s challenge-response mechanism. This support is essential for accelerating the deployment of BitVM and moving closer to widespread adoption.

NSTs are transactions that comply with Bitcoin’s consensus rules but are not relayed by the default Bitcoin Core software. By agreeing to include NSTs in blocks, Antpool, F2Pool, and SpiderPool will play a vital role in ensuring the integrity of the BitVM Bridge and expanding Bitcoin’s utility in DeFi applications.

The BitVM bridge serves as a secure tool for transferring BTC into various blockchain ecosystems, such as rollups and smart contracts, without relying on centralized intermediaries. This partnership not only benefits Bitlayer but also provides a strategic advantage for miners, who are facing diminishing block rewards.

The CEOs of Antpool, F2Pool, and SpiderPool affirm the potential of BitVM in driving economic activity and generating fees for miners. They acknowledge the importance of supporting innovative projects like Bitlayer to enhance Bitcoin’s capabilities and promote long-term sustainability for the ecosystem.

Bitlayer’s collaboration with major mining pools reflects the growing demand for secure Bitcoin-native DeFi solutions. By expanding partnerships with validators and early adopters, Bitlayer aims to strengthen and broaden the BitVM Bridge, positioning it as a cornerstone of Bitcoin’s future evolution.

- [posts_like_dislike id=1059]

Tags:ADAAIAmericaBinancebitcoinbtcCanadaCoinbaseCryptoDonald TrumpdubaiETHEUFinancegoldGovernmentHealthIranJapanminerMoving AverageS&P 500StocksStrategyTradingtrillionTrumpUSWashington

By Francisco Rodrigues (All times ET unless indicated otherwise) Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets...

Read moreBy Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin BTC surpassed Wednesday’s record to reach an all-time high of $111,875 in the early hours of Thursday, as traditional financial markets contended with rising bond yields and renewed concerns over ballooning U.S. debt.

The largest cryptocurrency has gained around 3.8% in the last 24 hours while the broader CoinDesk 20 CD20 index rose 4.74%, continuing a trend of strength driven by mounting institutional demand and growing interest in crypto exposure.

The rally is unfolding against a backdrop of higher yields on U.S. and Japanese government bonds. The 10-year U.S. Treasury yield rose to 4.6%, while the 30-year topped 5%, driven by concerns over President Donald Trump’s tax bill that analysts estimate could add as much as $5 trillion to the country’s debt, according to Reuters.

In Japan, yields on 30- and 40-year government bonds also hit record highs. The country’s debt-to-GDP ratio stands at 234%, QCP Capital said, and growing scrutiny coupled with weak demand for long-dated JGBs sent yields soaring.

That matters because higher yields — and thus higher returns — on investments that are considered relatively safe tend to lower the appeal of riskier assets like stocks, not to mention cryptocurrencies. While BTC, with its history of trading as a risky asset, hasn’t shown much sign of ebbing demand, it raises the question of how long the rally can continue.

Still, traders have been building large long positions in BTC options, with the most open interest now concentrated at the $110,000, $120,000 and even $300,000 calls for contracts expiring in late June in a sign of continuing bullish conviction.

U.S.-traded spot bitcoin exchange-traded funds have also been seeing significant demand. Total net inflows hit $1.6 billion over the week, and $4.24 billion so far in May, SoSoValue data shows. The inflows, coupled with bitcoin’s price rise, have seen the ETFs’ total net assets hit a record $129 billion.

There are, however, some muted signs of bearish activity.

“The largest block flow this week continues to be ETH December call spreads, while overnight BTC butterfly positions hint that some traders are positioning for consolidation around current levels,” Wintermute OTC trader Jake O. said.

Note, he’s talking about consolidation, not declines. And traditional participants may even be too bearish. While the U.S. endured a recent credit downgrade, markets are now pricing in a 6-level cut all the way down to BBB+.

On top of that, per Jake O., a recent equities market sell-off may not be a result of repositioning given higher bond yields, but rather profit-taking after nine consecutive positive sessions. Stay alert!

What to Watch

Crypto

May 22: Bitcoin Pizza Day.

May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

May 30: The second round of FTX repayments starts.

May 31 (TBC): Mezo mainnet launch.

Macro

Day 3 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

May 22, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail sales data.

May 23, 10 a.m.: The U.S. Census Bureau releases April new single-family homes data.

