Shares of cryptocurrency exchange Coinbase (COIN) surged to their highest level since its debut on the Nasdaq in April 2021 on Thursday, nearly recovering from a more than 90% drop during...

Read moreTariffs

Tags:AIbitcoinbtcCircleCoinbaseCryptoDonald TrumpETHEUFinancegoldIranIsraelJapanmemecoinS&P 500solanaTariffsTradingtrillionTrumpUSUSDCXRP

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and...

Read moreGood Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis.

South Korea has long been known for its outsized influence on altcoin markets, from the XRP mania that drove a 400% rally last year to the present-day obsession with a token that proudly calls itself USELESS.

The USELESS phenomenon has ties to South Korean KOLs, Bradley Park, a Seoul-based analyst with DNTV Research, shared in an interview.

At the center of everything is Yeomyung, a Korean KOL and liquidity provider who aped into USELESS early, held through a 50% drawdown, and is now sitting on serious paper gains.

Park noted that his early conviction has inspired copy-trading among Korean retail investors. Even wallets tied to insiders on Solana’s Jupiter JUP are holding. The rise of USELESS reflects a broader evolution in Korean market behavior.

Another character in this story is Bonk Guy, an early promoter of BONK, who reappeared to tweet enthusiastically about USELESS after the price rebounded, though some Korean traders, including Park, have questioned his sincerity.

Park pointed to the rise of Hyperliquid, Kaia, and now Solana-based memecoins like USELESS as evidence that Korea is no longer a secondary market.

While XRP’s rally was underpinned by legal clarity in the U.S., USELESS feels like a reflection of where attention and exhaustion are flowing in today’s market, Park said.

With no roadmap, no utility, and no pretense of building something bigger, it taps into a kind of memetic disillusionment: a collective shrug at traditional crypto promises, and an ironic bet on nothingness that appears to be more honest than many tokens claiming to change the world.

Trump Endorses GENIUS Act

President Donald Trump on Tuesday endorsed the GENIUS Act in a Truth Social post following its bipartisan passage in the Senate, calling it a major step toward U.S. leadership in the digital asset sector.

Trump urged the House of Representatives to pass the bill “lightning fast” and without amendments, stating it should be sent to his desk with “no delays, no add-ons.”

The message signals strong executive support for the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which introduces reserve and compliance requirements for dollar-backed stablecoin issuers.

Trump framed the legislation as key to enabling “massive investment” and “big innovation,” positioning the U.S. as a global leader in digital assets.

While the bill passed the Senate with significant bipartisan backing, its fate in the House remains uncertain.

Democratic lawmakers are weighing potential amendments, including stricter oversight for foreign-issued tokens and limitations on potential issuers.

However, the bill isn’t without its critics. In a recent CoinDesk editorial, Georgetown University finance professor James J. Angel argues that the GENIUS Act is a flawed piece of legislation.

News Roundup: Coinbase Unveils Coinbase Payments for Merchants

Coinbase unveiled Coinbase Payments on Wednesday, a new merchant-focused payments stack built on its Ethereum layer-2 network Base.

The product allows global ecommerce platforms like Shopify to accept USDC 24/7 without needing blockchain expertise, using tools like a gasless stablecoin checkout, an ecommerce API engine, and an onchain payments protocol.

Coinbase said the system is designed to replicate traditional payment rails while lowering costs and offering always-on settlement.

It also deepens its partnership with USDC issuer Circle, whose shares jumped 25% on the news, while Coinbase rallied 16%.

Coinbase says stablecoins processed $30 trillion in transactions last year, tripling from the year prior.

Market Movements:

- BTC: Bitcoin rebounded above $105,000 in a V-shaped recovery despite escalating Israel-Iran tensions, with strong ETF inflows and key support at $103,650 highlighting institutional confidence amid market volatility.

- ETH: Ethereum rebounded 4% to hold above $2,500 despite Middle East tensions, with record-high staking and accumulation signaling growing investor conviction amid market volatility.

- Gold: Gold slipped 0.19% to $3,383.11 after the Fed held rates steady at 4.25–4.5%, with Chair Powell signaling no imminent policy changes and emphasizing continued economic strength despite trade tensions.

- Nikkei 225: Japan’s Nikkei 225 slipped 0.27% on Thursday as Asia-Pacific markets traded mixed, weighed down by the Fed’s rate pause and ongoing Israel-Iran tensions.

- S&P 500: The S&P 500 dipped 0.03% to 5,980.87 after the Fed held rates steady, with Chair Powell signaling a wait-and-see approach amid uncertainty over Trump’s tariffs.

Elsewhere in Crypto:

- Crypto doesn’t have to be a market for lemons

- Are Criminals Really Switching From Crypto to Gold for Money Laundering?