Earnings (Estimates based on FactSet data)

May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

Governance votes & calls

Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock between DAO decisions and execution so stETH holders can escrow tokens to pause proposals at 1% of TVL or fully block and “rage-quit” at 10%. Voting ends May 28.

Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

May 22: Official Trump to announce its “next Era” on the day of the dinner for its largest holders.

June 10: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.67 million.

June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $182.58 million.

June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.99 million.

June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $16.78 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $61.86 million.

Token Launches

June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

Day 3 of 7: Dutch Blockchain Week (Amsterdam)

Day 3 of 3: Avalanche Summit London

Day 3 of 3: Seamless Middle East Fintech 2025 (Dubai)

Day 2 of 2: Crypto Expo Dubai

Day 2 of 2: Cryptoverse Conference (Warsaw)

May 27-29: Bitcoin 2025 (Las Vegas)

May 27-30: Web Summit Vancouver

May 29: Stablecon (New York)

May 29-30: Litecoin Summit 2025 (Las Vegas)

May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

June 2-7: SXSW London

June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

June 19-21: BTC Prague 2025

Token Talk

By Shaurya Malwa

The HYPE token is in focus after a billion-dollar bitcoin trade boosted Hyperliquid’s fundamentals.

Pseudonymous trader James Wynn opened a $1.1 billion long on BTC using 40x leverage via Hyperliquid in one of the largest on-chain DEX trades ever recorded.

The position, tied to wallet “0x507,” was entered when BTC was priced at $108K and now sits on over $40 million in unrealized profit.

Wynn booked partial profits early Thursday by closing 540 BTC (~$60 million), to net $1.5 million.

His prior exits were followed by BTC declines, so traders are watching closely.

Hyperliquid runs on its custom L1, HyperEVM, using the HyperBFT consensus (200K+ TPS) with CEX-level features like real-time order books and deep liquidity — no KYC required.

The platform’s permissionless design and lightning-fast execution are increasingly drawing capital from centralized venues to DeFi , and this trade could set a precedent for whale activity.

HYPE jumped 15% in the past 24 hours on renewed attention and usage-driven speculation.

Derivatives Positioning

Analyzing the liquidations heatmap of the BTC-USDT pair on Binance, the largest liquidations cluster around $108.5K and $106.9K with liquidations worth $143 million and $112.5 million, respectively.

Meanwhile, the options market swells post-breakout, with open interest on Deribit climbing above $34 billion, just shy of the all-time high of $35.9 billion set in December. The bulk of this positioning is centered on the 30 May expiry, which now holds over $9 billion in notional value to become a key date for potential volatility.

Bullish sentiment is clearly in control, with traders aggressively targeting upside via calls. Strikes at $100K, $120K and $150K have attracted particularly large open interest, reflecting growing conviction in a continued rally.

Put/call ratios underscore this shift in sentiment — the 24-hour volume ratio has dropped to 0.49, while the open interest ratio sits at 0.60, indicating a meaningful tilt toward bullish exposure following BTC’s move above $110K.

Near-term options activity is also picking up, with weekly and monthly contracts seeing notable inflows. Traders appear to be positioning for further momentum or short-term price swings in the wake of the breakout.

Market Movements

BTC is up 1.19% from 4 p.m. ET Wednesday at $110,690.36 (24hrs: +4.05%)

ETH is up 6.19% at $2,662.72 (24hrs: +5.23%)

CoinDesk 20 is up 3.64% at 3,348.63 (24hrs: +4.88%)

Ether CESR Composite Staking Rate is unchanged at 3.03%

BTC funding rate is at 0.03% (10.95% annualized) on Binance

DXY is up 0.25% at 99.81

Gold is down 0.26% at $3,305.6/oz

Silver is down 0.83% at $33.17/oz

Nikkei 225 closed -0.84% at 36,985.87

Hang Seng closed -1.19% at 23,544.31

FTSE is down 0.68% at 8,726.62

Euro Stoxx 50 is down 0.96% at 5,402.31

DJIA closed on Wednesday -0.91% at 41,860.44

S&P 500 closed -1.61% at 5,844.61

Nasdaq closed -1.41% at 18,872.64

S&P/TSX Composite Index closed -0.83% at 25,839.17

S&P 40 Latin America closed -1.31% at 2,597.38

U.S. 10-year Treasury rate is down 2 bps at 4.58%

E-mini S&P 500 futures are unchanged at 5,865.50

E-mini Nasdaq-100 futures are up 0.15% at 21,188.50

E-mini Dow Jones Industrial Average Index futures are down 0.17% at 41,875.00

Bitcoin Stats:

BTC Dominance: 63.90 (-0.62%)

Ethereum to bitcoin ratio: 0.02409 (3.52%)

Hashrate (seven-day moving average): 875 EH/s

Hashprice (spot): $58.24

Total Fees: 7.89 BTC / $847,124

CME Futures Open Interest: 160,740 BTC

BTC priced in gold: 33.4 oz

BTC vs gold market cap: 9.47%

Technical Analysis

Bitcoin reached a new all-time high of $111,875 this morning, breaking decisively above the previous peak just above $109,000 set in January.

With a confirmed close above that level and no sign of a swing failure pattern, the bias remains firmly tilted toward continued upside. In the near term, BTC may encounter resistance around the $112,000–$113,000 range, aligning with a trendline drawn from the prior highs in December and January.

However, last week’s consolidation above $100,000 — and the successful reclaim of the previous all-time high — suggest this area is now acting as short-term support.

A pullback below $100,000, especially into the weekly order block, would likely represent a healthy correction within the broader uptrend and could offer a compelling reentry opportunity if further downside is seen.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $402.69 (-3.41%), up 1.73% at $409.67 in pre-market

Coinbase Global (COIN): closed at $258.99 (-0.91%), up 2.78% at $266.20

Galaxy Digital Holdings (GLXY): closed at C$31 (+1.57%)

MARA Holdings (MARA): closed at $15.84 (-2.16%), up 4.42% at $16.54

Riot Platforms (RIOT): closed at $8.84 (-1.01%), up 3.39% at $9.14

Core Scientific (CORZ): closed at $10.78 (-1.28%), up 1.48% at $10.94

CleanSpark (CLSK): closed at $10.11 (+4.23%), up 4.65% at $10.58

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.75 (-1.33%)

Semler Scientific (SMLR): closed at $44.89 (+7.19%), up 6.01% at $47.59

Exodus Movement (EXOD): closed at $32.76 (-5.07%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $607.1 million

Cumulative net flows: $43.35 billion

Total BTC holdings ~ 1.19 million

Spot ETH ETFs

Daily net flow: $0.6 million

Cumulative net flows: $2.61 billion

Total ETH holdings ~ 3.49 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Top 20 digital assets’ prices and volumes

Chart of the day

Bitcoin adoption

- [posts_like_dislike id=1033]

VanEck recently obtained approval from the U.S. Securities and Exchange Commission (SEC) to launch an actively-managed exchange-traded fund (ETF) that will track digital asset stocks. The VanEck Onchain Economy ETF (NODE)...

Read moreVanEck recently obtained approval from the U.S. Securities and Exchange Commission (SEC) to launch an actively-managed exchange-traded fund (ETF) that will track digital asset stocks.

The VanEck Onchain Economy ETF (NODE) is set to hold between 30-60 stocks, with a management fee of 0.69%, according to Matthew Sigel, VanEck’s head of digital asset research. The included stocks will cover a range of sectors including crypto exchanges, miners, data centers, energy infrastructure, semiconductors, hardware, TradFi rails, consumer/gaming, asset managers, and “balance sheet HOLDERS.” Additionally, up to 25% of NODE’s exposure will be in crypto exchange-traded products (ETPs).

Sigel stated, “The global economy is shifting to a digital foundation. NODE offers active equity exposure to the real businesses building that future.”

The ETF is scheduled to start trading on May 14th and will utilize an offshore subsidiary in the Cayman Islands to indirectly access products like commodity futures, swaps, and pooled investment vehicles while adhering to U.S. federal tax regulations.

With an increasing number of crypto-related stocks hitting the market and various companies exploring going public this year, there is a growing demand among investors for exposure to crypto-related stocks. A survey conducted among financial advisors at an ETF conference in March revealed that crypto equity ETFs are a top interest for investment.