- UK to Propose Restrictions on How Banks Can Deal With Crypto Next Year

- [posts_like_dislike id=1199]

Tags:AIAmericaBinancebitcoinBlackrockbtcCoinbaseCryptoElon MuskETHEUEuropeFinancegoldJapanMicrostrategyStrategyTariffsTradingTrumpUSWashington

The recent TACO tease, implying “Trump Always Chickens Out” on tariffs, likely didn’t go down well with the President, who raised the stakes in the ongoing trade war on Friday, leading...

Read moreThe recent TACO tease, implying “Trump Always Chickens Out” on tariffs, likely didn’t go down well with the President, who raised the stakes in the ongoing trade war on Friday, leading to broad-based risk aversion.

On Friday, Trump said that on June 4, the U.S. tariffs on imported aluminum and steel would go from 25% to 50%, triggering a broad-based risk-off move across global markets. Bitcoin has since traded in the range of $103,000-$106,000, with little to no excitement in the broader crypto market. Notably, BlackRock’s spot bitcoin ETF (IBIT) registered an outflow of $430 million, ending a prolonged inflows streak.

“Tariff tensions will likely dominate the macro narrative through June, with meaningful policy deadlines only kicking in from 8 July. In the absence of fresh catalysts, BTC could remain rangebound, with the $100k and $110k levels critical to watch given their status as strikes with the highest month-end open interest,” Singapore-based trading firm QCP Capital said.

ETFs are becoming increasingly important to the market. Data shared by FalconX’s David Lawant shows that the cumulative trading volume in the 11 spot BTC ETFs listed in the U.S. is now well over 40% of the spot volume. The data supports the “Bitcoin ETFs are the new marginal buyer” hypothesis, according to Bitwise’s Head of Research – Europe, Andre Dragosch.

Meanwhile, on-chain data tracked by Glassnode showed a drop in momentum buyers alongside a sharp rise in profit takers last week. “This trend often shows near local tops, as traders begin locking in gains instead of building exposure,” Glassnode said.

High-stakes crypto trader James Wynn opened a fresh BTC long trade with 40x leverage and a liquidation price of $104,580, according to blockchain sleuth Lookonchain.

In other news, Japan’s “MicroStrategy” Metaplanet announced an additional purchase of 1,088 BTC, and billionaire entrepreneur Elon Musk announced a new XChat with Bitcoin-like encryption.

Binance’s founder CZ said on X that now might be a good time to develop a dark pool-style perpetual-focused decentralized exchange, noting that real-time order visibility can lead to MEV attacks and malicious liquidations.

In traditional markets, gold looked to break out of its recent consolidation, hinting at the next leg higher as Bank of America and Morgan Stanley forecast continued dollar weakness. Friday’s U.S. nonfarm payrolls release will be closely watched for signs of labor market weakness. Stay Alert!

What to Watch

Crypto

June 3, 1 p.m.: The Shannon hard fork network upgrade will get activated on the Pocket Network (POKT).

June 4, 10 a.m.: U.S. House Financial Services Committee will hold a hearing on “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

June 6: Sia (SC) is set to activate Phase 1 of its V2 hard fork, the largest upgrade in the project’s history. Phase 2 will get activated on July 6.

June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable on “DeFi and the American Spirit”

June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto market structure bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

Macro

June 2, 1 p.m.: Federal Reserve Chair Jerome H. Powell will deliver a speech at the Federal Reserve Board’s International Finance Division 75th Anniversary Conference in Washington. Livestream link.

June 2, 9:45 a.m.: S&P Global releases (Final) May U.S. Manufacturing PMI data. Manufacturing PMI Est. 52.3 vs. Prev. 50.2

June 2, 10 a.m.: The Institute for Supply Management (ISM) releases May Manufacturing PMI. Manufacturing PMI Est. 49.5 vs. Prev. 48.7

June 3: South Koreans will vote to choose a new president following the ouster of Yoon Suk Yeol, who was dismissed after briefly declaring martial law in December 2024.

June 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labor market data. Job Openings Est. 7.10M vs. Prev. 7.192M Job Quits Prev. 3.332M

June 3, 1 p.m.: Federal Reserve Governor Lisa D. Cook will deliver a speech on economic outlook at the Peter McColough Series on International Economics in New York. Livestream link.

June 4, 12:01 a.m.: U.S. tariffs on imported steel and aluminum will increase from 25% to 50%, according to a Friday evening Truth Social post by President Trump.

Earnings (Estimates based on FactSet data)

None in the near future.

Token Events

Governance votes & calls

Sui DAO is voting on moving to recover approximately $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 and Unichain support in Oku. The goal is to expand V4 adoption, support hook developers, and improve tools for LPs and traders. Voting ends June 6.