- [posts_like_dislike id=845]

Tags:ADAAIAmericaAppleBinancebitcoinbtcCanadaCoinbaseCommunicationCryptodubaiETHEUFinancegoldJapanminerMoving AverageRobinhoodS&P 500solanaStrategyTeslaTradingTrumpUSXRP

By [Your Name] (All times ET unless indicated otherwise) Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its...

Read moreBy [Your Name] (All times ET unless indicated otherwise)

Bitcoin (BTC) continues to defy global economic uncertainty, inching closer to reclaiming $86,000. It is now less than 3% away from its “Liberation Day” high. To put the move into perspective, bitcoin dominance — which measures BTC’s share of the total cryptocurrency market cap — is approaching 64%, a level not seen since January 2021.

In contrast, the Nasdaq 100 is still 5% away from its own Liberation Day high, underscoring bitcoin’s relative strength versus U.S. equities.

According to X account Cheddar Flow, the S&P 500 has just formed a “death cross” — a traditionally bearish signal that occurs when the 50-day moving average falls below the 200-day moving average. The last time this happened was March 15, 2022, when S&P 500 initially rose by 11% in the following week, only to be followed by a 20% decline. Bearish sentiment is also reflected in the options market, where investors are reportedly buying large volumes of NVDA puts, signaling expectations of lower prices.

In a Bloomberg interview on Monday, Treasury Secretary Scott Bessent reaffirmed confidence in the U.S. bond market, dismissing concerns that foreign nations are dumping Treasuries.

“I am not seeing a dumping of U.S. Treasuries,” Bessent said. “The Treasury has lots of tools, but we’re a long way from needing them.” He also emphasized the enduring status of the U.S. dollar as the world’s reserve currency, despite the DXY index — which measures the dollar’s value against a basket of major trading partners — falling below 100 and dropping over 10% in recent weeks.

Bessent also confirmed that the Trump administration is seeking a new Federal Reserve Chair to replace Jerome Powell, with interviews set to begin later in the year. He concluded the interview by suggesting that the VIX (S&P 500 volatility index) may have peaked after the largest one-day percentage drop in its history last week. Stay alert!

What to Watch:

Crypto:

April 15: The first SmarDEX (SDEX) halving means the SDEX token’s distribution will be cut by 50% for the next 12 months.

April 16: HashKey Chain (HSK) mainnet upgrade enhances network stability and fee control capabilities.

April 17: EigenLayer (EIGEN) activates slashing on Ethereum mainnet, enforcing penalties for operator misconduct.

April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing block rewards to 15,625 PEP per block.

April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

April 21: Coinbase Derivatives will list XRP futures pending approval by the Commodity Futures Trading Commission (CFTC).

Macro:

April 15, 8:30 a.m.: Statistics Canada releases March consumer price inflation data.

Core Inflation Rate MoM Prev. 0.7%

Core Inflation Rate YoY Prev. 2.7%

Inflation Rate MoM Est. 0.6% vs. Prev. 1.1%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.6%

April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail sales data.

Retail Sales MoM Est. 1.4% vs. Prev. 0.2%

Retail Sales YoY Prev. 3.1%

April 16, 9:45 a.m.: Bank of Canada releases its latest interest rate decision, followed by a press conference 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

April 16, 1:30 p.m.: Fed Chair Jerome H. Powell will deliver an “Economic Outlook” speech. Livestream link.

April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential construction data.

Housing Starts Est. 1.42M vs. Prev. 1.501M

Housing Starts MoM Prev. 11.2%

April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 12.

Initial Jobless Claims Est. 226K vs. Prev. 223K

April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March consumer price index (CPI) data.

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

Inflation Rate MoM Prev. -0.1%

Inflation Rate YoY Prev. 3.7%

Earnings (Estimates based on FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events:

Governance votes & calls

Venus DAO is discussing the forced liquidation of the remaining debt owed by a BNB bridge exploiter account that “supplied extraneously minted BNB to Venus and generated an over-collateralized debt position.”

Aave DAO is discussing taking further steps to deprecate Synthetix’s sUSD on Aave V3 Optimism over technical developments that have “compromised its ability to consistently maintain its peg.”

GMX DAO is discussing the establishment of a GMX reserve on Solana, which would involve bridging $500,000 in GMX to the blockchain and transferring the funds to the GMX-Solana Treasury.