June 4, 6:30 p.m.: Synthetix to host a community call.

June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

Unlocks

June 5: Ethena (ENA) to unlock 0.7% of its circulating supply worth $14.18 million.

June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $57.11 million.

June 13: Immutable (IMX) to unlock 1.33% of its circulating supply worth $13.24 million.

June 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $17.11 million.

June 15: Sei (SEI) to unlock 1.04% of its circulating supply worth $10.64 million.

Token Launches

June 3: Bondex (BDXN) to be listed on Binance, Bybit, Coinlist, and others.

June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN).

Conferences

Day 1 of 6: SXSW London

June 3: World Computer Summit 2025 (Zurich)

June 3-5: Money20/20 Europe 2025 (Amsterdam)

June 4-6: Non Fungible Conference (Lisbon)

June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

June 19-21: BTC Prague 2025

June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

June 26-27: Istanbul Blockchain Week

Token Talk

While You Were Sleeping

In the Ether

Derivatives Positioning

Market Movements

Bitcoin Stats

Technical Analysis

Crypto Equities

ETF Flows

Overnight Flows

Chart of the Day

Bitcoin Stats

- [posts_like_dislike id=1095]

By SEO Writer for The Parrot Press Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news...

Read moreBy SEO Writer for The Parrot Press

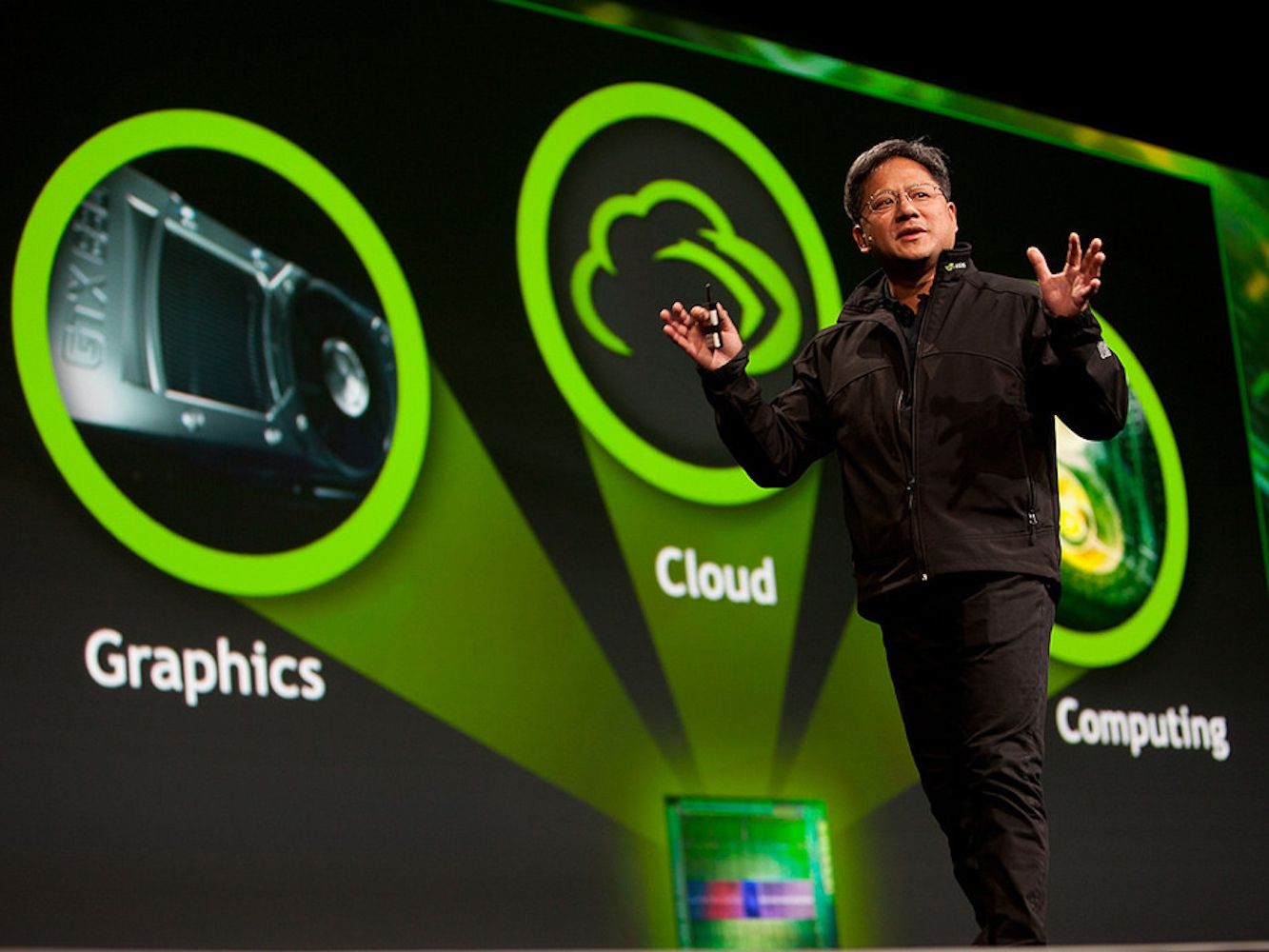

Bitcoin saw a rise and stock index futures surged early on Thursday after a U.S. court invalidated President Donald Trump’s broad-based tariffs. This news was followed by Nvidia’s upbeat earnings report, boosting positive sentiment in the market.

Large Bitcoin wallets holding over 10,000 BTC have transitioned to selling from buying as the cryptocurrency nears its all-time high. Additionally, an increase in exchange deposits indicates selling pressure. The options market data hints at potential volatility leading up to Friday’s monthly settlement.

Ether, the second-largest cryptocurrency by market value, surged to $2,780, its highest level since February 24, supported by bullish signals from the derivatives market. The rise in the token’s price this week is attributed to SharpLink’s $425 million Treasury plan. Notably, U.S.-listed spot ether ETFs saw a net inflow of $84.89 million on Wednesday for the eighth consecutive day.

Canada-listed investment firm Sol Strategies has filed to raise up to $1 billion to boost its investment in the Solana ecosystem. Despite this, SOL remained flat at around $170.

In other news, TON, PEPE, and FLOKI led the market while FARTCOIN, PI, and JUP experienced the most losses. Open interest in TON perpetual futures surged by 33% to $190 million, reaching its highest level since February 18.

Stablecoin issuer Circle froze wallets connected to the Libra token containing millions in USDC. Metaplanet issued $21 million in bonds to finance more Bitcoin purchases.

In traditional markets, some investment banks suggested that Trump has alternative tools to bypass the court ruling on tariffs. Yields on longer-duration Treasury notes increased, indicating strength in the dollar. Stay tuned for more updates!

What to Watch:

Crypto:

– May 30: The second round of FTX repayments start.

– May 31 (TBC): Mezo mainnet launch.

– June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable on “DeFi and the American Spirit”

Macro:

– Various economic releases and announcements scheduled for May 29-30.

Earnings:

– No significant earnings events in the near future.

Token Events:

Governance votes & calls:

– Various upcoming votes and calls for different tokens and platforms.

Unlocks:

– Schedule of upcoming token unlocks.

Token Launches:

– Information on upcoming token launches and deadlines.

Conferences:

– List of upcoming conferences and summits in the crypto and blockchain space.

Token Talk: An overview of major events and news in the token market.

Derivatives Positioning: Analysis of derivatives positions in the market.

Market Movements: Highlights of major market movements and performances.

Bitcoin Stats: Statistical data related to Bitcoin.

Technical Analysis: Insights into technical analysis of market trends.

Crypto Equities: Updates on crypto-related equities and their performance.

ETF Flows: Information on ETF flows related to Bitcoin and Ethereum.

Overnight Flows: Updates on overnight market movements and performance.

Chart of the Day: Featured chart highlighting market trends.

While You Were Sleeping: Summary of overnight news and developments.

In the Ether: A series of images illustrating various aspects of the cryptocurrency market.

- [posts_like_dislike id=1071]

Bitcoin (BTC) approached $100,000 on Thursday, as major cryptocurrencies like dogecoin (DOGE) and Cardano’s ADA led gains in the crypto market. This surge was supported by dovish signals from the Federal...

Read moreBitcoin (BTC) approached $100,000 on Thursday, as major cryptocurrencies like dogecoin (DOGE) and Cardano’s ADA led gains in the crypto market. This surge was supported by dovish signals from the Federal Reserve and hints of a pending trade deal from U.S. President Donald Trump.

DOGE rose by 5% and ADA saw a 4% jump, while ether (ETH), BNB Chain’s BNB, XRP, and Solana’s SOL increased by 2%-3%. The CoinDesk 20, which tracks the largest tokens, rose by 2.2%.

President Trump teased a “big” trade deal with a “highly respected country” in a social media post on Wednesday. Market analysts speculate that this deal with the U.K. could mark the beginning of several trade agreements, potentially easing the uncertainty created by tariffs and boosting risk appetite in global markets.