Treasure DAO is discussing handing the core contributor team the authority to wind down and close the Treasure Chain infrastructure on ZKsync and manage the primary MAGIC-ETH protocol-owned liquidity pool given the “crucial financial situation” of the protocol.

April 15, 10 a.m.: Injective to hold an X Spaces session with Guardian.

April 16, 7 a.m.: Aergo to host an Ask Me Anything (AMA) session on the future of decentralized artificial intelligence and the project.

April 16, 3 p.m.: Zcash to host a Town Hall on LockBox Distribution & Governance.

Unlocks

April 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $10.08 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $27.17 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating supply worth $325.97 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $82.60 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating supply worth $18.29 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating supply worth $10.07 million.

Token Launches

April 15: WalletConnect Token (WCT) to be listed on Binance, Bitget, AscendEX, BingX, BYDFi, LBank, Coinlist and others.

April 16: Badger (BADGER), Balacner (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT) and aelf (ELF) to be delisted from Binance.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Day 2 of 3: Morocco WEB3FEST GITEX Edition (Marrakech)

April 15: Strategic Bitcoin Reserve Summit (online)

Day 1 of 2: BUIDL Asia 2025 (Seoul)

Day 1 of 2: World Financial Innovation Series 2025 (Hanoi, Vietnam)

Day 1 of 3: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

Token Talk

Story Protocol’s IP tokens experienced a 20% drop and recovery within hours during an unusual trading session on Monday.

Trading volume surged on exchanges including Binance and OKX Spot, with $138 million recorded after the price rebound.

The sudden price movement was isolated from broader market trends, sparking speculation about insider activity or coordinated selling.

Also on Monday, MANTRA’s OM token plummeted over 90% in hours, dropping from around $6.30 to as low as 37 cents and wiping out over $5 billion in market capitalization.

The token has since rebounded slightly to trade around 63 cents.

Laser Digital, a Nomura-backed investor, was initially flagged for depositing $41 million in OM to OKX, but the company denied selling, clarifying it was collateral return from a financing trade. Shorooq Investors also denied selling.

Derivatives Positioning

BTC shorts have been liquidated on most exchanges in the past 24 hours, excluding BitMEX and Gate.io, according to Coinglass. The opposite is the case in ETH.

XRP’s perpetual futures open interest has dropped from 544.7 million XRP to 480 million XRP, diverging from the price recovery seen since Monday last week.

SUI, ONDO, ADA and APT have seen a notable increase in futures open interest in the past 24 hours. Of those, XMR is the only one with the positive OI-adjusted cumulative volume delta, representing net buying pressure.

On Deribit, short-dated BTC and ETH options continue to show a bias for protective puts, suggesting cautious sentiment.

Flows on OTC desk Paradigm have been mixed with both calls and puts bought in the April expiry.

Market Movements:

BTC is up 1.19% from 4 p.m. ET Monday at $85,877.18 (24hrs: +1.35%)

ETH is up 0.59% at $1,645.30 (24hrs: -1.97%)

CoinDesk 20 is up 0.99% at 2,519.69 (24hrs: +0.19%)

Ether CESR Composite Staking Rate is up 18 bps at 3.18%

BTC funding rate is at 0.0184% (6.7003% annualized) on Binance

DXY is unchanged at 99.70

Gold is up 1.26% at $3,245.30/oz

Silver is up 0.81% at $32.35/oz

Nikkei 225 closed +0.84% at 34,267.54

Hang Seng closed +0.23% at 21,466.27

FTSE is up 0.92% at 8,209.04

Euro Stoxx 50 is up 0.82% at 4,951.51

DJIA closed on Tuesday +0.78% at 40,524.79

S&P 500 closed +0.79% at 5,405.97

Nasdaq closed +0.64% at 16,831.48

S&P/TSX Composite Index closed +1.18% at 23,866.50

S&P 40 Latin America closed +1.8% at 2,340.02

U.S. 10-year Treasury rate is up 1 bp at 4.39%

E-mini S&P 500 futures are up 0.12% at 5,447.25

E-mini Nasdaq-100 futures are up 0.26% at 18,983.25

E-mini Dow Jones Industrial Average Index futures are unchanged at 40,750.00

Bitcoin Stats:

BTC Dominance: 63.80 (0.16%)

Ethereum to bitcoin ratio: 0.01913 (-0.31%)

Hashrate (seven-day moving average): 896 EH/s

Hashprice (spot): $44.1 PH/s

Total Fees: 6.33 BTC / $536,017

CME Futures Open Interest: 134,730

BTC priced in gold: 26.6 oz

BTC vs gold market cap: 7.56%

Technical Analysis

On Monday, the bitcoin cash-bitcoin (BCH/BTC) ratio failed to penetrate the trendline characterizing the 12-month bear market.