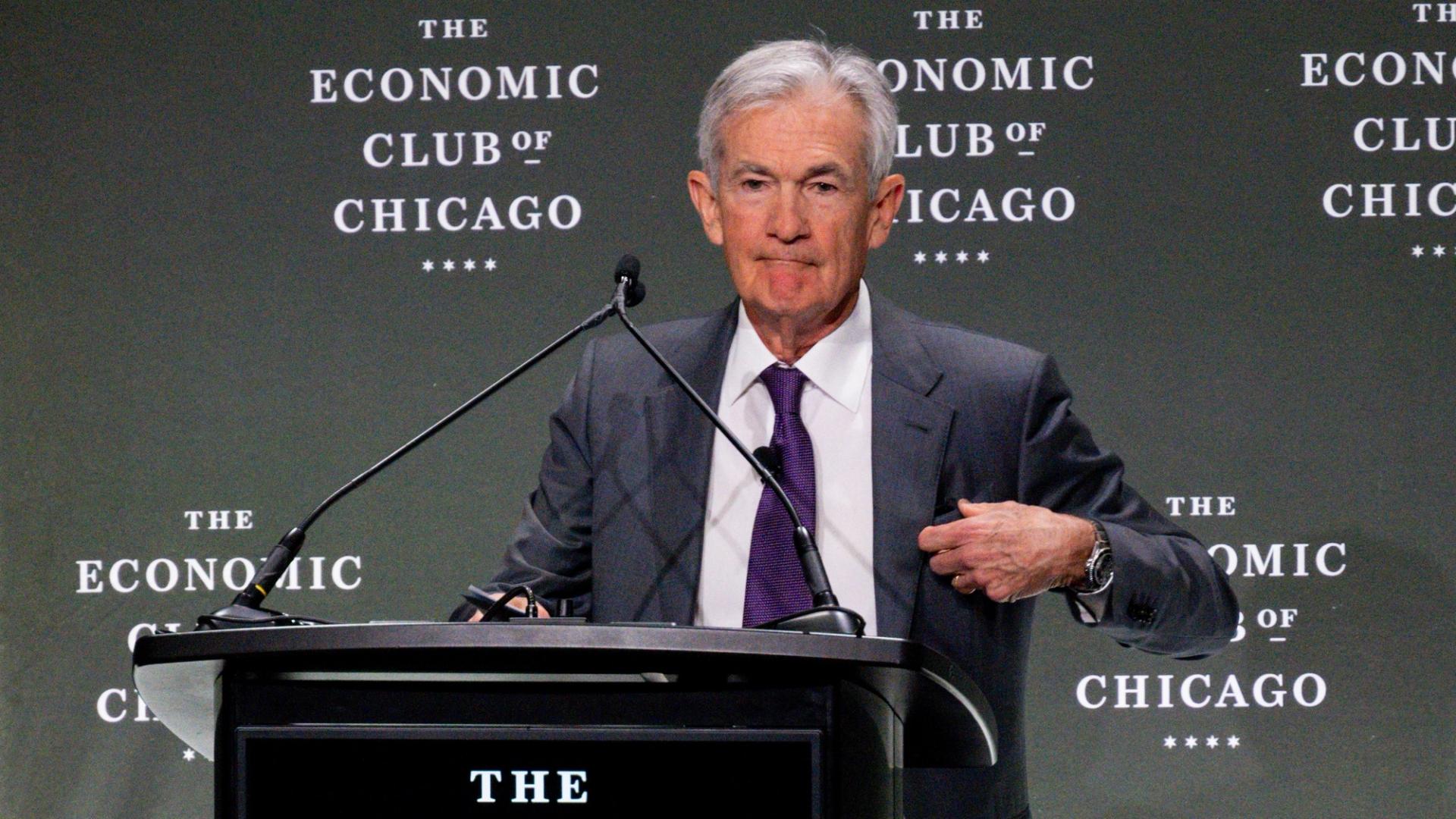

The decision by the Federal Reserve to maintain steady interest rates on Wednesday was expected, but markets are divided on when rate cuts may begin. The CME FedWatch Tool indicates a 55% probability of a rate cut to the 4.00%-4.25% range in July, with traders pricing in a cumulative 100 basis points of easing by the end of the year.

Market experts are closely watching the Fed’s policies, as potential stagflation—a combination of high inflation, stagnant economic growth, and rising unemployment—could have negative effects on the economy. Despite these concerns, Bitcoin has seen increased interest as a hedge against macroeconomic and geopolitical volatility.

Overall, Bitcoin’s recent price movements reflect a structural shift in how investors view cryptocurrencies as an essential component of diversified portfolios. The future remains uncertain, but Bitcoin’s resilience in volatile markets is evident.

To learn more, you can read the full article here: Fed Stagflation Risk Signal Could Be Bullish for Bitcoin, Analyst Says.

- [posts_like_dislike id=947]

Bitcoin (BTC) is currently trading above $97,000 in the Asian markets as there is a sense of relief following reports that the U.S. and China are working towards a trade deal....

Read moreBitcoin (BTC) is currently trading above $97,000 in the Asian markets as there is a sense of relief following reports that the U.S. and China are working towards a trade deal. However, there is skepticism in the market regarding the likelihood of a deal being reached this month.

According to China state media, the U.S. has initiated discussions with China on the issue of tariffs. Meanwhile, Dogecoin (DOGE) saw the highest gains among major cryptocurrencies with a 4% increase in the past 24 hours. Other cryptocurrencies such as Cardano’s ADA, XRP, Ether (ETH), and BNB also experienced gains between 1-3%.

There was a notable decline in Movement’s MOVE token price, dropping by 21% as founder Rushi Manche was suspended following a token manipulation scandal revealed by a recent exposé.

On Polymarket, bettors are not optimistic about a trade deal being reached this month between the U.S. and China, giving it only a 20% chance of happening by June. The market is cautious due to the hawkish rhetoric coming from the White House.

Market observers believe that with the current positive trend in other crypto metrics, the possibility of Bitcoin reaching $100,000 is within reach. This optimism is reinforced by Strategy’s continued Bitcoin purchases and efforts towards further institutionalization.

Kava Labs reaching a milestone of 100K users for its decentralized AI platform has also had a positive impact on Artificial Intelligence (AI) tokens in the market, with a 3% increase. Users are recognizing the value of decentralized and transparent AI systems, moving away from centralized models controlled by a few corporations.

- [posts_like_dislike id=919]

The recent surge in the price of gold, potentially indicating a blow-off top, seems to have had a positive impact on bitcoin (BTC). This trend is expected to continue, with bitcoin...

Read moreThe recent surge in the price of gold, potentially indicating a blow-off top, seems to have had a positive impact on bitcoin (BTC). This trend is expected to continue, with bitcoin already being one of the best-performing global assets lately.

Following President Trump’s Liberation Day tariffs in early April, gold’s rally reached new heights, peaking above $3,500 per ounce on April 21. During this time, bitcoin was trading at $87,000, which was relatively flat from Liberation Day but down by about 20% from its all-time high in January.

However, gold has since dropped by nearly 10% to slightly above $3,200 per ounce, while bitcoin has surged by about 10% to reach a two-month high of $97,000.

According to Geoff Kendrick from Standard Chartered, bitcoin might be a better hedge than gold against strategic asset reallocation out of the U.S. He pointed out that the inflow into bitcoin funds has surpassed that into gold funds, indicating a shift in investor sentiment.

Kendrick also highlighted that the margin between bitcoin ETF inflows and gold was last seen during the week of the U.S. presidential election. Following that event, the price of bitcoin rose by more than 40% to above $100,000 within two months.

- [posts_like_dislike id=913]

Over the past 24 hours, futures bets against higher crypto prices saw losses totaling over $500 million as a strong surge, potentially fueled by a U.S. decision to possibly ease China...

Read moreOver the past 24 hours, futures bets against higher crypto prices saw losses totaling over $500 million as a strong surge, potentially fueled by a U.S. decision to possibly ease China tariffs, resulted in the largest short liquidations since October.

Bitcoin (BTC) rallied from a low of $88,000 on Tuesday to above $93,500 during the Asian morning hours, leading a broader market jump with ether (ETH), Cardano’s ADA, and dogecoin (DOGE) all seeing a 14% increase. Solana’s SOL and XRP also rose by 7%, with all top hundred tokens by market cap showing gains.

Additionally, tokens like Sui Network’s SUI, UniSwap’s UNI, and Near Protocol saw strong gains of up to 18%. Memecoin mog (MOG) surged by 30%, continuing its trend of moving in sync with ETH.

Shorts worth nearly $530 million suffered losses as leveraged bets were unwound, with most short liquidations occurring on Bybit at $234 million, followed by Binance at $100 million and Gate at around $70 million. The largest single liquidation order involved an ETH futures position on Binance, valued at over $4.5 million.

Liquidations happen when an exchange closes a trader’s leveraged position due to a loss of the initial margin. This occurs when a trader doesn’t have enough funds to maintain the trade open.

The spike in crypto markets coincided with Trump’s comments about being open to positive trade talks with China and the possibility of reducing tariffs if a deal is reached. This news helped ease some of the cautious sentiment among traders.

Jeff Mei, COO at BTSE, shared his thoughts on the situation, mentioning the potential for rate cuts and a weakening U.S. dollar, which could explain the surge in bitcoin. If the U.S. dollar continues to depreciate, bitcoin may become a significant store of value as other currencies could also face depreciation.