A potential move above the trendline could see breakout traders join the market, lifting BCH higher.

Crypto Equities

Strategy (MSTR): closed on Monday at $311.45 (+3.82%), up 0.62% at $313.38 in pre-market

Coinbase Global (COIN): closed at $176.58 (+0.62%), up 1.28% at $178.84

Galaxy Digital Holdings (GLXY): closed at C$15.81 (+3.47%)

MARA Holdings (MARA): closed at $12.95 (+3.52%), up 1.24% at $13.11

Riot Platforms (RIOT): closed at $7.01 (-0.71%), up 0.71% at $7.06

Core Scientific (CORZ): closed at $7.06 (-0.14%)

CleanSpark (CLSK): closed at $7.78 (+3.73%), up 1.29% at $7.88

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.70 (+1.44%), up 1.44% at $12.90

Semler Scientific (SMLR): closed at $34.26 (+1.48%)

Exodus Movement (EXOD): closed at $39.43 (-10.55%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: $1.5 million

Cumulative net flows: $35.46 billion

Total BTC holdings ~1.11 million

Spot ETH ETFs

Daily net flow: -$6 million

Cumulative net flows: $2.28 billion

Total ETH holdings ~3.36 million

Source: Farside Investors

Overnight Flows

Chart of the Day Personalized: Disney’s Bob Iger to exit Apple’s board

In the Ether

**Insert interesting content about current events, stories, etc. in the crypto world**

That’s all for now, stay in-the-know with The Parrot Press for the latest updates and insights on the dynamic world of cryptocurrencies and finance!

- [posts_like_dislike id=821]

I first discovered Bitcoin in 2012 while studying at UT Austin. With interests in Austrian economics and open-source software, I was captivated by bitcoin as the intersection of both. I became...

Read moreI first discovered Bitcoin in 2012 while studying at UT Austin. With interests in Austrian economics and open-source software, I was captivated by bitcoin as the intersection of both. I became an early thought leader, co-founding the Satoshi Nakamoto Institute to house foundational writings and cypherpunk philosophy.

Throughout my roles at BitPay, Kraken, and most recently Riot Platforms (RIOT), my work has spanned bitcoin infrastructure and advocacy. At Riot, I led responses to environmental criticisms, including a viral parody video that put the critics on the defensive and reframed the debate around mining and value creation.

Now, with The Bitcoin Bond Company, I am taking on the next frontier: unlocking bitcoin for fixed-income investors.

Unlike Michael Saylor’s long-only strategy, I want to build bankruptcy-remote, bitcoin-only structures with clear life-cycles and risk-tranching. The idea is to make Bitcoin more palatable to traditional credit allocators.

My goal? Acquire $1 trillion in bitcoin over the next 21 years — market conditions permitting.

On the price cycle, I believe the four-year halving model is losing relevance for price prediction purposes. Bitcoin’s CAGR is now tied to interest rates, noting its shift toward becoming a global macro asset. Higher Fed rates pull capital out of Bitcoin — that’s what slows adoption.

While education remains a major hurdle, I’m optimistic. Ten years ago, this idea was laughed off. Today, Bitcoin-backed credit products are inevitable.

At Consensus 2025, I am focused on accelerating that education, especially among institutions looking to diversify beyond real estate and equities.

I am also clear-eyed about the risks and hurdles in bitcoin adoption. The biggest challenge is education. Most investors have never seen a fixed-income product backed purely by bitcoin. They’re used to real estate or corporate debt — this is a new asset class for them.

When asked about concerns like low transaction fees or empty blocks in 2025, I pushed back. People worry about low fees, but that assumes a static system. If there’s ever an attack or censorship, fees skyrocket — and miners spin up. It’s anti-fragile by design.

Ultimately, my pitch is simple: Bitcoin is no longer a fringe experiment. It’s a core monetary technology — and it’s time the credit markets caught up.

- [posts_like_dislike id=777]