Overall, the recent market movements reflect a mix of geopolitical factors and investor sentiment, pointing towards a potentially interesting period for the cryptocurrency market.

- [posts_like_dislike id=867]

Tags:AIAmericabitcoinbtcCoinbaseCryptoDonald TrumpdubaiETHEUgoldMoving AverageS&P 500solanaTariffsTradingTrumpUSXRP

By Parrot Press Staff President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy...

Read moreBy Parrot Press Staff

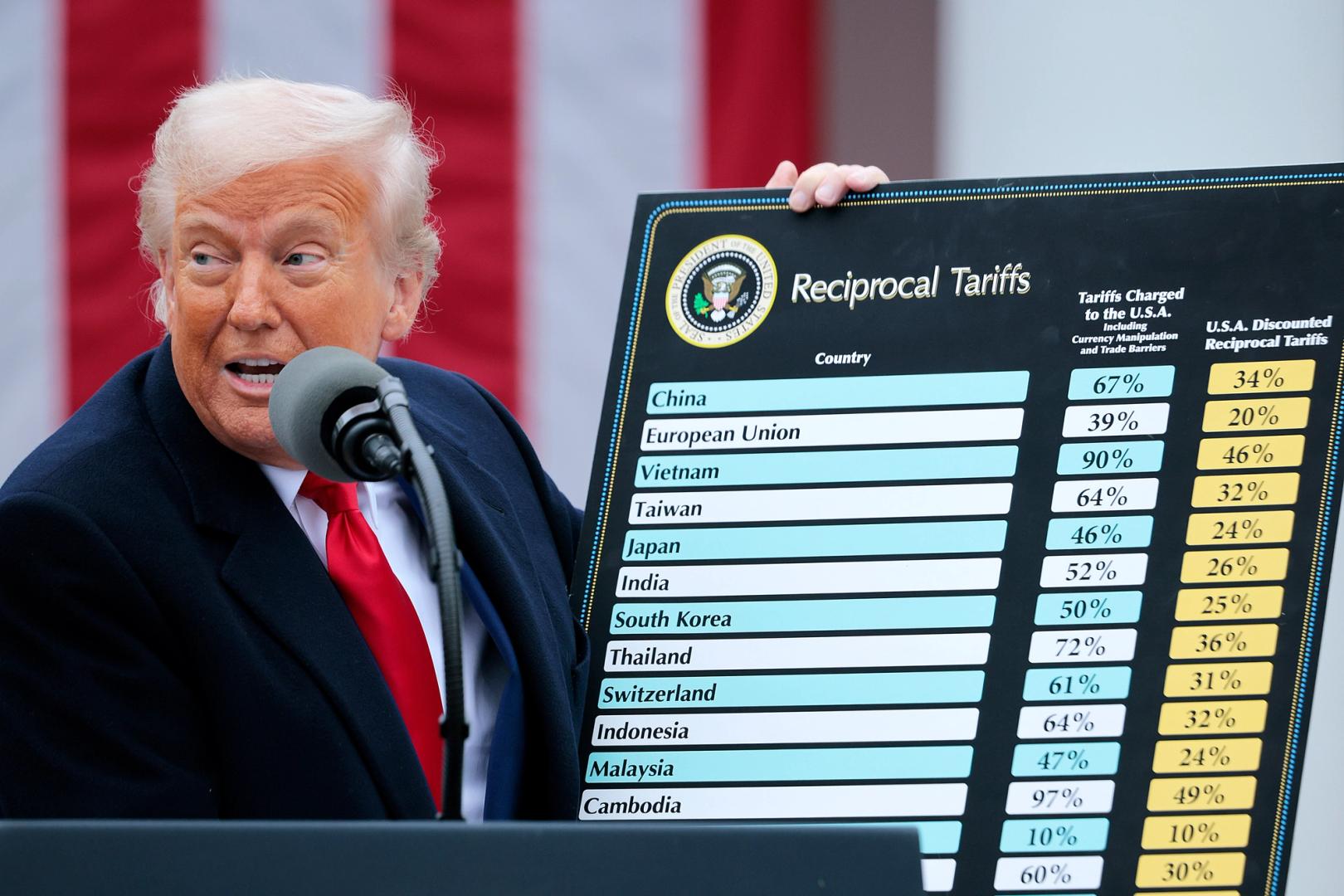

President Donald Trump’s recent announcement of “reciprocal tariffs” this month has caused economic trade policy uncertainty to reach an all-time high. This has led investors to shy away from risk assets, such as bitcoin (BTC) and other cryptocurrencies.

Federal Reserve Chairman Jerome Powell added fuel to the fire by stating late Wednesday that the central bank anticipates a rise in unemployment as the economy is likely to slow down and inflation is expected to increase. Powell mentioned that some of the tariffs imposed are likely to be paid by the public, further weighing on risk assets. This resulted in the Nasdaq dropping 1.17% and the S&P 500 decreasing by 2.24% before the closing bell. Despite this, bitcoin saw an increase of more than 1% in the past 24 hours. The CoinDesk 20 (CD20) index, which provides a broader market perspective, also saw a rise of 1.8%. However, the crypto market is more considered a gauge of risk rather than a safe haven, as reported by Coindesk.

According to Michael Brown, an analyst at Pepperstone, there is likely to be a growing demand for “assets which provide shelter from political incoherence and trade uncertainty,” as reported by The Telegraph. While bitcoin has outperformed the stock market, showing a 1% increase in the past month compared to the Nasdaq’s 8% drop, institutional investors are turning to gold as a safe haven investment.

Gold has seen an 11% increase over the last month and a 27% increase since the beginning of the year, reaching around $3,340 per troy ounce. A survey conducted by Bank of America’s Global Fund Manager revealed that 49% of fund managers view “long gold” as the most crowded trade on Wall Street, with 42% of them predicting it to be the best-performing asset of the year.

UBS analysts suggested that adding gold allocations has become more compelling due to the escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks, and diversification away from US assets and the US dollar, as reported by Investopedia.

Gold fund flows have reached $80 billion so far this year, while data from SoSoValue indicates that spot bitcoin ETFs have seen $5.25 billion net inflows in January, with net outflows occurring since the rise in uncertainty. In the month of April alone, over $900 million has exited these funds, following net outflows of $3.56 billion in February and $767 million in March. It is advised to stay alert in such an uncertain market environment.

In the latest Token Events updates, EigenLayer is implementing slashing on Ethereum mainnet, Pepecoin is undergoing its second halving, BNB Chain will be undergoing the opBNB mainnet hardfork, and Coinbase Derivatives will be listing XRP futures pending approval by the U.S. Commodity Futures Trading Commission.

Various conferences and events, such as CoinDesk’s Consensus in Toronto on May 14-16, NexTech Week Tokyo, Money20/20 Asia in Bangkok, Crypto Horizons 2025 in Dubai, and many more are scheduled to take place in the upcoming days.

In other news, Raydium’s LaunchLab platform has gone live, competing with Pump.fun and introducing a perceived competing platform to the Solana ecosystem. This has led to over 1,750 tokens being created shortly after LaunchLab’s debut, driving the price of Raydium’s RAY token up by as much as 10%.

On the technical analysis front, Bitcoin has rebounded off the golden pocket zone, showing strong buyer interest. It has broken out of the daily downtrend that has been in place since February, indicating a potential shift in structure. BTC is currently sitting below the daily 50 and 200 exponential moving averages, which act as important decision points for the price direction.

Overall, the market is seeing fluctuations due to economic uncertainty, geopolitical risks, and trade concerns, highlighting the importance of diversification and following market trends closely.

- [posts_like_dislike id=837]

Equity and crypto markets took a hit late Tuesday as Nvidia shares plummeted in after-hours trading following a $5.5 billion charge linked to the Trump administration’s ban on the company’s H20...

Read moreEquity and crypto markets took a hit late Tuesday as Nvidia shares plummeted in after-hours trading following a $5.5 billion charge linked to the Trump administration’s ban on the company’s H20 chip sales to China.

Bitcoin, the top cryptocurrency by market value, dropped to $83,600, continuing its decline from the earlier two-week high of $86,440. XRP and Cardano’s ADA token also saw decreases, with XRP falling over 2% to $2.08 and ADA slipping 4% to $0.61. The CoinDesk 20 Index, a broader market indicator, weakened by over 2%.

Shares related to artificial intelligence fared poorly as NVDA shares dropped 8% to $89.10 after the company revealed that it expects to write down $5.5 billion in the fiscal first quarter due to restricted exports of its H20 chip to China.

The futures linked to the Nasdaq index also fell over 1%, providing negative signals for risk assets. The upcoming U.S. retail sales report for March is expected to show a 1.2% increase in consumer spending, which could help alleviate recession concerns arising from trade tensions.

Federal Reserve Chairman Jerome Powell is scheduled to speak on Wednesday about his outlook for the U.S. economy. Market-based measures like inflation breakevens have decreased amid trade tensions, potentially giving the Fed room to cut rates.

Federal Reserve Governor Christopher Waller recently stated that the bank may need to quickly implement rate cuts if President Trump reinstates tariffs unveiled on April 2. Trump announced tariffs on 180 nations but suspended them for most nations, excluding China, for 90 days.

- [posts_like_dislike id=827]